Nestlé India reported highest revenue and net profits in last ten quarters in Q3CY22

Posted by : Sheen Hitaishi | Wed Oct 26 2022

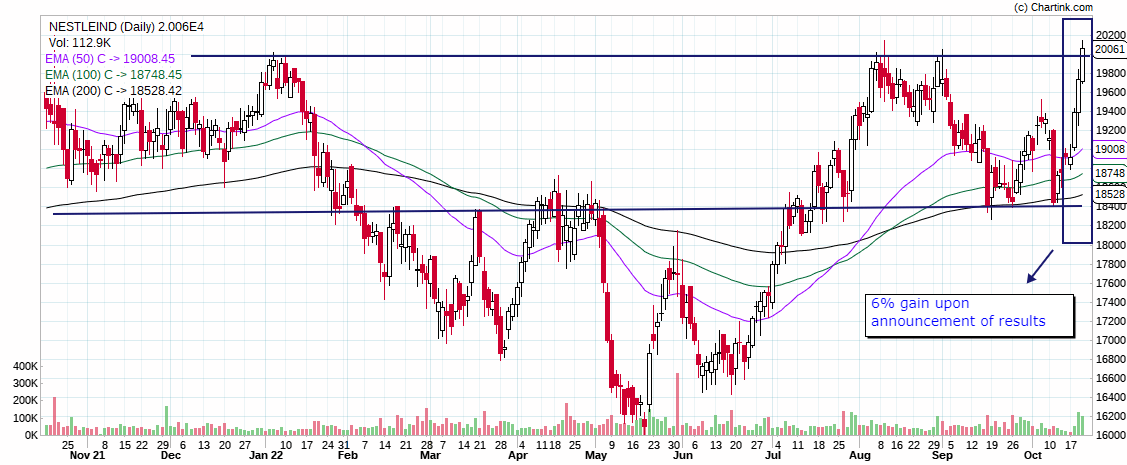

Nestlé India Ltd, a subsidiary of Swiss MNC, Nestlé operates in the food segment in India and has a market cap of Rs 193,268 crores. The company announced their Q3CY22 results on 19th October 22, where they beat revenue estimates while reporting in-line EBITDA margins. In Q2CY23, Nestlé saw a slight thump on sales forecasts. Double-digit YoY growth across all segments, backed by improved volumes, mix, and greater realisations, drove sales growth. While demand and sentiment in metro areas remained strong, it was also strong in smaller towns and rural markets, which is a positive development. Even the share price of Nestle has moved up with the announcement of Q3CY22 results. So, before moving ahead, let’s analyse their Q3CY22 results & check what lies ahead for them.

