Outperforming sectors of Q2FY23

Posted by : Sheen Hitaishi | Tue Oct 03 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1696310518475{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]At the end of Q2FY24, the markets have presented some pleasant surprises. When considering the key indices used to track various sectors in the economy, this quarter clearly demonstrates the dominance of certain sectors retaining their leadership, as well as the outperformance of sectors that were previously out of favor.

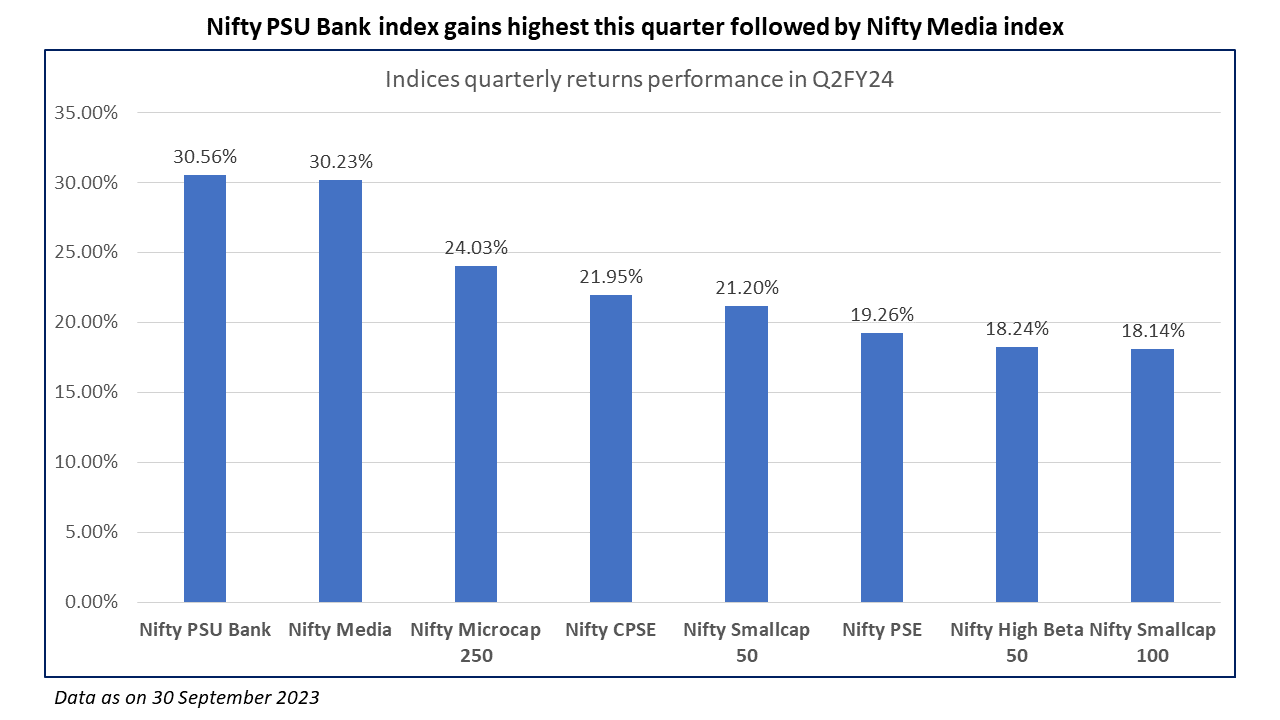

Leading the outperforming sectors is the Nifty PSU Bank index, which delivered a return of 30.56% this quarter. This is one sector that has been consistently outperforming for the last two years. This sectoral index also delivered the highest returns in FY23. It is highly likely that it will maintain its position as the top-performing sectoral index this financial year as well.

Close on the heels of the Nifty PSU Bank is the Nifty Media index, which has delivered a staggering 30.23% return this quarter. Among the other sectoral indices, surprise outperformance has been delivered by the Nifty CPSE and Nifty PSE indices, comprising state-owned enterprises. Government spending in the infrastructure and power sectors is seen as the driver of growth in this index.

