Earnings Per Share EPS Formula | Everything You Should Know About

Posted by : sachet | Wed Jul 23 2025

Earnings per share (EPS) indicate the profit each outstanding share of common stock has earned. A higher EPS indicates a more profitable company. EPS can be calculated by dividing the company’s net income by the total number of outstanding shares. A balance sheet and income statement are the key measures to get a company’s period-end numbers, which would help calculate the earnings per share (EPS).

Types of Earnings Per Share (EPS) & How they Differ?

Earnings per share (EPS) are categorised into different aspects of the financial parameter, indicating whether the stock appears to be overvalued or undervalued. Explore the types of earnings per share (EPS) below to understand the ratio in more detail.

- Trailing EPS

Trailing earnings per share (EPS) is a financial ratio indicating the company’s earnings figures from the previous year. It reflects the company’s previous performance but never forecasts its future potential. Calculate the trailing EPS using the four most recent quarters.

- Current EPS

Current earnings per share (EPS) are calculated based on the current year’s net income and the number of shares outstanding of a common stock. You can find the current EPS data for companies like SBI, HDFC, Maruti Suzuki, Reliance Industries, ITC, etc., on Univest. Calculate the current earnings per share (EPS) using real-time projections and available figures.

- Forward EPS

Forward earnings per share (EPS) signifies the company’s anticipations on future earnings and outstanding shares. It can help investors to choose the fundamentally strong stocks for their ideal returns. Forward EPS may be biased as one can not predict the future earnings of the company with specific/accurate figures.

- GAAP EPS or Reported EPS

GAAP, often known as Generally Accepted Accounting Principles, is the metric used to imply the earnings per share EPS formula. It is disclosed in the SEC filings and used to distort the company’s profits. GAAP EPS is also abbreviated as Reported EPS.

- Ongoing EPS or Pro Forma EPS

Ongoing Earnings Per Share EPS calculation helps to understand the earnings via the core operations of the company. It helps in gauging income in the coming decades and investors may witness top shares with high growth potential through the Ongoing or Pro Forma EPS metric. Net income and exclusion of one-off events are the major considerations for earnings per share EPS formula calculation in this method.

- Retained EPS

Retained Earnings Per Share is the portion of profit that a company manages to hold on instead of dividend declaration to its stakeholders. This profit may be utilised to pay off the existing debt and borrowings of the company. For example, Retained Earnings Per Share can be calculated with the EPS formula (Net Income + Current Retained Income – Preferred Dividends / Weighted Average Number of Outstanding Shares).

- Cash EPS

Cash Earnings Per Share (EPS) is the type of EPS that helps get a detailed picture of the company’s financial position. It signifies the exact amount of cash earned by an organisation and is quite difficult to be manipulated. Cash EPS Formula = Operating Cash Flow / Diluted Outstanding Shares.

- Book Value EPS

Book Value Earnings Per Share (EPS) make it accessible to know the worth of a company’s share in the liquidated situation. It is the static representation of the company’s performance as it points out the balance sheet.

What Does EPS Show?

Earnings Per Share (EPS) indicates the company’s profitability on an absolute basis. It is the technical parameter to know whether a stock is undervalued or overvalued. Moreover, one can consider it as the major component of the calculation of P/E Ratio (Price-to-Earnings).

Investors can divide the current stock price by earnings per share to check how much the market is willing to pay for each rupee of earnings. When used along with several other financial metrics, earnings per share (EPS) also reflects ways to choose fundamentally strong stocks.

Also Read: What is EPS (Earnings Per Share) in the Stock Market?

