KPR Mill – Favourable factors could push the stock higher

Posted by : Sheen Hitaishi | Tue Jun 13 2023

KPR Mills is one of India’s largest vertically integrated textile manufacturing companies, operating across the entire value chain from ‘fibre-to-fashion’. Recently, the company ventured into the retail segment with FASO, a 100% organic brand offering innerwear, sportswear, and athleisure products. Additionally, KPR Mills is involved in the sugar business and has a power-generation capacity of 90 MW. In FY22, the domestic market accounted for 62% of the total revenue, while exports to over 60 countries, including Europe, Australia, and the US, contributed 38% to the revenue.

KPR Mills records highest ever quarterly revenues in Q4FY23

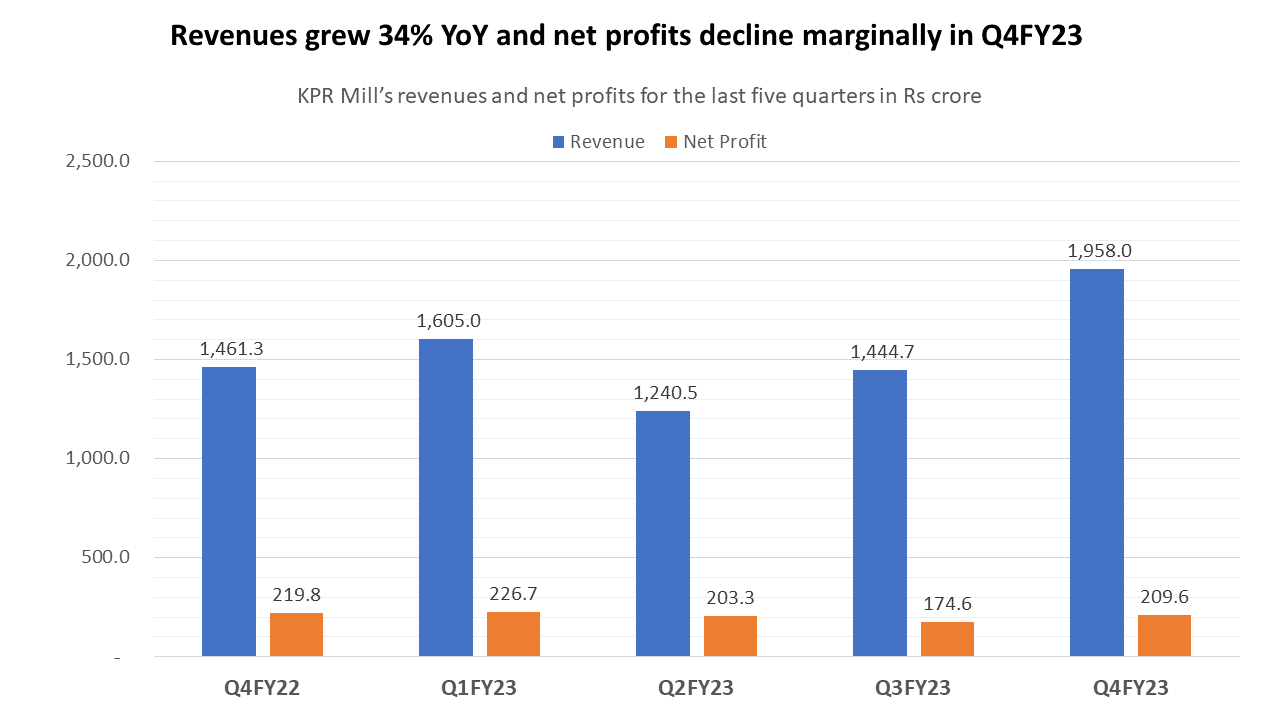

In Q4FY23, KPR Mills achieved a remarkable 34% year-on-year revenue growth, marking their second consecutive quarter of revenue growth. Although the company achieved new revenue highs, the net profits were lower compared to the previous year.

