Bharti Airtel shares hit all-time high on Q2FY23 results

Posted by : Sheen Hitaishi | Sat Nov 05 2022

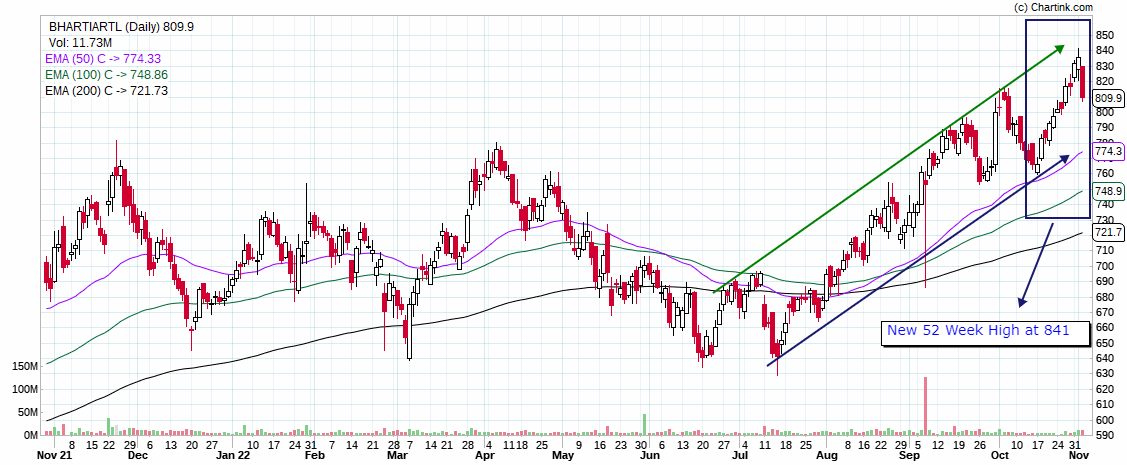

Bharti Airtel Limited is a leading global telecommunications company with operations in 18 countries across Asia and Africa. Headquartered in New Delhi, India, Bharti Airtel ranks amongst the top 3 mobile service providers globally in terms of subscribers. The company on 31 st October 22 announced their Q2FY23 results, where it saw a healthy operating performance. Their PAT grew in robust high double digits supported by growth in revenue & increased number of subscribers. While on technical charts, Airtel stock was seen making a new all-time high of 841 on the announcement of the results. Overall, the stock as well as Q2FY23 performance was robust, so let’s now analyse the same and understand what lies ahead for the company.