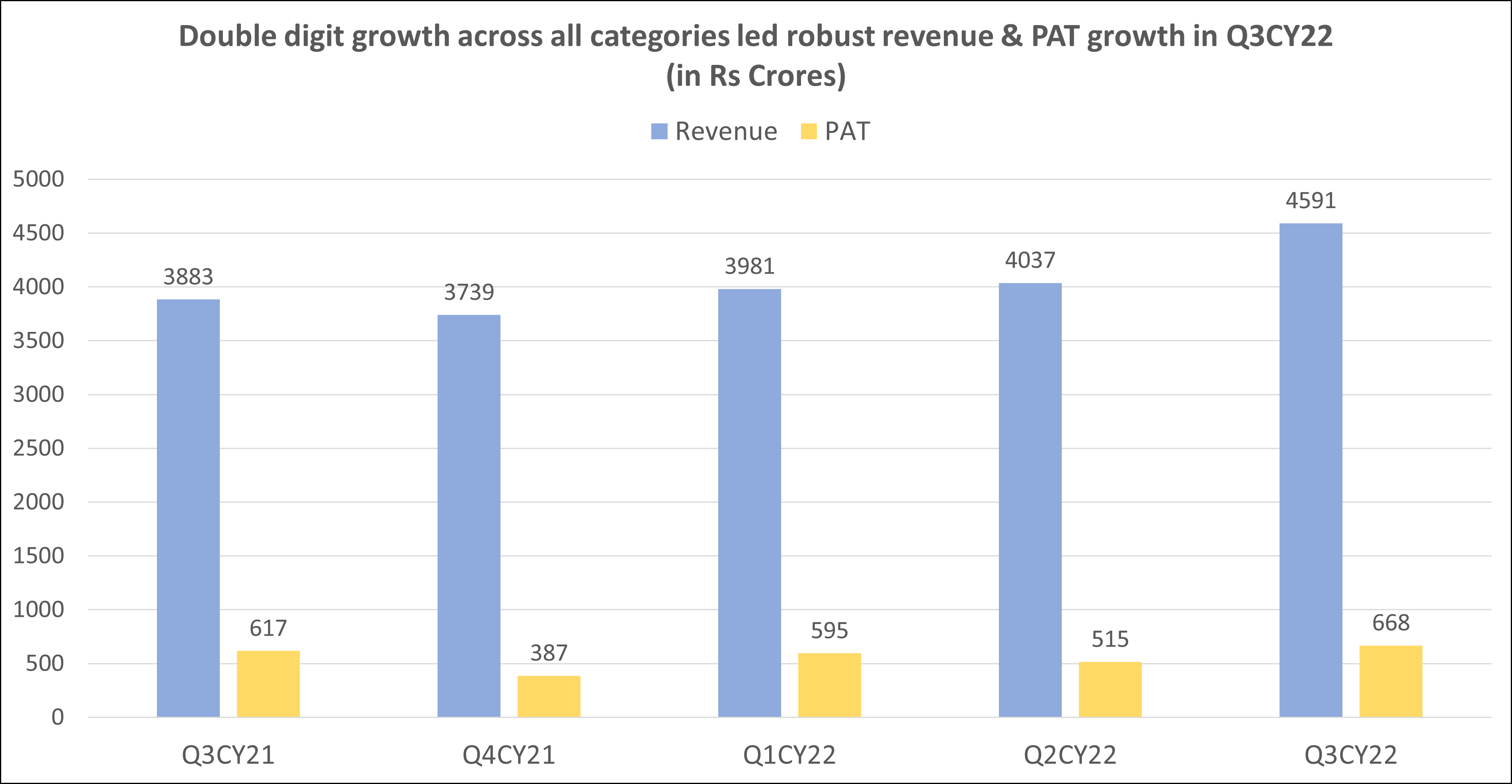

Nestlé results Q3CY22: PAT rose 8.3% YoY backed by healthy revenue growth of 18.3%

In comparison to the Q3CY21, Nestlé India’s profit after tax increased by 8.3% YoY to Rs 668 crores in Q3CY22. In terms of sequential growth, the profit is up 29.7% from the Rs 515 crores achieved in Q2CY22. For the quarter, revenue increased to Rs 4,591 crores, up 18.3% from Rs 3,883 crores reported in Q3CY21. Sequentially, the revenue has increased from Rs 4,037 crores by 13.7%. Nestlé saw strong growth across several brands, including Maggi, Milkmaid, Nescafe Classic, and Sunrise. While innovative formats like “rapid commerce” and “click and mortar” contributed 7.2% to the quarterly sales, export sales climbed by 15.7% YoY.

“In the past five years, this quarter has seen the strongest sales rise. This accomplishment was made possible by persistently strong volume and mix development and widespread double-digit growth across all categories.” Nestlé India’s chairman and managing director, Suresh Narayanan, stated.

