Q3FY23 Results of leading IT companies spring a pleasant surprise

Posted by : Sheen Hitaishi | Mon Jan 16 2023

Among the major IT companies, TCS was the first to release Q3FY23 results. Following this, other top-tier IT also posted their Q3FY23 results in the last week. Investors have therefore begun appraising companies based on their results and contrary to analyst expectations, the results were much better than anticipated and do not indicate any kind of slowdown as of now.

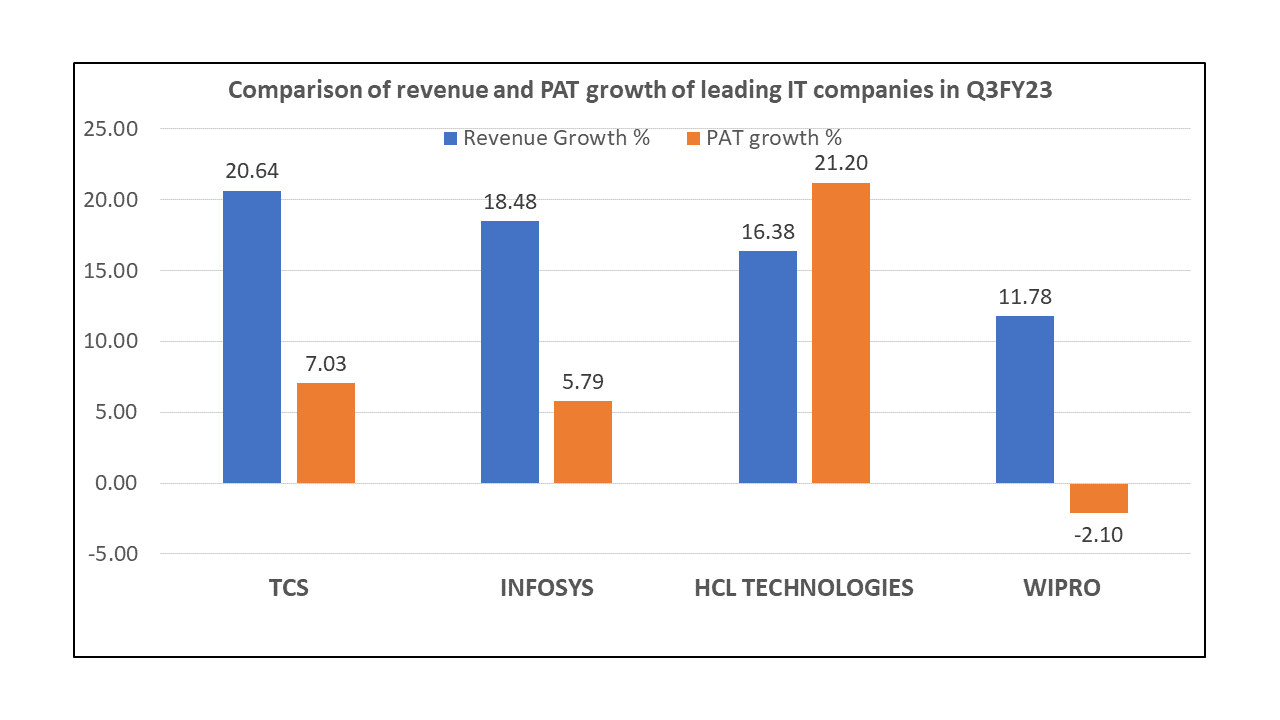

Three of the four companies saw their revenues as well as profits growing in Q3FY23 and did manage to report a moderate quarter. This too in a quarter that is considered a weak quarter for this industry. This includes HCL Tech, Infosys & HCL Tech which have shown positive growth while Wipro was the only player which was lagging behind. TCS, the market leader also saw robust YoY growth despite moonlighting & other issues such as high attrition acting as headwinds.

Let’s analyse how Tata consultancy services, Infosys & HCL Technologies have performed individually deep diving into their financials.

