TVS Motors & Hero MotoCorp, both reports stellar Q2FY23 numbers

Posted by : Sheen Hitaishi | Tue Nov 15 2022

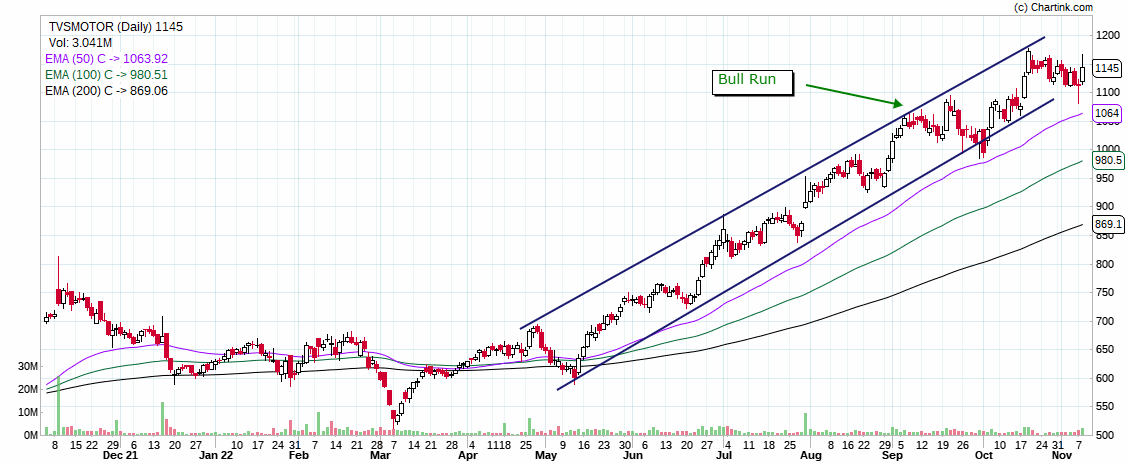

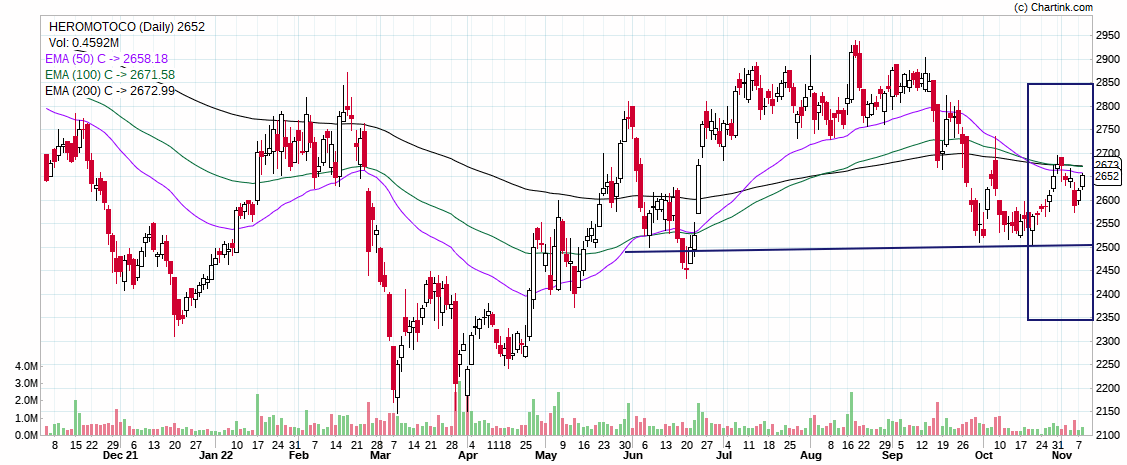

TVS Motors and Hero MotoCorp are two of the most preferred choices when it comes to the two-wheeler Automobile sector for brokers and investors. Hero MotoCorp is also the market leader in the domestic two-wheeler segment, while TVS Motors remains a leader with respect to investor returns delivered by the stock. Both automakers have recently announced their Q2FY23 numbers, where both of them managed to report healthy performance. Even though the share price of both has moved up following the announcement of Q2 results, TVS continues its bull run while Hero MotoCorp is in a sideways trend on the charts.