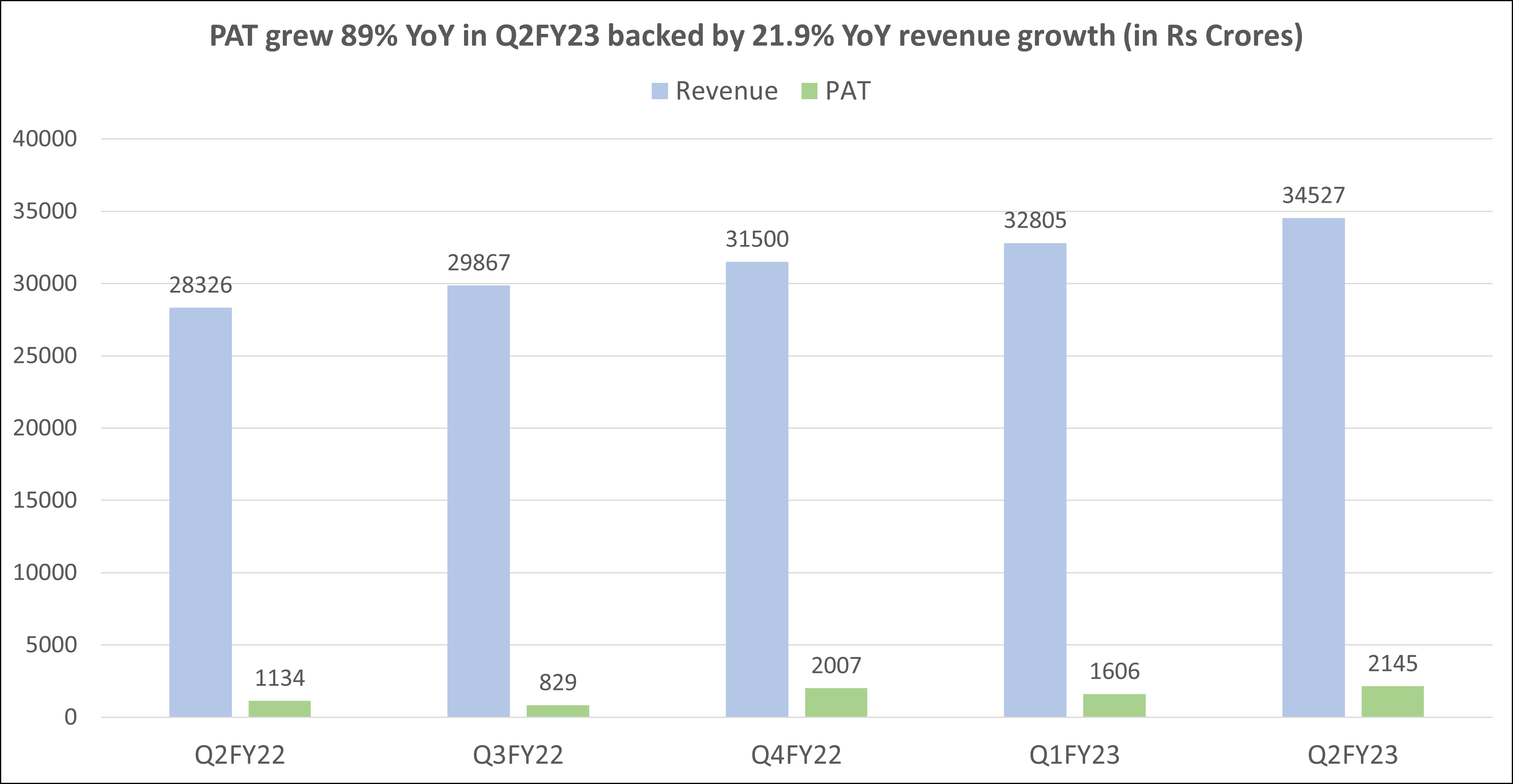

Bharti Airtel results Q2FY23: PAT grew 89% YoY & 20.7% QoQ

The company’s consolidated net profit for Q2FY23 rose 89% to Rs 2,145.2 crores against Rs 1,134 crores reported in Q2FY22, thanks to strong growth in data traffic. Whereas, on a sequential basis PAT grew 20.7% from Rs 2,469 crores reported in Q1FY23.

The company’s revenue from operations rose 21.9% YoY to Rs 34,527 crores in Q2FY23, from Rs 28,326 crores in Q2FY22, backed by strong and consistent performance delivery across the portfolio and crossing 500 million customers globally.