TCS quarterly revenues cross $7 bn in Q3FY23, its highest ever

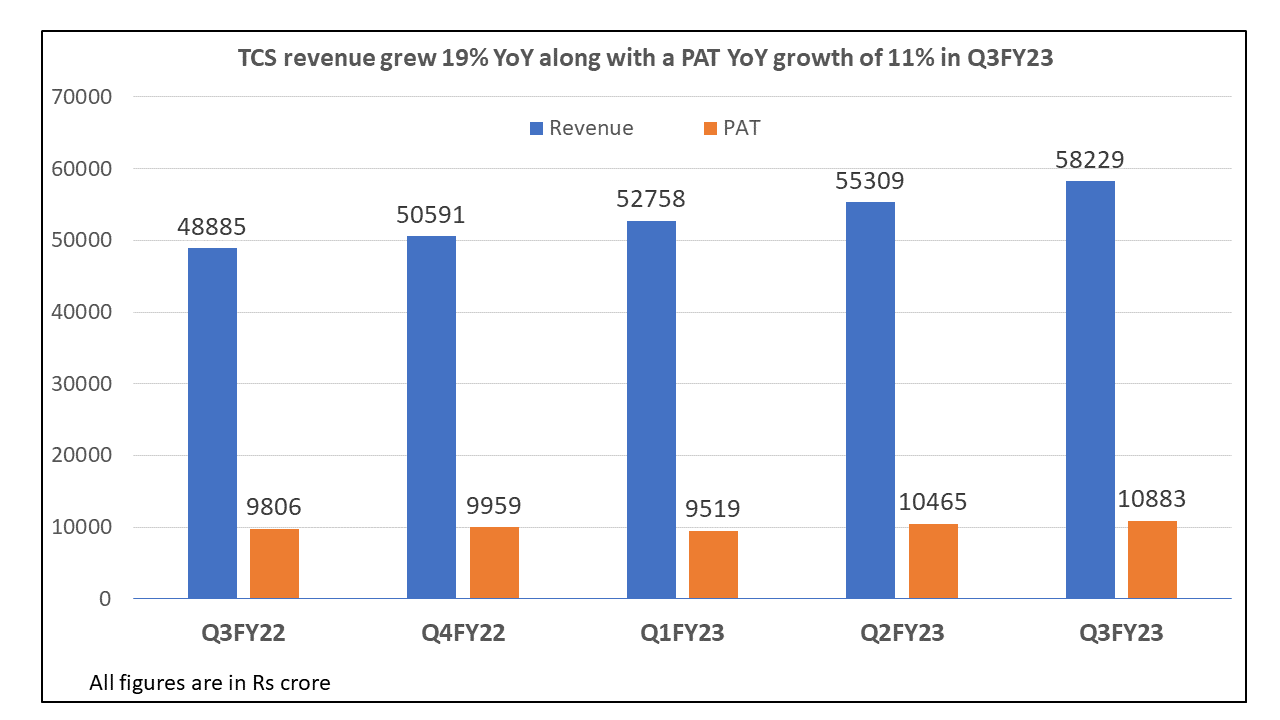

India’s top IT company Tata Consultancy Services Ltd (TCS) kickstarted the earnings season for the third quarter of the current fiscal (Q3FY23) on Monday 9th Jan 2023, by reporting a marginally lower-than-expected profit at ₹10,883 crores. Analysts on average expected a profit of ₹11,046 crore, according to Refinitiv data.

Revenue growth has been better, but the profit margin was lower than expected. Growth was led by Retail and CPG (+18.7%) and Life Sciences & Healthcare verticals (+14.4%). Communications & Media grew by +13.5% and Technology & Services grew by +13.6%.

The company’s order book for the third quarter stood at $7.8 billion, down from $8.1 billion in the September quarter. “A declining headcount and book-to-bill ratio falling to a three-year low point to a sharp growth moderation,” said analysts at Jefferies India.

