Sun Pharma results Q2FY23

Posted by : Sheen Hitaishi | Fri Nov 04 2022

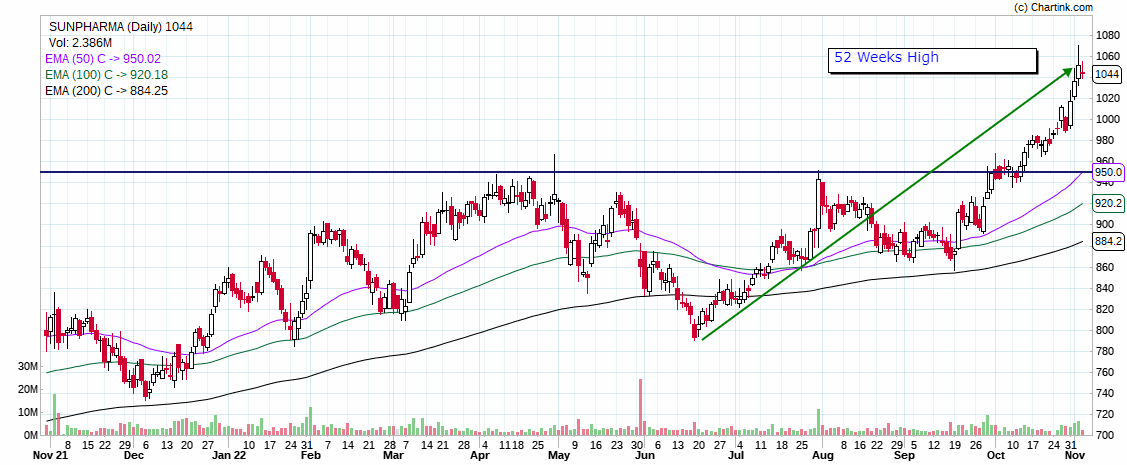

Sun is the world’s fourth largest generics/specialty pharma company with 43 manufacturing sites at its disposal addressing segments like specialty products, branded generics, complex generics, pure generics, and APIs. With a market share of 8.6%, Sun is ranked No. 1 in domestic formulations. It enjoys a leadership position in 11 specialties based on prescription and has a market cap of Rs 2,46,412 crores. The company on 1st November’22 announced their Q2FY23 results, where they reported better-than-expected Q2 numbers. This robust performance was led by superior execution in the Specialty portfolio, US Generics (excluding Taro), and the Domestic Formulation (DF) segment; benefits from the PLI scheme; and a favourable currency movement. Even on the stock market, the stock price has gone up and is currently trading close to its 52 weeks high. So, let’s now have a look at the company’s Q2FY23 and check whether there is any hidden investment opportunity.

