Post Market Update (02-11-2023)

Posted by : Sheen Hitaishi | Thu Nov 02 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1698931403414{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]

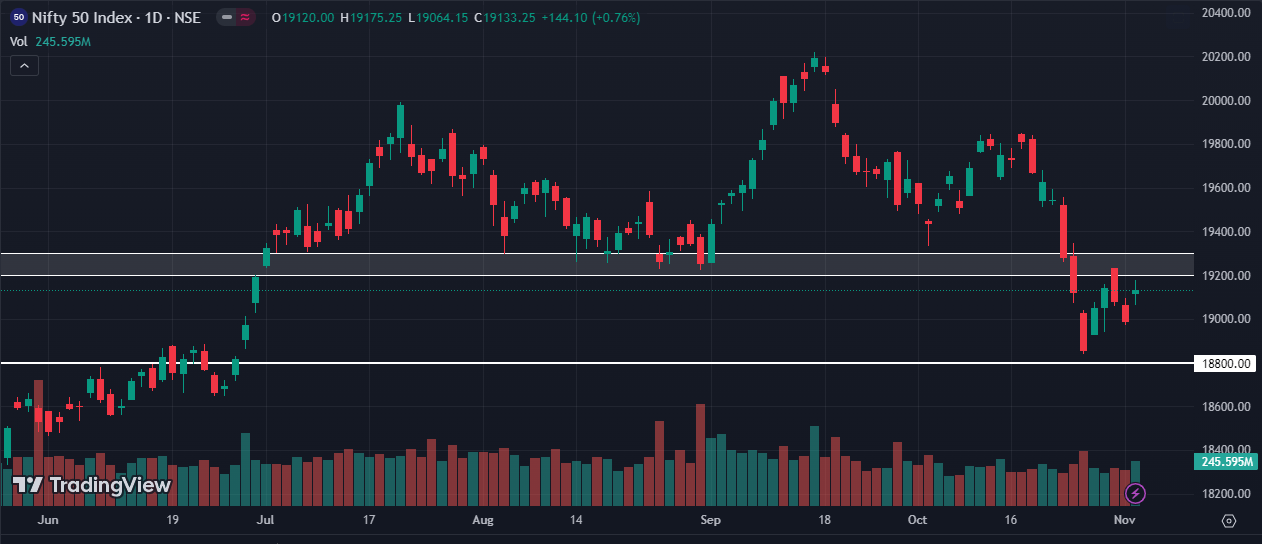

Nifty

Nifty commenced the trading session with a notable gap up, supported by positive global cues, following the Federal Reserve’s decision to maintain rates unchanged for the second consecutive time.

The market has been trading within a range over the past 3-4 sessions, with the momentum expected to intensify in the upcoming sessions after a breakout from the 18800-19250 range. Potential resistance is seen within the 19200-19300 zone, while immediate support remains steadfast at the 18800 level.

FII net sell stands at -1,261.19 crores and DII net buy stands at 1,380.15 crores.

