Stock Bought By MFs In March 2023

Posted by : Sheen Hitaishi | Wed Apr 19 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1681900850346{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]In March 2023, the benchmark Nifty 50 index closed almost flat putting a halt to the downtrend over the previous three months. During this month, sectors such as healthcare, realty and auto were the top performing sectors.

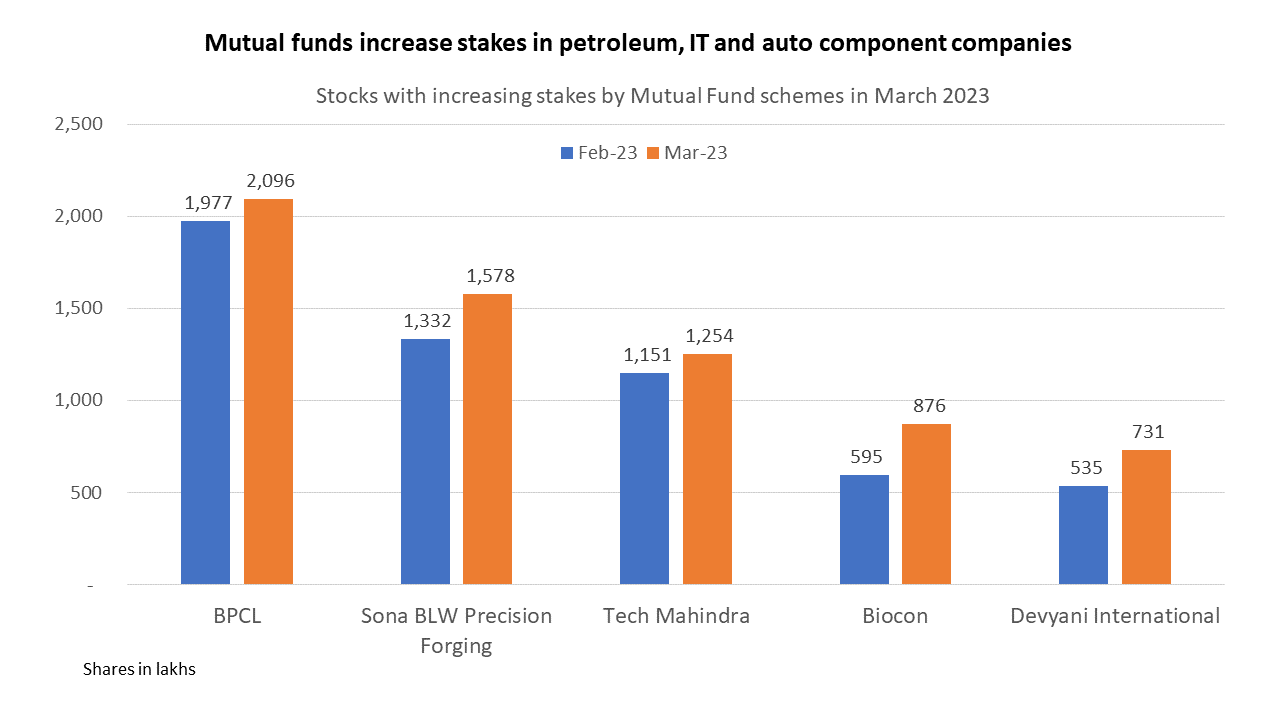

Seizing the opportunity, fund managers of mutual funds bought stocks across sectors in companies with growth prospects. The buying interest ranges from a large state-owned petroleum company, a leading IT company and even one of the oldest asset management companies.

Listed below are stocks from the Nifty 500 universe which saw increasing share in mutual fund schemes. Each stock saw net purchases of more than one lakh shares by at least four mutual schemes each in March.

BPCL (Bharat Petroleum Corporation Ltd)

BPCL is a public sector refining & marketing company which operates more than 19000 retail outlets across the country. Its GRMs (Gross Refining Margins) are likely to improve with a rise in product cracks. Although the company has not passed on higher crude oil costs to customers, with narrowing of diesel losses performance is likely to improve in the near term.

Funds who increased holdings in BPCL were Kotak Equity Arbitrage Fund Growth, SBI Long Term Equity Fund Regular IDCW, Nippon India Large Cap Fund – Growth and Nippon India Vision Fund – Growth.

Sona BLW Precision Forging

Sona BLW Precision Forgings is one of India’s leading automotive technology companies, designing, manufacturing, and supplying highly engineered, critical automotive systems and components such as differential assemblies, differential gears, conventional and micro-hybrid starter motors, EV traction motors to automotive OEMs across US, Europe, India and China. Revival of auto sales post pandemic has been a growth driver for the company.

