Real Estate Sector – On a solid foundation for further growth

Posted by : Sheen Hitaishi | Thu Jun 22 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1687431621888{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]As we are halfway through 2023, the real estate sector has surprised investors with its outperformance in the stock market. The realty sector has been the top performer among all other sectors over the last six months.

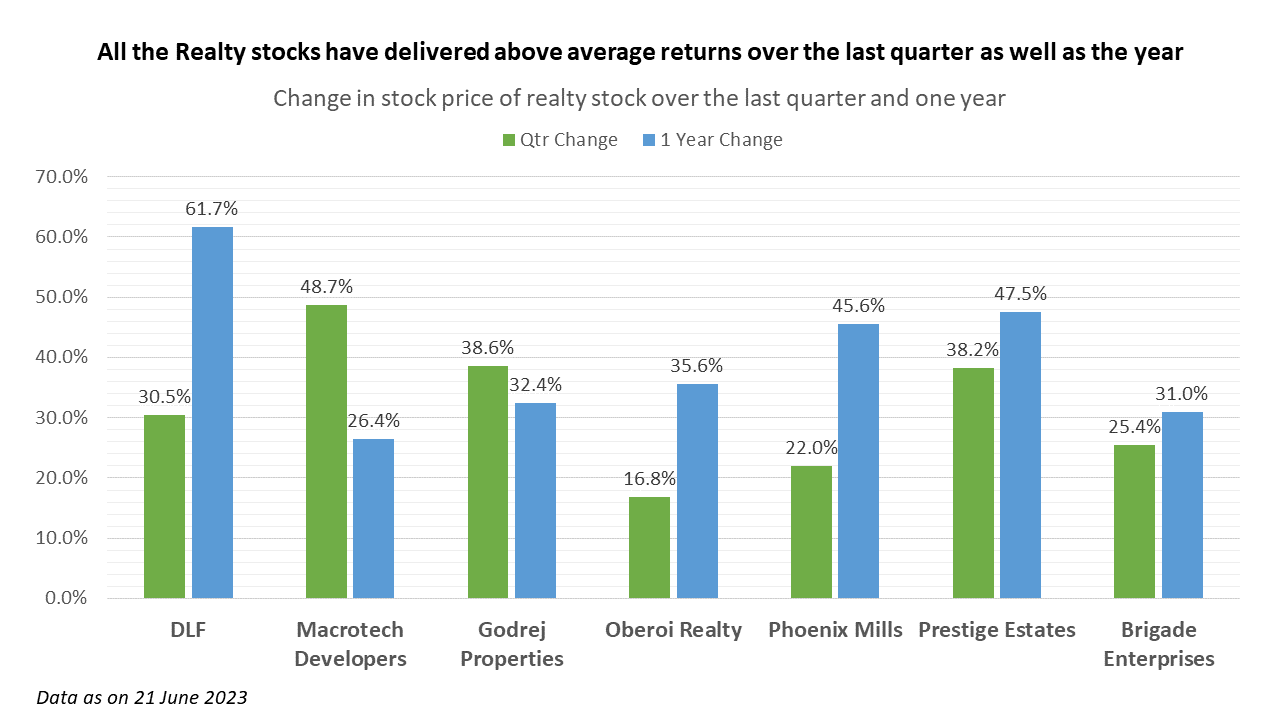

The data below shows that the stocks of the top seven real estate companies, excluding Oberoi Realty, have risen by more than 20% in the past quarter. On a yearly basis, apart from Macrotech Developers (also known as Lodha Developers), all other stocks have yielded returns of over 30%. The majority of real estate players have reported their highest-ever sales in FY23.

Regulatory changes paved the way for consolidation in this sector

What’s behind the sudden turnaround in these stocks? Multiple factors are at play, including rising sales, stable interest rates, and favorable government policies that are driving this sector. Although the change in this sector is not recent, the current growth is the culmination of policy decisions made over the past few years, which are now reflecting the outcomes.

Until 2016, the sector was notorious for its malpractices and money laundering. However, this changed with the introduction of the RERA regulation, which made it mandatory for developers to deposit money from sales into an escrow account designated for that specific project. Additionally, another significant event in the same year was demonetization, which dealt a severe blow to many shady transactions within the sector. As a result, unscrupulous players were pushed aside while organized players started consolidating their operations.