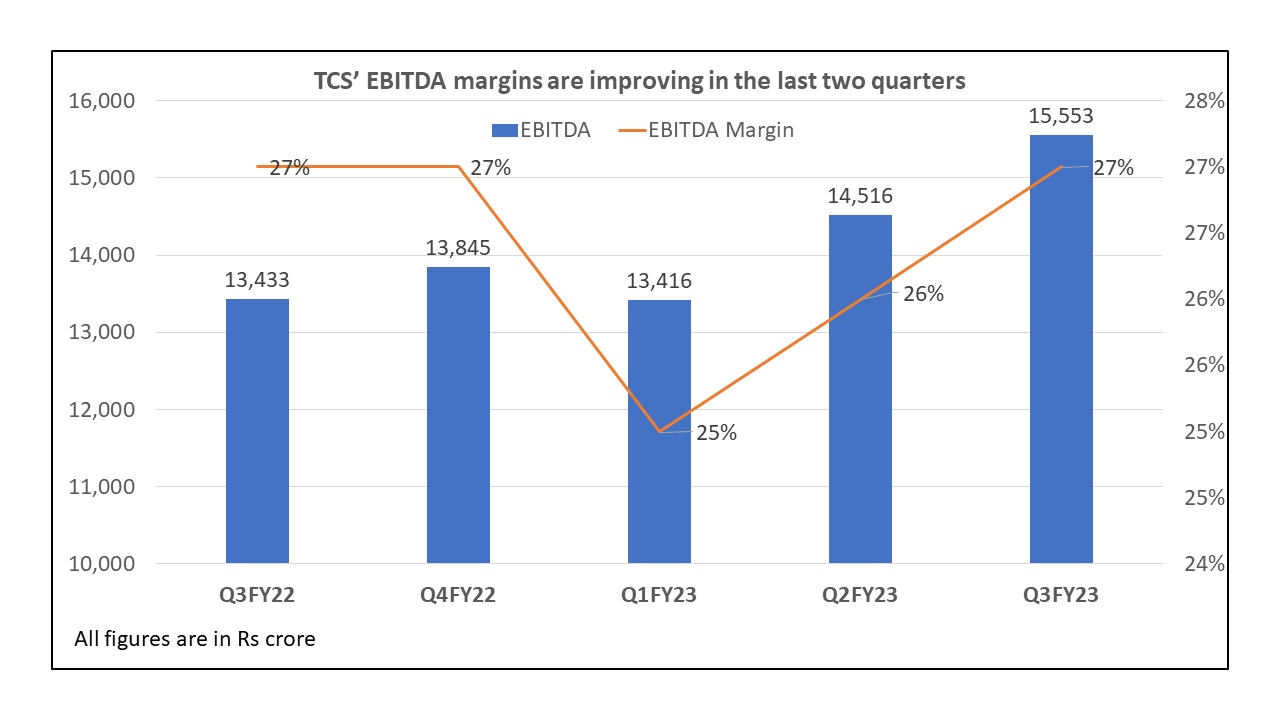

CFO Samir Sekaria said Improved productivity and currency depreciation support helped them to improve the Profit margin. The operating margin during October-December 2022 quarter came at 27%; the same as YoY, however, has expanded from 26% in the previous quarter of September 2022.

