Top Insurance Stocks in India

Posted by : Ketan Sonalkar | Tue Feb 27 2024

Insurance Stocks in India

India’s insurance sector, a behemoth amidst emerging markets, pulsates with immense potential. With a burgeoning population, rising disposable incomes, and increasing awareness of risk mitigation, the industry is projected to soar, reaching an estimated $280 billion by 2025. This guide delves into the intricacies of this dynamic landscape, empowering investors to navigate it with confidence, including insights into the top insurance stocks in India.

Factors to Consider Before Investing:

Before embarking on your insurance voyage, consider these crucial factors:

- Market Dynamics: Assess the overall economic climate, government regulations, and insurance penetration levels. India boasts a young, insurance-under-penetrated population, indicating fertile ground for growth.

- Company Fundamentals: Scrutinize financial health, market share, product portfolio, geographical reach, and brand reputation of individual companies. Opt for diversified players with robust solvency ratios and strong leadership.

- Growth Drivers: Evaluate factors like digital adoption, business insurance partnerships, new product launches, and rural market expansion. Focus on companies capitalizing on these trends to unlock future potential.

- Valuation Metrics: Employ valuation ratios like Price-to-Earnings (P/E), Price-to-Book (P/B), and Embedded Value (EV) to gauge attractiveness compared to peers and historical data. Avoid overvalued stocks and seek those with growth potential at reasonable valuations.

You may also look like Best Value Stocks in India

Apart from these, there are many other metrics that are specific to the insurance business. Sales of life insurance products are calculated based on a metric called APE (annualized premium equivalent). APE is specifically used when sales contain both single premium and regular premium businesses. Single-premium insurance policies require a single lump-sum payment from the policyholder. APE is the sum of the regular annualized premium from the new business in addition to 10% of the first single premium in a given period. Growth of APE for insurance companies YoY is a key evaluation parameter, including insights into the top insurance stocks in India. Additionally, consider exploring Top Mid-Cap Stocks Under ₹500 for a diversified investment approach.

VNB (value of new business) in insurance industry parlance, is a metric to measure the performance of insurance companies. VNB is the profit the company makes on policies sold during the period after accounting for all the costs incurred and assuming future premium payments and mortality. In life insurance, VNB is the present value of future profits associated with new policies sold during the accounting period.

Another key metric to track is the “Persistency Ratio”. Persistence ratio is the proportion of policyholders who continue to pay their renewal premium. It helps identify the stickiness of policyholders, and whether they keep paying their premiums, providing valuable insights for evaluating the performance of top insurance stocks in India.

Top Insurance Stocks in India:

Now, let’s chart the course to promising shores:

- Life Insurance: Life Insurance Corporation of India (LIC): The behemoth, holding over 60% market share. Its vast distribution network, brand recognition, and focus on affordable products offer stability and growth potential. LIC is government-owned and enjoyed a monopoly status for nearly five decades till private sector players were allowed in this sector in the early 2000’s. Due to this it still commands the highest market share of the life insurance industry.

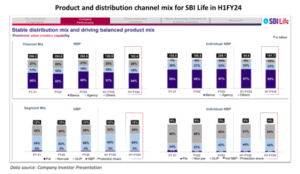

- SBI Life Insurance Company: A subsidiary of the State Bank of India, leveraging its extensive banking network for customer acquisition. Strong product innovation and focus on high-net-worth individuals drive its growth. SBI reports another remarkable quarterly performance, showcasing its robust position in the insurance sector.

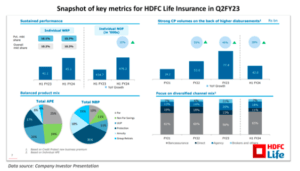

- HDFC Life Insurance Company: Known for its focus on urban markets and high-value products, catering to the growing middle class. Its strong digital presence and bancassurance partnerships fuel its success. Last year it acquired Exide Life and expanded its presence in south India.

- General Insurance: Bajaj Finserv Ltd: A diversified financial conglomerate with a dominant presence in general insurance. Its focus on motor and health insurance segments, coupled with robust distribution channels, attracts investors. It is the holding company of Bajaj Allianz General Insurance, which has a significant market share in health insurance.

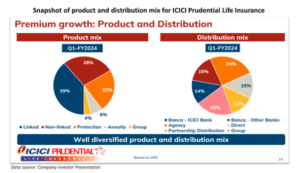

- ICICI Lombard General Insurance Company: A subsidiary of ICICI Bank, leveraging its vast banking network for customer acquisition. Its focus on technology-driven processes and innovative products fuels its growth.