Funds who increased holdings in Sona BLW Precision Forging were HDFC Mid-Cap Opportunities Fund Growth, IIFL Focused Equity Fund Regular Growth, Axis Business Cycles Fund Regular Growth and Mirae Asset Large Cap Fund Regular Growth.

Tech Mahindra

Tech Mahindra is among the top five Indian IT services companies engaged in consulting-led integrated portfolio services to customers which are Telecom Equipment Manufacturers, Telecom Service Providers and IT Infrastructure Service Providers, Business Process Outsourcing Service Providers as well as Enterprise Solutions Services. 5G telecom services rollout is a huge opportunity for the company as its strength lies in the telecom domain.

Funds who increased holdings in Tech Mahindra include Motilal Oswal Flexicap Fund Regular Plan Growth, Tata Digital India Fund Regular Growth, SBI Dividend Yield Fund Regular Growth and ICICI Prudential Business Cycle Fund Regular Growth.

Biocon

Biocon Ltd is a biopharmaceutical company, developing therapies for chronic diseases, such as autoimmune, cancer and diabetes. The company has developed and introduced novel biologics, biosimilars, differentiated small molecules, and affordable recombinant human insulin and analogs.

Biocon’s greenfield immunosuppressant API facility in Visakhapatnam and peptide facility in Bengaluru are on track, with validation batches scheduled to be launched by H1FY24. The company has entered into an agreement with Zentiva to manufacture and supply Liraglutide in 30 countries in Europe.

Funds who increased holdings in Biocon were SBI Contra Fund Regular Payout Inc Dist cum Cap Wdrl, Mirae Asset Tax Saver Fund -Regular Plan-Growth, Mirae Asset Large Cap Fund Regular Growth and Invesco India Arbitrage Fund Growth.

Devyani International

Devyani International is engaged in the business of developing, managing, and operating quick service restaurants and food courts for brands such as Pizza Hut, KFC, Costa Coffee, Vaango etc. and retail stores of TWG Tea.

It added 81 new stores in Q3FY23 taking the total count to 1,177 stores. During the quarter, the company opened 17 Pizza Hut stores and 38 KFC stores and expanded its presence from 224 cities at the end of September 2022 to 227 cities at the end of December 2022.

Funds who increased holdings in Devyani International include Franklin India Flexi Cap Fund Growth, Aditya Birla Sun Life ELSS Tax Relief 96 IDCW, Franklin India Taxshield Growth and Aditya Birla Sun Life Equity Advantage Fund Growth.