The garment business revenues grew by 10% year-on-year to reach Rs. 656 crore. Sales volume decreased by 17% to 32 million pieces, while the realization per piece increased by 33% YoY to Rs. 205. On the other hand, the yarn and fabric business revenues decreased by 10% to Rs. 516 crore, primarily due to a 15% decline in realizations. The sugar business witnessed a significant growth of 2.5 times, reaching Rs. 560.1 crore in revenue. Profitability was impacted by higher input costs, an unfavorable mix, increased employee expenses, and higher power costs leading to increased other expenses.

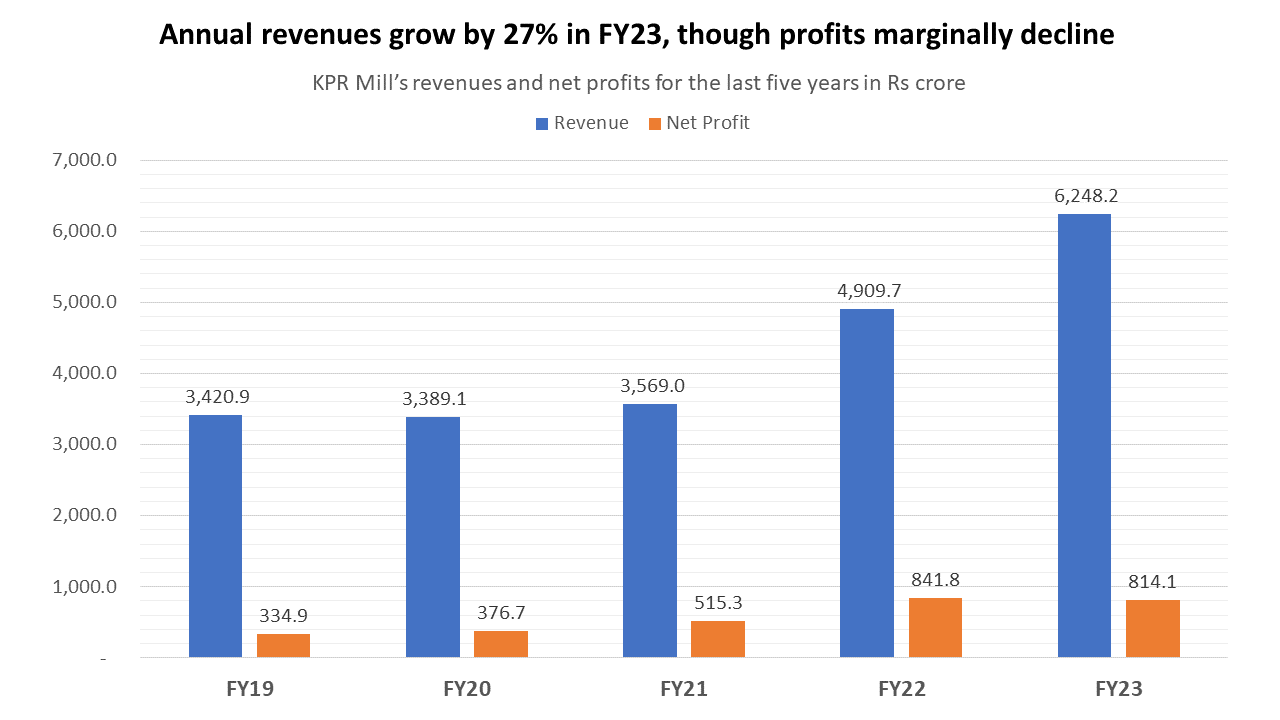

FY23 witnessed the highest annual revenues ever recorded, growing by 27% on a year-on-year basis. However, net profits did not grow in sync with revenues, primarily due to the higher cost of cotton, which reached its peak in Q2. The revenue growth was also fueled by the increasing contribution of the sugar business, which rose from 13% to 20% of the overall revenue share in FY23.

Expansion across business verticals can propel growth

KPR Mills has announced capacity expansion and modernization plans across multiple facilities. These plans include expanding the ethanol capacity from the existing 130 KLPD to 250 KLPD by the end of FY24, with a capital expenditure of Rs. 150 crore. Additionally, the company will set up a spinning mill for viscose yarn production, investing Rs. 100 crore by FY2024. Furthermore, KPR Mills will enhance the capacity of its solar power plant by 12 MW, costing Rs. 50 crore, by the end of the year. It is also upgrading its existing processing and printing facilities, with a budget of Rs. 50 crore.

