Key Analysis about Tata Technologies IPO

Posted by : Sheen Hitaishi | Tue Nov 21 2023

Opening and Closing Dates:

The IPO is scheduled to open on 22nd November, 2023, and will close on 24th November, 2023.

Company Overview:

Tata Technologies (TTL) is a global product engineering and digital services company.

Services contribute to 78.6% of revenue, including outsourced engineering services & digital transformation services.

Technology solutions, accounting for 21.4% of revenue, involve reselling third-party software applications, value-added services, and education solutions.

Major focus on automotive (about 88% of services revenue), aerospace, and industrial heavy machinery verticals.

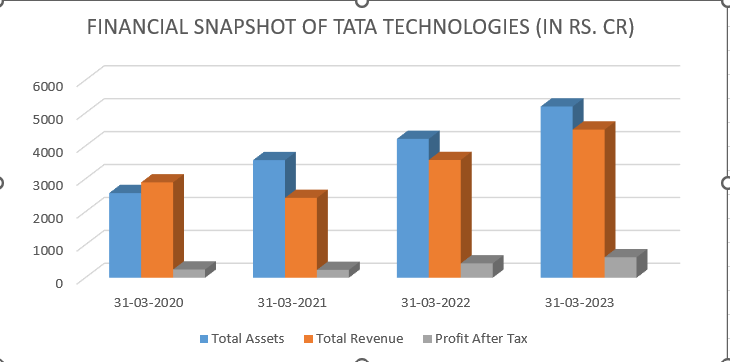

Financial Performance:

Consolidated net profit grew by an impressive 42.8% YoY, reaching Rs 624 crores for the year ended March 2023.

Revenue saw a substantial increase of 25.81%.

IPO Details:

- Price Band: Rs 475-500 per share (Face Value: Rs 2).

- Lot Size: Minimum bid of 30 equity shares, with multiples of 300 thereafter.

- Retail investors’ minimum investment: Rs 14,250 at the lower price band; Rs 15,000 at the upper end.

The IPO aims to raise approximately Rs 3,042.51 crores at the upper price band.

Listing date is set for 5th December 2023.

Offer Composition:

Offer-for-sale includes shares from promoters and investors.

Promoter Tata Motors plans to offload 4.62 crore equity shares worth Rs 2,314 crore.

Investors Alpha TC Holdings Pte Ltd and Tata Capital Growth Fund I will sell 97.17 lakh shares (Rs 486 crore) and 49 lakh shares (Rs 243 crore), respectively.

Tata Technologies has reserved shares for employees and Tata Motors shareholders.

Rationale to Subscribe:

Long-term opportunities in the Engineering Research and Development (Er&d) segments of automotive and aerospace.

Significant size and scale for participation in growing markets.

Potential for margin and cash flow improvement in the future.

Potential Downsides:

Risks associated with high client concentration in the portfolio.

The possibility of limited margin expansion due to substantial growth in technology solutions.

Investors are advised to thoroughly assess the prospectus and consider potential risks before making investment decisions.

Additional IPOs Scheduled for November 22, 2023:

i. Flair Writing Industries Ltd:

ii. Fedbank Financial Services Ltd:

iii. Gandhar Oil Refinery (India) Ltd:

iv. Rockingdeals Circular Economy Ltd:

About the Author

Ankit Jaiswal, our Senior Equity Research Analyst at Univest, brings over 8 years of experience in the stock market, financial analysis, and investing. With qualifications including the NISM Series VIII Equity Derivatives Certification and CMT Level 2, he’s a key asset, driving the insightful contributions to our research team.

Note – This channel is for educational and training purposes only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly Update

Related Posts

Meesho Filed DRHP With SEBI For IPO: Check Key Insights

Jio IPO Details: Everything You Should Know About

Smartworks Coworking Spaces IPO GMP: Day 1 IPO Live Updates

Smartworks Coworking Spaces IPO GMP & Review: Apply or Avoid?

Asston Pharmaceuticals IPO GMP: Day 1 IPO Live Updates

National Stock Exchange NSE IPO Details: Everything You Should Know About