Brokerages have given ‘Buy’ recommendations for both the stocks post announcement of Q2FY23 results, let’s now analyse their results in deeper detail through this article and check out Univest’s view of the same.

Q2FY23 results: TVS reported double-digit PAT growth while Hero reported a marginal decline

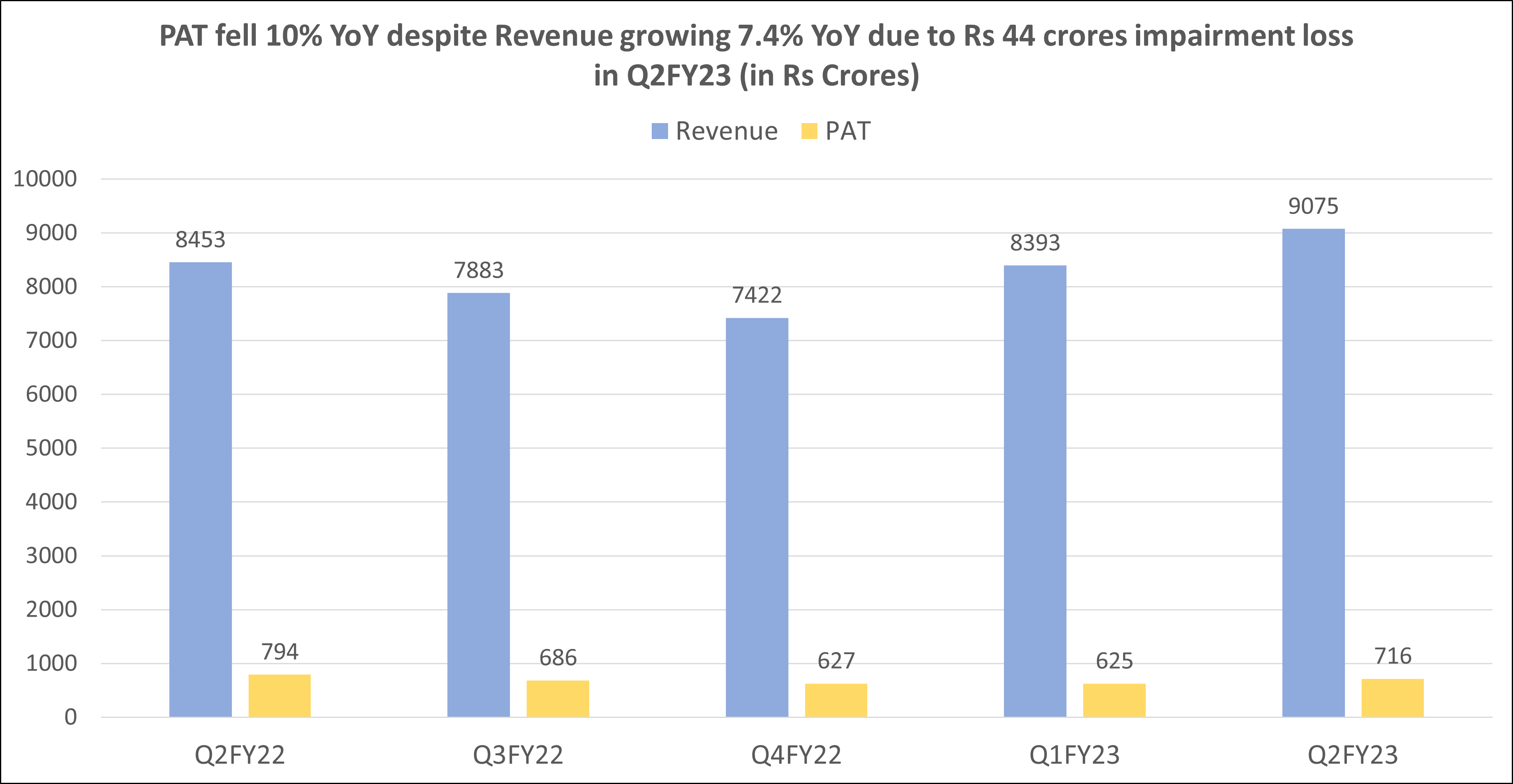

Hero MotoCorp: 44 crores MTM loss for impairment dragged profits

Hero’s PAT for the quarter came in at Rs 716 crores, up 14.7% QoQ from Rs 625 crores reported in Q1FY23 while it declined 10% YoY from Rs 794 crores reported in Q2FY22. This was despite the 7.4% YoY rise in sales to Rs 9,075 crores from Rs 8,453 crores reported in Q2FY22. While sequentially the company saw 8% growth from Rs 8,393 crores reported in Q1FY23. The PAT fell because, during the quarter, the company booked Rs 44 crores as MTM loss for impairment of investment in Gogoro.

While the business maintained its optimism over domestic demand. Additionally, a recovery in rural market sales was seen amid a 20% YoY increase in retail sales during the course of the 32-day holiday season.

The company’s “India fir se, Dil se” campaign was introduced during the holiday season and helped Hero connect with customers while also unlocking pent-up demand, which boosted sales of high-end goods.