- New India Assurance Company Ltd: A state-owned company with a strong presence in rural markets and niche segments like crop insurance. Its focus on risk diversification and government backing provide stability.

Conclusion:

Investing in the Indian insurance sector necessitates comprehensive research, meticulous analysis, and a keen eye for potential. By navigating the tides with prudence and leveraging insights from this guide, you can chart a course toward profitable waters within this burgeoning ocean of opportunity, including a closer look at the top insurance stocks in India.

FAQs for Navigating the Indian Insurance Sector:

- Which are the top insurance companies in India, and what are their strengths?

Life Insurance:

Life Insurance Corporation of India (LIC): Largest market share, vast distribution network, brand recognition, affordable products, offering stability and growth.

SBI Life Insurance Company: Strong business insurance network, focus on high-net-worth individuals, product innovation, and growth potential.

HDFC Life Insurance Company: Urban market focus, high-value products catering to the growing middle class, digital presence, and strong partnerships.

General Insurance:

Bajaj Finserv Ltd: Diversified financial conglomerate, with a dominant presence in motor and health insurance, robust distribution channels, and growth momentum.

ICICI Lombard General Insurance Company: ICICI Bank network leverage, technology-driven processes, innovative products, and a focus on growth.

New India Assurance Company Ltd: State-owned stability, strong rural market presence, niche segments like crop insurance, and risk diversification.

- What are the top gainers and top losers within the insurance sector today, and what are the reasons behind their performance?

Real-time data on top gainers and losers can be found on financial websites and stock market apps. Understanding the reasons behind their performance requires considering factors like market trends, economic indicators, and specific industry dynamics, including insights into the top insurance stocks in India.

Company-specific news: Positive announcements, acquisitions, new product launches, or partnerships can drive gains, while negative news or regulatory issues can lead to losses.

Sector-specific events: Changes in government regulations, economic conditions, or industry trends can impact the overall performance of the insurance sector.

Market sentiment: Investor confidence and broader market movements can influence individual stock prices within the sector.

- How should you value insurance companies, and what are some key metrics to consider?

Several valuation metrics are used to assess insurance company attractiveness:

APE – The APE (Annualised Premium Equivalent) numbers every quarter directly indicate the growth in a number of policies sold.

VNB – The VNB (Value of New Business) gives an insight into the profits that will be generated from the sales of policies in that specific quarter/year.

Persistency Ratios: This indicates the percentage of policyholders that continue to pay their premiums over the duration of their respective policies. The higher the number, the better it is for a life insurance company.

Embedded Value (EV): Estimates the present value of an insurance company’s future cash flows. A higher EV compared to the market capitalization indicates potential for undervaluation.

Remember, these metrics should be used in conjunction with other factors like company fundamentals, growth prospects, and overall market conditions.

- Which are some important indices one should track to gauge the insurance sector’s performance?

Nifty Insurance Index: Tracks the performance of the leading insurance companies listed on the National Stock Exchange of India (NSE).

Nifty Life Insurance Index: Tracks the performance of life insurance companies within the Nifty Insurance Index.

Nifty Non-Life Insurance Index: Tracks the performance of non-life insurance companies within the Nifty Insurance Index.

- Which important sectoral indices should one track to understand broader market trends?

Nifty Financial Services Index: Tracks the performance of the entire financial services sector, including insurance companies. This provides insights into the overall health of the financial sector and its potential impact on the insurance industry.

Sensex: Tracks the performance of the top 30 companies listed on the Bombay Stock Exchange (BSE), offering a broader view of the overall Indian market and its potential influence on the insurance sector.

Remember: Investing in the insurance company stocks carries inherent risks. Conduct thorough research, consult financial advisors, and make informed decisions based on your risk tolerance and investment goals. By understanding the key factors and utilizing the provided tools, you can navigate the Indian insurance landscape with greater confidence and make well-informed investment decisions, including considerations of the top insurance stocks in India.

Related Posts

Nahar Poly Films Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

PAN HR Solutions IPO Day 1: Subscription at 0.03x, GMP Flat | Live Updates

Thermax Q3 Results 2026 Highlights: Net Profit Surged by 76.17% & Revenue Up 4.19% YoY

Aarti Industries Q3 Results 2026 Highlights: Net Profit Surged by 189.13% & Revenue Up 25.90% YoY

PB Fintech Q3 Results 2026 Highlights: Net Profit Surged by 164.87% & Revenue Up 37.13% YoY