Tata Motors – Riding Out a Rough Path To a Smooth One

Posted by : Sheen Hitaishi | Wed May 24 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1684856212240{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]Tata Motors is a leading automobile manufacturer in India in the commercial vehicle (CV) and passenger vehicle (PV) segments. The company also owns Jaguar Land Rover (JLR), which it acquired in 2008. The company is a leader in the heavy commercial vehicle segment commanding nearly 50% market share and is also a leader in electric PV with nearly 80% market share.

Tata Motors bounces back in FY23 with all time high sales

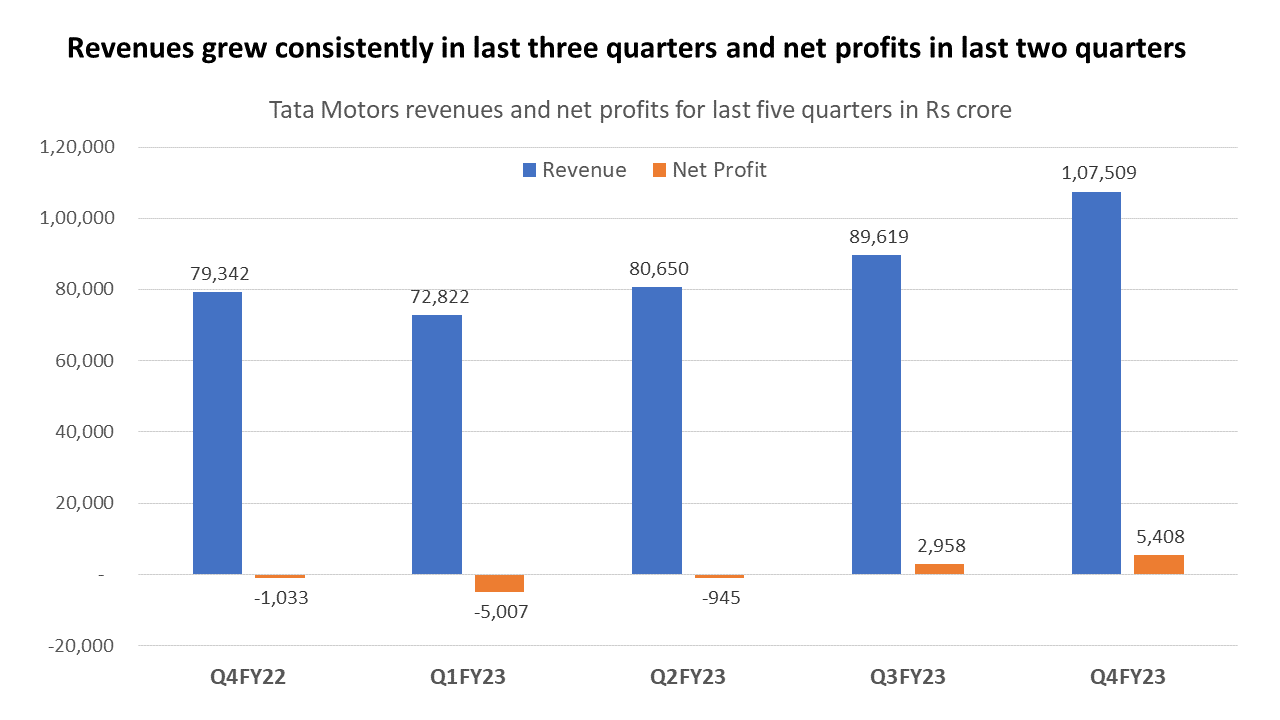

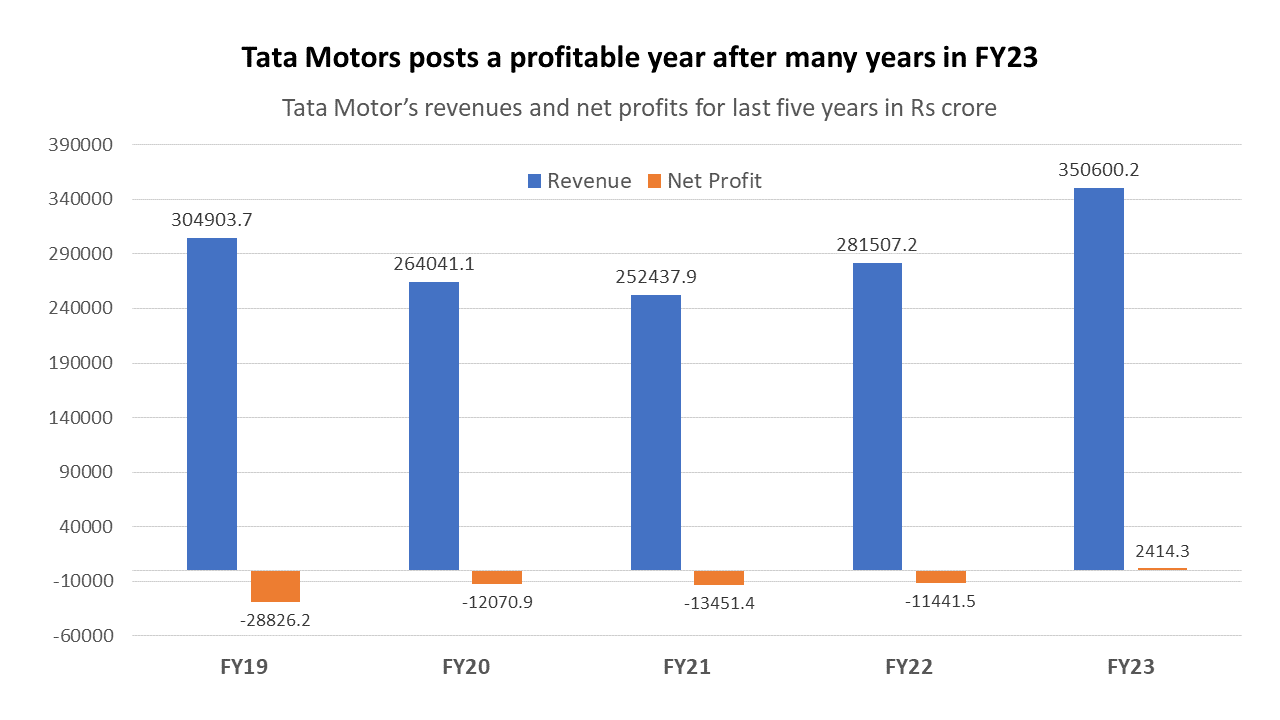

Tata Motors has seen some tough times in the last five years and has posted losses since past few years. These were on account of subdued demand during the pandemic, shortage of semiconductors hampering production and acceptance of its passenger vehicles. However, the company seems to have turned around and recorded its highest ever annual revenue in FY23 at Rs 3,50,600 crore and posted a net profit of Rs 2,414 crore after four consecutive years.

The company has been consistently improving its performance with sales rising for the last three quarters. In Q4FY23, revenues stood at Rs 1,07,509 crore, higher by 35.5% on a YoY basis and EBITDA at Rs 13,114 crore, a YoY change of 58.3%. The company also recorded a net profit of Rs 5,408 crores in Q4FY23, which was the highest in last twelve quarters. The company also reduced its debt by Rs 13,800 crore.