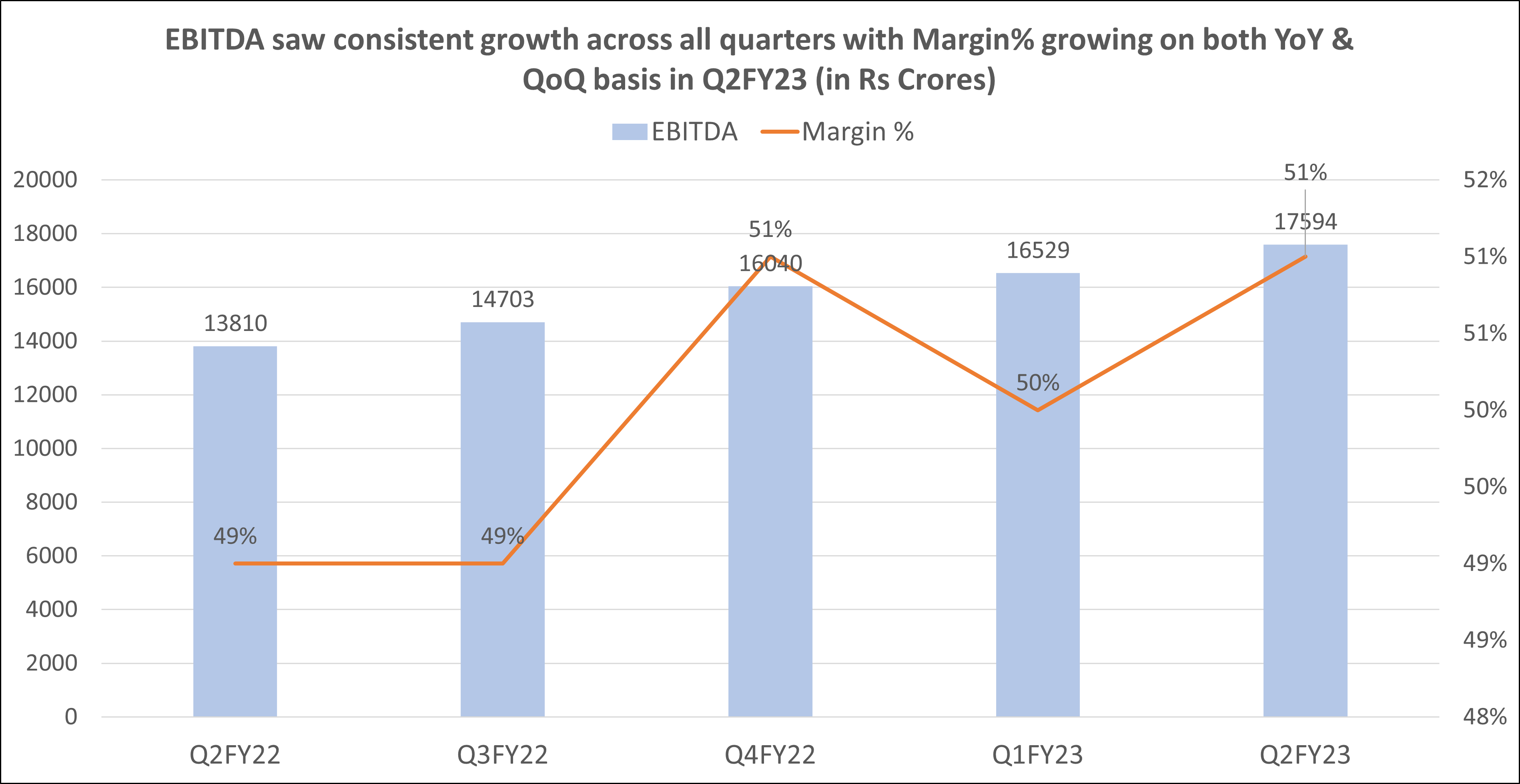

“We have delivered yet another quarter with competitive revenue growth and improved margins. Our consolidated revenue grew sequentially by 5.3% and our EBITDA margin expanded to 51.3%. The consistency of our execution is driven by the strength and resilience of our portfolio,” said Gopal Vittal, MD and CEO, of India & South Asia.

You may also like: Bajaj Finance Q2FY23 results

Indian Business Update: ARPU at Rs 190, up 23.7% YoY

According to the company, its India average revenue per user (ARPU) for the quarter was Rs 190, up 23.7% yearly and 3.6% sequentially.

Bharti Airtel said its India business saw 4.2% growth in voice traffic during the quarter and 19.6% growth in data traffic. Incidentally, higher usage drove the earnings of the company. The customer base, however, was up just 1.3% YoY and 0.1% QoQ.

Overall, India’s revenues for the quarter totalled Rs 24,333.3 crore, up 22.3 % from Rs 19,890.4 crore in the same quarter last year. These revenues included mobile, home, digital TV, and B2C services.

Bharti Airtel results Q2FY23: EBITDA Margin% back at 51% driven by lower SUC charges

Consolidated EBITDA was at Rs 17,721.2 crores during Q2FY23, up 26.4% YoY and 6.7% QoQ from Rs 13,810 crores in Q2FY22 and Rs 16,529 crores in Q1FY23. EBITDA margin for the quarter was at 51.3% as compared to 49.5% in Q2FY22 and 50.6% in Q1FY23, driven by lower SUC (Spectrum Usage Charges) charges after new spectrum purchase.

During the quarter, the company realised partial benefits from SUC and anticipates more benefits of Rs 250 crores in the coming quarter. Remember that the Department of Telecommunications (DoT) removed the 3% floor rate on spectrum usage charges and that the spectrum purchased in the most recent auction had zero SUC. As a result, the weighted average SUC will significantly decrease, saving Rs 2000 crores in yearly EBITDA.

Bharti Airtel results Q2FY23: 5G Update

Recently, Airtel announced that its 5G services were now operational in Delhi, Mumbai, Chennai, Bengaluru, Hyderabad, Siliguri, Nagpur, and Varanasi, eight cities. Customers that use 5G services will be charged according to their current 4G plans.

During the first phase of the 5G network, mobile subscribers will receive speeds of up to 600 megabits per second, and devices are anticipated to perform on par with business PCs in terms of app access and data processing.

Univest View along with Technical Analysis:

Bharti Airtel has delivered sound Q2FY23 results and investors can therefore expect a rise in ARPU to act as a catalyst for the stock and see a potential rerating upside in both India and Africa business on the back of steady earnings growth. ARPU is expected to reach Rs 225 in FY25 vs. current levels of Rs 190, driven by one more round of tariff hike of 10% in FY24 and higher wallet share of premium subscribers.

As seen in the charts, the stock is currently in a bull run with 50 EMA above 100 & 200 EMA. Further, the stock made a new all-time high of 841 on the day of the announcement of Q2FY23 results, post which it saw a minor retraction.

ICICI Direct said, “Favourable industry structure of three players (two being strong), government relief, last tariff hike, and fundraising has put Airtel in a sweet spot to maintain its relative strength among peers with a formidable digital ecosystem offering. We maintain our BUY rating with TP of Rs 960.”

While Motilal Oswal said, “In the near term, higher investments in 5G can dilute FCF going forward and may lead to elevated debt levels. We maintain our Buy rating with a TP of 1010.”

On the Univest App, the company has a Buy rating with a strong stance for fundamentals. Further, the stock has bullish momentum on short as well as long-term time frame. Therefore, existing investors can remain invested while fresh investors can consider taking a position with long-term TP of 950.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Maruti Suzuki reported excellent Q2FY23 results

Related Posts

Omnitech Engineering IPO Review 2026: GMP Rises 3.52%, Key Investor Insights

Yaap Digital IPO Review 2026: GMP Flat, Key Investor Insights

Yashhtej Industries IPO Listing Preview: What to Expect Now?

Kiaasa Retail IPO Day 1: Subscription at 0.06x, GMP Rises 20.74% | Live Updates

Mobilise App Lab IPO Day 1: Subscription at 1.32x, GMP Rises 20.00% | Live Updates