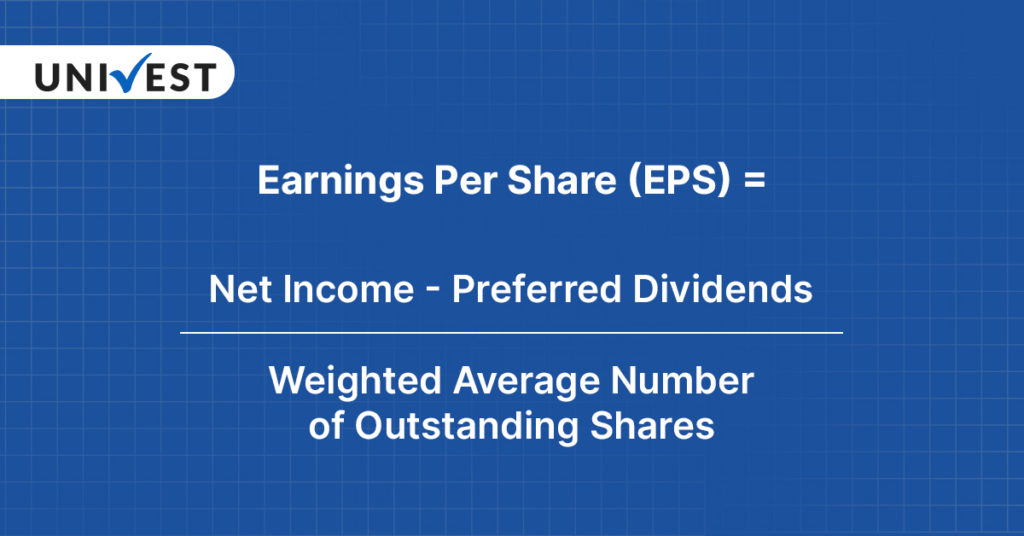

How to Calculate EPS: Step-By-Step EPS Formula

EPS formula is one of the most considered financial metrics indicating the company’s profitability. Here is the earnings per share calculations with the help of earnings per share EPS formula.

Earnings Per Share (EPS) Formula = (Net Income – Preferred Dividends) / Weighted Average Number of Outstanding Shares

For example, the net income of a company (X) is Rs 20 crore and it is required to pay Rs 2 crore as preferred dividends, and has a weighted average of outstanding shares as Rs 4 crore at the current period. The earnings per share EPS of X would be Rs 2 per share.

From the EPS formula above, it has been analysed that preferred dividends should be excluded from net income to get the EPS value. This is because earnings per share (EPS) is the measure of income available for the common shareholders, and the addition of dividends may bias the obtained value.

Moreover, EPS shows the earnings of the company against each share of its stock. Investors can use the EPS metric to have a better idea on the company’s financial health to compare it with the other players in the identical sector.

Basic EPS vs. Diluted EPS

Diluted EPS and Basic EPS are the financial metrics to measure the company’s profitability. Both of these measures indicate the same thing, but have some calculation differences. Generally speaking, Basic EPS can be calculated by dividing net income after taxes by the stock’s weighted average outstanding shares over the period. However, diluted EPS considers all the possible dilutions when options are converted into shares.

Diluted EPS wins over the basic EPS in estimating the actual value of a company as it includes all the dilutions through ESOP or other similar cases. On the other hand, investors also considered basic EPS as the optimal way to compute the cash flow of a company for the coming period.

For instance, if the total number of shares that could be created and issued from the company X’s convertible instruments was of Rs 4 crore. And a number is added to its total outstanding share, its diluted weighted average shares outstanding will become Rs 4 crore + Rs 1 crore = Rs 5 crore. As the net income of X was Rs 20 crore, then the diluted EPS formula will provide the figure of 20/5 = 4. Thus, the earnings per share with diluted EPS formula will be 4.

Note: One must sometimes make adjustments to the numerator in calculating fully diluted EPS.

Rolling EPS vs. Trailing EPS

Rolling EPS estimates annual earnings on each share by combining the data from the past two quarters. It can be calculated using the following EPS formula:

Rolling Earnings Per Share (EPS) Formula = (Net Income From the Previous 2 Quarters + Next 2 Quarters – Preferred Dividends) / Weighted Average Number of Outstanding Shares

However, Trailing EPS is estimated on the basis of the previous year’s figures. It is the measure of how much a company earned per share in the past four quarters. It can be calculated using the following EPS formula.