Infosys Q3 result: Revenue grows 18% YoY to Rs 38,318 cr

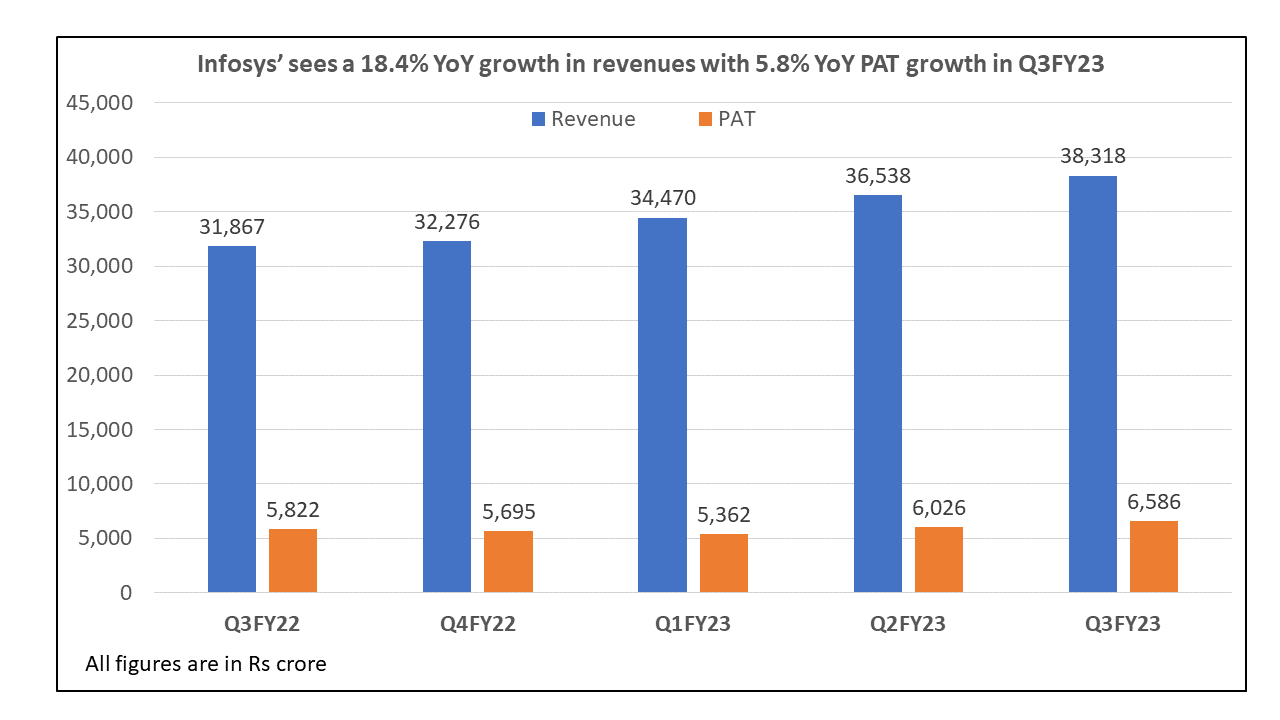

IT giant Infosys recorded an 18.4% growth in revenue at Rs 38,318 crore in Q3FY23 as compared to Rs 31,867 crore in Q3FY22, according to the BSE filing of the company. The net profit of the company rose 9.2% YoY to Rs 6,586 crore during Q3FY23.

Infosys said its growth remained broad-based and deal momentum was robust, with digital transformation rapidly scaling across verticals and regions. Large deal wins accelerated with a total contract value (TCV) of $2.53 billion during the quarter.

