Stocks bought by Mutual Funds in November 2023

Posted by : Sheen Hitaishi | Mon Dec 18 2023

In November, the Nifty 50 index showed a robust upward trend, closing 5.52% higher at the month’s end. Each week’s closure surpassed the previous, indicating the index’s strength.

Mutual fund managers have actively purchased stocks with perceived growth potential, spurred by this bullish trend. Particularly, sectors such as banking and finance, energy, railways, and pharmaceuticals saw heightened buying interest.

Below are some stocks from the Nifty 500 universe that observed increased ownership in equity mutual fund schemes. Stocks primarily influenced by index funds and arbitrage funds have been excluded from this list.

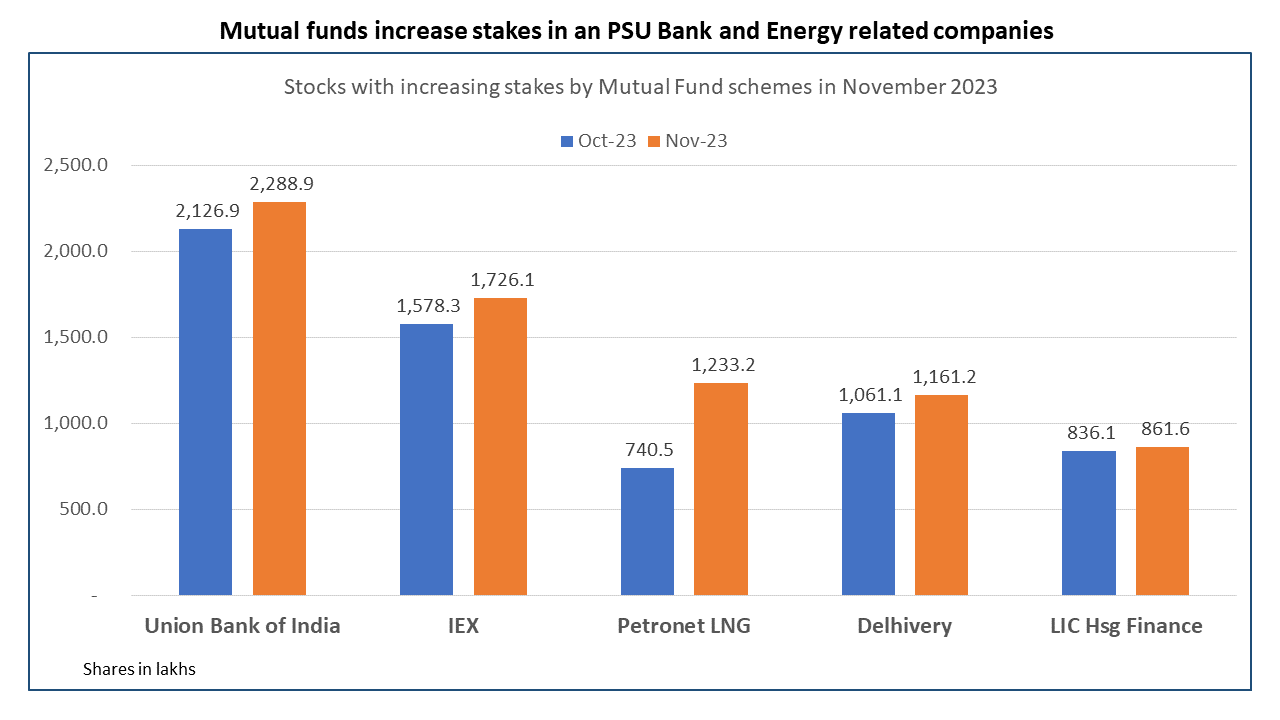

Union Bank of India

Union Bank of India is among the country’s leading public sector banks, offering Retail Banking, Corporate/Wholesale Banking, Treasury Operations, Cash Management Services, Merchant Banking, and more.

The bank has demonstrated strong performance in recent quarters, driven by robust Net Interest Income (NII), healthy margins, increased other income, and reduced provisions. In its latest Q2FY24 results, the bank reported a 23.2% YoY revenue growth and a remarkable 90% YoY increase in net profits.

Notable funds that increased their holdings in Union Bank of India include:

- Nippon India Large Cap Fund – Growth

- HDFC Mid-Cap Opportunities Fund Growth

- Mahindra Manulife Large & Mid Cap Fund Regular Growth

- Mahindra Manulife Mid Cap Fund Regular Growth

IEX (Indian Energy Exchange)

Indian Energy Exchange Limited (IEX) is India’s first and largest power exchange, commanding over 98% of the traded volume in electricity with a diverse registered base of more than 6,300 participants. The sharp rise in electricity demand led to several DISCOMS contracting power through bilateral agreements. Bilateral contract volumes surged by 25% in Q2FY24.

