Titan gets its shine back with Q3FY23 Results

Posted by : Sheen Hitaishi | Fri Feb 03 2023

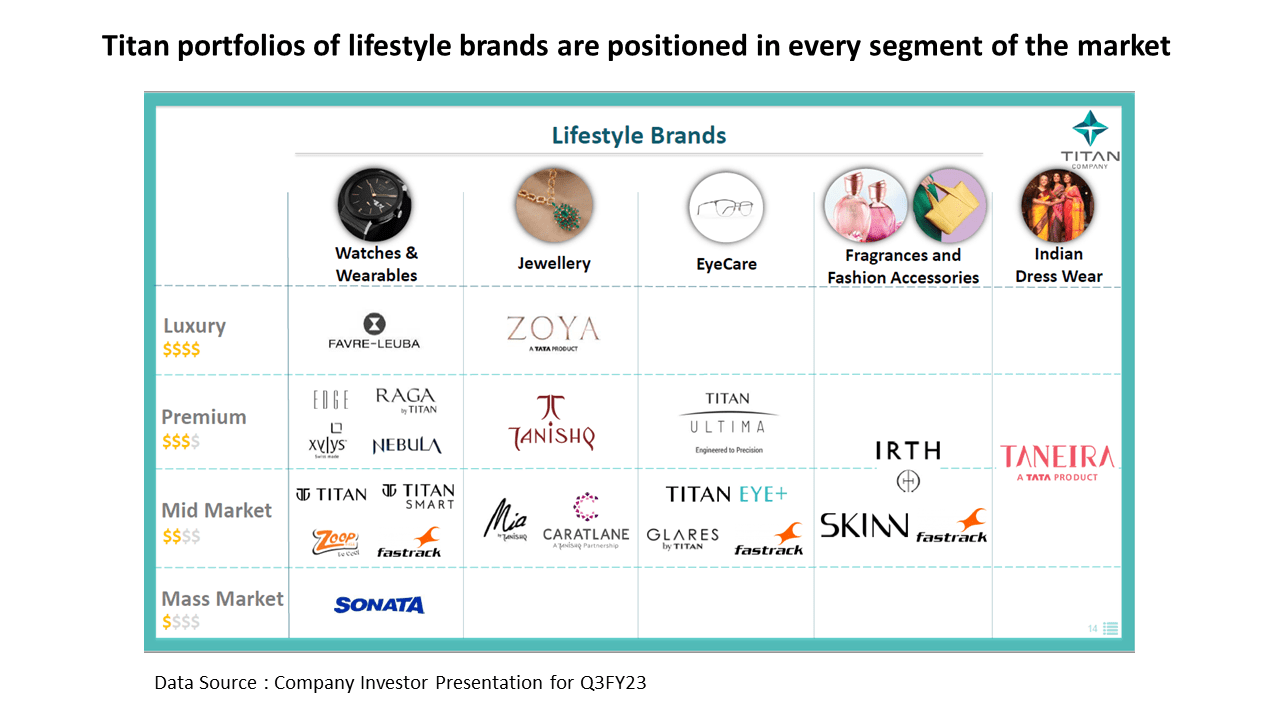

Titan has been one of the biggest wealth creators for investors in the Indian stock market. What started out as a watch brand is now a diversified lifestyle brand. The company posted its Q3FY23 results on 2nd February and the market has given a thumbs up to this stock. The day after his results were declared, its stock price saw again off. More than 7%. indicating that Investors still have faith in the future performance of the stock.

Commenting on the results, Mr. CK Venkataraman, Managing Director of the Company stated: “The quarter witnessed a strong festive consumer demand, and we delivered a healthy double-digit growth of 12% over a strong base of Q3FY22. We continue to pursue market share growth and are actively investing in capabilities across all of our business segments. Our international endeavour is shaping well, and we are quite satisfied with the consumer response we are getting in the chosen international markets.”

