Price hikes lead growth for FMCG in Q2FY23, weak rural demand a red flag

Posted by : Sheen Hitaishi | Thu Nov 24 2022

FMCG sector with well-established names such as HUL, ITC, Dabur, and Varun Beverages are all key players in this sector. While these brands are popular among consumers they are also on the radar of investors as well. The investment rationale is that these are mostly daily consumption goods whose demand will be either consistently rising.

While NIFTY this year has seen severe volatility and is currently trading at 18,000 levels, NIFTY FMCG Index has seen a breakout in July i.e., at the beginning of Q2FY23 and that too after a huge consolidation. Further, this break-out drove this index to a sharp upward movement as seen in the chart below, indicating a rally also experienced by several FMCG stocks due to their strong performance in Q2FY23.

While many investors believe Q2FY23 has been robust for FMCG players, the main reason behind this was the price hikes taken by the FMCG players to pass on the burden of inflation in raw material prices. This enabled FMCG players to boost their sales in Q2, which also affected their share prices positively. The graph below shows the YTD and Q2FY23 share returns delivered by a few well known FMCG players.

Varun Beverages has been the leader with respect to investor gains delivered compared to any other FMCG stock in consideration. Whereas Marico and Dabur appeared to be laggards as they not only saw the lowest share price increase in Q2FY23 but also went on to deliver negative YTD returns.

Therefore, it becomes important to conduct a comparative analysis of the Q2FY23 performance of select FMCG stocks from different segments to understand which ones carry the potential for maximum future returns. So, let’s now look and compare the Q2FY23 performance of a few major stocks like HUL, ITC, Dabur, Marico, and Varun Beverages.