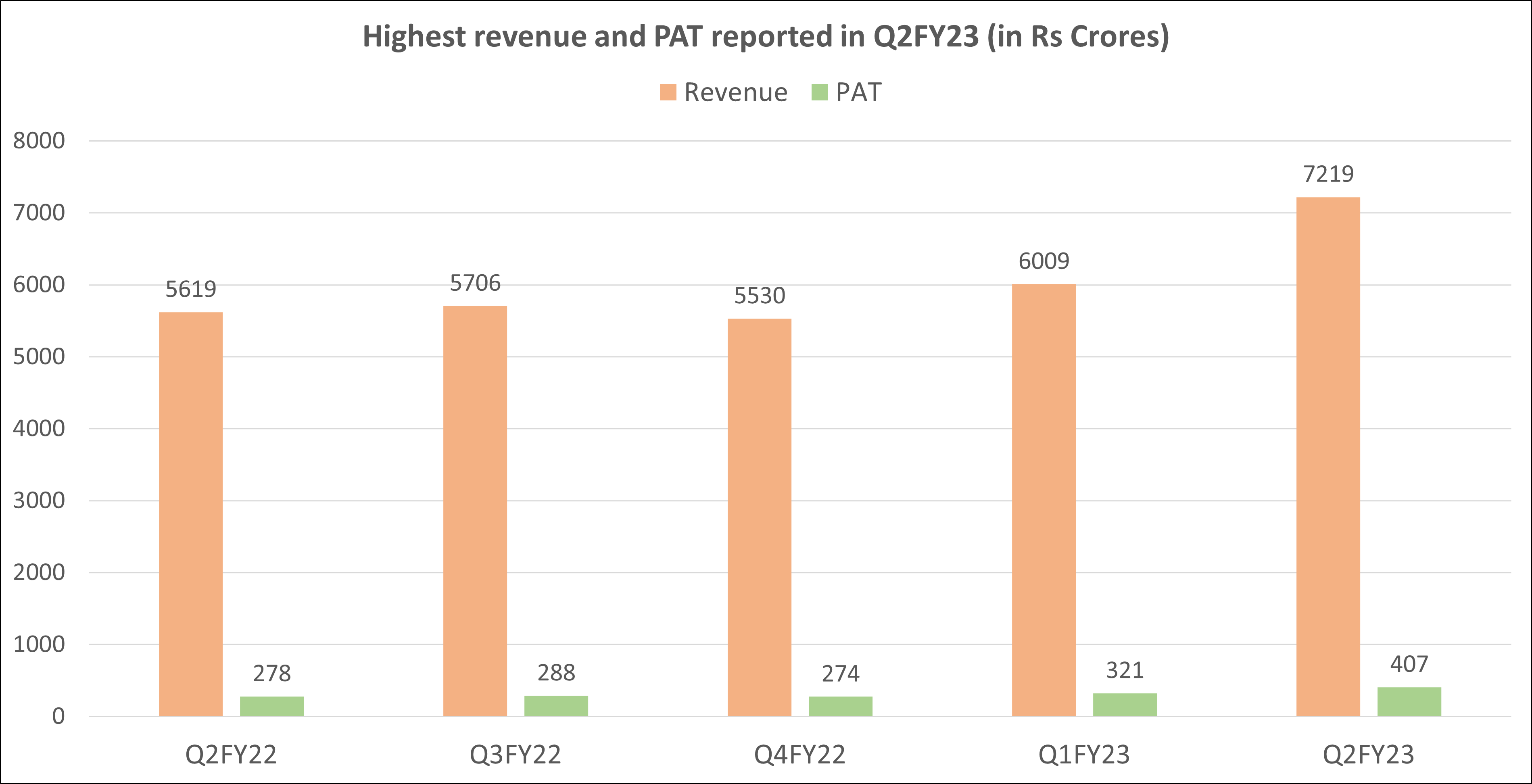

TVS Motors: Continues to deliver outperformance

TVS continued to outperform peers even in H1 and has seen a 480-bps market share gain in scooters to 24.1%. Also, it has recovered its lost share in motorcycles in Q2, to end H1 with a stable market share YoY. The company has reported a 46.4% YoY PAT growth to Rs 407 crores from Rs 278 crores reported in Q2FY22. Whereas sequentially the company saw a 27% growth from Rs 321 crores reported in Q1FY23.

While looking at the revenue that supported the robust PAT growth, a 28.5% YoY & 20% QoQ growth to Rs 7,219 crores can be seen taking place from Rs 5,619 crores in Q2FY22 and Rs 6,009 crores in Q1FY23.