Consequently, at the end of FY23, unsold inventory is at multi-year lows, registrations for home purchases are booming, and new home bookings remain strong. The winners in this scenario are a few large and branded players who have achieved an annualized growth rate of 33% in new home bookings between FY20 and FY22. This trend is continuing in FY23 as well.

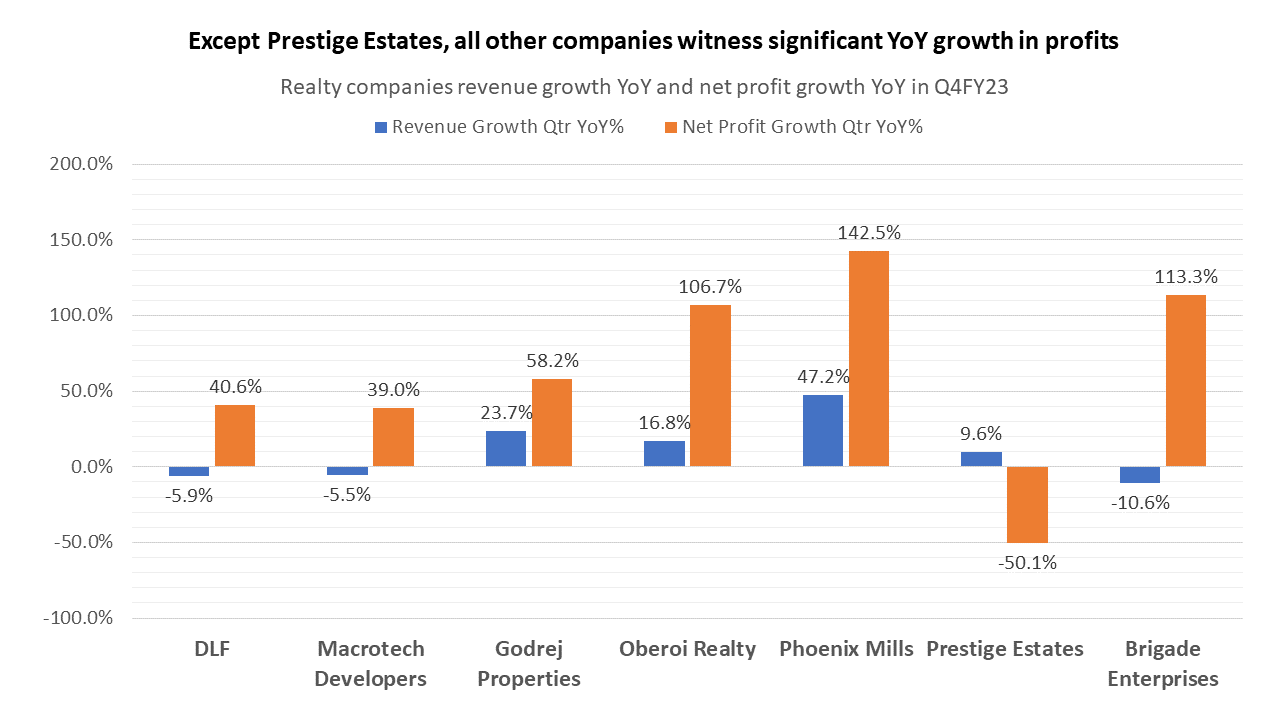

Another significant aspect observed in the Q4FY23 results is the growth of YoY profits across the board, surpassing the sales growth for the same period. The only exception is Prestige Estates. Let’s consider the case of DLF: while revenues declined by nearly 6% on a YoY basis, net profits grew by 40%. Exceptional profit growth was also witnessed in Phoenix Mills, Oberoi Realty, and Brigade Enterprises, all of which more than doubled their profits. The sales growth is also driven by different categories of buyers. Post the pandemic, the share of non-resident Indians (NRIs) in the Indian property market has doubled, and now almost 20% of the sales for many real estate developers are coming from outside the country. The United States is one of the biggest markets, and buyers from the Middle East and Southeast Asia are also showing interest in buying property in India.

