Will PSU Banks repeat their superlative performance of FY23 in FY24?

Posted by : Sheen Hitaishi | Thu Jun 01 2023

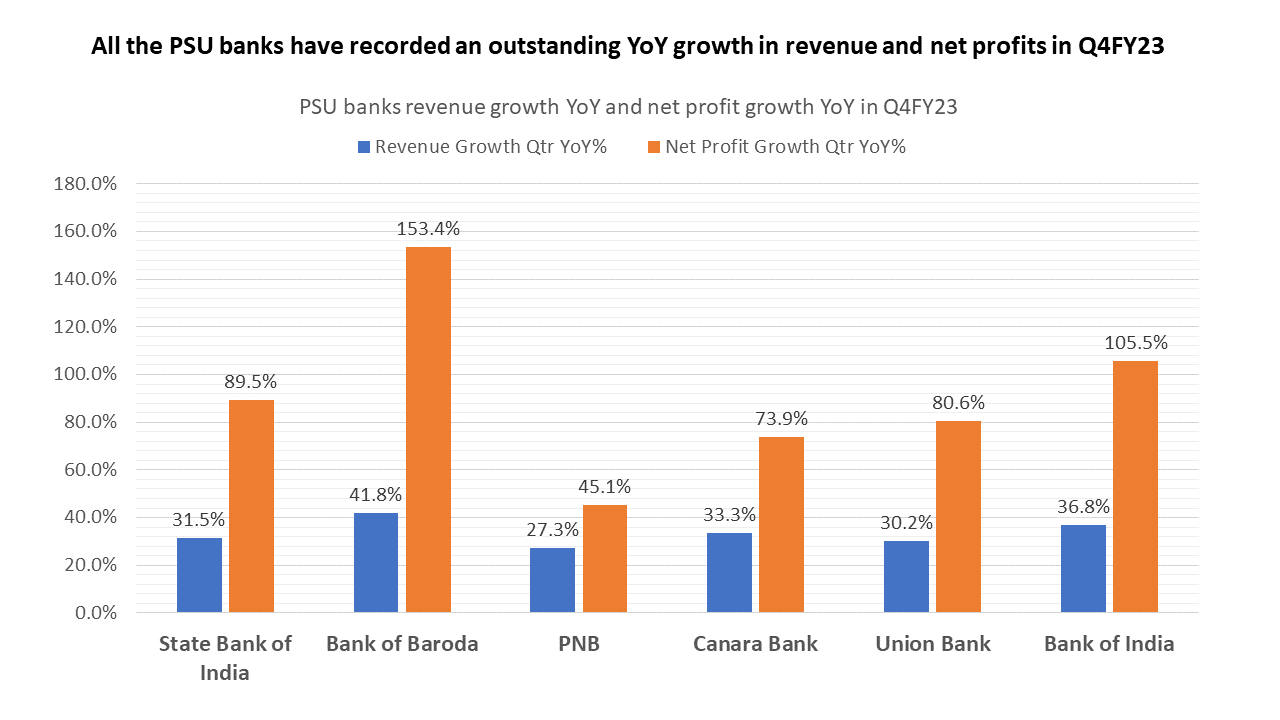

PSU Banks, which were among the laggards on the stock market for many years, have outperformed in the last two years. In fact, the Nifty PSU index delivered a 70% return for investors in the calendar year 2022, the highest among all indices. As the results for the last quarter of FY23 have been released, PSU banks have continued their strong performance in Q4 as well. All major PSU banks recorded more than 25% YoY growth in revenues, with some even achieving over 100% YoY growth in net profits.

The cumulative profit for public sector banks crossed the Rs 1 lakh crore-mark in FY23, with the market leader State Bank of India (SBI) accounting for nearly half of the total earnings. From posting a total net loss of Rs 85,390 crore in 2017-18, the PSU banks have come a long way as their profits touched Rs 1,04,649 crore in FY23.

In percentage terms, Bank of Maharashtra (BoM) had the highest annual net profit growth of 126% to Rs 2,602 crore, followed by UCO with a 100% rise to Rs 1,862 crore and Bank of Baroda with a 94% increase to Rs 14,110 crore.