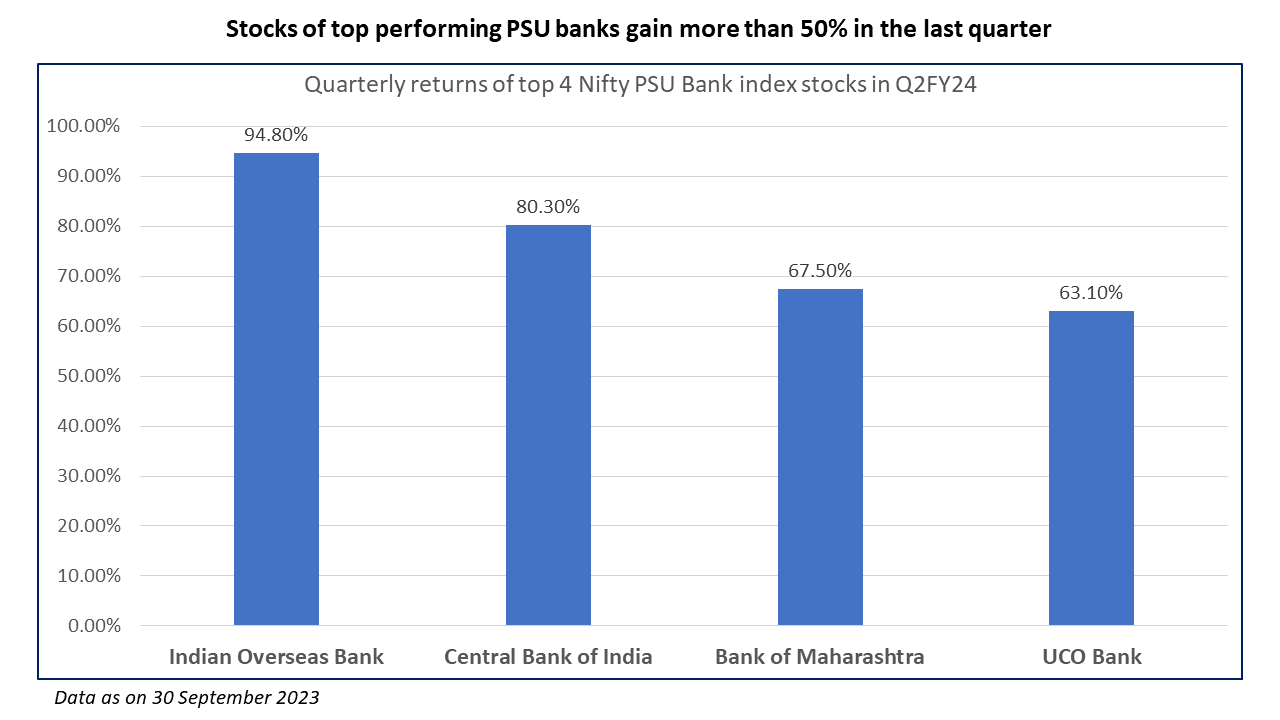

Analyzing the top-performing index, post-Covid, PSU banks have managed to improve their net interest income due to the high-interest regime. However, after the high-interest regime peaked, only those banks are expected to report strong financials that have a better CASA. State-owned large-cap banking stocks are comparatively better placed than their peers. It is noteworthy that the returns delivered by some of the mid-sized PSU banks have been far higher than the returns of private sector banks.

The highest gainer among the PSU banks was Indian Overseas Bank with a gain of 94.8%, followed by Central Bank of India with a gain of 80.3% in the last quarter. This is in stark contrast to the returns of large private banks like ICICI Bank, which gained 1.5%, and Axis Bank, which gained 6% in the last quarter.