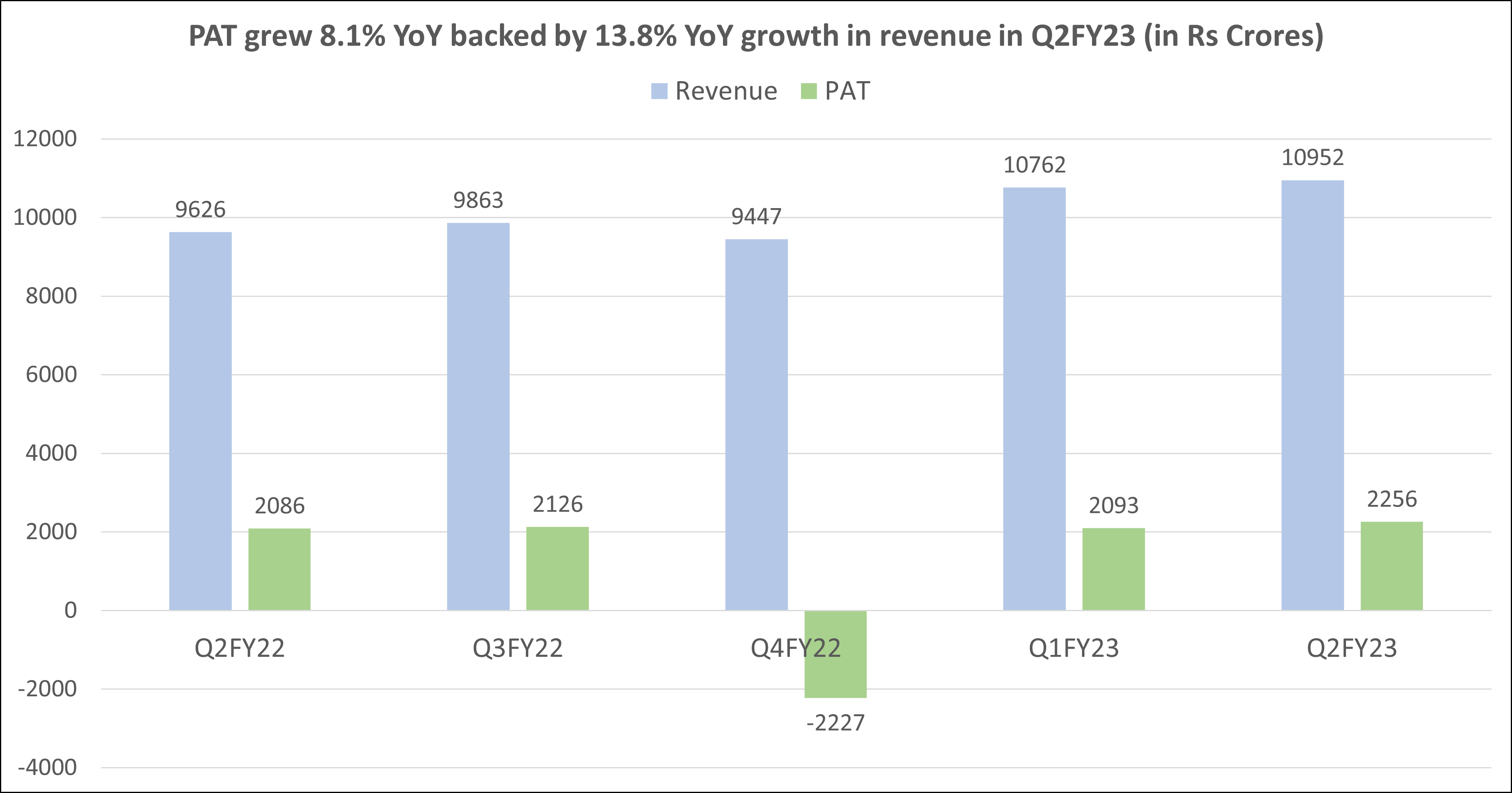

Sun Pharma results Q2FY23: Both PAT & revenue were seen growing sequentially as well as yearly

Sun’s PAT grew 8.1% YoY to Rs 2,256 crores from Rs 2,086 crores in Q2FY22. Whereas PAT grew 7.8% QoQ from Rs 2,093 crores reported in Q1FY23. Revenues grew 13.8% YoY to Rs 10952.3 crores from Rs 9,626 crores in Q2FY22, driven by market share gain in India, sustained ramp-up of global specialty business, and growth in Emerging Markets. While sequentially, revenue grew slightly by 1.7% from Rs 10,762 crores reported in Q1FY23.