Trailing Earnings Per Share (EPS) Formula = (Net Income From the Previous 4 Quarters – Preferred Dividends) / Weighted Average Number of Outstanding Shares

Difference Between Adjusted EPS and EPS

Did you know earnings per share are different from adjusted EPS? Yes, they are. Base earnings per share (EPS) offers a blurred image of the company’s profitability as it may be influenced by one-time factors. This is where adjusted EPS comes into the picture. It calculates the earnings per share after the impact of non-recurring factors has been removed from the net income. In the case of adjusted EPS, net profits are adjusted and non-core profit and loss are removed from the equation.

Note: In India, business ventures don’t need to disclose the adjusted EPS numbers, but they are suggested to do so.

Significance of Earnings Per Share (EPS) in Stock Market

Earnings per share (EPS) is a key metric for several investors to research and identify fundamentally strong stocks. We’ve mentioned the importance of EPS in better assessing potential shares to achieve ideal returns in the Indian stock market.

- Comparator

Earnings per share (EPS) allows investors to compare one company’s profitability with another operating in a similar industry. It provides individuals with a competitive analysis between two different stocks. Identify the multibagger stocks with the help of their earnings per share (EPS) to diversify your investment portfolio.

- Informed Investment Decision

Earnings per share (EPS) growth sometimes represents high-growth stocks and may authenticate investors’ investment decisions. Consider a company’s EPS growth over time to understand its potential to deliver returns in the coming decades.

- Stock Valuation

Earnings per share (EPS) help investors determine whether a stock is undervalued, overvalued, or fairly valued. Investors use the EPS formula to determine a company’s profitability and invest in undervalued stocks.

- Assess Profitability

Earnings per share (EPS) is significant to analyse a company’s ability to earn profits. It shows the profitability of a company on each outstanding share. Assess the profitability of multiple companies with the help of earnings per share metric and compare them with each other to choose the best stocks to invest in.

Limitations of Earnings Per Share (EPS)

Although earnings per share (EPS) has been considered a robust measure of a company’s profitability, it also has some drawbacks. Here is a list of EPS limitations that could be a point of concern for investors and business owners.

- Inflation Factor

The earnings per share EPS formula does not consider inflation as the outcome may be biased in the first place. Inflation might increase the cost of operations for several business enterprises, which may project misleading results from the calculations.

- Short-Term Manipulation

Most businesses manipulate their EPS values to reflect high earnings. This short-term manipulation may negatively impact the stock in the longer term.

- Cash Flow

Earnings per share do not factor in a company’s cash flow, which results in a biased situation. In this case, higher EPS does not promise the company’s desired level of solvency and may impact the stock prices on a large scale.

How to Use Earnings Per Share (EPS)?

Earnings per share are a significant financial indicator of a company’s absolute profitability. EPS is essential for calculating the P/E Ratio, in which E represents EPS value. Investors may not receive EPS’s earnings directly. They can compare the earnings per share (EPS) of one stock with another stock’s to choose the potential investment options.

What Is a Good Earnings Per Share Ratio?

Earnings per share (EPS) should be higher to represent more profitable companies listed on NSE and BSE. It is the general rule of thumb. But, do you know, higher EPS does not guarantee good performance. Yes, it is possible. For example, in the case of cash flow factor, we’ve discussed that despite not indicating desired level of solvency, EPS may provide an unauthentic picture of the company’s profitability.

In addition, investors should look for sustainable and consistent earnings growth while calculating earnings per share. Investing in the potential stocks is vital to diversify the investment portfolios. Also, investors should consider the company’s historical performance, industry peers, and market expectations through the earnings per share (EPS).

Let’s Wrap

Earnings per share (EPS) is a key metric to identify the profitable companies listed on the stock exchanges. Investors can use this metric and compare the obtained figure of one company with another’s. Earnings per share exist in multiple forms including trailing EPS, cash EPS, retained EPS, current EPS, forward EPS, GAAP EPS, etc. Use this financial metric to analyse the company’s financial health comprehensively. Remember about the limitations of earnings per share (EPS) such as inflation factor, manipulation, and cash flow factor to avoid significant losses in the stock market.