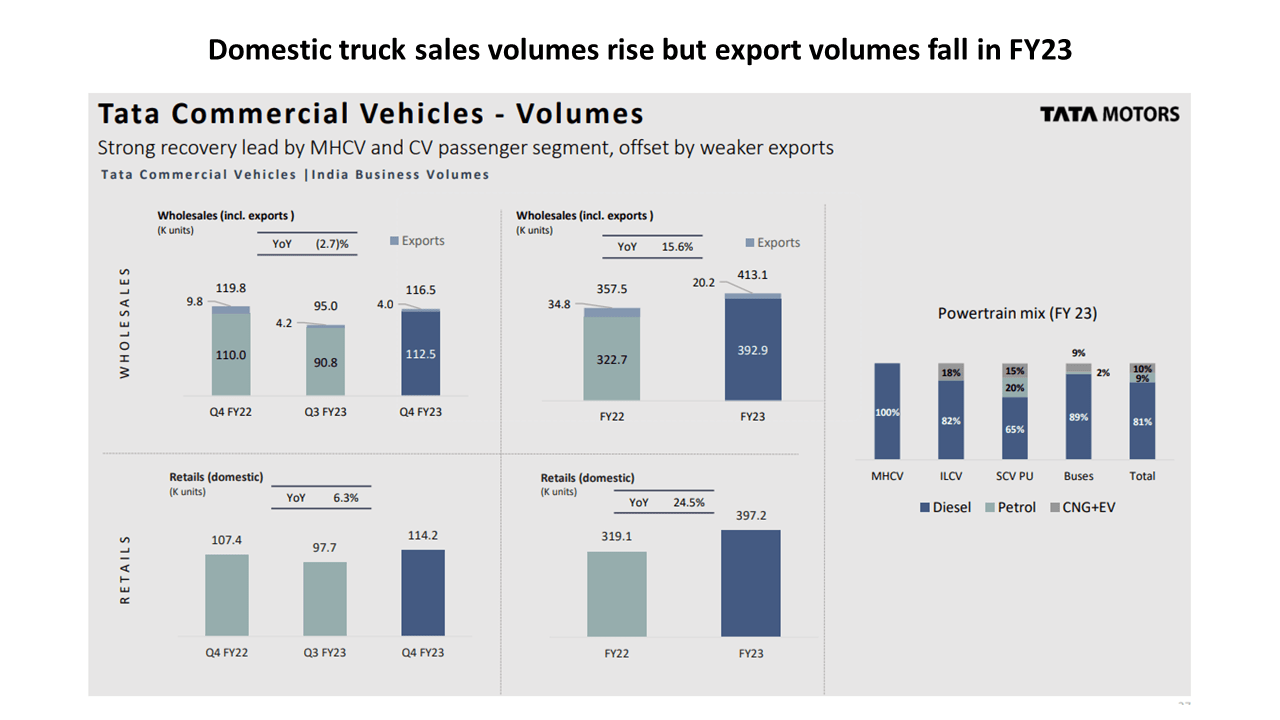

The EV segment continues to grow at a rapid pace, with 16,000 units sold during the Q4FY23. This quarter also saw revival in exports of CVs at 119k units, down 3.0% YoY, but up by 22.2% QoQ, led by heavy CV and passenger segment.

FY23 will be remembered as the year where Tata Motors made a comeback on all fronts. The revenues were the highest ever crossing Rs 350,000 crore and it posted a profit of Rs 2,414 crore after four loss making years.