You may also like: Mutual Fund Buys in October 2022

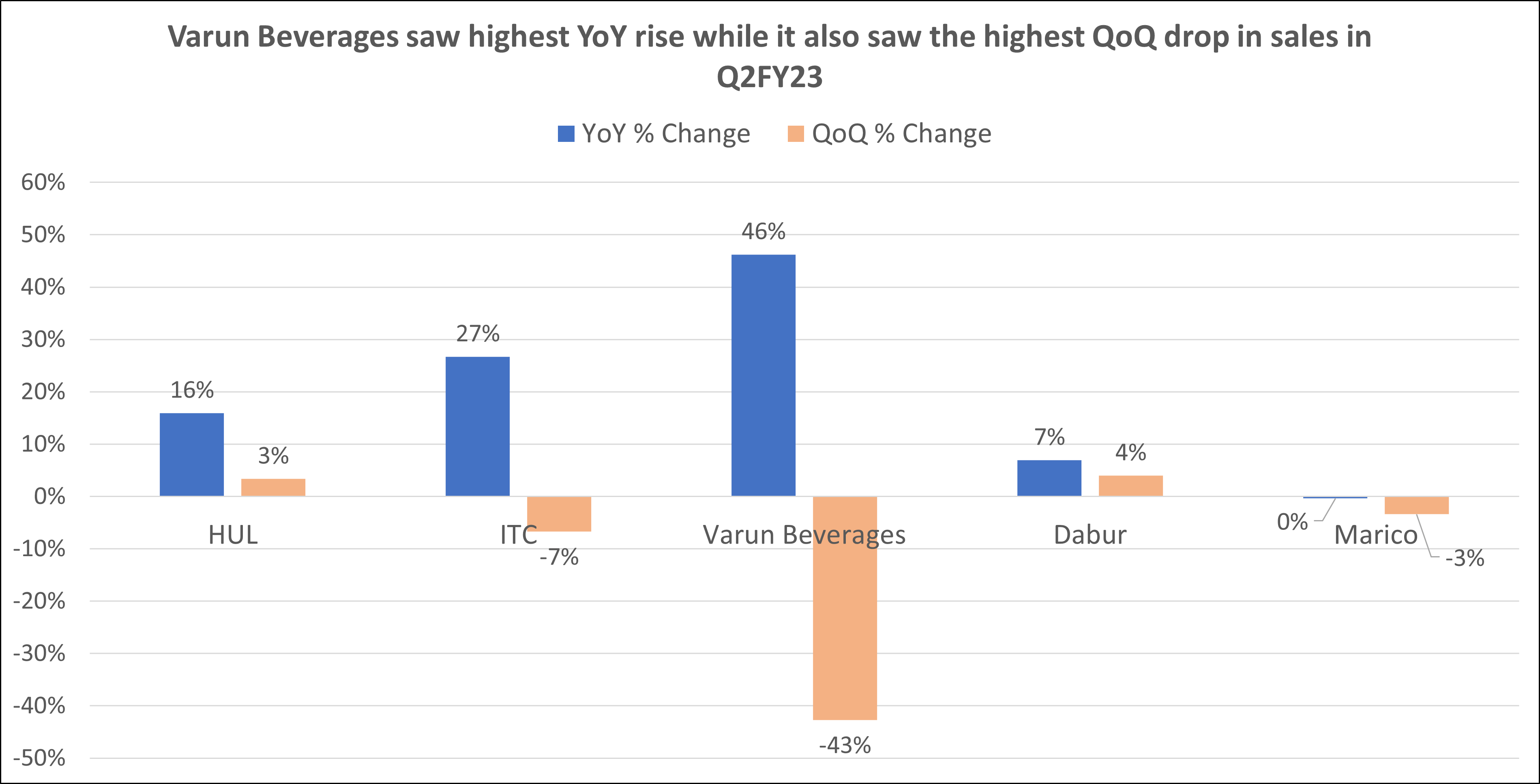

Revenue growth seemed positive driven by price hikes in Q2FY23

In Q2FY23, all companies in the spotlight witnessed an increase in revenue, primarily driven by pricing increases. Industry-wide growth was still being driven by price increases, and low demand was a result of rising inflation. Additionally, it has prevented significant volume growth for a few quarters.

As can be seen in the graph below, except for Marico, the rest of the players have reported positive YoY growth in Q2FY23 sales. Moreover, Varun Beverages has reported the highest YoY growth in revenue of 46% followed by ITC at 27% YoY growth, and then HUL & Dabur.

Whereas Marico saw almost negligible growth as revenue remained flat YoY. Interestingly, Varun Beverages also saw the highest QoQ drop in Q2FY23 similar to ITC and Marico at 7% and 3% QoQ drop respectively. Only, Dabur and HUL saw a positive QoQ rise in sales in Q2FY23 which stood at 4% and 3% respectively.

Additionally, during the previous few quarters, FMCG players have been hurt by increasing commodity prices. Customers were compelled to reduce discretionary spending as a result of the increased costs, which caused food inflation. Inflation’s effects have been more pronounced in rural areas. Given that the effects of inflationary pressures are more obvious in the rural market, urban demand growth continues to outperform rural demand growth. In addition to price increases, the urban market and the category of premium products also contributed to the revenue rise for most businesses.