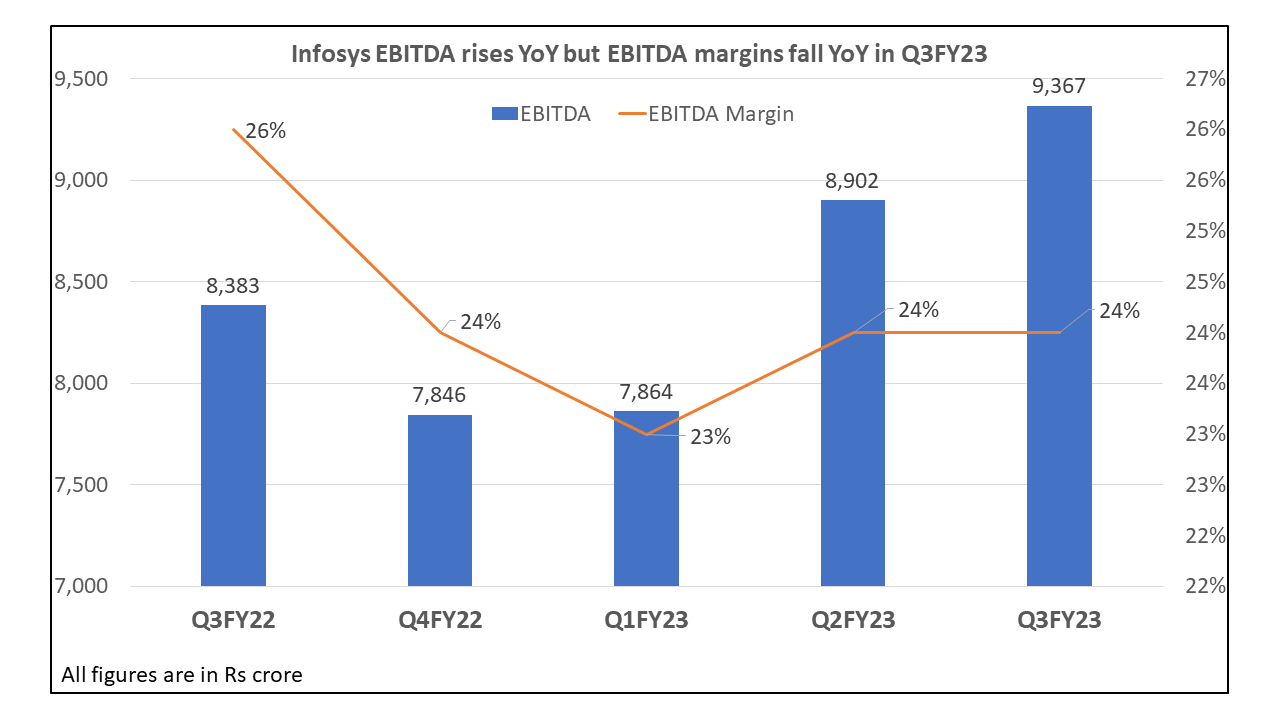

In Q3FY22, the net profit was Rs 6586 crore. It registered an operating margin of 24% during the quarter. Based on constant currency, the net profit margin was 17%.

“Operating margins in Q3 remained resilient due to cost optimization benefits which offset the impact of seasonal weakness in operating parameters”, said Nilanjan Roy, CFO of Infosys.

Infosys’ total employee count stood at 2,92,067 as of December 31st 2021, as against 2,79,617 on September 30, 2021, while voluntary attrition was at 25.5% compared to 20.1 % in the September quarter. Despite the cost escalations driven primarily by supply-side challenges, the company delivered another quarter of healthy margins, with improved cost optimization, continued operating leverage, and a stable pricing environment.

HCL Tech saw consistent growth in revenue along with the highest EBITDA in Q3FY23

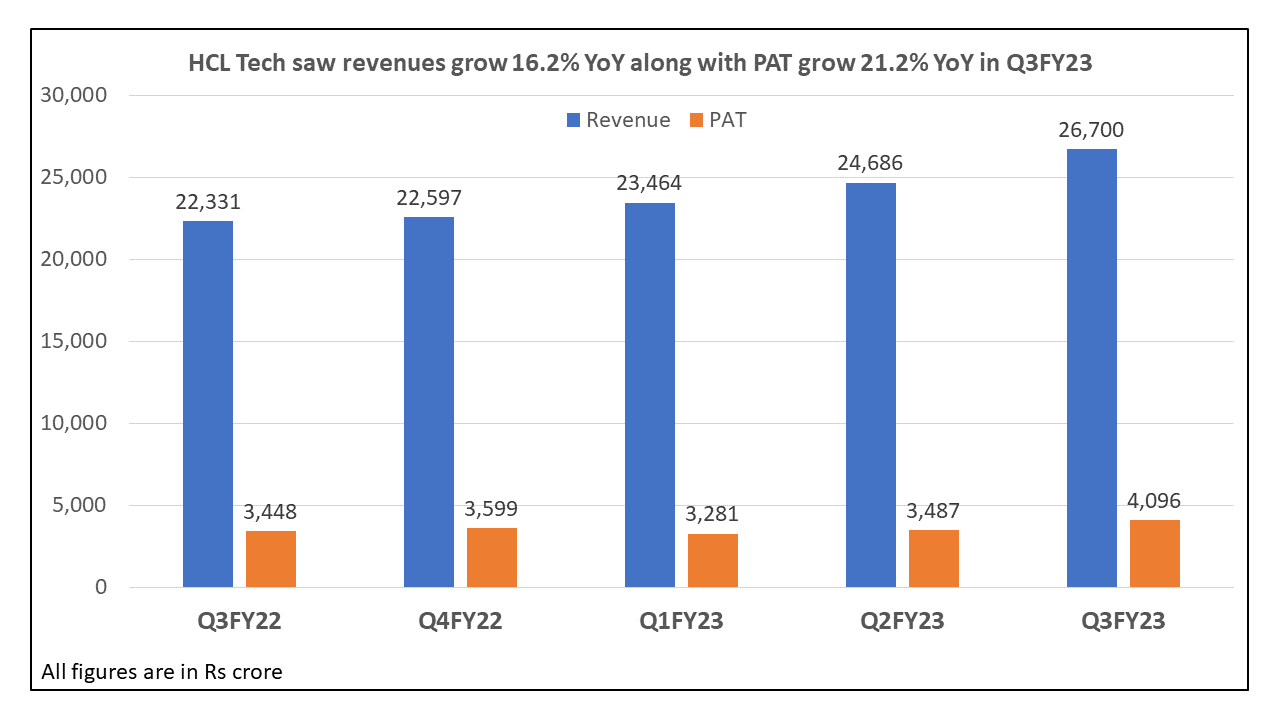

HCL Tech reported a combined net profit of Rs 4096 crores in Q3FY23, up 21.2% YoY. Revenue increased by 16.38% YoY to Rs 26,700 crores. The company reported a higher-than-expected profit for the December quarter helped by strong deal wins, but lowered its full-year revenue view citing seasonal challenges in the fourth quarter. On a sequential basis, the profit after tax (PAT) rose 17% from Rs 3,489 crore in the previous September quarter.