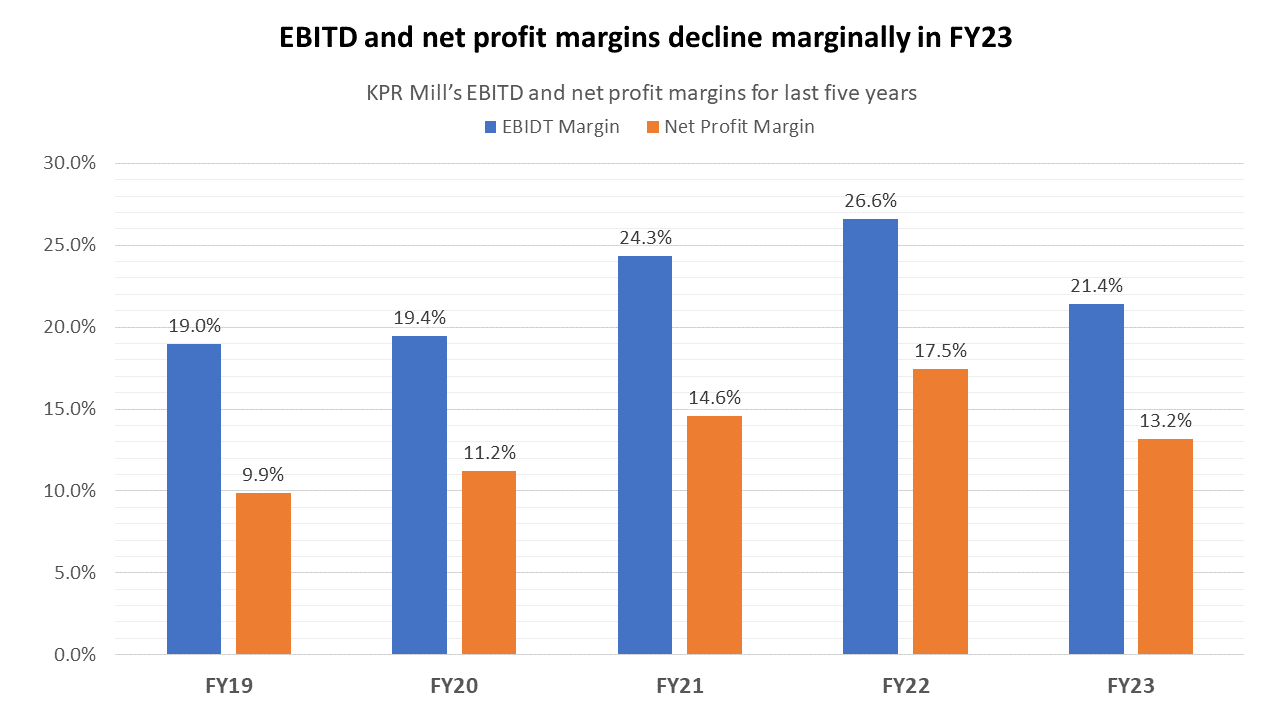

Another notable factor is that KPR Mill has maintained healthy EBITDA and net profit margins over the past few years. These margins reached their peak in FY22, with an EBITDA margin of 26.6% and a net profit margin of 17.5%. However, in FY23, these margins declined due to higher raw material and power costs.

The management has provided guidance for double-digit revenue growth in FY24. They anticipate that EBITDA margins will improve in FY24 and FY25, driven by a reduction in cotton prices and an improved product mix. The garment business is expected to achieve an EBITDA margin of approximately 25%, the sugar business around 25%, and the yarn and fabric business to achieve EBITDA margins of approximately 19-20%.

