Mid and small cap IT companies lead revival of the IT sector in 2023

Posted by : Sheen Hitaishi | Mon Feb 20 2023

The Indian IT software and services sector has been one of the biggest wealth creators for investors over the last decade. India is home to some of the world’s leading global IT powerhouses, including TCS, Infosys, Wipro, and Tech Mahindra among many others. The Indian IT industry employs about 5 million people and generates roughly 10% of India’s GDP. This sector is of critical importance to India’s growth story. Apart from the leaders, there are many mid and small companies that make a significant contribution.

Leading Indian IT firms like TCS, HCL, and Wipro, among others, are focused on cutting-edge technology such as artificial intelligence (AI) and machine learning (ML) while catering to their client’s requirements. Further, it is a testament to their increased interest in these newer and innovative technologies, that Infosys had invested in OpenAI, the start-up that designed the conversational AI tool ChatGPT, over half a decade ago.

Digital transformation leads the way for IT companies

Many analysts believe that IT companies would help move not just the digital transformation journey of their clients, but also aid the growth of India itself. They add that the government’s focus on developing digital infrastructure to power public services and provide access to healthcare, education, financial- and agri-services speaks of the massive opportunity for collaboration available in the IT sector. The India Stack with Aadhaar, UPI, CoWin, and the national health stack, has set a high benchmark for using technology for the public good.

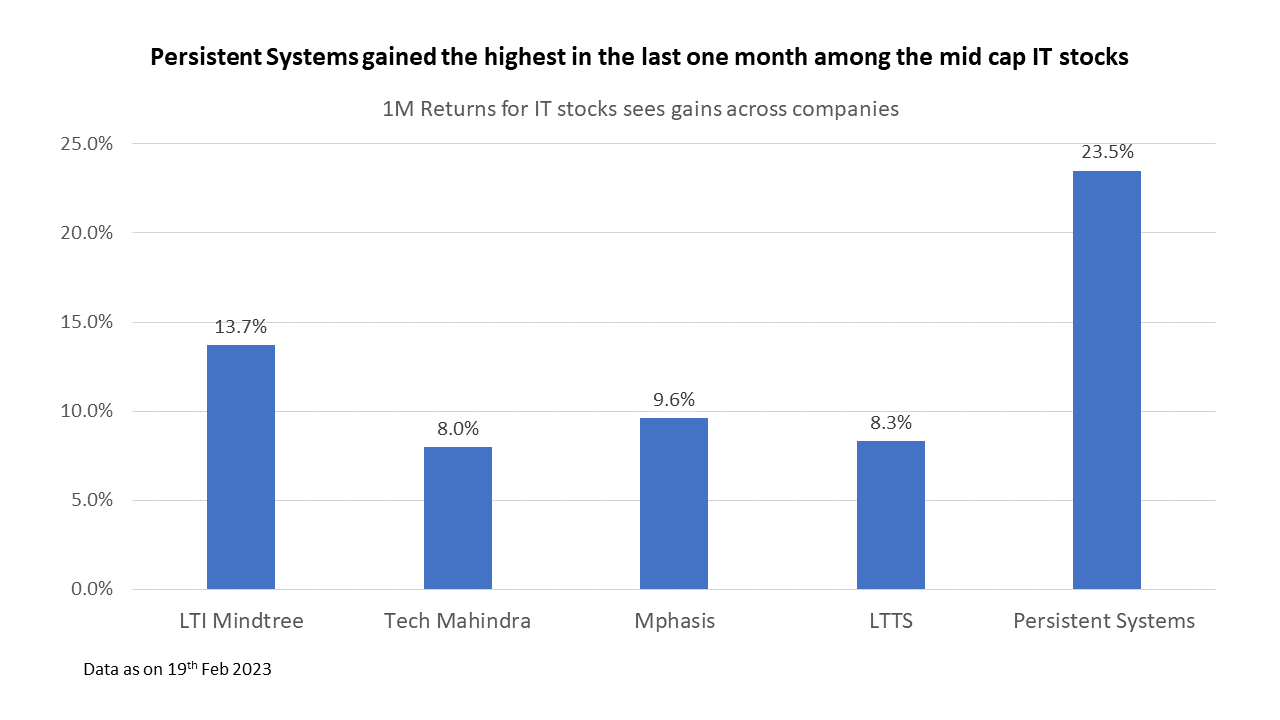

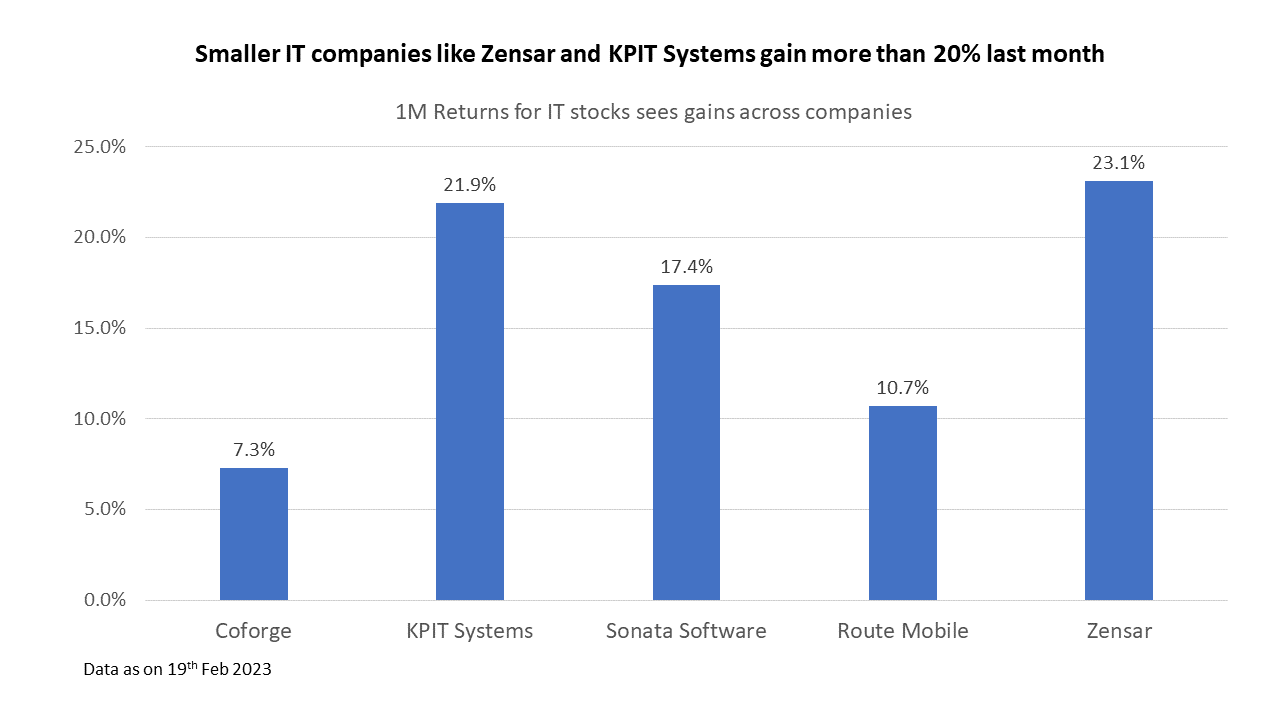

In 2022, the IT sector was the worst-performing sector with the sector index losing almost 20% through the year. However, with the onset of 2023, the tide seems to have turned with many of the IT stocks seeing a rise in the last month. More than the leading IT companies, it is the mid and small-cap IT companies that have made substantial gains in the last month.

Companies such as Persistent Systems, KPIT Systems, and Zensar Technologies have given more than 20% returns to investors in the last month. Persistent has achieved US$1 bn revenue on a quarterly annualised basis and is now aiming at US$2 bn annual revenue in the medium term. It acquired five companies in FY22, building capabilities in payments, cloud, etc.

There are many factors that are responsible for the revival of interest in IT stocks. Attrition, which was a major challenge for IT companies during FY21 and FY22 has tapered down in Q3FY23. IT majors, such as TCS, Infosys, and HCL Tech witnessed a fall in attrition rate during the December quarter. According to analysts, the IT sector attrition has softened from peak levels of 25-30% in the previous year to about 20% in Q3FY23.

Deal wins continue to remain strong

IT services companies are witnessing an uptick in large and mega deals in specific sectors like banking, financial services, and insurance (BFSI) as they turn to technology to optimise costs in the current uncertain economic environment.

Tata Consultancy Services (TCS), announced an over £600-million (about $723-million) contract with Phoenix Group, UK’s largest long-term savings and retirements provider, to digitally transform the latter’s ReAssure business using the TCS BaNCS-based platform.

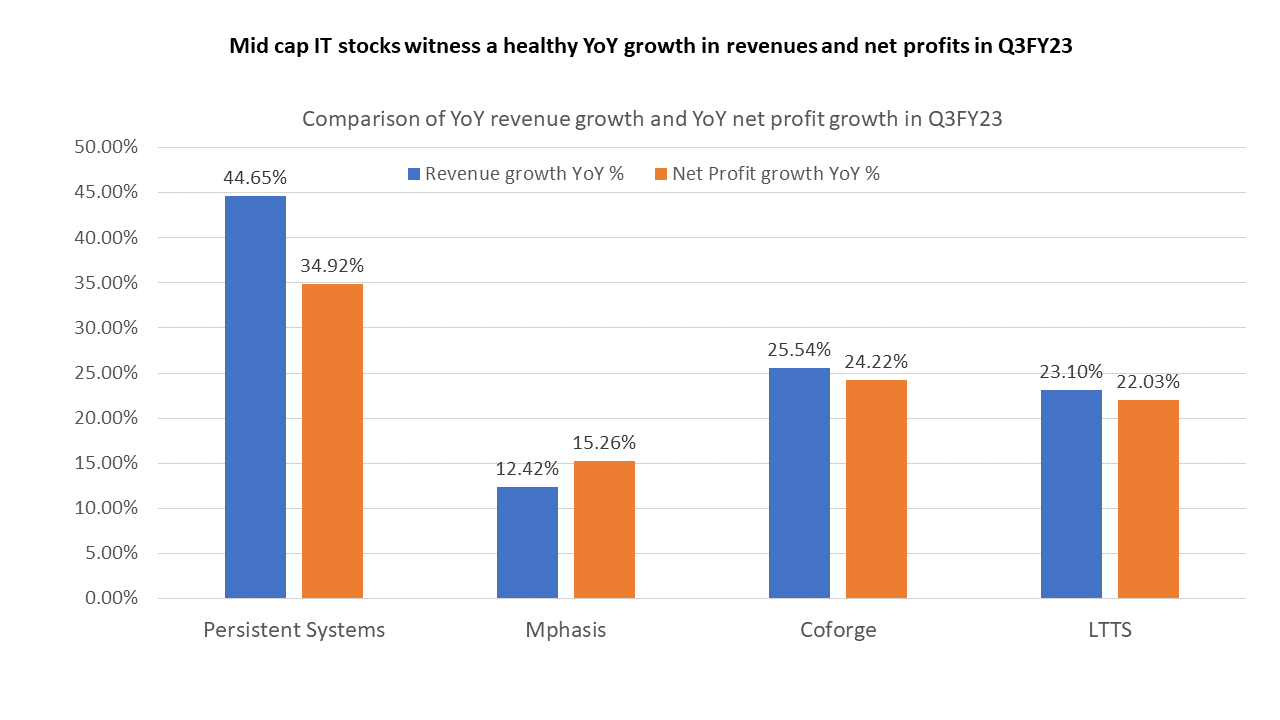

Infosys signed 32 large deals worth a total contract value (TCV) of $3.3 billion in Q3FY23, the highest in the last eight quarters. While the major players continue to win high-value deals, the mid and small-cap IT companies are not far behind either. The Q3FY23 results for some of the mid-cap companies point to strong YoY revenue and profit growth.

Fundamentals reflect there is no slowdown as anticipated by analysts

The data below shows that these companies have grown much higher on a YoY basis than that was expected. The narrative being driven was that there will be a slowdown in client spending, but the Q3FY23 numbers paint a different picture. Our hypothesis is that IT companies and clients cannot afford to slow down spending due to the rapid pace of change and transformation in technology. Any slowdown will have a long-term impact and catching up on technology will be another challenge in itself.

The management commentary of some of these mid-cap companies is also encouraging. Coforge also said there is a good mix of cloud transformation in the five large deals it won during Q3FY23. The management mentioned there are some areas in the market, which are being affected by macro issues but so far, they are largely insulated from the pain. The company indicated that it has a good runaway for growth despite macros issues due to continued order wins. Coforge mentioned that its revenue growth in FY24 is likely to be around 15%. It also added that 22% CC growth guidance for FY23 is conservative, in its opinion, and it would like to exceed the growth for FY23.

For investors, the IT sector could see a rebound in 2023, and the focus clearly is on the mid and small-cap companies who look all set to deliver better returns than their larger counterparts.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stock buying by MFs in January 2023

Related Posts

Why is the MRF Share Price Falling?

Best SIP Plans for 3 Years in 2026: Build Wealth with Stability

Acetech E-commerce IPO Review 2026: GMP Flat, Key Investor Insights

PNGS Reva Diamond Jewellery IPO Day 3: Subscription at 0.99x, GMP Rises 0.26% | Live Updates

PNGS Reva Diamond Jewellery IPO Allotment Status: 0.99x Subscribed, GMP Falls 0.26% — Check Online