“The strong revenue growth is attributed to both the momentum in our services business as well as our software business,” HCL Tech CEO and Managing Director C Vijayakumar said. Vijaykumar said new deal bookings for the quarter stood at $ 2.35 billion, up 10% YoY. HCL Tech said it won 17 large deals during the quarter, which included seven deals in services and 10 in software. The average contract value was up 1.9% YoY, it said.

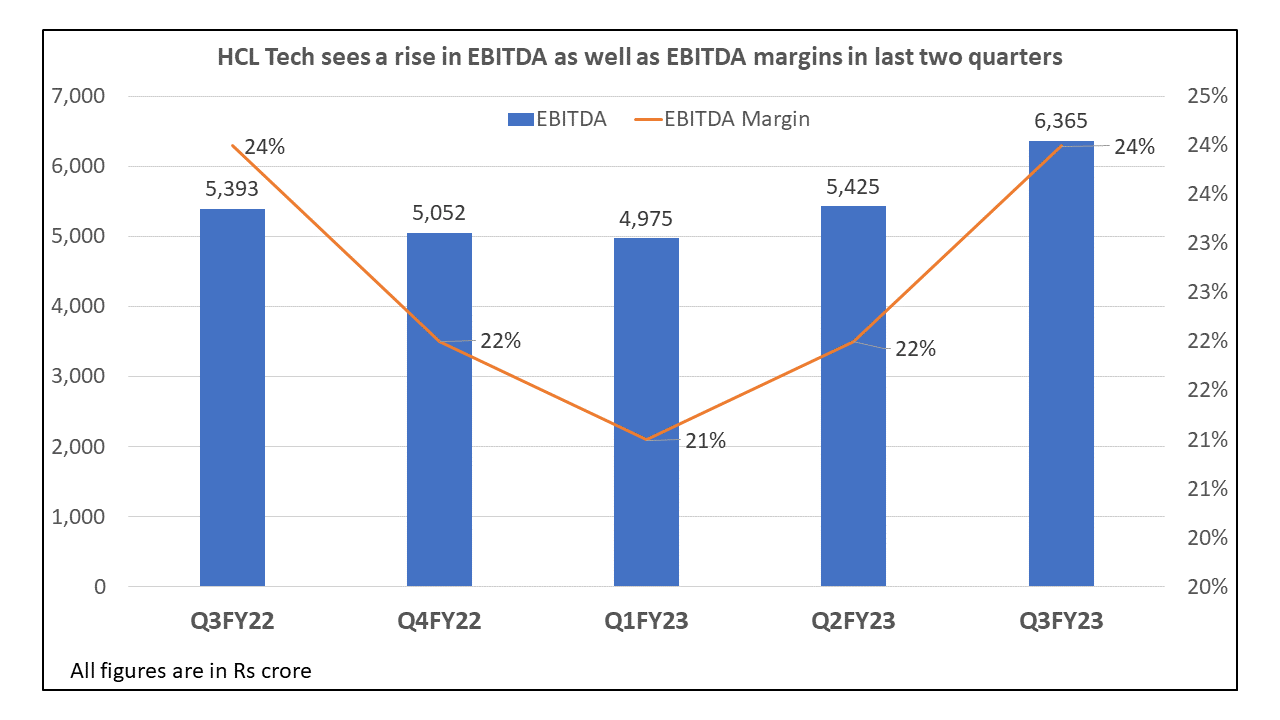

Lastly, HCL Tech’s EBITDA grew 15% YoY to Rs 6365 crores in Q3FY23 from Rs 5393 crores in Q3FY22. While the EBITDA bottomed out in Q1FY23, grew 8% QoQ from Rs 5425 crores in Q1FY23. Further, this was the highest-ever reported EBITDA. The company’s board has approved an interim dividend of ₹10 per equity share for FY23. The record date is set as 20 January 2023. The payment for the said interim dividend shall be made on 1 February 2023.