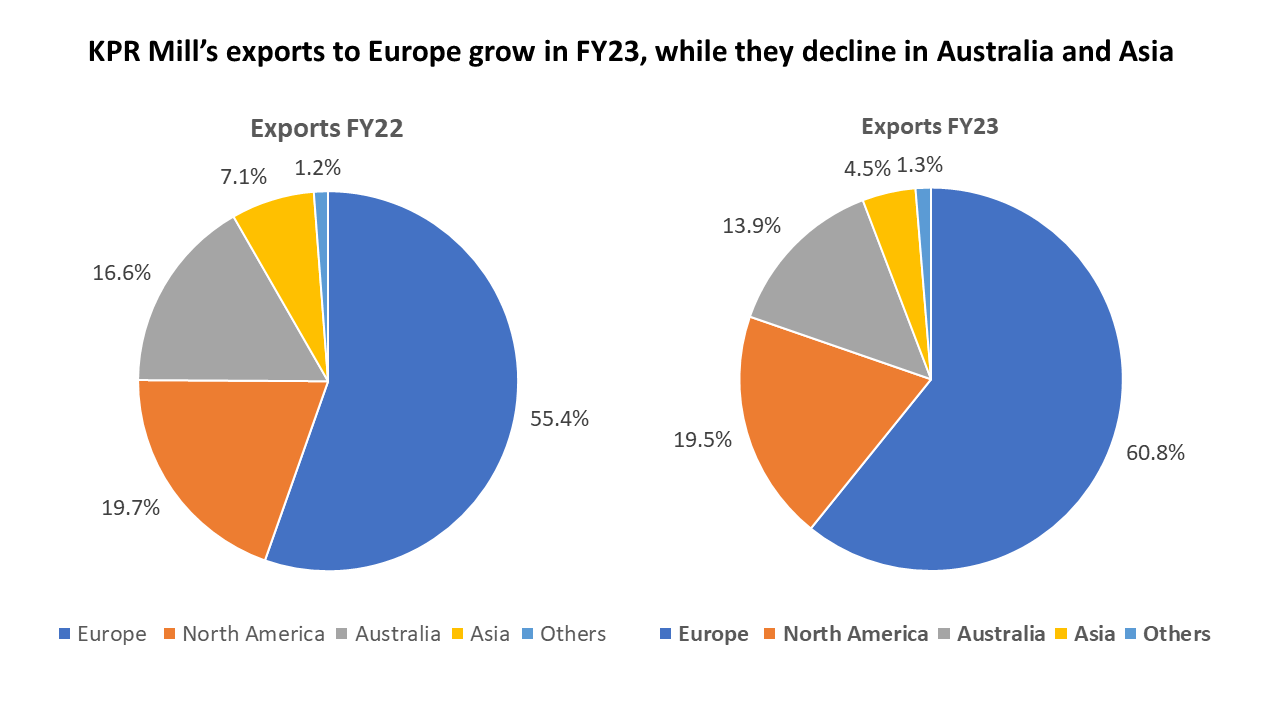

It is important to note the changing export trends in different geographies, considering that garment exports account for 38% of the company’s revenues. The export potential of the sector, coupled with the government’s strategy to boost exports through bilateral deals, is helping the country achieve new goals. India has already signed an FTA with the UAE and a trade deal with Australia, which is expected to enhance exports to Australia.

The growth in Europe can be attributed to existing customers such as Primark, along with increased orders from some European customers after the commissioning of the new plant. Furthermore, the anticipated FTA with the UK is expected to further bolster exports to the UK.

In the domestic market, KPR Mills introduced its innerwear and athleisure brand, FASO, and ventured into the Exclusive Brand Outlet (EBO) segment by opening its first EBO in Chennai. The management has expressed its ambitious plan to seize opportunities in the Indian innerwear segment and expand through direct retailing by opening 100 EBOs. The brand is also actively expanding its dealer network.