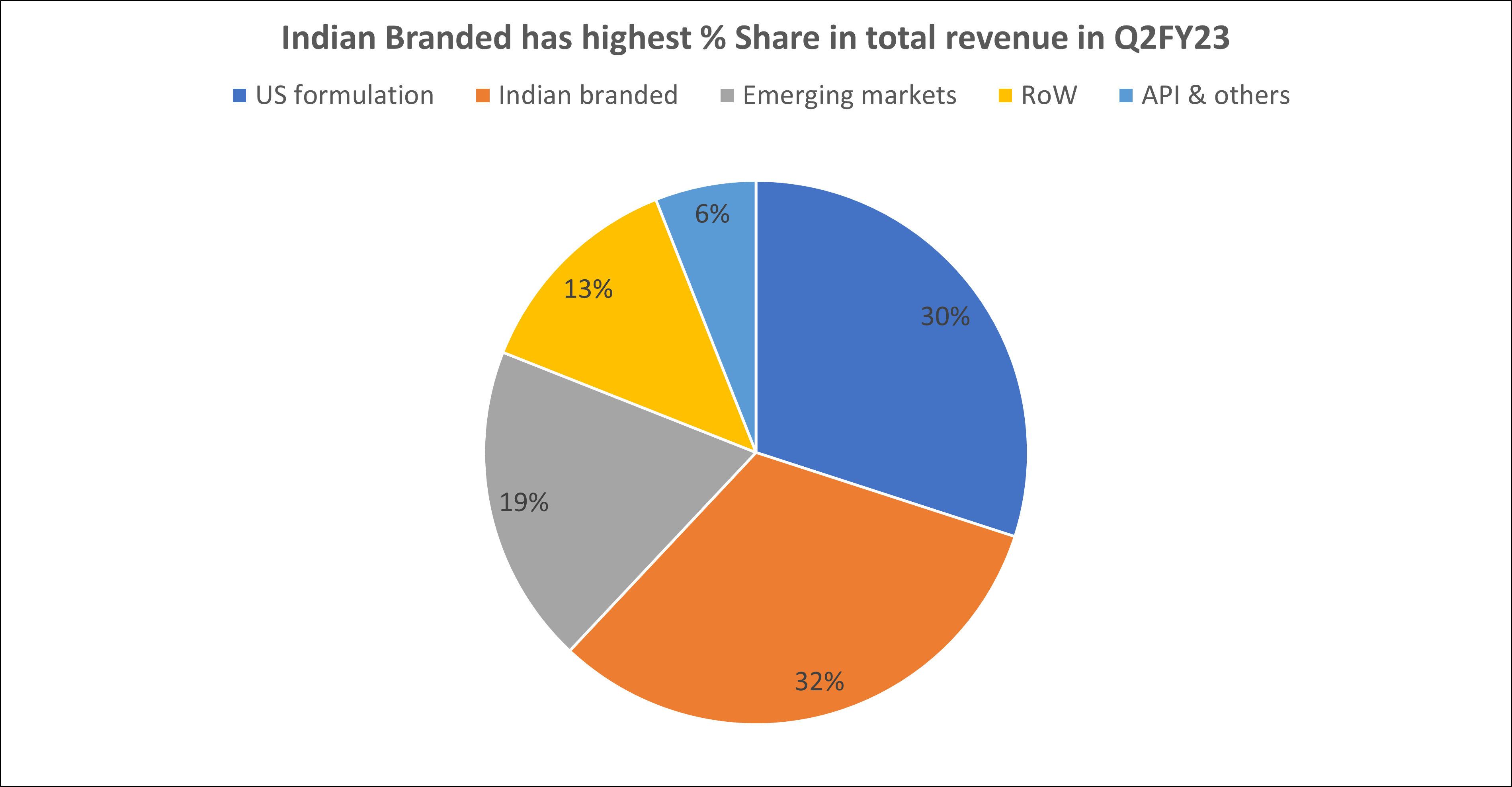

Furthermore, India formulations witnessed YoY growth of 8.5% driven by demand growth, new product launches, and increased market shares. US formulations grew 22.9% YoY to Rs 3,292 crores, growth driven by specialty portfolio amid demand uptick for Cequa, Ilumya, and Winlevi with Specialty at US$200 million. Emerging markets witnessed YoY growth of 6.7% in US$ terms. RoW markets witnessed a de-growth of 3.8% YoY in US$ terms, due to adverse currency movements. API witnessed YoY growth of 9% to Rs 543.2 crores.

