Stocks bought by Mutual Funds in September 2023

Posted by : Sheen Hitaishi | Thu Oct 19 2023

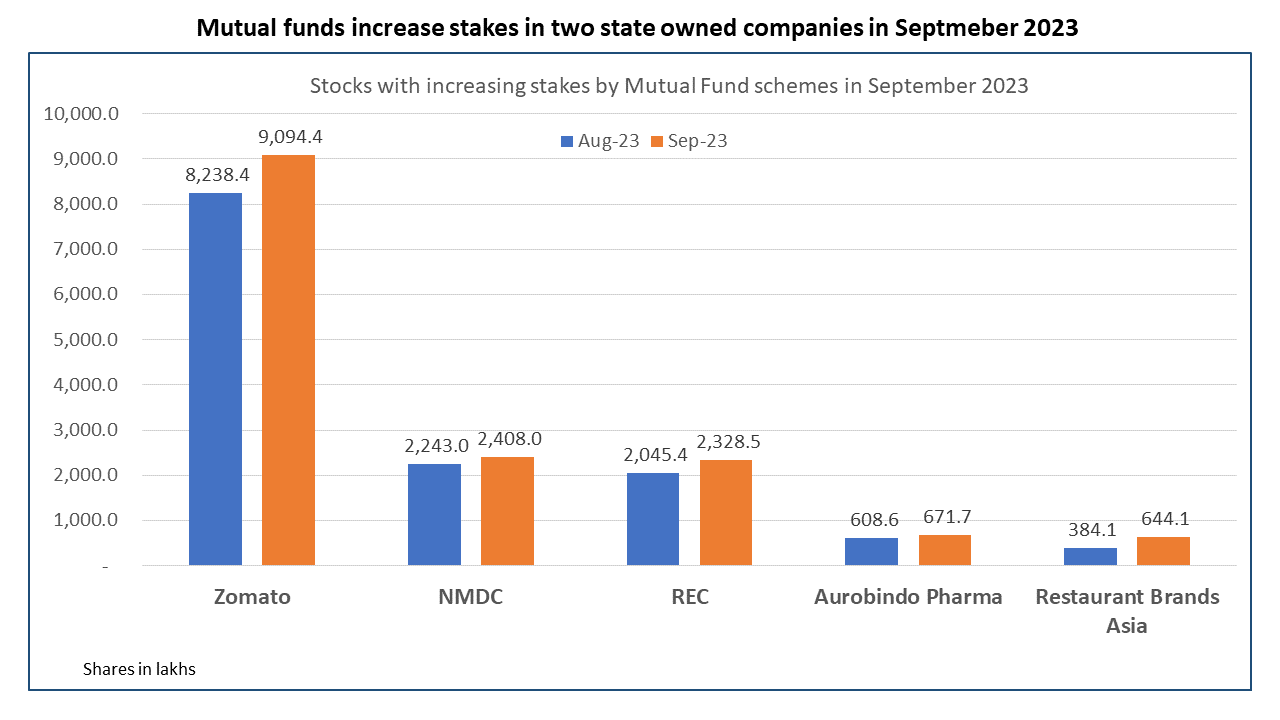

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1697713182299{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]In September, mutual fund schemes bought stocks across the board, from sectors as diverse as state owned companies, agrochemicals, cement and pharmaceuticals.

Listed below are few stocks from the Nifty 500 universe which saw increasing share in mutual fund schemes. Each stock saw net purchases of more than one lakh shares by at least four mutual fund schemes in September and a 5% increase in holdings. Stocks with maximum buying in index funds and arbitrage funds have been excluded.

Zomato

Zomato is a leading food delivery aggregator in India, with presence in 23 other countries as well. The company’s management is confident of attaining over 40% YoY growth in the coming years, primarily fuelled by an increase in the user base. Zomato has seen rising buying interest from mutual fund schemes for the fifth consecutive month.

Funds who increased holdings in Zomato:

- ICICI Prudential Balanced Advantage Fund Growth

- ICICI Prudential Flexicap Fund Regular Growth

- Franklin India Focused Equity Fund Growth

- Tata Digital India Fund Regular Growth

NMDC

NMDC, a Navratna Public Sector Enterprise under the Ministry of Steel, Government of India, is the single largest producer of iron ore in India. It owns and operates highly mechanized iron ore mines in Chhattisgarh and Karnataka.

NMDC has taken a price hike of Rs. 300/per tonne (or 6.5%/7.7%) for iron ore lump/fines in September 2023, which reflects a recovery in international iron ore price. Capacity expansion by domestic steel companies bodes well for the NMDC over the next two financial years. Moreover, the recent demerger of the steel business is also a positive development for the company. NMDC has also seen increasing buying by mutual fund schemes consistently over last six months.

Funds who increased holdings in NMDC:

- Invesco India Arbitrage Fund Growth

- Quant Mid Cap Fund Growth

- Kotak Multi Asset Allocation Fund Regular Growth

- HDFC Arbitrage Fund Wholesale Plan Growth

REC

REC is a public sector non-banking finance company (NBFC). The company primarily caters to the funding requirements of power generation and T&D projects, especially in rural areas.