Funds that increased holdings in IEX include:

- SBI Small Cap Fund Regular Plan Growth

- Invesco India Arbitrage Fund Growth

- SBI Multi Asset Allocation Fund Regular Growth

- Baroda BNP Paribas Arbitrage Regular Growth

Petronet LNG

Petronet LNG specializes in LNG import, regasification, and supply to BPCL, GAIL, IOCL, and others. The company operates LNG Regasification Terminals with a production capacity of 17.5 MMTPA at Dahej in Gujarat. Recently, the board approved a petrochemical project at Dahej with an investment of Rs 207 billion. The project comprises a 750ktpa propane dehydrogenation (PDH) unit, a 500ktpa polypropylene (PP) plant, and handling facilities for propane and ethane. Management anticipates project completion by 2028.

Funds that increased holdings in Petronet LNG:

- SBI Balanced Advantage Fund Regular Growth

- SBI Contra Fund Regular Payout IDCW

- SBI Long Term Equity Fund Regular Payout of IDCW

- Kotak Equity Arbitrage Fund Growth

Delhivery

Delhivery operates in warehousing and last-mile logistics and is India’s largest and fastest-growing fully integrated logistics player by revenue. Services include express parcel, ecommerce, and heavy goods delivery. The company has seen consistent revenue growth for the past six quarters, aiming for profitability by the end of FY24, despite incurring losses over the last eight quarters. However, the losses are decreasing, portraying an optimistic trajectory.

Funds that increased holdings in Delhivery:

- Mirae Asset Tax Saver Fund -Regular Plan-Growth

- SBI Long Term Equity Fund Regular Payout of IDCW

- Mirae Asset Emerging Bluechip Fund Growth

- SBI Large & Midcap Fund Regular Payout IDCW

LIC Housing Finance LIC Housing Finance, a leading housing finance company in India, extends long-term finance for residential properties to individuals, professionals, and builders. With a vast network of 314 marketing offices. The management anticipates a 12-15% YoY loan book growth in FY24, aiming to improve the 80% sanction-to-disbursement ratio by streamlining processes impacted by prior organizational restructuring. Q2FY24 witnessed a significant rise in ROE, climbing to 16% from 5% in Q2FY23.

Funds that increased holdings in LIC Housing Finance:

- Mirae Asset Tax Saver Fund -Regular Plan-Growth

- Canara Robeco Emerging Equities Growth

- ICICI Prudential Multi-Asset Fund Growth

- Mirae Asset Midcap Fund Regular Growth

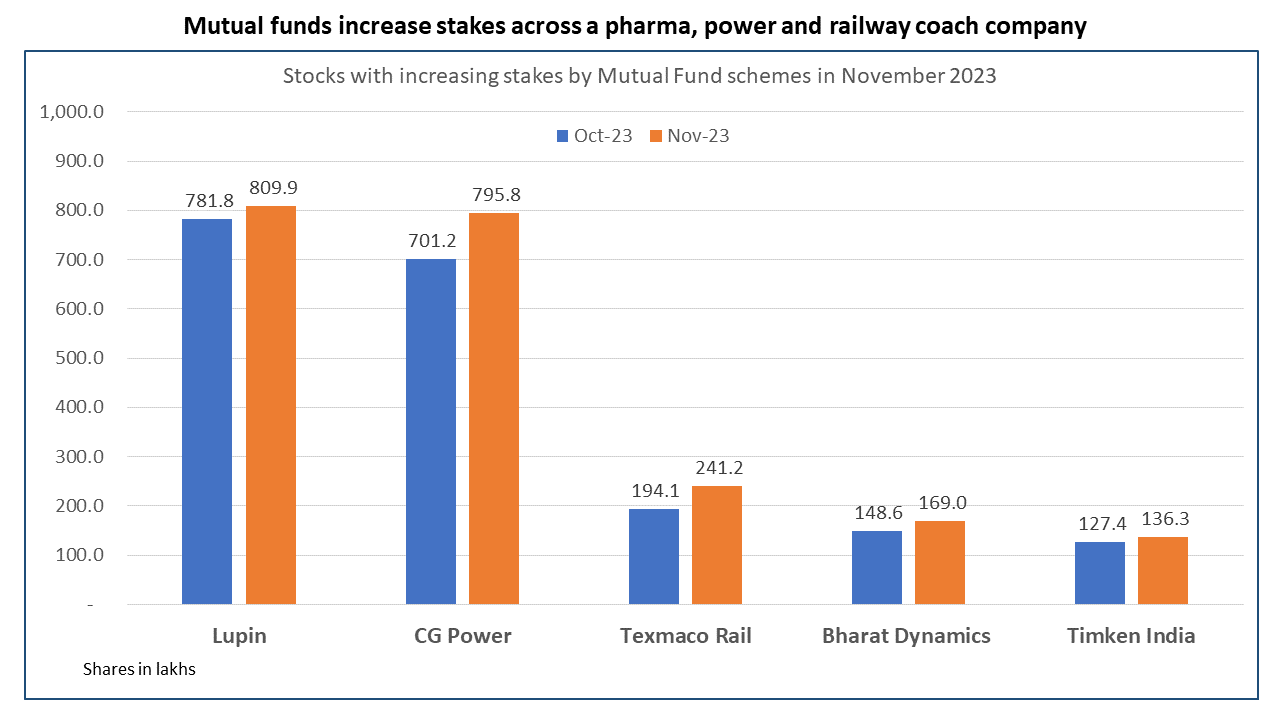

Lupin

Lupin, a multinational pharmaceutical company, specializes in branded and generic formulations, active pharmaceutical ingredients (APIs), and advanced drug delivery systems in biotechnology. It operates 15 manufacturing sites and seven research and development (R&D) sites worldwide. In October, the company received approval for a new drug, Tolvaptan, and expects approval for other products like Mirabegron and Oracea in the coming months. Plans to launch Tiotropium in various markets by FY24-end or FY25 are underway. In Q2FY24, its revenues grew by 22% YoY.

Funds that increased holdings in Lupin:

- Quant Mid Cap Fund Growth

- Quant Flexi Cap Fund Growth

- Nippon India Vision Fund – Growth

- Kotak Equity Arbitrage Fund Growth

CG Power and Industrial Solutions

CG Power deals with the development and distribution of electrical equipment such as transformers, reactors, and control equipment. It also manufactures industrial motors, pumps, and communication systems. The company plans to boost power transformer capacity from 17,000 MVA to 25,000 MVA and aims to capture a 10% market share in distribution capacity within 12 to 15 months. Anticipated capex of Rs. 500 crore over the next two financial years includes Rs. 280 crore for motor expansion, Rs. 125 crore for transformer expansion, and the remainder for regular capex.

Funds that increased holdings in CG Power:

- Motilal Oswal Midcap Regular Growth

- PGIM India Midcap Opportunities Fund Regular Growth

- Motilal Oswal Flexicap Fund Regular Plan Growth

- DSP Midcap Fund Growth

Texmaco Rail

Texmaco Rail & Engineering manufactures Rolling Stock (Wagons, Coaches, Loco shells), Hydro Mechanical Equipment, Steel Castings, Rail EPC, Bridges, and other steel structures. Texmaco Rail holds an order book of 20,000 wagons and has received orders on the export front from Rail EPC and Railway wagon divisions. These orders span both government and private sectors. In FY23, it executed orders for 3,200 wagons.

Funds that increased holdings in Texmaco Rail:

- Nippon India Small Cap Fund – Growth

- LIC MF Large & Mid Cap Regular Growth

- LIC MF Multi Cap Fund Regular Growth

- LIC MF Small Cap Fund Regular Growth

Bharat Dynamics

Bharat Dynamics manufactures missiles and allied defence equipment, serving primarily the Indian Armed Forces and Government of India. The successful launch of the indigenously developed Astra Airto-Air (A2A) BVR missile from the Tejas fighter jet in August marked a significant milestone. The defense ministry placed an order for 248 Astra Mk-1 missiles in March last year.

Funds that increased holdings in Bharat Dynamics:

- Canara Robeco Small Cap Fund Regular Growth

- Nippon India ELSS Tax Saver Fund Growth

- Nippon India Small Cap Fund – Growth

- Motilal Oswal Large and Midcap Fund Regular Growth

Timken India

Timken India manufactures, distributes, and sells anti-friction bearings, primarily tapered roller bearings, roller bearings, components, accessories, and mechanical power transmission products for a diverse customer base. Management attributed a temporary shrink in the railway sector in Q2FY24 to delays in purchasing rather than a lack of orders. The company holds a strong position in the railways segment and anticipates an upturn from Q4FY24.

Funds that increased holdings in Timken India:

- HDFC Mid-Cap Opportunities Fund Growth

- HSBC Small Cap Fund Fund Regular Growth

- Axis Midcap Fund Growth

- Axis Small Cap Fund Regular Growth

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Forget just profits! BSE Chief Wants Us to Look Beyond Numbers at Companies

Related Posts

ITC Share Price Falls 18.80% YoY: What Went Wrong & What’s the Target

Clear Max Envior Energy Solutions IPO Review 2026: GMP Rises 0.66%, Key Investor Insights

Shree Ram Twistex IPO Review 2026: GMP Rises 4.81%, Key Investor Insights

Embassy Developments Share Price Falls 52.67% YoY: What Went Wrong & What’s the Target

Accord Transformer & Switchgear IPO Review 2026: GMP Rises 21.74%, Key Investor Insights