You may also like: Nestle Q3CY22 results

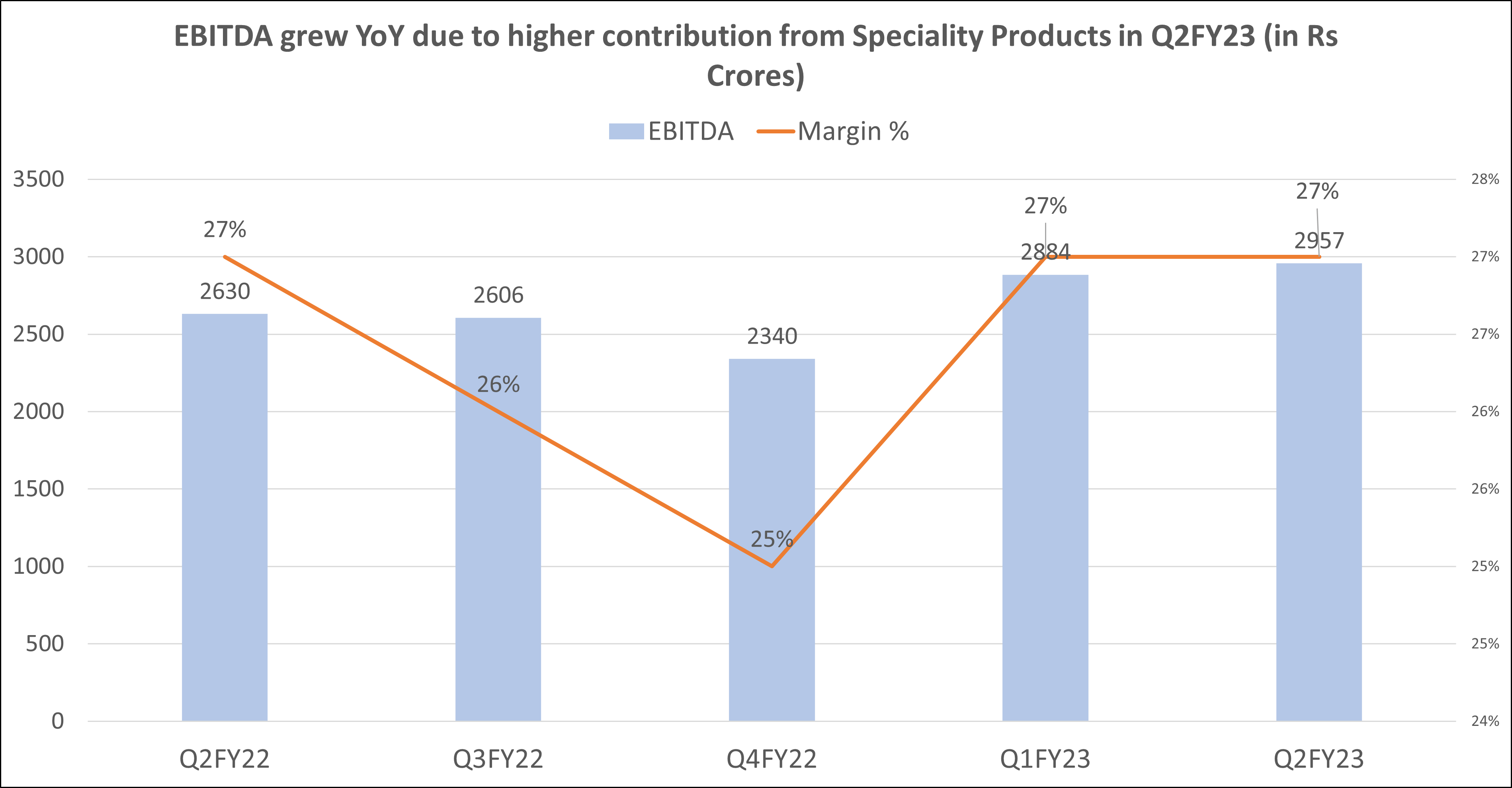

Sun Pharma results Q2FY23: EBITDA came in flat QoQ while it grew YoY

Sun Pharma also has its EBITDA increasing 12.4% YoY to Rs 2956.6 crores. While EBITDA margins declined 33 bps YoY to 27% due to higher employee and other expenses. Further, gross margins increased 147 bps over the previous year to 75.3%. The expansion was mainly due to the change in product mix, and higher contribution from specialty products.

Univest View along with Technical Analysis:

Overall, Q2FY23 witnessed a strong performance led by global specialty businesses. Investors can expect India business to outperform and ramp-up in global specialty sales to continue supporting margins and profitability offset by rising R&D spend. Further, on the technical charts the stock can be seen making a steep up move after surpassing the resistance of 950. Its 50 EMA is currently above 100 & 200 EMA and that for more than a year with an exception of June’22 where it turned bearish for some time.

Motilal Oswal said, “We remain positive on the stock on the back of an increased prescription base for the Specialty portfolio, robust franchise building in Branded Generics, niche ANDA pipeline awaiting approval, and controlled cost. We reiterate our Buy rating with TP of Rs 1240.”

ICICI Direct said, “We maintain BUY as 1) global specialty portfolio continues to maintain momentum, 2) growth in India formulations from new launches and field force expansion, and 3) calibrated cost approach including R&D spend. We give a target price of Rs 1225.”

On Univest App, the company has a Buy rating with a neutral stance for Fundamentals. That might be because of the decline in margin % in Q2FY23. However technically the company is bullish on both short as well as long-term time frames. Therefore, existing investors can remain invested while fresh investors can consider buying the stock with a medium to a long-term target price of 1200. While a key point to be tracked by the investors is for the stance on fundamentals to turn Strong instead of the current neutral rating.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Tech Mahindra and Sun Pharmaceuticals results declared

Related Posts

LTIMindtree Q3 Results 2026 Highlights: Net Profit Rises by 46% & Revenue Up 1% YoY

Reliance Industries Q3 Results 2026 Highlights: Net Profit Rises by 0.57% & Revenue Up 10% YoY

L&T Finance Q3 Results 2026 Highlights: Net Profit Rises by 17.91% & Revenue Up 11.73% YoY

Sensex Slides 324 Points Down at Close, FMCG Emerges Top Performer

JB Chemicals & Pharmaceuticals Q3 Results 2026 Highlights: Net Profit Surged by 21.79% & Revenue Up 10.51% YoY