Attrition Rate: WIPRO had the lowest attrition rate while Infosys had the highest

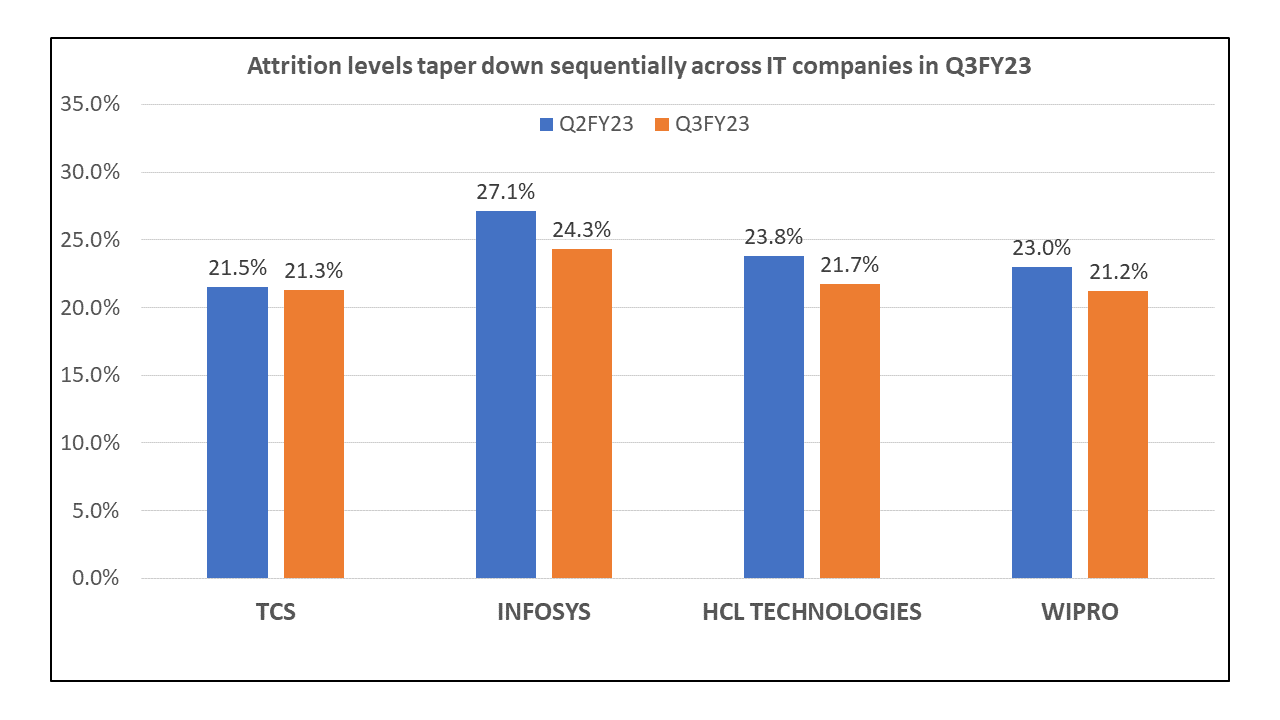

Nilanjan Roy, Chief Financial Officer of Infosys said, “Attrition reduced meaningfully during the quarter and is expected to decline further in the near term.” Overall attrition rates have decreased on both QoQ and YoY basis, companies are also planning for fresh hires and training to keep up with healthy attrition rates.

Milind Lakkad, Chief HR (Human Resources) Officer, said: “Our focus over the last few quarters on bringing in fresh talent at scale, training them on new technologies, and making them productive is paying off.”

For Q3FY23, Infosys reported a voluntary attrition rate of 24.3%. Although it was lower than the 27.1% recorded in the previous quarter, it was lower yearly than the 25.5% reported in Q2FY22.

In Q3FY23, HCL Tech’s attrition rate stayed at 21.7%, while TCS’s IT services attrition rate was 21.3%. According to the company, Wipro’s voluntary attrition for the quarter was calculated over the preceding 12 months and was at 21.2%.