You may also like: Maruti Suzuki reported excellent Q2FY23 results

Q2FY23 results: Robust margins reported by both of them

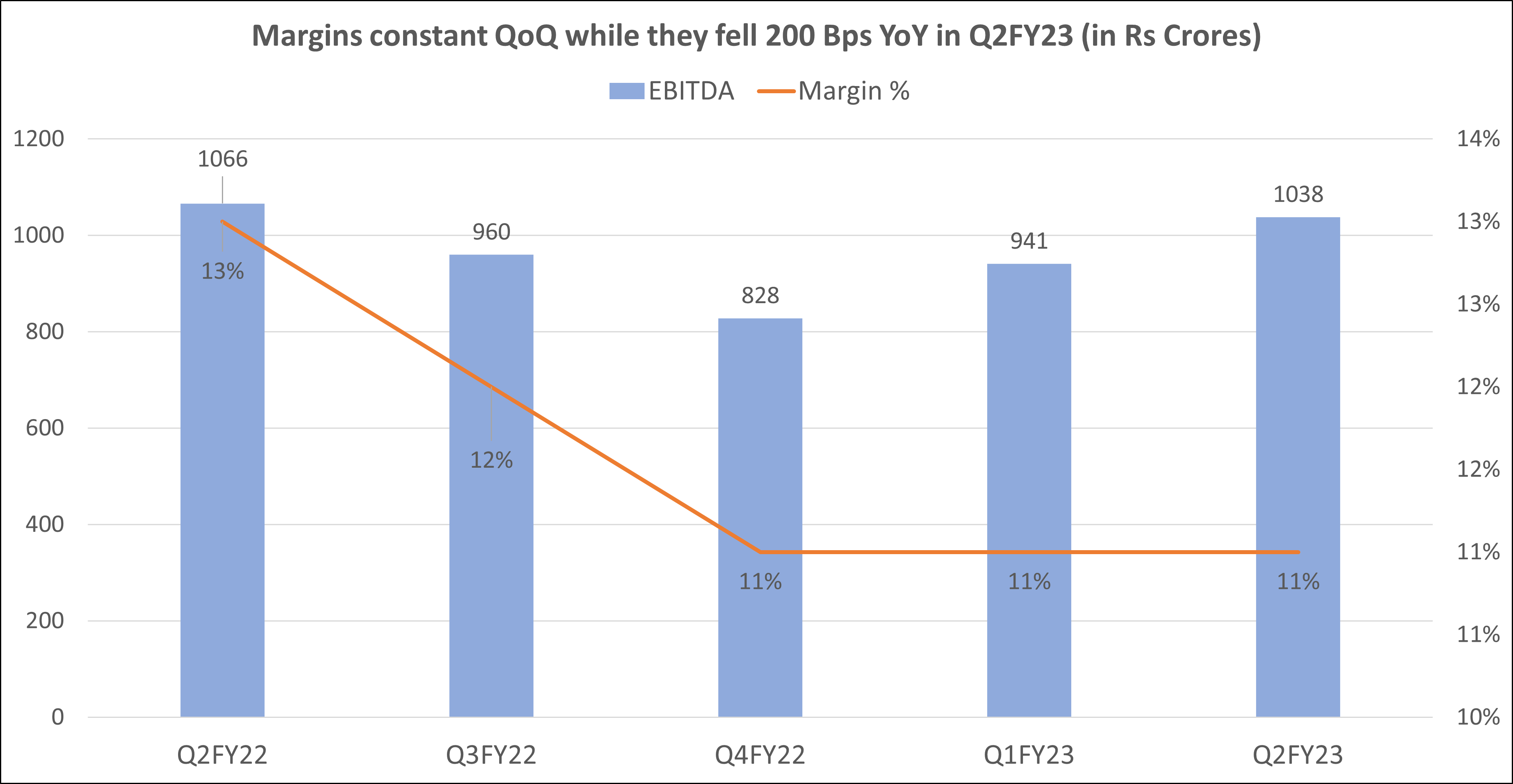

Hero MotoCorp

Hero MotoCorp’s EBITDA in Q2FY23 was at Rs 1,038 crores with corresponding EBITDA margins at 11.4% (up 20 bps QoQ). The company witnessed an 80 bps gross margin expansion on a QoQ basis. The benefits, however, were negated by higher other expenses, which were up 95 bps QoQ at 10.6% of sales.

The management said some benefits of commodity cost flowed to HMCL during Q2FY23 (30-40 bps). It expects further RM costs decline benefits to flow in following quarters with currency (rupee depreciation) as the only headwind liming the benefits.

Further, Hero MotoCorp is all set to foray into the electric segment next month with the launch of its first model in the domestic market. In a regulatory filing, the company said that “a new era in mobility is about to begin” alluding to an event under its Vida brand on October 7, 2022. The two-wheeler major has issued invites to its dealers, investors and global distributors for the event to be held in Jaipur, Rajasthan. Industry sources confirmed that the company will launch its first EV product at the event.

