Weekly Update

Posted by : Sheen Hitaishi | Sun Feb 05 2023

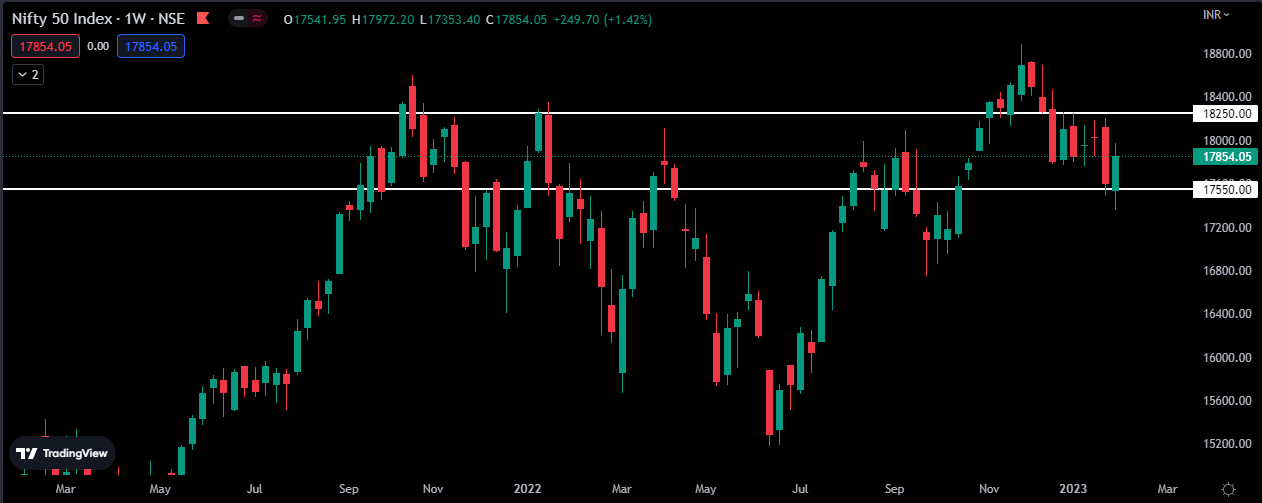

NIFTY50

Nifty closed the week with a gain of 1.42% despite the turbulence. The Budget’s volatility brought Nifty to its 200 EMA, but it recovered and ended on a high note. Nifty Metal was the worst performer, declining by 7.6%, followed by Energy with a 6.3% decrease. FMCG and IT ended the week with positive results, up by 3.5% and 2.8% respectively.

For Nifty to return to a neutral market position, it must remain above its recent low of 17353 for one more day. However, a sustained follow-through is necessary to reclassify the market as an official uptrend.

The 200 EMA, located at 17550, will serve as support on a closing basis, while 18250 will be a significant resistance in the upcoming week.

Nifty50 Weekly Chart

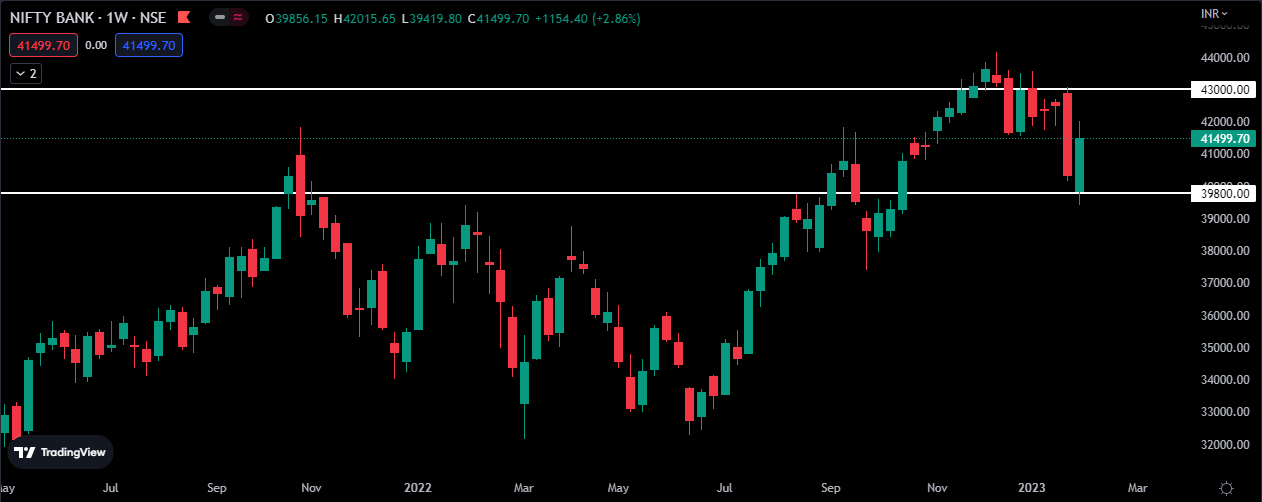

BANK NIFTY

Bank Nifty finished the week up 2.68% amidst fluctuation. Instability in the Budget caused Bank Nifty to near its 200 EMA, but it recovered and ended the week positively. ICICI, Kotak, Axis, and HDFC Banks rose from their support levels and can be a focus for next week(s).

The 200 EMA of Bank Nifty which is at 39800, will act as support on a closing basis, while 43000 will act as strong resistance.

Bank Nifty Weekly Chart

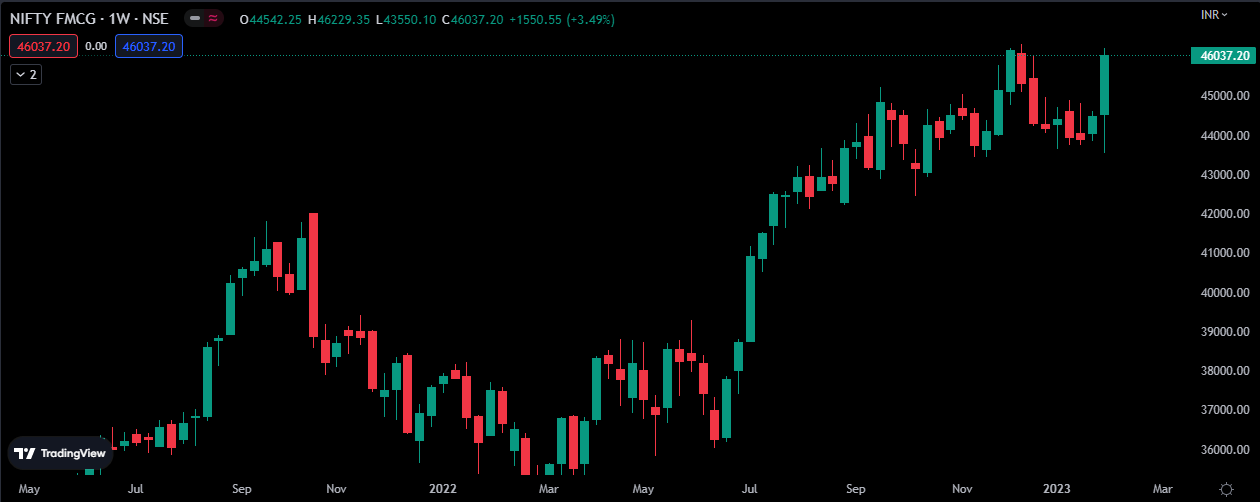

Top Performing Sector of the Week

Nifty FMCG 3.49% Up

– ITC 10.01% Up

– Radico Khaitan 8.11% Up

– Britannia 5.67% Up

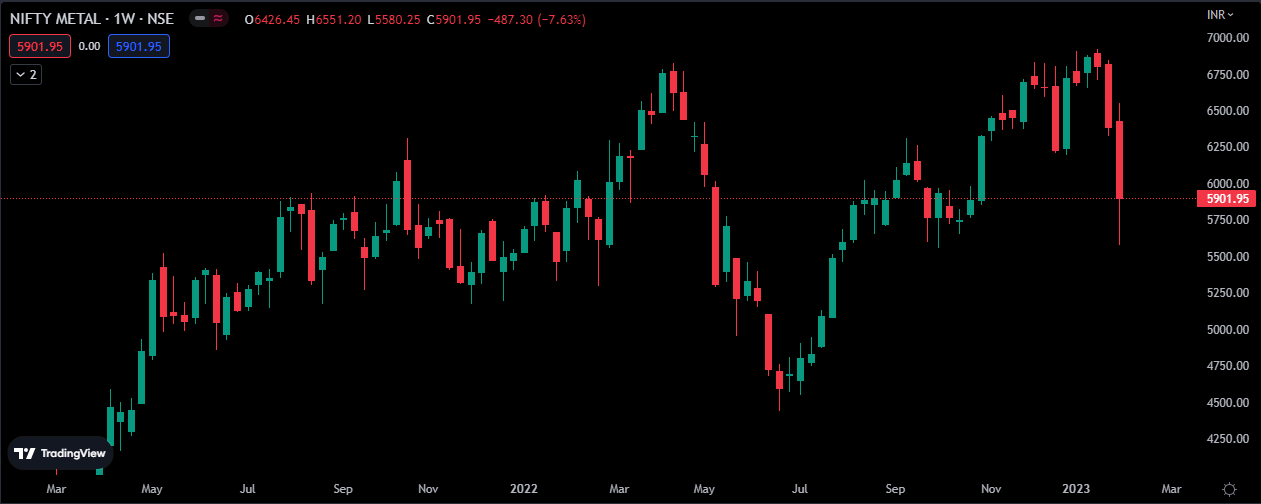

Worst Performing Sector of the Week

Nifty Metal 7.63% down

– Hindustan Copper 12.92% down

– Welspun Corp 7.13% down

– Hindalco Industries 4.04% down

News

- Bank Of Baroda’s Q3 FY23 net interest income grew 26.5% y/y to Rs 10,818 crore. Profit increased 75.4% y/y to Rs 3,853 crore.

- Divis Laboratories‘s Q3 FY23 revenue was down 31.5% y/y to Rs 1,707.7 crore. Profit fell 66% y/y to Rs 306.8 crore. The stock closed 11.7% lower.

- Jubilant Pharmova’s Q3 FY23 revenue was up 18.5% y/y to Rs 1,552.5 crore. It reported a loss of Rs 15.7 crore compared to a profit of Rs 50.9 crore a year ago.

- G M M Pfaudler’s Q3 FY23 revenue increased 23.4% y/y to Rs 792.3 crore. Profit fell 41.3% y/y to Rs 18.7 crore.

- Teamlease Services’s board of directors approved the proposal to buy back its equity shares at Rs 3,050 per share.

- Apollo Tyre’s Q3 FY23 revenue grew 12.5% y/y to Rs 6,423 crore. Profit increased 31% y/y to Rs 292.1 crore.

About the Author

Sagar Wadhwa

Sagar Wadhwa is a Senior Equity Research Analyst who is a key member of the research team at Univest. He has extensive knowledge and expertise in the stock market, financial analysis, and investing and uses this expertise to provide valuable insights to the research team.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Budget 2023 Analysis – Many high points and a few low ones

Related Posts

India Glycols Gears Up for Q3 Reveal on 10th February; Check Key Expectations Here

HLE Glascoat Gears Up for Q3 Reveal on 10th February; Check Key Expectations Here

Grasim Industries Gears Up for Q3 Reveal on 10th February; Check Key Expectations Here

Gujarat Pipavav Port Gears Up for Q3 Reveal on 10th February; Check Key Expectations Here

GNFC (India) Gears Up for Q3 Reveal on 10th February; Check Key Expectations Here