On the other hand, the growth of residential real estate in India’s top Tier I and Tier II cities is being driven by the evolving priorities of millennials. Now in their 30s and early 40s, they are increasingly purchasing homes, driven by higher spending power and a desire for homes that reflect their personalities and lifestyles.

Another segment experiencing traction is the luxury housing segment. The surge in demand for luxury properties has led to price increases, particularly in major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai. However, despite the price hike, luxury real estate remains a popular investment option for high-net-worth individuals (HNIs) in India. Many of them consider it as a means to diversify their investment portfolio.

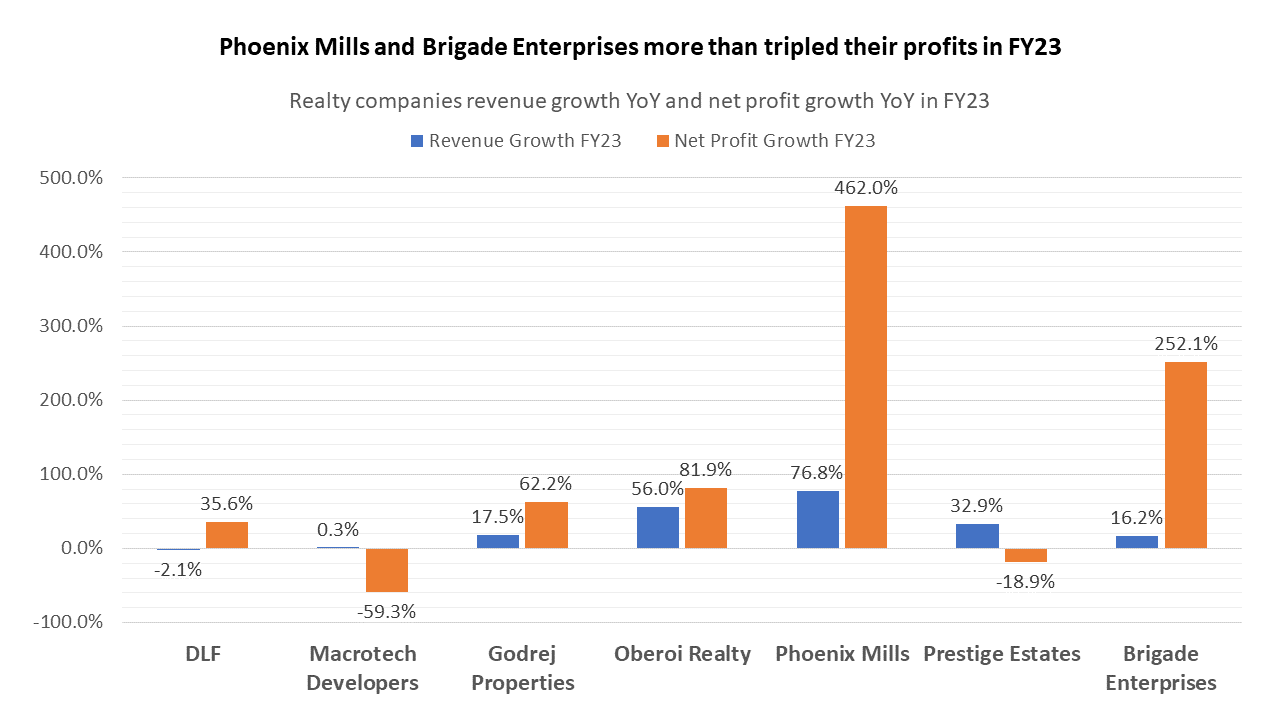

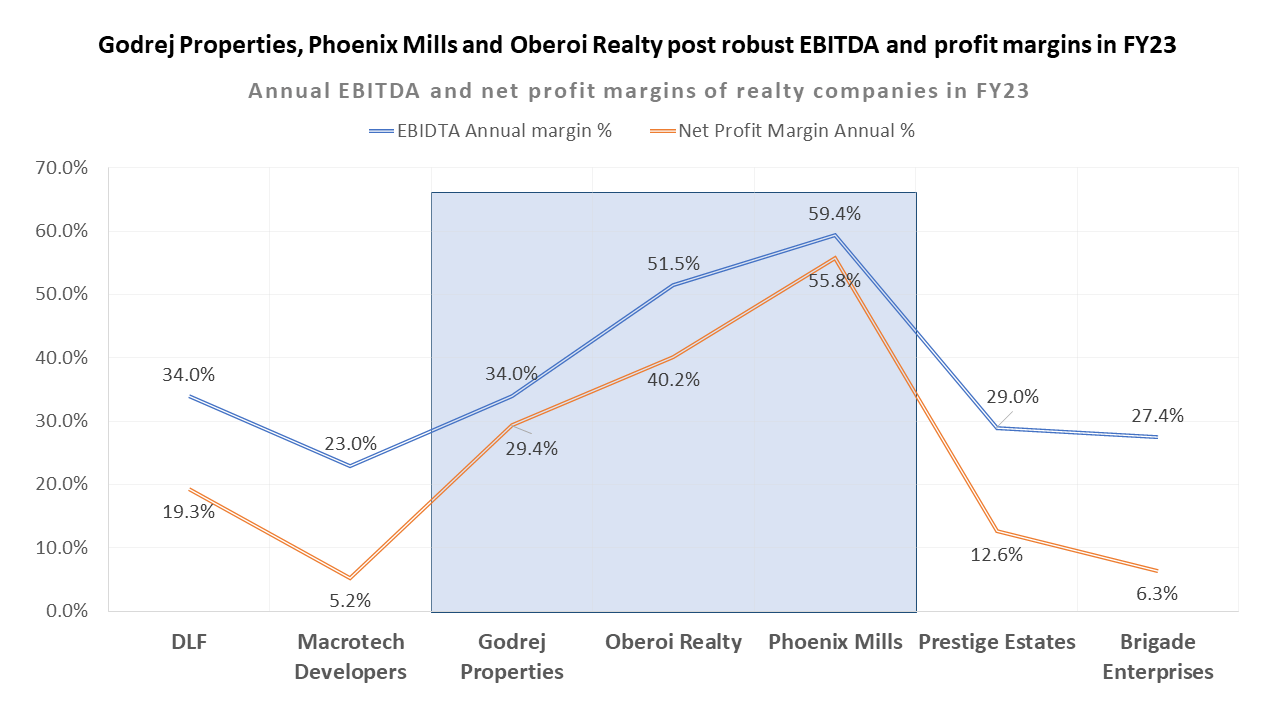

The real estate sector’s outperformance is evident in the splendid FY23 results. With the exception of Macrotech and Prestige Estates, all other companies substantially increased their profits compared to FY22. Particularly noteworthy is Phoenix Mills, which achieved an astounding 462% growth in annual profits. The performance of developers is also influenced by their business models. Phoenix Mills’ remarkable profit surge can be attributed to a model that relies heavily on rental assets, whereas some other developers, who heavily depend on sales, experience prolonged periods with unsold inventories, which negatively impacts profitability. In FY23, most players maintained stable ratios for EBITDA and net profit margins.