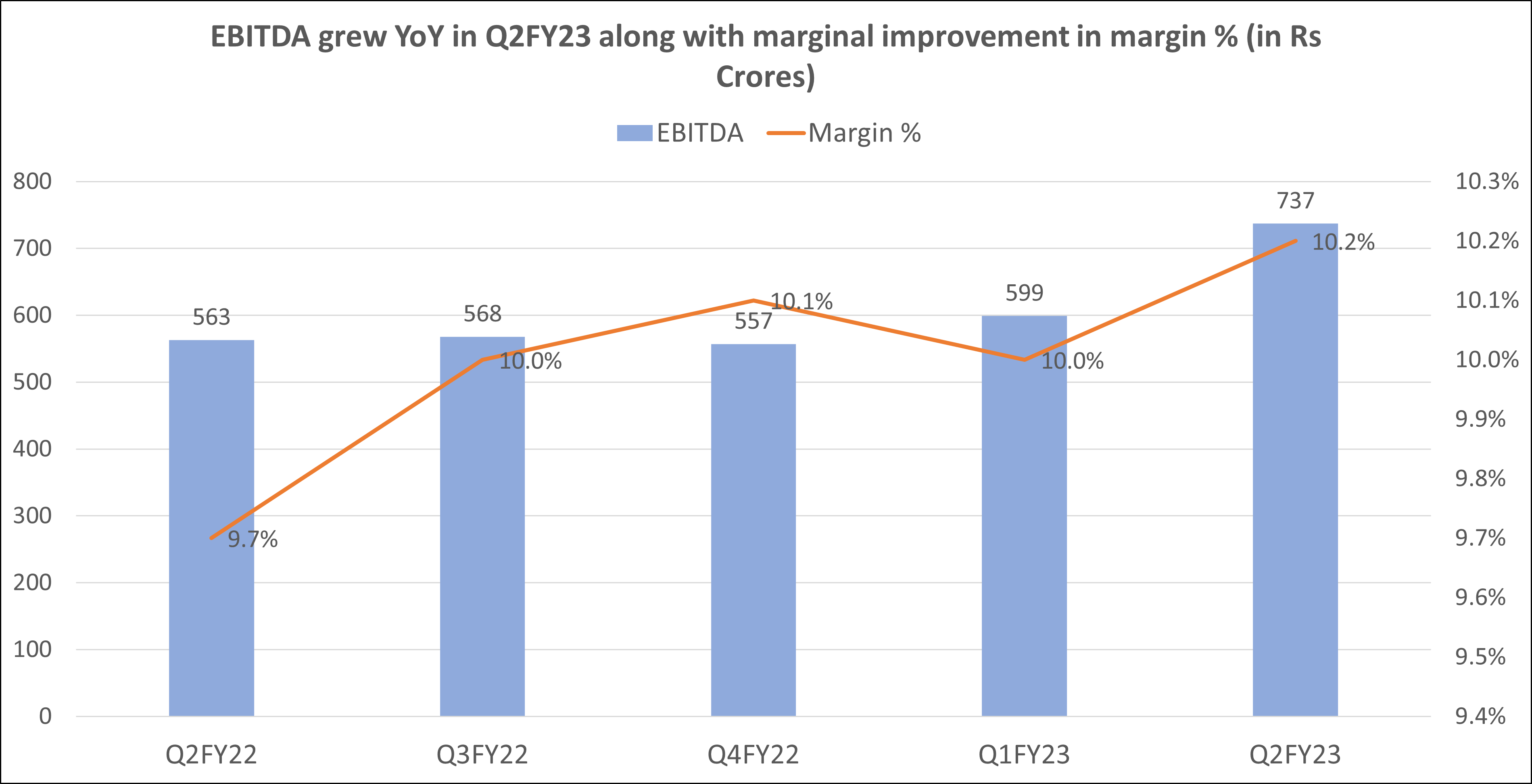

TVS Motors

While the EBITDA margin marginally grew by 20 bps QoQ to 10.2% and was in line with analysts’ estimates. As other expenses were higher in Q2 due to higher marketing spending on both new products, the EBITDA margin was flat QoQ (marketing spend, up 30 bps QoQ on the launch of Ronin).

Univest View along with Technical Analysis

TVS Motors

TVS share price can be seen taking slanting resistance and support as it is in a bull run for more than 7 months. The share price has further boosted after the announcement of Q2FY23 results with 50 EMA well above 100 & 200 EMA.

HDFC Securities said, “Given better-than-expected volume growth in H1 and improved outlook, we have raised our earnings for TVS by 19% each for FY23-FY25. We maintain BUY with a revised TP of INR 1,275/share (from Rs 1,030 earlier) as we roll forward to September 24 earnings.”

While on the Univest App, the company has a Buy rating with a neutral stance on fundamentals. Whereas the trend of the company is bullish on short as well as long term as per Univest App. Therefore, existing investors can remain invested while fresh investors can consider entering into the stock with a long-term view.

Hero MotoCorp

Currently, the Hero MotoCorp is trading close to last year’s price with 50 EMA recently coming below 100 & 200 EMA. Further, the company has gained slightly after the announcement of Q2FY23 results and is taking immediate support at 2500. Lastly, a cup and handle pattern can also be observed taking place on the daily charts, which can then proceed toward a long term breakout.

HDFC Securities said, “Given a lower-than-expected demand in Q2, we lower our earnings estimates by 6-8% over FY23-25E. At 13.7x FY24 PER, the valuation is attractive. We maintain BUY with a revised TP of Rs 3,086 (from Rs 3,347) as we roll forward to Sep-24 estimates.”

On the Univest App, Hero MotoCorp has a Hold rating with a neutral stance for fundamentals. While for trends, the company has a neutral stance for long as well as short-term trends. Therefore, existing investors can remain invested while fresh investors can enter once the rating on the app becomes Buy and the trend turns bullish.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Dr. Reddy’s reported robust Q2FY23 numbers