In absolute terms, SBI reported an annual profit of Rs 50,232 crore in FY23, an increase of 59% over FY22. Except for Punjab National Bank (PNB), other PSBs have reported an impressive annual increase in their profit after tax. PNB posted a 27% decline in annual net profit from Rs 3,457 crore in FY22 to Rs 2,507 crore in FY23.

With the profits generated in FY23, many PSUs have declared dividends. The government will receive a staggering dividend income aggregating Rs 13,804 crore from public sector banks. This is about 58% higher than the Rs 8,718 crore paid out in the previous financial year.

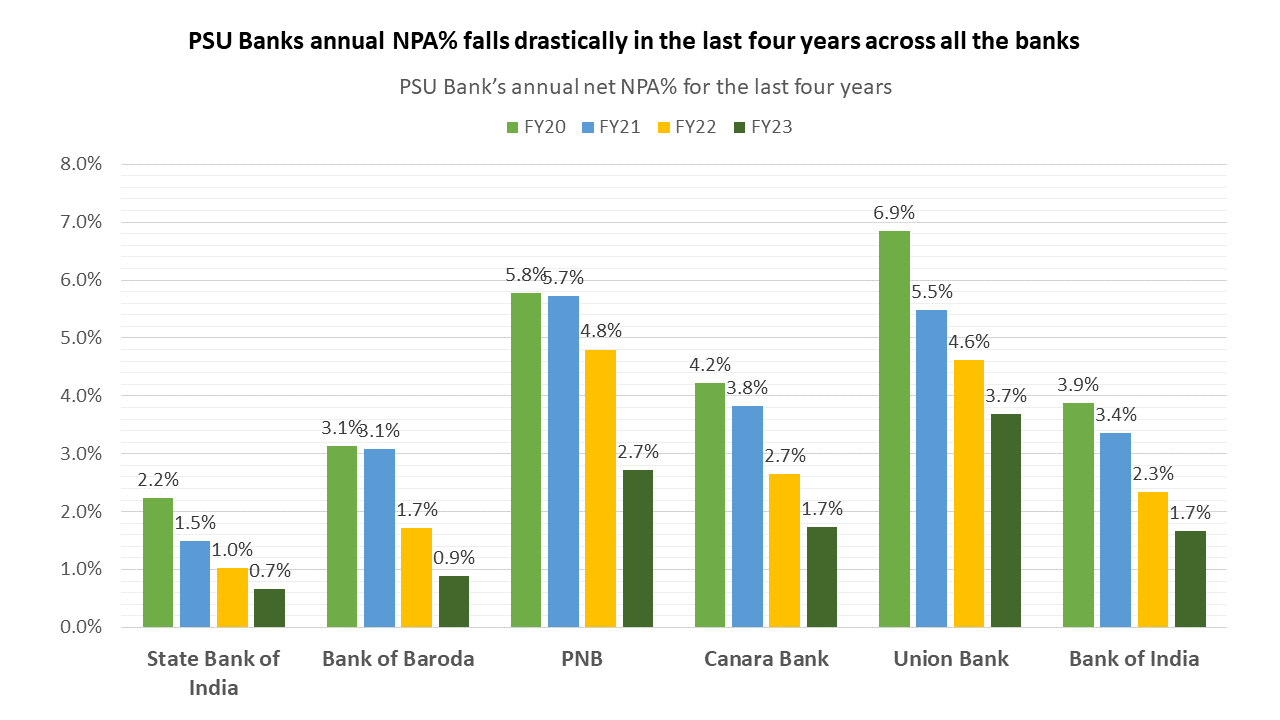

Policy decisions and technology advancements play key roles in this turnaround

PSU banks have experienced a remarkable turnaround story, transitioning from record losses to record profits. This achievement in the public sector banking industry can be attributed to the initiatives and series of reforms undertaken by the government, led by Prime Minister Narendra Modi, along with Finance Minister Nirmala Sitharaman, Financial Services Secretary Rajiv Kumar, and their successors. The government was determined to address the issue of non-performing assets (NPAs) that had reached all-time highs in FY18 and ensure that PSU banks cleaned up their act.

One of the factors that contributed to the turnaround was the absence of indiscriminate lending during the pandemic years. This period was utilized to write off previous losses, and lending norms were made more stringent. As a result, the clean-up of the balance sheet began to reflect from the third quarter of FY22, and the banks showed improvement in key financial metrics throughout FY23. Technological advancements, bank mergers, and the unwavering confidence of bankers have also played crucial roles in this turnaround story.