FAQs on Earnings Per Share (EPS)

1. What does EPS mean?

Ans. Earnings Per Share (EPS) refers to the measure of a company’s profitability from each outstanding share of a common stock. It can be calculated by dividing the net income (excluding preferred dividends) by the total number of outstanding shares. As a general rule of thumb, higher EPS indicates that the company is financially healthy in the eyes of investors.

2. What is EPS formula?

Ans. The below EPS formula can calculate the earnings per share:

Earnings Per Share (EPS) = (Net Income – Preferred Dividends) / Weighted Average Number of Outstanding Shares

3. What are the components of EPS equation?

Ans. The major components of EPS equation include net income, exclusion of preferred dividends, exercisable rights on new shares, and current shares outstanding. Consider these components while calculating EPS of a stock before investing in.

4. How to use EPS?

Ans. Earnings per share are a significant financial indicator of a company’s absolute profitability. EPS is essential for calculating the P/E Ratio, in which E represents EPS value. Investors may not receive EPS’s earnings directly. They can compare the earnings per share (EPS) of one stock with another stock’s to choose the potential investment options.

Disclaimer: The data/information mentioned above in the form of facts, statistics, and images are for informational purposes. Investors should conduct their own research on the best stocks before investing in the share market. Moreover, the summary of information sourced from the public domain neither recommends any stock investing nor guarantees the authenticity of the technical indicators.

Read Our Articles on Other Financial Metrics

Price to Earnings Ratio (PE Ratio) | Definition, Formula, & Examples

Price-To-Book Ratio | P/B Ratio Meaning, Formula, & Interpretation

What is Dividend Yield – Meaning, Calculation & Taxation

Return on Equity (ROE) – A Comprehensive Guide Towards Understanding ROE

Debt-to-Equity Ratio: Understanding the Meaning, Formula and Interpretation

Also Explore

Explore Current and Previous IPOs

| Company | Opening Date | Closing Date |

| NAPS Global India Limited | 4th March 2025 | 6th March 2025 |

| Balaji Phosphates Limited | 28th February 2025 | 04th March 2025 |

| Shreenath Paper Products Limited | 25th February 2025 | 28th February 2025 |

| Nukleus Office Solutions Limtied | 24th February 2025 | 27th February 2025 |

| Beezasan Explotech Limited | 21th February 2025 | 25th February 2025 |

| HP Telecom India Limited | 20th February 2025 | 24th February 2025 |

| Swasth Foodtech India Limited | 20th February 2025 | 24th February 2025 |

| Royalarac Electrodes Limited | 14th February 2025 | 18th February 2025 |

| Tejas Cargo Limited | 14th February 2025 | 18th February 2025 |

| Quality Power Electrics Equipment Limited | 14th February 2025 | 18th February 2025 |

Univest Screeners

Popular Stocks to Consider

Explore Webstories on Univest

- Why Mid Budget Hotels Are A Strong Investment Opportunity

- The Rise Of Home Sharing Platforms And Their Stock Potential

- Challenges In The Post Pandemic Hospitality Recovery

- How Adventure Tourism Is Reshaping India’s Travel Market

- Top Defense Stocks Benefiting From Rising Government Spending

- How India’s Atmanirbhar Bharat Initiative Boosts Defense Stocks

- Why Mid Budget Hotels Are A Strong Investment Opportunity

Disclaimer: The data mentioned above is for educational purposes. It is essential to conduct your own research before investing in the stock market. You can consult a financial advisor or try Univest to generate exemplary returns.

Related Posts

IIFL Finance NCD: Tranche Detail

PNGS Reva Diamond Jewellery IPO Review 2026: GMP Rises 5.70%, Key Investor Insights

IEX Share Price Falls 25.96% YoY: What Went Wrong & What’s the Target

Yashhtej Industries IPO Allotment Status: 1.05x Subscribed, GMP Rises 1.82% — Check Online

Manilam Industries IPO Day 1: Subscription at 0.03x, GMP Flat | Live Updates