Univest View with Technical Analysis

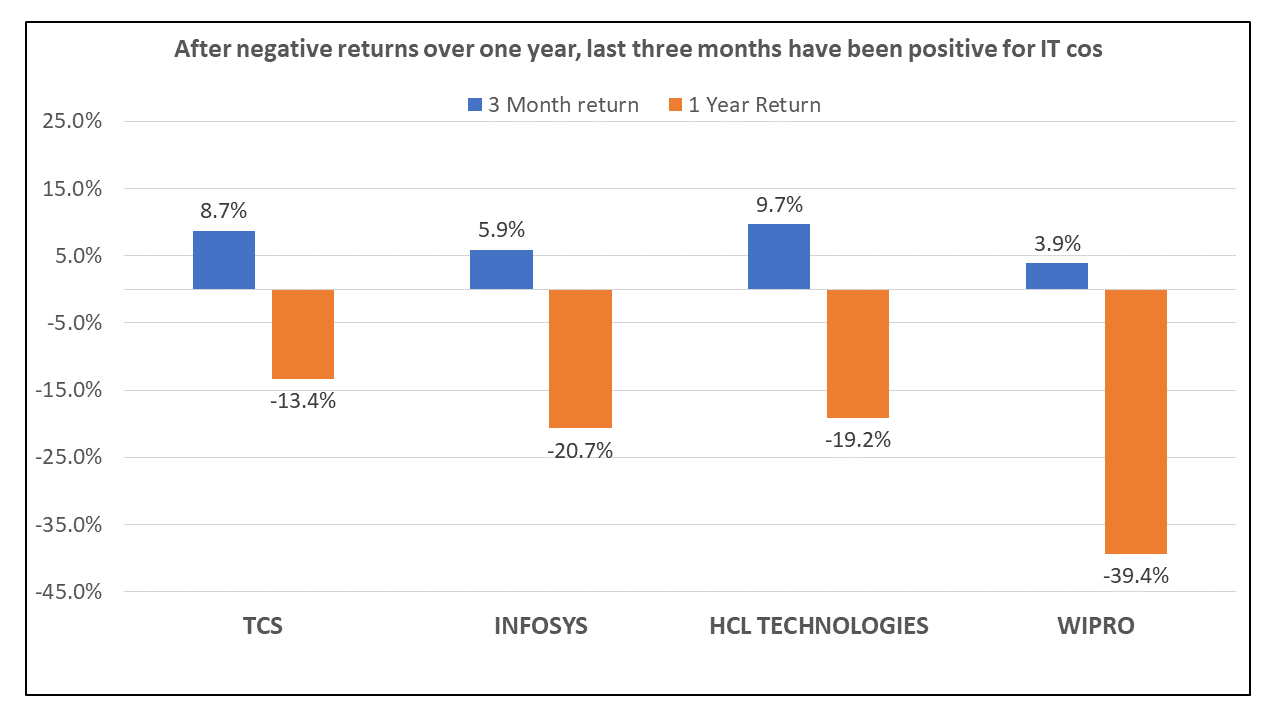

All the top-tier IT companies have underperformed Nifty in one-year returns. TCS fell the least with a fall of 13.4% while Wipro fell around 40%. But, over the last three months, the returns from these companies have been positive. While all these companies are currently in the Hold zone as per the Univest app, these could soon come into the Buy zone.

Over the past year, the IT sector has been among the worst-performing sectors in the stock market. With the results for the top-tier IT companies not indicating any great signs of distress or any kind of weakness, it would be safe to assume that the narrative of a recession in this industry may just have been blown away. The numbers speak louder than narratives and if this quarter’s numbers are anything to go by, we might witness a rally in IT stocks very soon. Though this is dependent on many external factors, another quarter of better-than-expected results would see the IT sector bounce back into action.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255)

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

You may also like: Stock picks for 2023

Note – This channel is for educational and training purposes only & any stock mentioned here should not be taken as a tip/recommendation/advice

Related Posts

IIFL Finance NCD: Tranche Detail

PNGS Reva Diamond Jewellery IPO Review 2026: GMP Rises 5.70%, Key Investor Insights

IEX Share Price Falls 25.96% YoY: What Went Wrong & What’s the Target

Yashhtej Industries IPO Allotment Status: 1.05x Subscribed, GMP Rises 1.82% — Check Online

Manilam Industries IPO Day 1: Subscription at 0.03x, GMP Flat | Live Updates