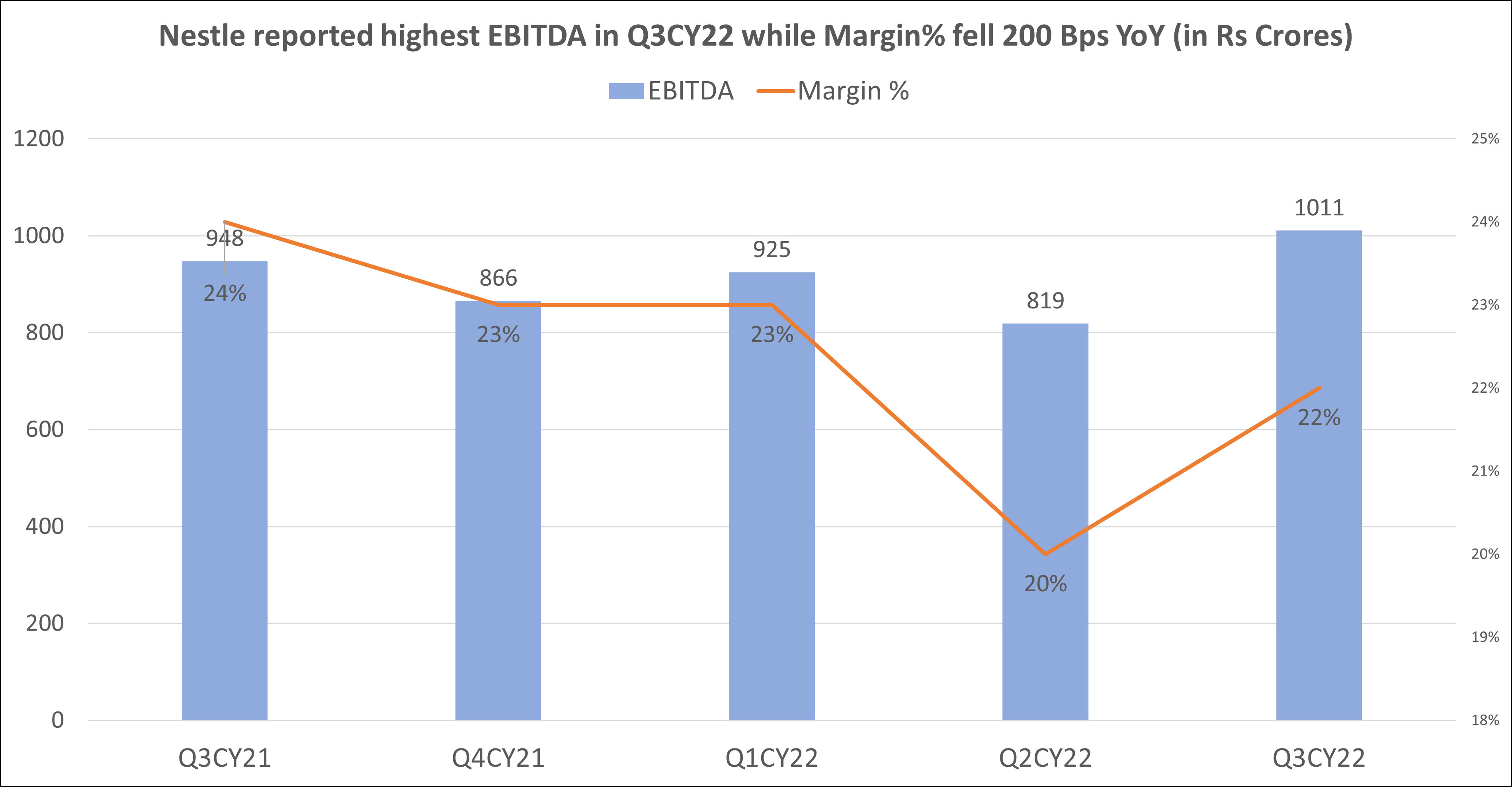

Nestlé results Q3CY22:

EBITDA (Earnings before interest, taxes, depreciation, and amortization) for the company grew 6.7% YoY to Rs 1,011 crores from Rs 948 crores in Q3CY21. Whereas the EBITDA margin declined 250 Bps to 22% due to raw material price inflation. While sequentially, both EBITDA & EBITDA margin % saw positive growth, with EBITDA expanding 23.4% QoQ & margin % increasing by 200 Bps.

“Early indications of price stability for a few commodities, like food oils and packaging materials, are now apparent. However, with continuing demand growth and volatility, it is anticipated that prices for fresh milk, fuels, grains, and green coffee would remain stable” added Narayanan.

You may also like: HDFC Bank results

Other Key Updates: Debut of first-ever D2C platform, MyNestlé

Other Key Updates: Debut of first-ever D2C platform, MyNestlé The company also made a big announcement about the debut of the MyNestlé platform. It features personalised gifts, subscriptions, discounts, and curated product bundles. It is the company’s first-ever direct-to-consumer (D2C) platform. The management also added, “Not only this, but customers may taste gourmet meals on the site and receive free nutrition counselling.”

In addition, providing an update on the acquisition of Purina Petcare, Nestlé stated that in accordance with the business transfer agreement, the company has acquired the business for Rs 142.13 crores after the quarter’s end and will take ownership of it on October 1st, 2022. Lastly, the company is undertaking a CapEx of Rs 2600 crore in the next three to four years to expand the capacity of its existing products. Additionally, Nestlé is increasing its rural footprint from 80,000 villages to 1.2 lakh villages in the next three years.

Univest View along with Technical Analysis

While the company has announced a good set of Q3CY22 results & did manage to gain investors support by gaining in consecutive 3 trading sessions upon announcement of results, brokerages still have mixed opinions. The 50 EMA line is still above 100 & 200 EMA and the stock is currently trading close to its resistance level. If the stock sustains above resistance & closes above that by this week, it is headed for an up move and will be ready to make new lifetime highs.

ICICI Direct said, “We slightly increase our revenue & earnings estimates for CY22-24 on the back of expected volume recovery with softening of RM costs. We continue to maintain our HOLD rating on the stock & value the stock at Rs 22400.”

“Nestle’s valuation is expensive and does not offer any significant upside from a one-year perspective. We value the company at a TP of Rs 18,700. We reiterate our neutral rating on the stock.” said Motilal Oswal.

Even HDFC Securities had similar views as Motilal Oswal as they said that with a rich valuation, the absolute upside is limited in the medium term and thus gave a TP of Rs 17500 to Nestle stock.

While key risks involve high inflation in milk, coffee and wheat could remain sticky. Secondly, stronger than expected volume growth in the core business. On the Univest app, the company has a ‘Hold’ rating with a neutral stance for fundamentals & short-term trend. While the company is bullish in long term, as per the Univest app. Therefore, existing investors can remain invested in the company, while fresh investors should wait till the stock comes in the ‘Buy’ category or the stock is able to sustain above the resistance level till the end of October.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Q2FY23 appears to be mixed for different FMCG players

Related Posts

Khazanchi Jewellers Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

Kesar Enterprises Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

J.G. Chemicals Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

IFGL Refractories Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

EFC Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here