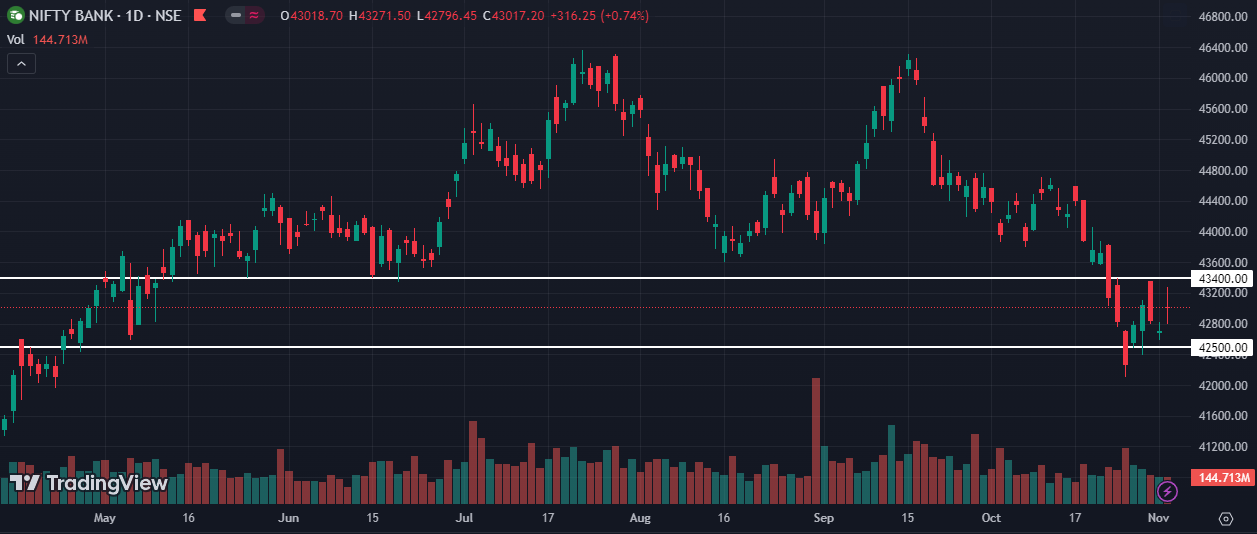

Nifty Bank

Nifty Bank

Bank Nifty has formed consecutive doji candles in the last two trading sessions, maintaining a tight trading range. Anticipated momentum is contingent on a breakout from the 42500-43400 range.

Probable support is identified at the 42500 level, with an immediate hurdle at the 43400 level.

Midcap and Smallcap

Midcap and Smallcap

Both the Midcap and Smallcap segments exhibited robust gains of over 1% in today’s session, concluding near the day’s high. It is advisable to focus on strong sectors and adopt a stock-specific approach.

Potential resistance levels are positioned at 32000 and 37600, with probable support at 30800 and 36400 for the BSE Midcap and Small indices, respectively.

PCR

The Put-Call Ratio (PCR) stands at 0.81 and 0.82 for Nifty and Bank Nifty, respectively, continuing to dwell within a neutral zone.

The highest call Open Interest (OI) is situated at the 19,200 strike, while the most substantial put OI is observed at 19000 for the Nifty’s weekly expiry.

In Bank Nifty, there is a substantial OI buildup at the 43000 strike on both the call and put sides, indicating a notable tug of war between the bulls and bears. The next pivotal levels, as per OI data, are noted at 43500 and 42500 strikes for CE and PE, respectively.

VIX

The Volatility Index (VIX) recorded an 8% decline in today’s session, closing at the 11.07 level, indicative of a sense of complacency in the market.

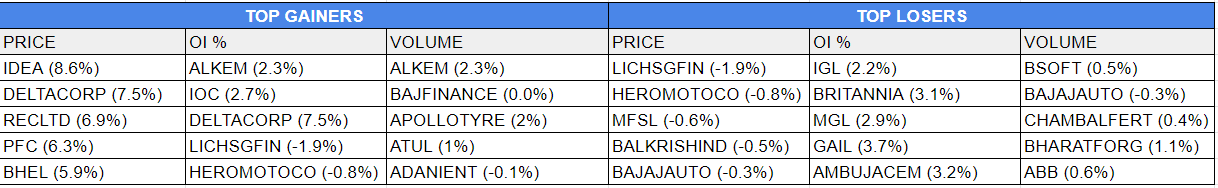

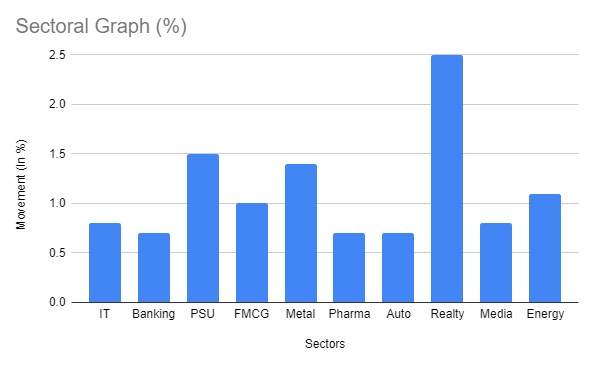

Sectors Update

All major sectors closed in positive territory during today’s session, with notable outperformance seen in Realty, PSU banks, Metals, Energy, and FMCG.

Advance Decline

Advance Decline

The advance-decline data painted a bullish picture, with 1419 stocks advancing while 689 stocks declined within the NSE universe during the trading session.

About the Author

Ankit Jaiswal, our Senior Equity Research Analyst at Univest, brings over 8 years of experience in the stock market, financial analysis, and investing. With qualifications including the NISM Series VIII Equity Derivatives Certification and CMT Level 2, he’s a key asset, driving the insightful contributions to our research team.

Note – This channel is for educational and training purposes only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like:

Recent Ownership changes that led to turnarounds!!

[/vc_column_text][/vc_column][/vc_row]

Related Posts

Canara HSBC Life Insurance IPO Details: Everything You Should Know about

ARC Insulation & Insulators IPO Listing at 16% Premium at ₹145 Per Share

Sattva Engineering Construction IPO GMP: Day 3 IPO Live Updates

Stock Market Today: Sensex Gained 126.56 Points Up; Nifty Scales 24,540.85 | Check More Updates

Stocks to Watch Today: 29th August 2025 | Hexaware Technologies, RBL Bank, Shukra Pharma, Infosys, & More!