In September, REC signed a memorandum of understanding (MoU) with Punjab National Bank (PNB) for co-financing loans worth ₹55,000 crore for projects in the sectors of power as well as infrastructure and logistics in the next three years.

It has now diversified into the non-power infrastructure sector, which includes roads and expressways, metro rail, airports, IT communication, social and commercial infrastructure (educational institution, hospitals), ports and electro-mechanical (E&M) works in respect of sectors such as steel, refinery, etc.

Funds who increased holdings in REC:

- DSP Tax Saver Fund Regular Plan Growth

- DSP Equity Opportunities Fund Growth

- Invesco India Growth Opportunities Fund Growth

- DSP Flexi Cap Fund Payout of Income Dist cum Cap Wdrl

Aurobindo Pharma

Aurobindo Pharma is a leading pharmaceutical company that is vertically integrated with business units engaged in formulations, custom synthesis, peptides, R&D and APIs.

Strong growth momentum in the US and Europe businesses, robust demand, diverse product portfolio, new product launches, market share gains and improved operating leverage augur well for the company’s future.

The stock which saw a sharp decline from May 2021 has more than doubled from its lows in Jan 2023.

Funds who increased holdings in Aurobindo Pharma:

- HDFC Mid-Cap Opportunities Fund Growth

- Sundaram large and Mid-Cap Fund Growth

- ICICI Prudential Value Discovery Fund Growth

- Bandhan Sterling Value Fund Regular Plan Growth

Restaurant Brands Asia

Restaurant Brands Asia is one of the fastest growing international QSR chains in India based on number of restaurants. As the national master franchisee of the “Burger King” brand in India, the company has exclusive rights to develop, establish, operate and franchise Burger King branded restaurants in India.

Management has maintained guidance of 10% SSSG (Same Store Sales Growth) for FY2024 and 8% SSSG for FY2025. It targets 67% gross margins in FY2024 for the India business. Popeyes will help the Indonesia business to break-even in FY2024.

RBA opened 5 Burger King restaurants, taking the total restaurant count to 396 in Q1FY24. It has 11 BK cafés in Q1, that takes the total count to 286 cafes. The company is planning to have 450 restaurants in India in FY2024.

Funds who increased holdings in Restaurant Brands Asia:

- Quant Small Cap Fund Growth

- Tata Equity P/E Fund Regular Growth

- Tata India Tax Savings Fund Regular Payout of Inc Dist cum Cap Wdrl

- Quant Business Cycle Fund Regular Growth

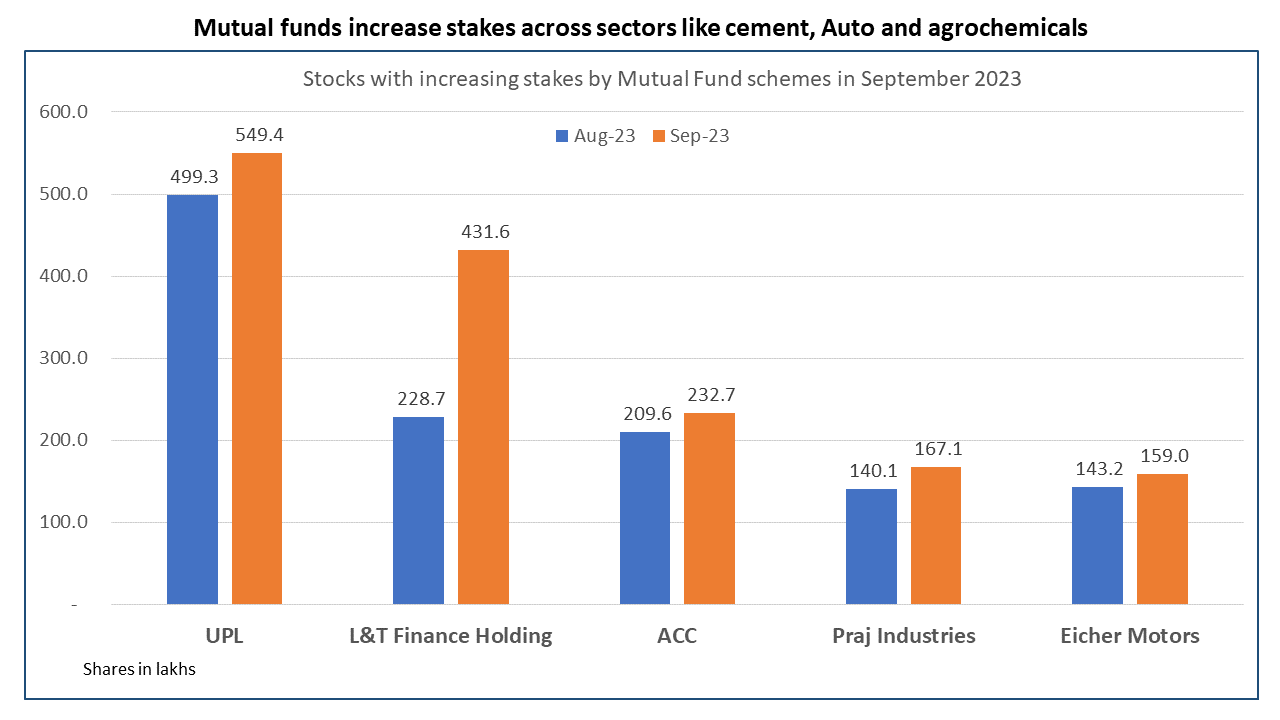

UPL

UPL Limited is a global generic crop protection, chemicals and seeds company. The Company is principally engaged in the agro-business of production and sale of agrochemicals, field crops, vegetable seeds etc.

The last two quarters saw a decline in the company’s revenues and net profits. The management is optimistic about a change in the situation and channel inventories are expected to normalize from Q3FY24 onwards with increasing demand.

Funds who increased holdings in UPL:

- Mirae Asset Emerging Bluechip Fund Growth

- Mirae Asset Tax Saver Fund -Regular Plan-Growth

- SBI Arbitrage Opportunities Fund Regular Growth

- HDFC Balanced Advantage Fund Growth

L&T Finance Holdings

L&T Finance Holdings offers financial products and services in the corporate, infrastructure and retail sectors. It also offers fund products and investment services.

L&T Finance Holdings’s twin strategy of growing its retail book and significantly reducing the wholesale book, while maintaining healthy asset quality, has enabled it to achieve its Lakshya 2026 retail mix goal of over 80.0%, three years ahead of its schedule.

Funds who increased holdings in L&T Finance Holdings:

- DSP Midcap Fund Growth

- SBI Arbitrage Opportunities Fund Regular Growth

- Axis Business Cycles Fund Regular Growth

- Mahindra Manulife Flexi Cap Fund Regular Growth

ACC

ACC is one of India’s oldest cement companies and was acquired last year by the Adani group. It recently began commercial clinker production at its greenfield Ametha Integrated Cement Plant, situated in the Katni district of Madhya Pradesh. This plant boasts a clinker capacity of 3.3 million metric tonnes per annum (MTPA) along with a cement capacity of 1 MTPA, adding to the overall production capacity of ACC.

Funds who increased holdings in ACC:

- Mirae Asset Emerging Bluechip Fund Growth

- SBI Contra Fund Regular Payout Inc Dist cum Cap Wdrl

- Mirae Asset Midcap Fund Regular Growth

- Aditya Birla Sun Life Multi-Cap Fund Regular Growth

Praj Industries

Praj Industries is a knowledge-based company with expertise and experience in Bioprocesses and engineering. It delivers know how, license, engineering design, plant & equipment, project management, commissioning and customer care and turnkey projects.

It is well-positioned to benefit from the Ethanol Blended Petrol (EBP) Programme with a 50% market share in the domestic bioethanol plant installation segment. It is also scaling up its non-bio-energy businesses, Praj HiPurity Systems (HPS), Critical Process Equipment & Skids (CEPS), and wastewater treatment. A strong orderbook and huge domestic and global order opportunities has provided significant growth visibility.

Funds who increased holdings in Praj Industries:

- Franklin India Smaller Companies Fund Growth

- Canara Robeco Emerging Equities Growth

- Canara Robeco Multi Cap Fund Regular Growth

- Bandhan Balanced Advantage Regular Growth

Eicher Motors

Eicher Motors Limited is an Indian multinational automotive company that has diversified interests in motorcycle and commercial vehicles manufacturing. It manufactures the iconic ‘Royal Enfield’ brand of motorcycles, which leads the premium motorcycle segment in India. It has a 50-50 joint venture with the Sweden’s AB Volvo operating as VE Commercial Vehicles Limited (VECV), which designs and manufactures trucks and buses.

The recent Q1FY23 was one of the best quarters for the company in term of sales for both motorcycles as well as commercial vehicles. Though its leading brand Royal Enfield is facing competition from peers with the entry of Harley Davidson and Triumph at similar price points, it recently launched its new generation “Bullet 350” last month which is expected to get a good response.

Funds who increased holdings in Eicher Motors:

- Mirae Asset Emerging Bluechip Fund Growth

- Mirae Asset Large Cap Fund Regular Growth

- Nippon India Arbitrage Fund Growth

- Tata Arbitrage Fund Regular Growth

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: TCS Q2FY24 Results : Consistent YoY growth along with strong deal wins

[/vc_column_text][/vc_column][/vc_row]

Related Posts

Why is the Mega Corporation Share Price Falling?

Penny Stocks Below 5 rupees | Multibagger Stocks in 2026

Gaudium IVF & Women Health IPO Listing Preview: What to Expect Now?

Manilam Industries India IPO Listing Preview: What to Expect Now?

Yashhtej Industries IPO Listing at 25% discount at ₹88 Per Share