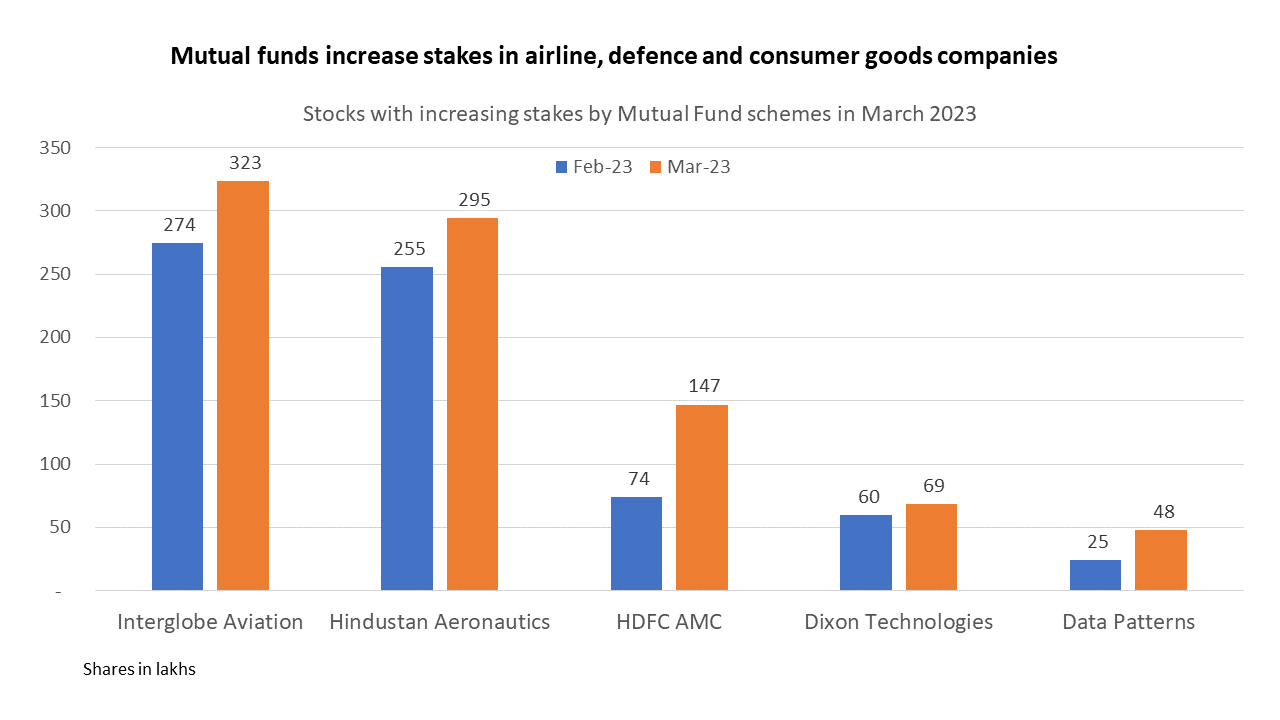

Interglobe Aviation

Interglobe Aviation, more commonly known as Indigo is one of India’s most profitable low-cost airlines. With travel back on people’s agenda after two years of the pandemic, airlines are flying full along almost all routes.

Funds who increased holdings of Interglobe Aviation include ICICI Prudential Balanced Advantage Fund Growth, SBI Equity Hybrid Fund Regular Payout Inc Dist cum Cap Wdrl, ICICI Prudential Value Discovery Fund Growth and Bandhan Flexi Cap Fund Growth.

Hindustan Aeronautics

Hindustan Aeronautics is engaged in the design, development, manufacture, repair, overhaul, and servicing of a wide range of products including, aircraft, helicopters, aero-engines, avionics, accessories, and aerospace structures to meet the requirement of Indian Defence Forces.

Key orders in the pipeline for the next one to two years include 25 advanced light helicopters (ALH) for the Army, 12 light utility helicopters (LUH), 12 Sukhoi-30 MKI and 240 AL-31 engines for Sukhoi-30 MKI aircraft. Total estimated cost of these orders is at around Rs 50,000 crore.

Funds who increased holdings in Hindustan Aeronautics were HDFC Flexi Cap Fund Growth, Franklin India Flexi Cap Fund Growth, Invesco India Contra Fund Growth and ICICI Prudential Technology Fund Growth.

HDFC AMC

HDFC Asset Management Company Ltd. (HDFC AMC) is a leading AMC in India, with assets under management (AUM-closing) of Rs. 4,481bn as on 31st December 2022.

Healthy pipeline of new product launches is likely to aid AUM growth and market share gain. Another advantage is the experienced team, strong distribution network and scheme performance which are positives in the long run.

Funds who increased holdings HDFC AMC were IDCW, SBI Balanced Advantage Fund Regular Growth, SBI Large & Midcap Fund Regular IDCW and PGIM India Midcap Opportunities Fund Regular Growth.

Dixon Technologies

Dixon Technologies transformed from being a manufacturer of electronic goods to leading multi-product corporation with widespread activities. The Company is primarily engaged in the manufacturing of electronics as its core business activity. It is also a beneficiary of the Government PLI scheme for electronics manufacturing.

Funds who increased holdings in Dixon Technologies were HDFC Mid-Cap Opportunities Fund Growth, Nippon India Large Cap Fund – Growth, Nippon India Growth Fund – Growth and Motilal Oswal Midcap 30 Regular Growth.

Data Patterns

Data Patterns is a vertically integrated defence and aerospace electronics solutions provider, catering to the indigenously developed defence products industry. The company is one of the key beneficiaries in the private defence industry from the recent orders received by Bharat Electronics.

The company expects Rs 2000-3000 crore worth orders in the pipeline for the next three to four years which includes radars, avionics, fire control systems for BrahMos Missile, checkout equipment, etc.

Funds who increased holdings Data Patterns include Nippon India Small Cap Fund – Growth, Axis SmallCap Fund Regular Growth, Kotak Tax Saver-Scheme- Growth and Axis Business Cycles Fund Regular Growth.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Results Update Q4FY23- TCS and Infosys [/vc_column_text][/vc_column][/vc_row]

Related Posts

Yes Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

IDBI Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

ICICI Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

HDFC Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

South Indian Bank Q3 Results 2026 Highlights: Net Profit Surged by 9.00% & Revenue Up 6.00% YoY