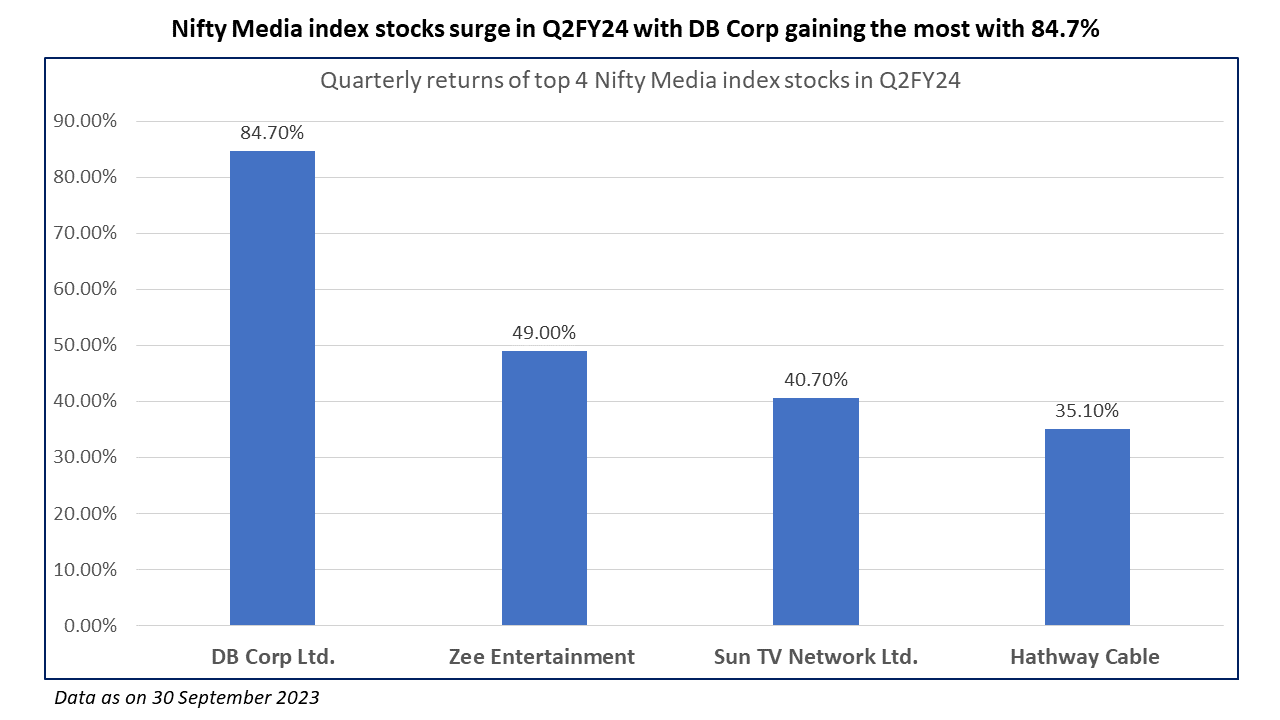

The rise in media stocks can be attributed to several favorable circumstances. Firstly, the return of consumers to malls and multiplexes. Secondly, the upcoming festival season is expected to witness a surge in consumer spending, which will be supported by higher ad spending by media companies. Thirdly, the upcoming Cricket World Cup opens up a floodgate of opportunities for these companies.