Key Highlights of the Results

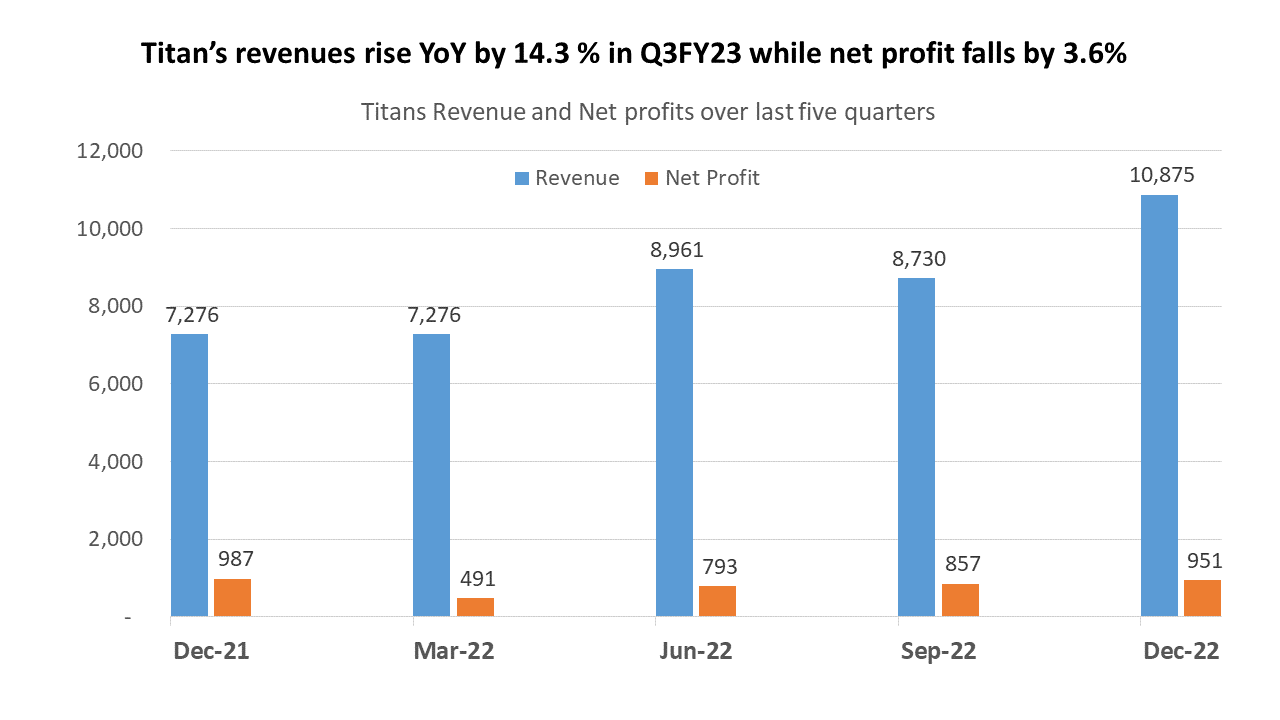

- Titan on a standalone basis recorded a growth of YoY 12% in Q3FY23

- The corresponding PBT (Net Profit) stood at Rs 1,267 crore, lower by 4%, compared to Q3FY22

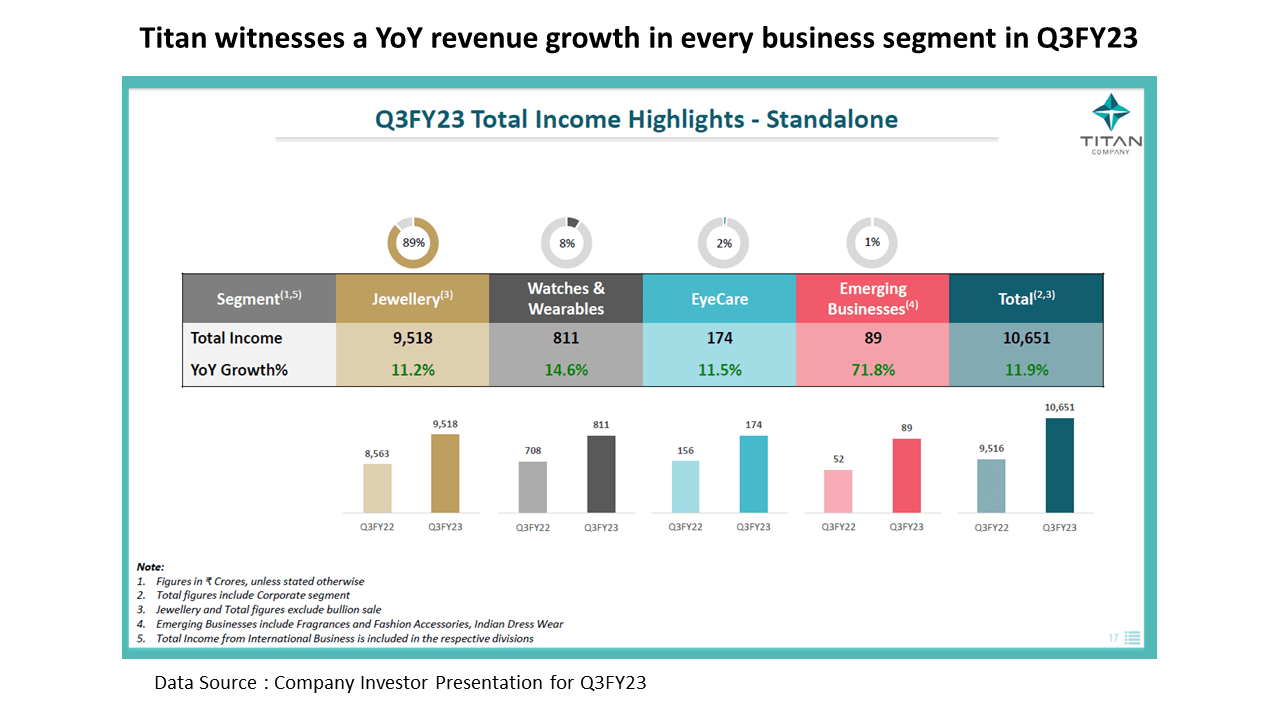

- Total Income from its jewellery segment stood at Rs 9,518 crore registering an increase of 11% compared to Q3FY22, and the corresponding EBIT stood at Rs 1,236 crore clocking a 13.0% EBIT margin.

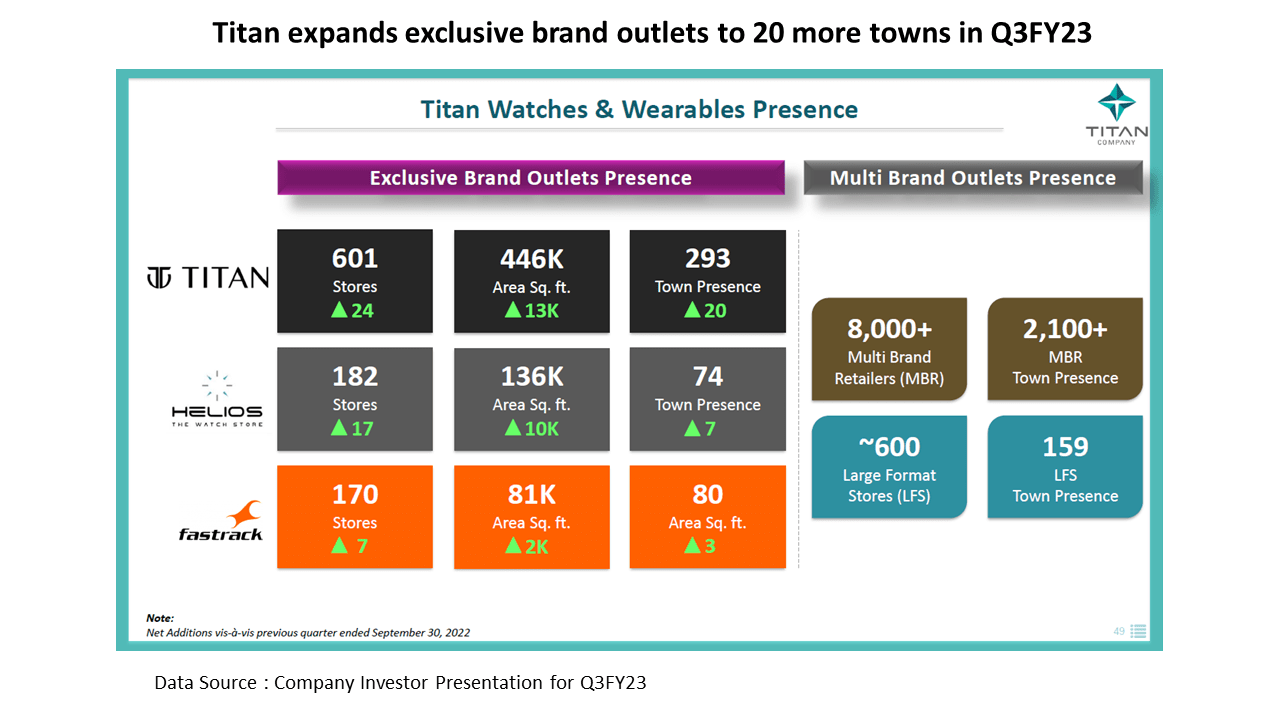

- In the Watches & Wearables segment, revenues in Q3FY23 stood at Rs 811 crore, up by 15% compared to Q3FY22 with an EBIT of Rs 89 crore clocking an EBIT margin of 11.0%.

- In the Eyecare segment, revenues stood at Rs 174 crore, up by 12% compared to Q3FY22. This business segment reported an EBIT of Rs 32 crore clocking an EBIT margin of 18.4%.

Comparing the data for the last five quarters, revenues have been rising steadily. In Q3FY23, the revenues rose by 14.3%, while the net profits fell by 3.6%. The fall in profit margins was partially on account of the rising gold prices. The revenue growth was driven mainly by the festive season and Q3 typically witnesses higher sales on account of the festive demand.

In an interview with Economic Time, the MD said that he does not see any major impact of gold prices being at al all high. “The thing is that over the last year let us say nearly two decades that I have seen at every point when it is high and let us say it is the highest in history this question has come up and has made us think about it but because gold is also a monetary asset to store a value, people know that the money that they put in is sitting in it, typically they end up adjusting the weight of the product that they are planning to buy within the broad rupee budget that they have in mind with some kind of flexibility.

They end up adjusting the weight of the product that they are planning to buy within the broad rupee budget that they have in mind with some kind of flexibility. A hundred thousand budget may go up to 105 or 110 or something like that but the grams that they may buy a slightly smaller piece compared to what they originally.” Said Mr. CK Venkataraman.

In Q3FY23, every business segment of Titan was able to grow on a YoY basis. Jewellery is the largest contributing segment contributing nearly 89% of revenues. This segment grew YoY by 11.2% and generated a revenue of Rs 9,518 crore in Q3FY23.

The next segment that makes a significant contribution is the Watches and wearables segment contributing to about 8% of the revenues. This segment recorded revenues of Rs 811 crore with a YoY growth of 14.6%.

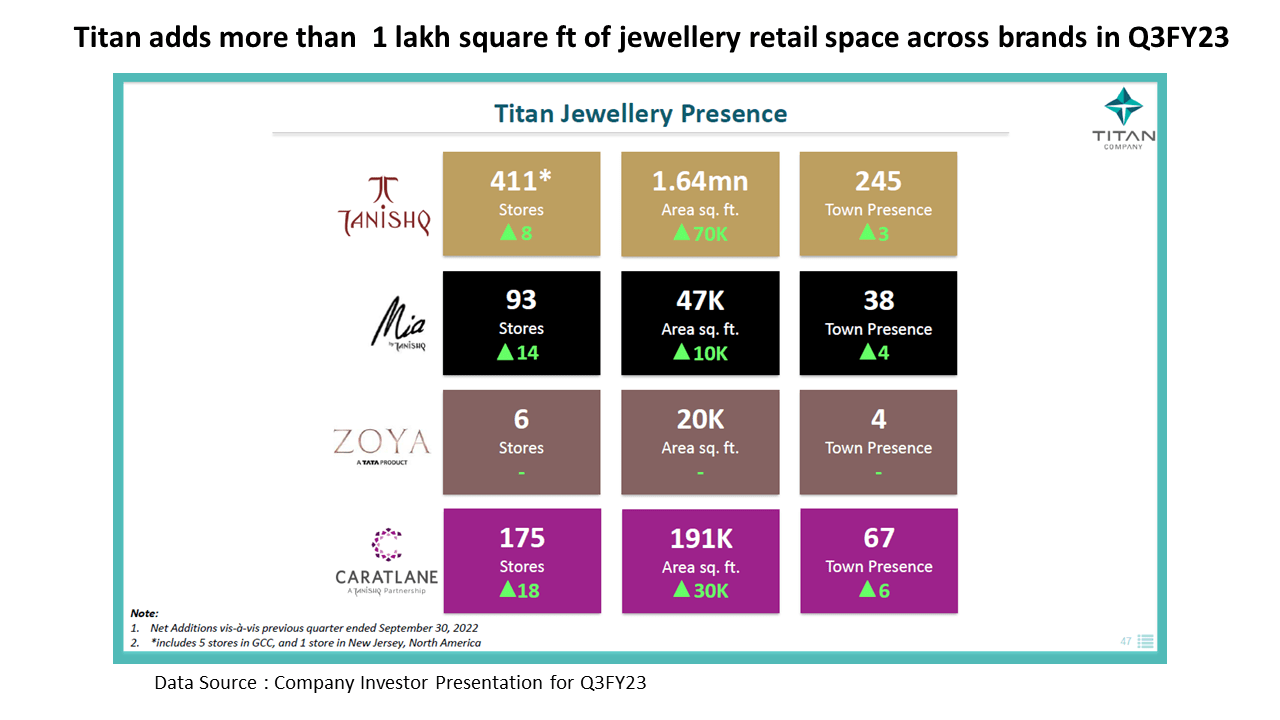

Titan added more than 40k sq ft of retail space in the Tanishq brand, while it added 20k sq ft in the Zoya brand and another 10k sq ft in the Mia brand, expanding its store presence to 245 towns.

In Q3FY23, every business segment of Titan was able to grow on a YoY basis. Jewellery is the largest contributing segment contributing nearly 89% of revenues. This segment grew YoY by 11.2% and generated a revenue of Rs 9,518 crore in Q3FY23.

The next segment that makes a significant contribution is the Watches and wearables segment contributing to about 8% of the revenues. This segment recorded revenues of Rs 811 crore with a YoY growth of 14.6%.

Titan added more than 40k sq ft of retail space in the Tanishq brand, while it added 20k sq ft in the Zoya brand and another 10k sq ft in the Mia brand, expanding its store presence to 245 towns.

The jewellery segment is also well differentiated with different brands catering to various customer segments. Growth in this segment was driven due to a few factors. One is the average ticket sizes saw steady improvement over the same period last year. The festive season saw healthy growth in walk-ins with stable buyer conversions. Contribution from high-value purchases increased in the overall pie became larger. Sales contributions from Golden Harvest (GH) program have reached pre-Covid levels. The GH scheme is one which allows customers to purchase gold in installments and provides a hedge against price fluctuations.

The watches and wearables segment saw growth in the analog segment largely due to an improvement in the Average Selling Price (ASP) in the portfolio. Among key channels, E-Commerce grew the fastest followed by Helios stores. Fastrack brand’s growth significantly outstripped that of the Division thereby also improving its contribution to the Revenue pie.

Coming to the other segments, in Eyewear Revenues from Lenses and Sunglasses grew

faster as compared to Frames. Titan Eye+ opened its first international store in Dubai in the month of December 2022.

In F&FA (Fragrances and Fashion Accessories) segment, Fragrances grew 46% YoY and Fashion Accessories clocked a growth of around 21% YoY. Amongst major channels, Trade and E-Com clocked higher growths than the overall Division.

Taneira sales grew by 150% YoY driven by new store openings and healthy double-digit growth from existing stores. The customer response during the festive season was quite encouraging. The brand opened 5 new stores during the quarter, taking the total store count to 36 covering 17 cities.

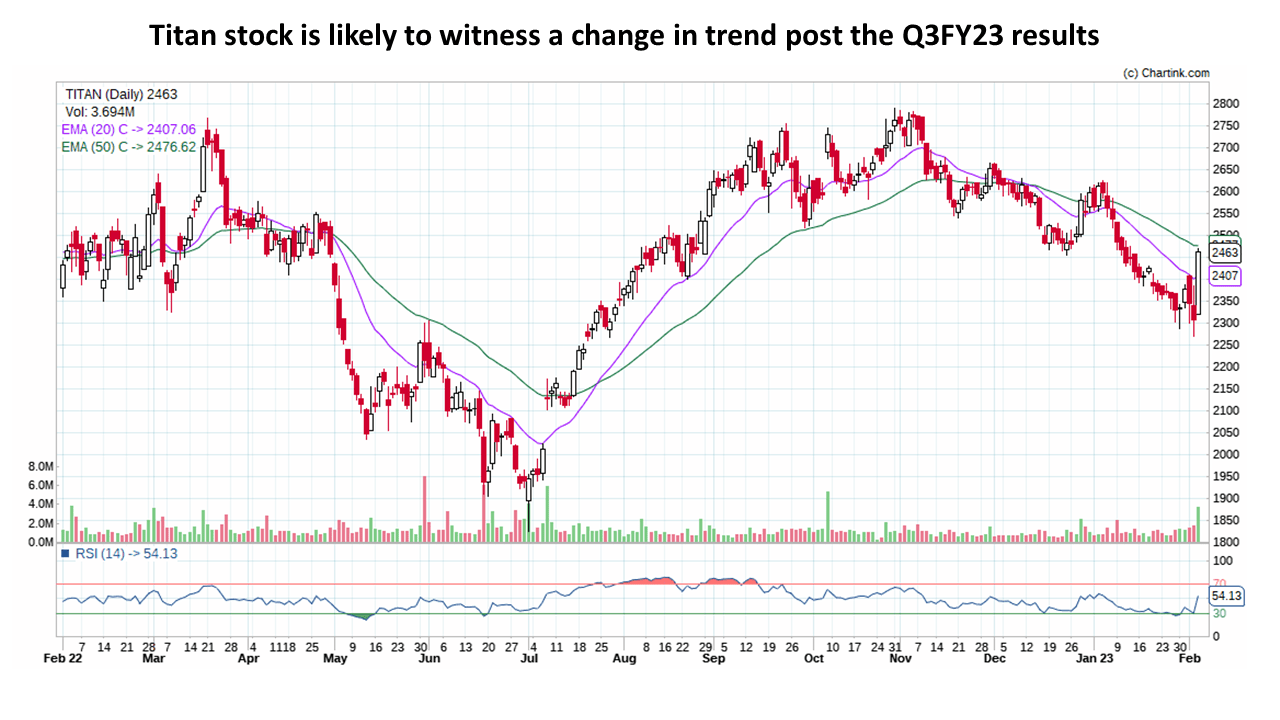

What do the charts say?

The technical chart of Titan has been trading in a downtrend for the last three months making lower highs and lower lows on the chart. However, the stock post the Q3FY23 results gained 7% and erased the losses of the last 12 trading sessions in a single day. This was also accompanied by higher volumes indicating that buying interest is clearly growing.

The stock has crossed its 50-day EMA and is close to crossing its 20-day EMA. A rally in Titan could see the stock touch the previous high of 2800 in next few months.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Budget 2023 Analysis – Many high points and a few low ones

Related Posts

Weekly Update- 02 January 2026

Victory Electric Vehicles International IPO GMP & Review: Apply or Avoid?

Best Small-Cap Mutual Funds for high growth potential

Best Mutual Funds To Invest in India For High Returns

Modern Diagnostic IPO Allotment Status Check Online: GMP, Subscription, Price, and More