Housing sales across the top seven cities of India grew by 36% in FY23, reaching 3.8 lakh units. Despite interest rate hikes, many listed developers have managed to keep their cost of debt below 10%. These developers are focused on execution, with many projects being completed on time. Additionally, there are many new projects in the pipeline, which contribute to the future potential of this sector.

DLF plans to launch approximately 11 million square feet of development this fiscal year, with a sales potential of almost Rs 19,700 crore. They also have a launch inventory of around Rs 7,400 crore, giving the company a potential real estate inventory worth almost Rs 27,000 crore.

Phoenix Mills’ two malls, one in Ahmedabad and the other in Indore, became operational in the last quarter and have already leased out 90% of the retail spaces. Malls in Pune and Bangalore are expected to commence operations in the next quarter.

Godrej Properties intends to launch projects with a development area of 20 million square feet in FY24, including key projects at Ashok Vihar in Delhi, Worli, and Mahalaxmi in Mumbai.

Other developers also have many projects at various stages of development or are in the process of finalizing land deals for new projects. All these projects provide visibility into the sales potential for real estate players in FY24.

The real estate sector has been the top-performing sector since the beginning of this year, and there is a high chance that it will continue its run and emerge as the top-performing sector of the calendar year 2023.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stock bought by Mutual Funds in May 2023[/vc_column_text][/vc_column][/vc_row]