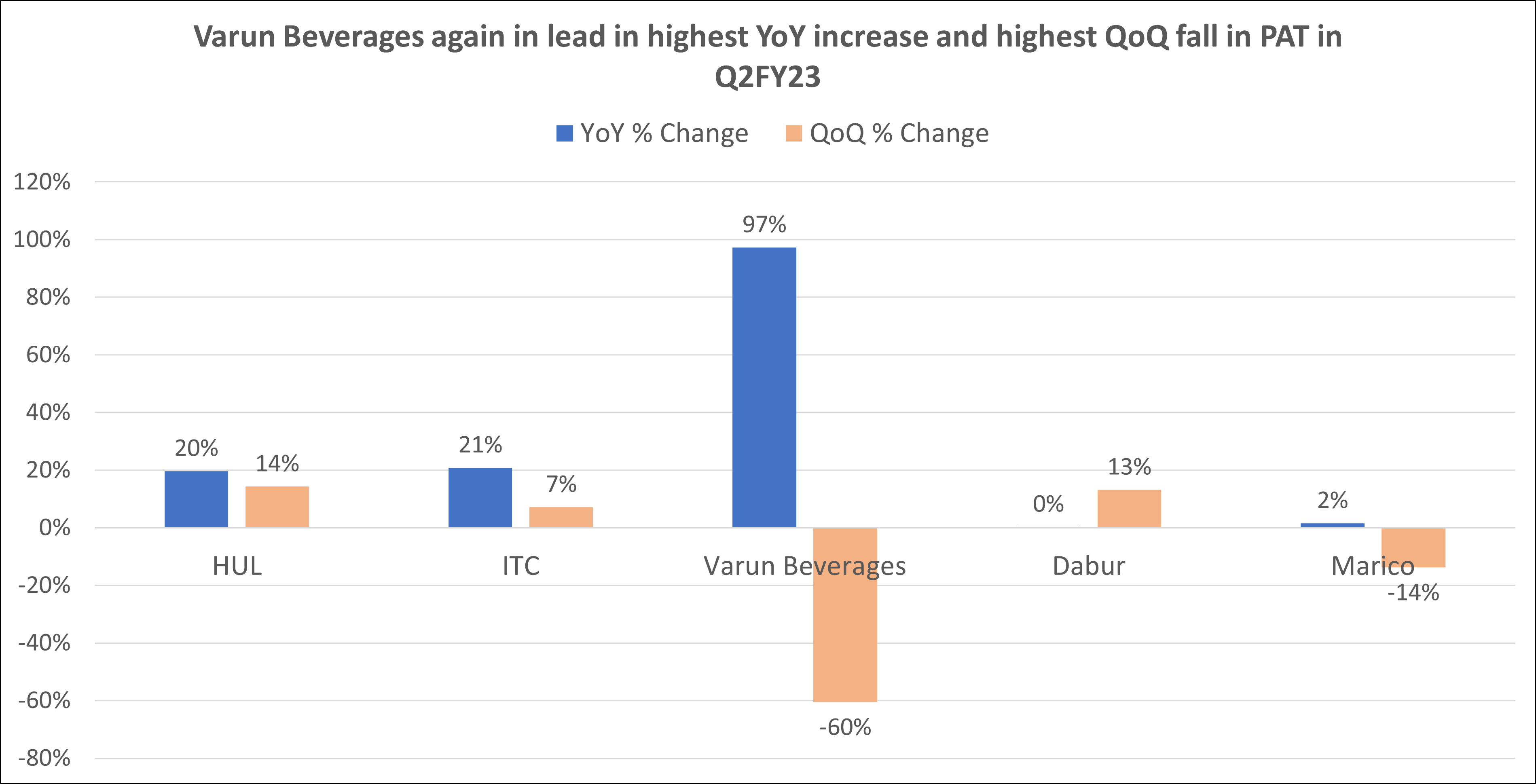

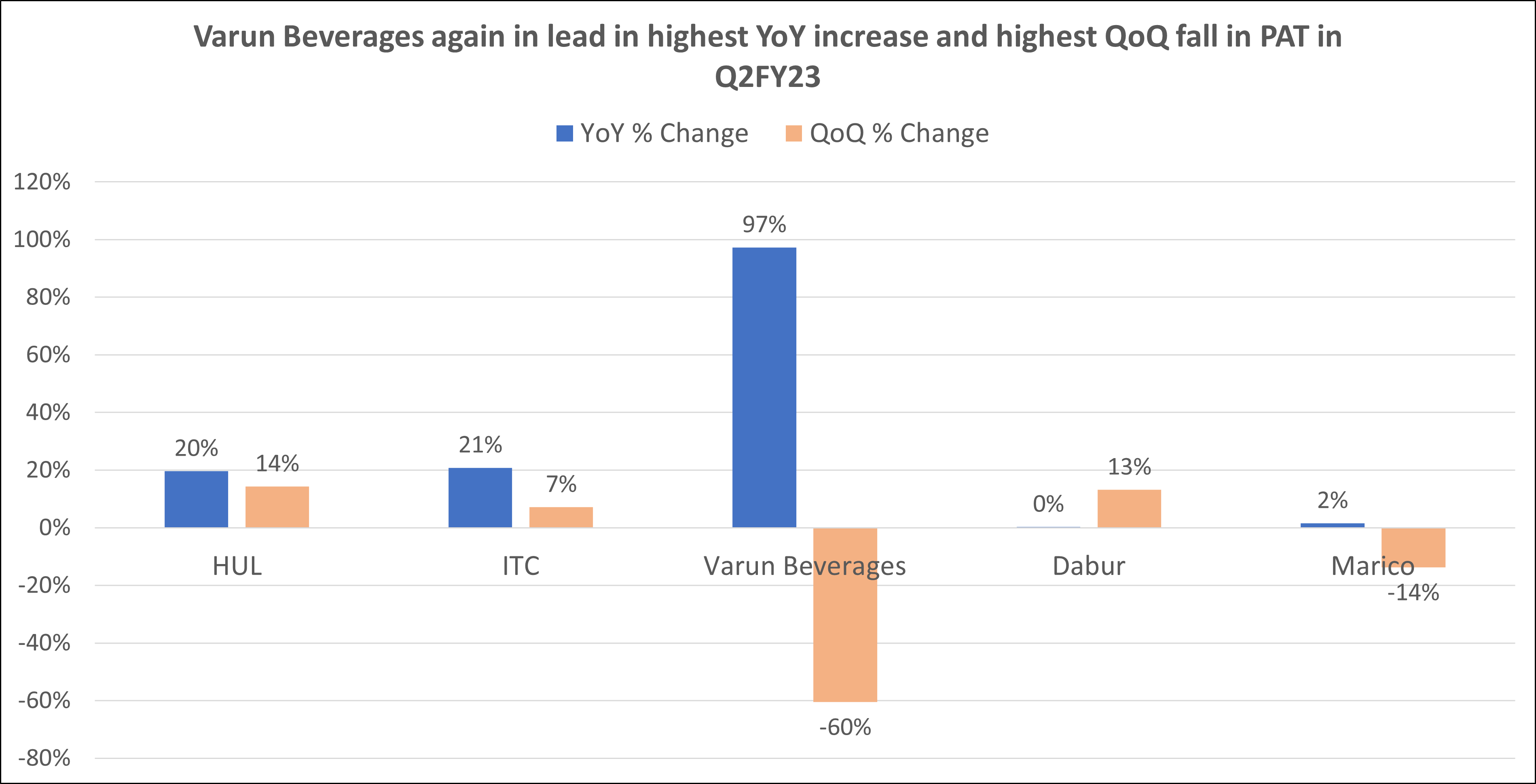

PAT growth affected badly due to decline in rural demand and high-cost pressures

As essential commodity costs remain elevated, FMCG companies’ profitability is under pressure. The weakening rupee made things worse for these enterprises in addition to rising input costs. The industry adopted a number of cost management strategies to lessen cost constraints. Companies across the board experienced considerable reductions in the capital spent on advertising and other costs.

Hindustan Unilever’s profit increased as a result of the home care and beauty & personal products divisions’ increases in market share. The company’s management ascribed a one-time prior-period tax benefit in Q2 for the company’s net profit increase of almost 20% YoY. Dabur and Marico experienced a loss in net profit as a result of the decline in rural demand and the sharp increase in input costs.

Whereas, both ITC and Varun Beverages reported healthy YoY growth in PAT in Q2FY23. Coming onto the QoQ change, except for Varun and Marico rest of the players saw marginal growth in their new profits. This was mainly on account of a slight reduction in cost pressures.

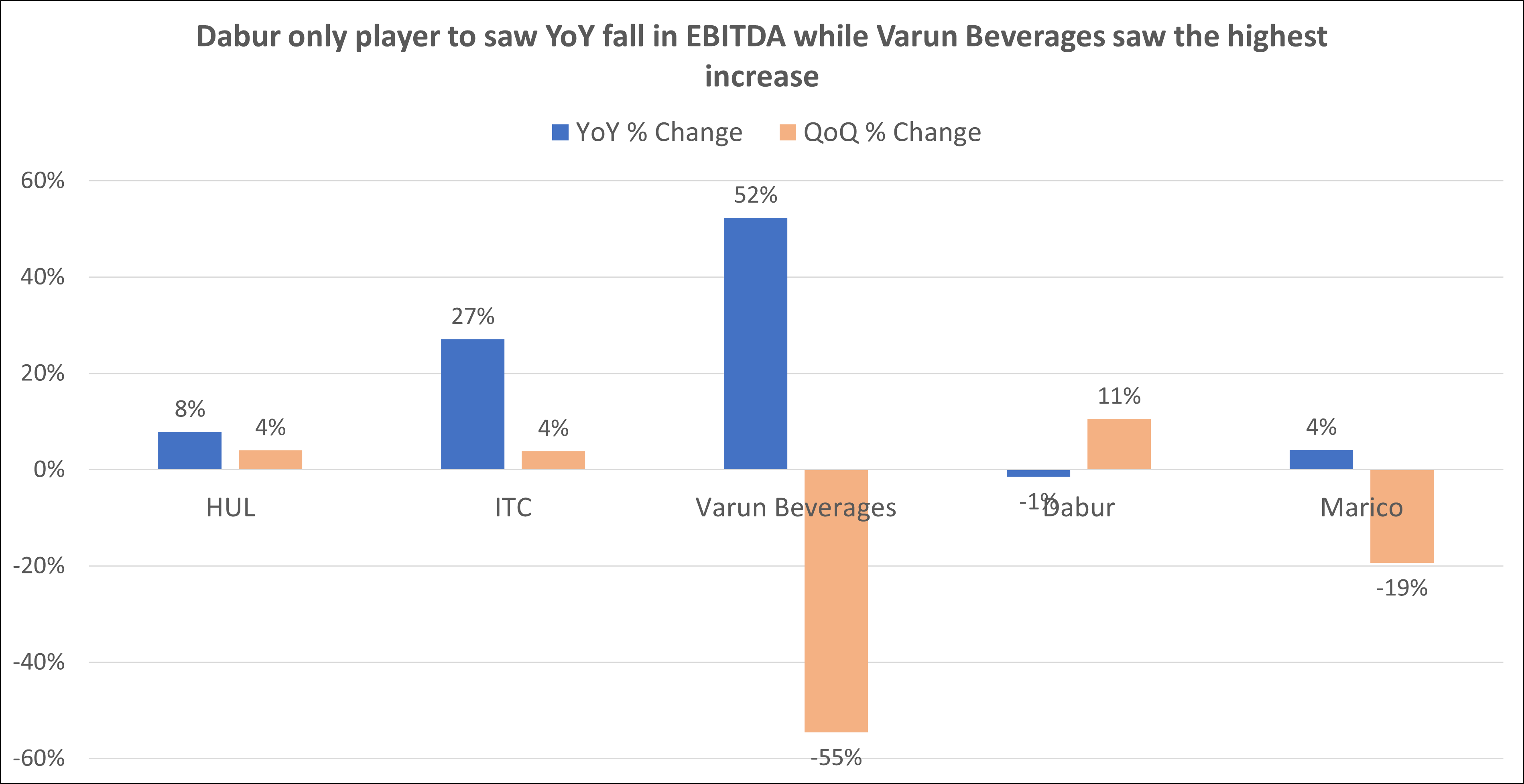

EBITDA margins on their way to recovery

The majority of FMCG companies saw a decline in gross margins in Q2, continuing a recent trend. This is because price increases have lagged behind increases in input prices. The inability of FMCG companies to fully pass on increased input prices to their clients has harmed profitability. To retain or expand their market share, they are strategically raising prices while only partially passing on high costs.

Additionally, the pressure on the sector’s input margins has gotten harsher as a result of the sinking rupee and increasing inflation. However, a lot of businesses predict that demand will increase, and raw material prices will start to decline in Q3FY23.

In the graph above, it can be clearly seen that except for ITC and Varun, the rest of the players have seen a low single-digit growth in their margins. Further, Dabur was the only player to report degrowth on a YoY basis in Q2FY23. Even sequentially, most players saw either a significant fall in their margins or a very marginal decline. Dabur again was the only exception that saw a QoQ rise. Mohit Malhotra, CEO and Managing Director of Dabur India, said, “Going forward, we expect the quantum of inflation to moderate on account of high inflation in the base. While current demand remains weak, the festive season, near-normal monsoon, good harvest, and minimum support price increases should enable rural markets to recover soon.

Univest View:

Despite a minor decline in commodity prices, FMCG companies are still under pressure to cut costs. Except for palm oil, the majority of other essential raw materials, including soda ash, milk, barley, and wheat, continue to have high volatility. Only a few segments, including food & drinks and home care, saw growth in terms of volume throughout the whole sector. On a YoY basis, the majority of the companies in focus saw their volumes increase by single digits.

Therefore, it can be concluded that despite the YoY growth in Q2FY23 reported by FMCG players, margins continue to remain under pressure with profitability getting affected due to a fall in rural demand. However, FMCG companies expect rural demand to improve in the coming quarters on the back of a normal monsoon, higher wages, and better minimum support prices. They believe this will improve the overall consumption cycle. Even the festive season will act as a major supporter for FMCG players in Q3FY23. Lastly, they are also expecting the inflationary pressure to normalise going forward. If things work favourably, then we can expect a further improvement in the next quarter’s results from companies in the FMCG sector.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: LIC reported stellar Q2FY23 numbers

Related Posts

Gabion Technologies IPO Allotment Status Check Online: GMP, Subscription, Price, and More

Leap India IPO Date, Price, Lot Size & More: Upcoming IPO

Eldorado Agritech IPO Date, Price, Lot Size & More: Upcoming IPO

Technocraft Ventures IPO Date, Price, Lot Size & More: Upcoming IPO

List of Stock Market Holidays in February 2026: NSE & BSE Holiday Calendar