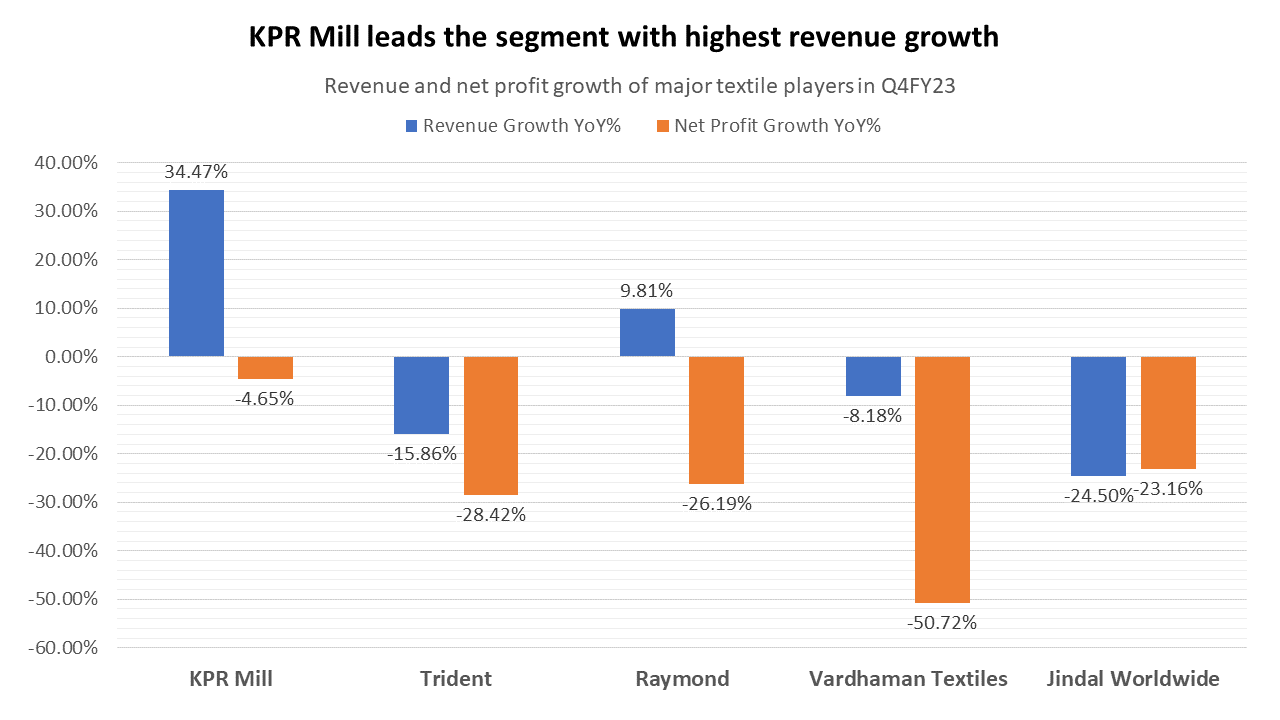

KPR Mill outperforms its peers when comparing the latest Q4FY23 results. Among the top five players in the textile industry, it achieved the highest year-on-year revenue growth. While the net profit declined for all these players, KPR Mill experienced the least decline. This was attributed to price hikes implemented to offset higher operating costs.

Over the past three years, KPR Mill has been one of the best-performing textile stocks, delivering returns of more than 5X. It closely follows Raymond, which provided 4X returns to investors. KPR Mill reached its peak price of 750 per share in January 2022 and experienced a downtrend until December 2022. However, since the beginning of 2023, the stock has begun to change its trend and move towards an uptrend.

KPR Mill possesses several factors that can drive growth and potentially raise the stock price. These include the decline in cotton prices from peak levels, capacity expansion of production facilities, market penetration of the FASO brand, increased revenue from the sugar business, and higher export opportunities. With the stock price on a new uptrend, it is expected that the stock price will surpass its previous high and reach levels of 760 over the next few months.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Auto Sales Data May 2023 – Healthy domestic sales for two wheelers and cars

Related Posts

ICICI Lombard General Insurance Company Q3 Results 2026 Highlights: Net Profit Falls by 9.06% & Revenue Up 12.69% YoY

Tata Elxsi Q3 Results 2026 Highlights: Net Profit Falls by 45.28% & Revenue Up 1.52% YoY

ICICI Prudential Life Insurance Company Q3 Results 2026 Highlights: Net Profit Surged by 19.16% & Revenue Down 3.69% YoY

Ador Welding Gears Up for Q3 Reveal on 15th January; Check Key Expectations Here

Sterling and Wilson Renewable Energy Gears Up for Q3 Reveal on 15th January; Check Key Expectations Here