Improving JLR sales across regions put this vertical in the top gear

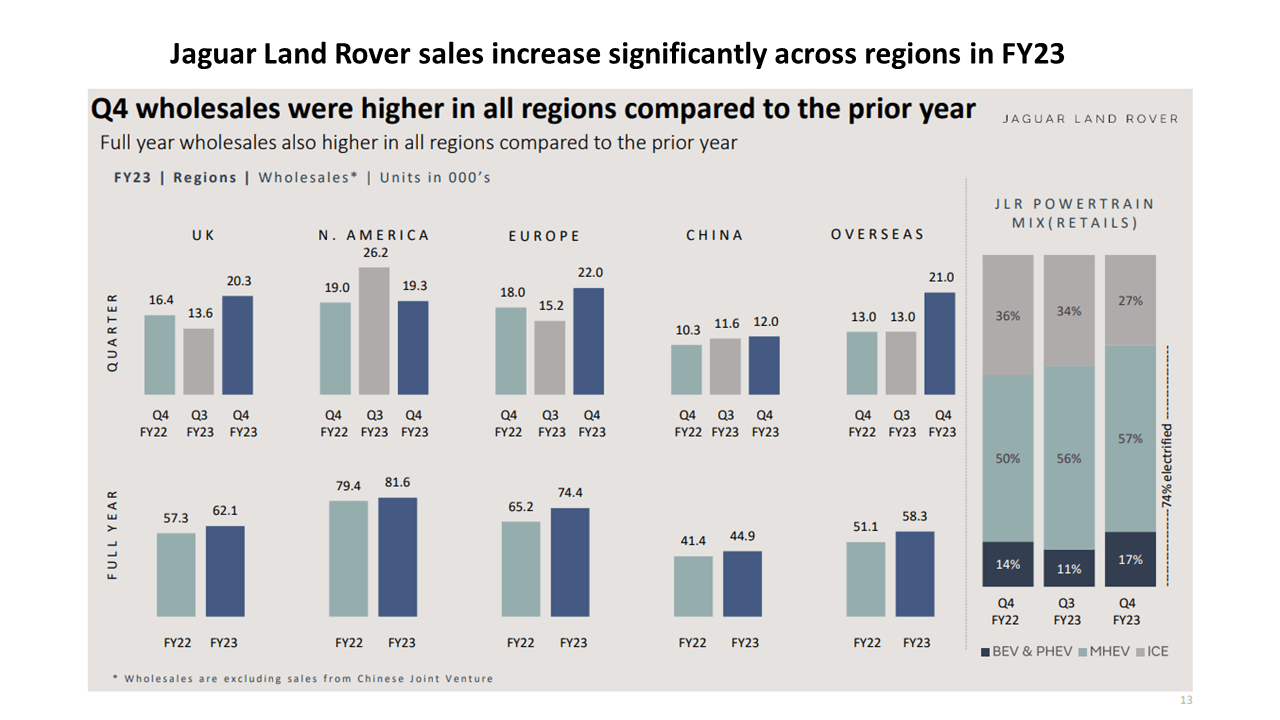

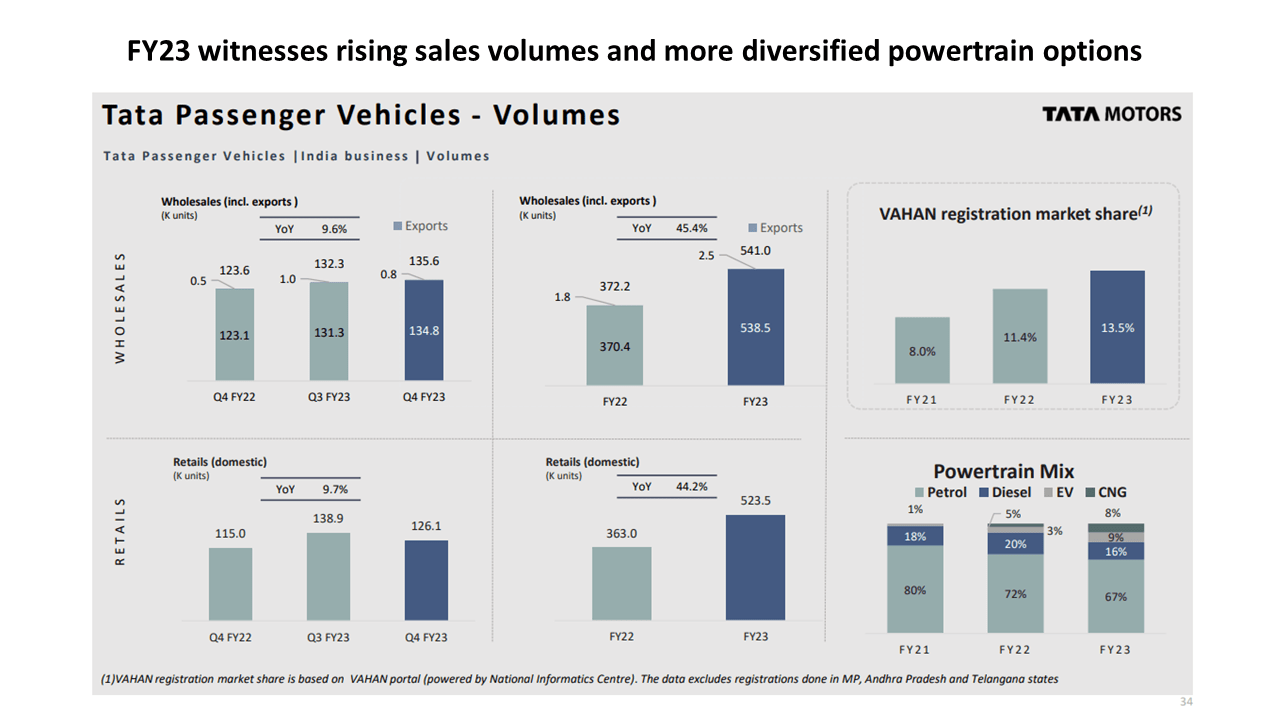

Revenue was driven by strong volume growth in PVs and JLR. JLR’s wholesale volume rose 23.7% YoY to 95k vehicles, largely on account of robust demand in India and improvement in semiconductor supplies. JLR’s order book remained strong at 200k units, with Range Rover, Range Rover Sport and Defender models comprising 76.0% share. PV volume grew 9.6% YoY to 136k units, supported by its ‘New Forever’ philosophy, multiple powertrain options and debottlenecking exercises.

The management commentary on demand outlook remained optimistic with pending order book of 2 lakh units for JLR as of Q4FY23 end vs 2.15 lakh units as of Q3FY23. They have informed that the company does not foresee demand moderation. Further, the management guided for sales of 4 lakh+ units for FY24 with improving chip supplies and expect gradual improvement in quarterly performance.

The management also informed about sales in Q1FY24 to be similar to Q4FY23. The management said that sales in North America were impacted due to seasonality but demand on the ground remined strong. JLR had 74% electrified powertrain mix in Q4FY23 (BEV & PHEV 17%, 57% MHEV) vs. 67% in Q3FY23.

The company’s “Refocus” programme saved £250 million in Q4FY23, achieved £1.1 mn cash and cost improvements for FY23 in line with its target of ~£1 bn for FY23. JLR generated positive free cashflow of £815 million in the quarter resulting in £1.3 billion FCF for H2FY23 and £521 million for FY23. Further the management said net debt improved to £3.0 billion as of FY23 with cash of £3.8 billion.

Commenting on the CV segment the management said, “Advance buying in Q4FY23 in anticipation of price hikes for engines post BS VI Phase II will have near term impact on demand. With the government’s continuing thrust on infrastructure development, we remain optimistic about the overall CV demand in FY24 despite near term challenges on interest rates, fuel prices and inflation. We will continue to drive our demand-pull strategy and drive customer preference through innovation, service quality and thematic brand activation. We will aim for higher realizations and cost savings to secure double-digit EBITDA margins for FY24 and improve the performance of all business verticals.”

Tata Motors has been able to expand its PV portfolio well over the past few years. Ever since the introduction of the Nexon, Punch, Altroz and Harrier, these PV models have found widespread acceptance among the customer base and Tata Motors is very likely to secure second place in market share in PVs in the next quarter. The improved quality of these models is also a reason for their increasing popularity.

In the EV PV segment, Tata Motors is currently leagues ahead of its competition with nearly 80% market share. It has also introduced newer EV models apart from its flagship “Nexon EV” and CNG models, thereby diversifying the product range.

Conclusion

There are many factors that have contributed to the stellar performance of Tata Motors in FY23. By the end of FY23, the auto industry has overcome the issue of chip shortages due to which production speed increased. Sales of JLR in the international market have been improving in Q4. Tata Motors is able to maintain its leadership in the passenger EV segment with Nexon EV and has launched newer EV models also. Tata Motors also maintains leadership in the HCV segment. All these make Tata Motors a strong player in the auto sector.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly Update – 19th May 2023[/vc_column_text][/vc_column][/vc_row]

Related Posts

Weekly Update- 20 Feburary 2026

IIFL Finance NCD: Tranche Detail

PNGS Reva Diamond Jewellery IPO Review 2026: GMP Rises 5.70%, Key Investor Insights

IEX Share Price Falls 25.96% YoY: What Went Wrong & What’s the Target

Yashhtej Industries IPO Allotment Status: 1.05x Subscribed, GMP Rises 1.82% — Check Online