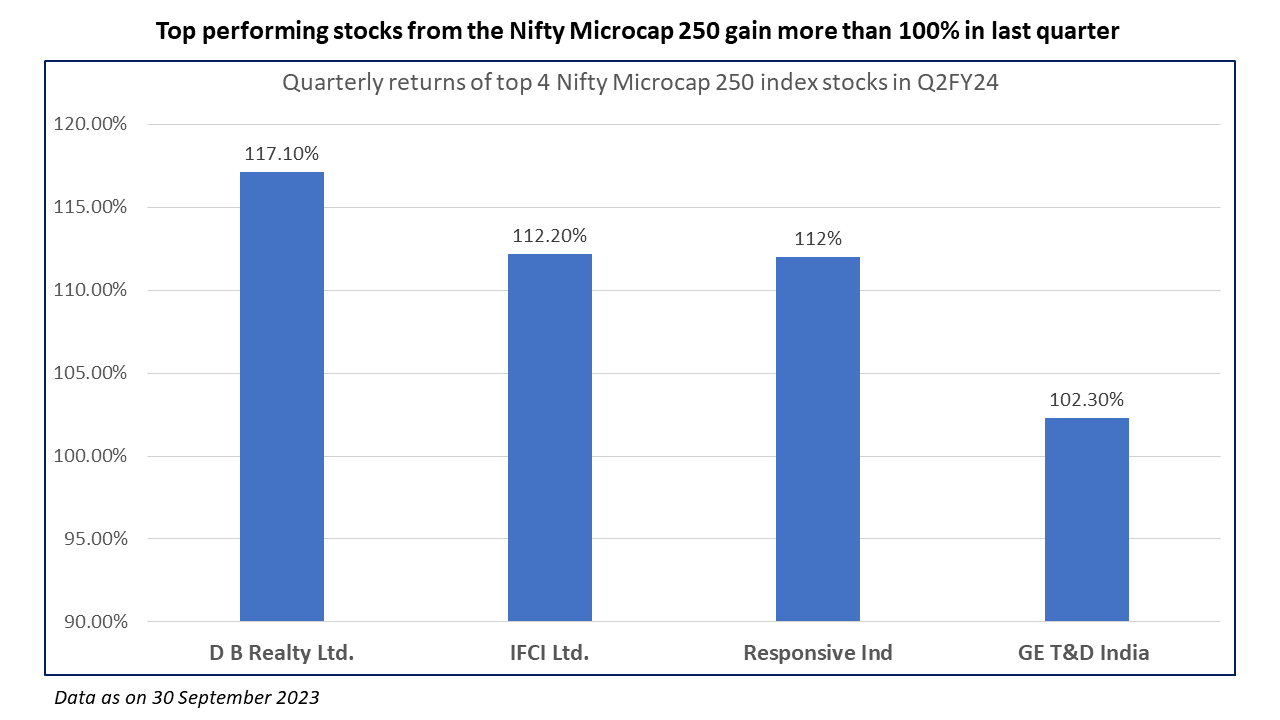

The rise in microcap and small-cap indices can be attributed to the improving economic environment and government reforms across sectors, which have opened up immense opportunities for both domestic and overseas investors to explore and invest in companies beyond the top 100 market-cap firms. This renewed focus on mid and small-cap companies with growth potential and lower valuations is also reflected in the returns of mid-cap and small-cap mutual funds, which have outperformed other categories of mutual funds in the last quarter. As a result, many investors have been flocking to invest in these mid-cap and small-cap mutual funds.

Top-performing stocks from the Nifty Microcap 250 index have gained more than 100% in the last quarter. A notable feature among this set is that the top-performing stocks in this index belong to diverse industries. With such a sharp rise in the last quarter, it is expected that while stocks in this index may continue to rise, they may not do so at the same pace as in the previous quarter.

As we are now halfway through the financial year, we can clearly see that some sectors will continue to remain strong, while others may witness weakness after a strong performance in the last quarter. Many sectors, such as IT and pharma, which were previously favored by domestic and international investors, seem to be out of favor at the moment. However, these sectors may regain momentum in the coming quarters.

At Univest, our analyst team has been tracking these sectors throughout the quarter and has recommended several stocks from PSU banks, state-owned companies, as well as small-cap ideas for short-term, medium-term, and long-term trade opportunities that have proven profitable for our subscribers in Q2FY24. We look forward to your continued support as we strive to identify sectoral winners early in the next quarter as well.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: PSU Banks: A Top Performer Again this Year[/vc_column_text][/vc_column][/vc_row]