Another round of disinvestment in PSU banks is likely

During the 2021 Budget speech, Finance Minister Nirmala Sitharaman announced the government’s plan to privatize two public sector banks. News reports suggest that these could be selected from the following five: Central Bank of India, Indian Overseas Bank, Bank of Maharashtra, UCO Bank, and Punjab and Sind Bank. The divestment of these relatively small banks may not draw strong protests, and their strong growth and profitability metrics make them attractive to buyers. This move could further drive investor interest in PSU bank stocks.

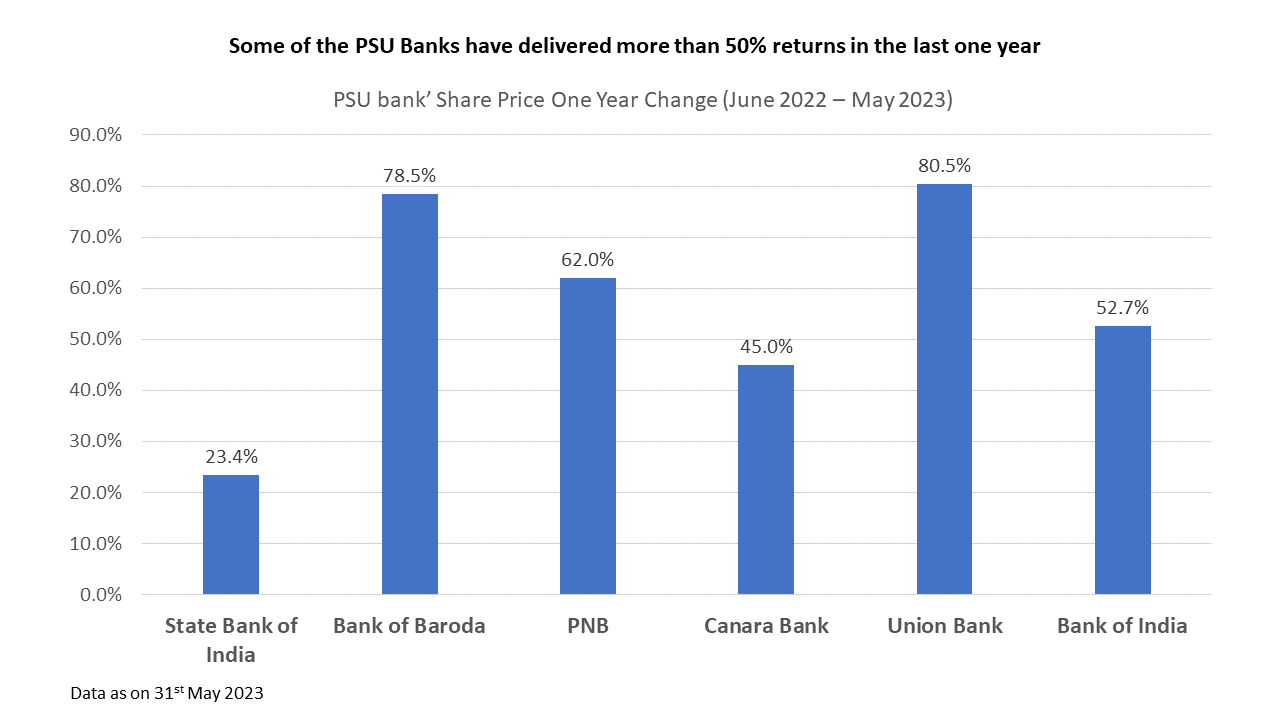

The stock prices of PSU banks have reflected the improved performance of these banks, with some of the larger PSU banks delivering returns of up to 80% over the past year.

The question now arises: Will this dream run for PSU banks continue? There are several factors that drove performance for PSU banks in the last two financial years. As the economy emerged from the pandemic period, incentives in various sectors fueled loan disbursals for banks. For instance, many states offered concessions in stamp duty for new property purchases for a limited time. With the Indian economy back on a strong footing and returning to normal, the banking sector is expected to perform well. However, it remains to be seen whether PSU banks can sustain their growth momentum and deliver spectacular results in FY24 as well.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly update