Top Dividend-Paying Stocks in India

Posted by : Ketan Sonalkar | Fri Feb 02 2024

Top Dividend Paying Stocks in India

Investing in Top Dividend Paying Stocks in India can be a compelling strategy for generating passive income and building wealth over the long term. While not without its risks, understanding the intricacies of dividend stocks and making informed choices can offer valuable benefits for savvy investors. Let’s delve into the world of Indian high dividend-paying stocks, exploring their advantages, considerations, and top contenders in the market.

Dividend Delights: A Glimpse into the Benefits

The main attraction of Top dividend paying stocks lies in their regular payouts, a portion of the company’s profits distributed to shareholders. These payouts can provide a steady stream of income, acting as a cushion against market volatility and potentially supplementing your regular income.

Beyond the immediate financial rewards, Top dividend paying stocks offer several other potential benefits:

- Reduced Volatility: Dividend-paying companies are often mature and established, leading to greater stability and potentially lower volatility compared to growth stocks.

- Consistency: Companies with a consistent track record of increasing dividends can be particularly attractive, offering reliable income growth.

Who Should Embrace Dividend-Paying Stocks?

While top dividend paying stocks offer various advantages, they might not be suitable for everyone. Consider these factors to determine if they align with your investment goals and risk tolerance:

- Investment Horizon: Dividend stocks are ideal for long-term investors seeking steady income and capital appreciation over time. Dividends are typically paid out only once or twice a year and these are in the range of 1% -2% of the stock’s current price.

- Risk Tolerance: Top Dividend paying stocks generally carry lower risk than growth stocks, but they’re not immune to market fluctuations. Assess your risk tolerance before investing. Noyt all stocks may pay dividends consistently every year.

- Income Needs: If you require income from your stock portfolio, top dividend stocks can be a valuable source. However, remember that dividends are not guaranteed and can be suspended or reduced.

Unveiling the Top Contenders: 10 High-Flying Dividend Stocks in India

Now, let’s explore some of the top dividend-paying stocks in India, based on information gathered from the provided articles:

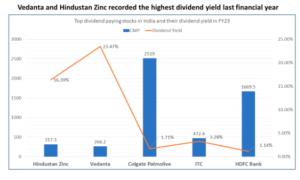

- Hindustan Zinc (HINDZINC): This leading zinc producer boasts a high dividend yield and a strong track record of dividend growth. Hindustan Zinc Ltd. has declared 41 dividends since June 28, 2001.In the past 12 months, Hindustan Zinc Ltd. has declared an equity dividend amounting to Rs 52.00 per share.At the current share price of Rs 318.50, Hindustan Zinc Ltd.’s dividend yield is 16.33%.

- Vedanta (VEDL): A diversified metals and mining company, Vedanta offers a decent dividend yield and potential for capital appreciation. Vedanta Ltd. has declared 41 dividends since July 23, 2001. In the past 12 months, Vedanta Ltd. has declared an equity dividend amounting to Rs 62.50 per share. At the current share price of Rs 266.15, Vedanta Ltd.’s dividend yield is 23.48%.

- Colgate-Palmolive (India) Ltd (COLGATE): This FMCG giant enjoys a strong brand presence and a consistent dividend payout history. Colgate-Palmolive (India) Ltd. has declared 61 dividends since July 25, 2001. In the past 12 months, Colgate-Palmolive (India) Ltd. has declared an equity dividend amounting to Rs 43.00 per share. At the current share price of Rs 2502.45, Colgate-Palmolive (India) Ltd.’s dividend yield is 1.72%.

- ITC Ltd (ITC): A diversified conglomerate with interests in tobacco, FMCG, and hotels, ITC is among the Top Dividend Paying Stocks in India, offering a stable dividend yield and potential for long-term growth. ITC Ltd. has declared 27 dividends since July 3, 2001. In the past 12 months, ITC Ltd. has declared an equity dividend amounting to Rs 15.50 per share. At the current share price of Rs 476.40, ITC Ltd.’s dividend yield is 3.25%.

- HDFC Bank Ltd (HDFCBANK): One of India’s largest private banks, HDFC Bank features a healthy dividend yield and strong financial fundamentals. HDFC Bank Ltd. has declared 24 dividends since April 20, 2001. In the past 12 months, HDFC Bank Ltd. has declared an equity dividend amounting to Rs 19.00 per share. At the current share price of Rs 1690.85, HDFC Bank Ltd.’s dividend yield is 1.12%.

As we navigate the exciting world of Top dividend paying stocks in India, let’s explore some additional aspects that can enrich your investment journey.

Beyond the Big Bulls: Exploring Alternative High-Yielders

While established blue-chip companies often dominate the top dividend Paying Stocks in India lists, venturing into mid-cap and small-cap territory can potentially unlock higher yields. However, these come with increased risk and require thorough due diligence. Here are some potential high-yield contenders from lesser-known segments:

- Balmer Lawrie Investments Ltd (BLIL): Balmer Lawrie Investments Ltd. has declared 22 dividends since Sept. 19, 2003. In the past 12 months, Balmer Lawrie Investments Ltd. has declared an equity dividend amounting to Rs 33.00 per share. At the current share price of Rs 510.20, Balmer Lawrie Investments Ltd.’s dividend yield is 6.47%.

- Polycab India Ltd (POLYCAB): A leading player in wires and cables, Polycab boasts a consistent dividend track record and a compelling yield.

- Punjab National Bank (PNB): This state-owned bank offers a relatively high dividend yield compared to its private sector counterparts.

The Art of Active Dividend Investing: Strategies for Maximizing Returns

For seasoned investors seeking to optimize their dividend income, employing smart strategies can lead to significant gains. Here are some techniques to consider:

- Dividend Capture: Time your investments strategically to benefit from dividend ex-dates, maximizing your capture of upcoming payouts.

- Tax Optimization: Explore tax-efficient accounts and instruments to minimize the tax burden on your dividend income.

Navigating the Risks and Challenges: Cautious Steps for Dividend Investors

While top dividend paying stocks offer undeniable benefits, remember that no investment is without risk. Here are some important considerations for cautious investors:

- Dividend Sustainability: Don’t be solely swayed by high yields. Analyze the company’s financial health and history to ensure long-term sustainability of dividend payments.

- Economic Headwinds: External factors like economic downturns can impact a company’s ability to pay dividends. Stay informed about potential economic risks.

- Liquidity Considerations: Some top dividend paying stocks, especially in smaller companies, might have lower liquidity, making it difficult to sell quickly if needed.

In Conclusion: Making Informed Choices in the Diverse Landscape of Dividend Stocks

Investing in Top dividend paying stocks in India, particularly in Logistics Stocks, requires careful analysis, strategic planning, and a healthy dose of caution. By diligently weighing the benefits and risks, considering your individual financial goals, and staying informed about market trends, you can navigate the dynamic world of Indian dividend stocks and make informed choices towards building a secure and prosperous future.

FAQs:

Does investing in dividend stocks give dual benefits to investors?

Yes, investing in Top dividend paying stocks in India can offer two primary benefits: regular income through dividend payouts and potential capital appreciation over time.

Which Indian companies are on the dividend-paying penny stocks list?

Exploring penny stocks, including the Best Value Stocks in India, carries significant risks due to their inherent volatility. While some penny stocks do offer high dividend yields, thorough research and risk assessment are crucial before investing in such assets.

How can I invest in dividend-paying penny stocks using the univest App?

While I cannot provide specific investment advice or endorse any particular app, it’s essential to conduct thorough research on any platform before using it for investing. Remember, penny stocks come with significant risks, and using investment apps requires careful due diligence and consideration of your own financial goals and risk tolerance.

You may also look like: Top Insurance Stocks in India

Related Posts

Lemon Tree Hotels Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Tata Steel Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Aye Finance IPO Review 2026: GMP Rises 0.28%, Key Investor Insights

MRF Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Whirlpool of India Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here