Maruti Suzuki surprises with impressive numbers in Q3FY23

Posted by : Sheen Hitaishi | Wed Jan 25 2023

Maruti Suzuki is the market leader in the domestic passenger vehicle (PV) space with a market share pegged at 43.4% as of FY22 data. Maruti Suzuki on 24th January 23 announced their Q3FY23 results, where they reported an excellent performance across all metrics. The company recorded a whooping triple-digit YoY growth in its net profits supported by the highest-ever EBITDA margin. Even on the technical charts, the Maruti Suzuki stock has made a breakthrough candle by surpassing previous highs as it gained almost 3% intra-day on the day of the announcement of Q3FY23 results. So, let’s now analyse their Q3FY23 numbers & check if there is any more upside potential.

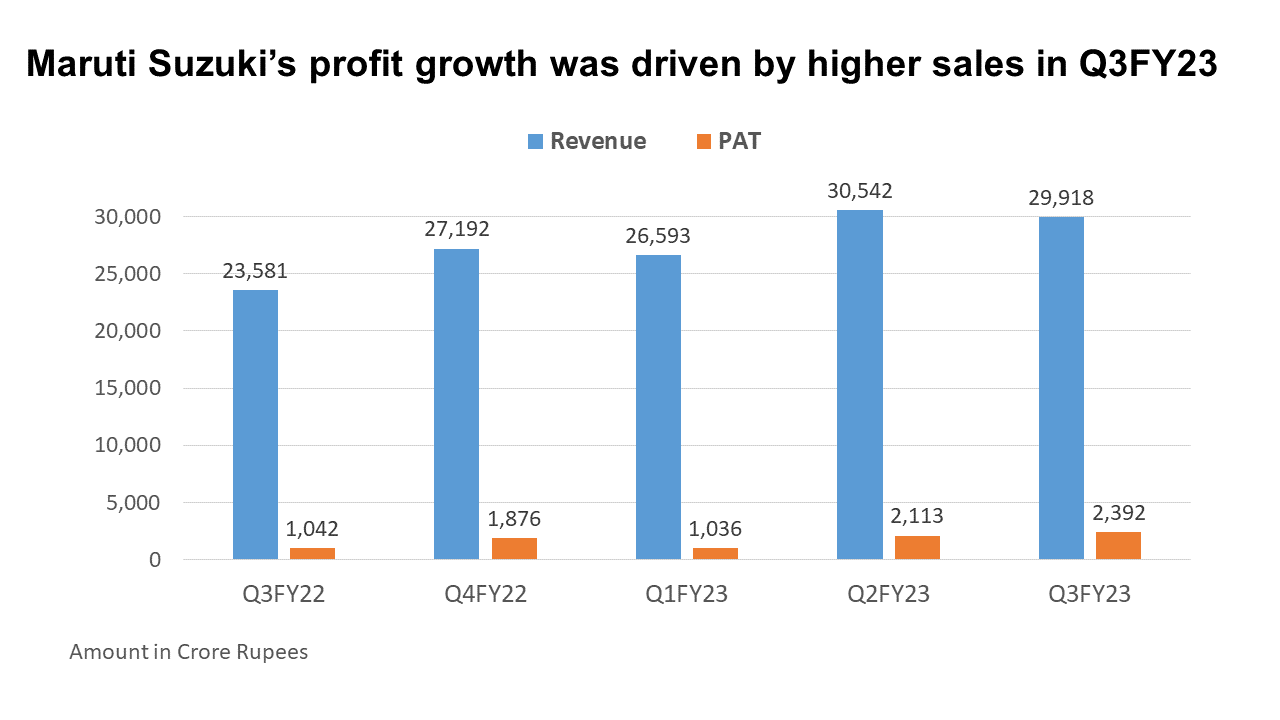

Maruti Suzuki Q3: Profit zooms 130% to Rs 2,391 crore, revenue up 25%

Maruti Suzuki’s net profit for the December quarter more than doubled on the year to Rs 2,391 crore. The total revenue from operations came in at Rs 29189, crore, rising 24.96 percent from Rs 23,581 crore in the corresponding quarter a year ago, the largest carmaker in the country said in an exchange filing. This was aided by its new launches the Brezza and the Grand Vitara in the mid-size SUVs. These models are making up for the fall in demand for smaller and more compact cars as customer preferences have moved to bigger-sized cars.

Among the positive factors that aided the company’s margin included cost reduction efforts, improved realisation, favourable foreign exchange variation, softening commodity prices, and higher non-operating income.

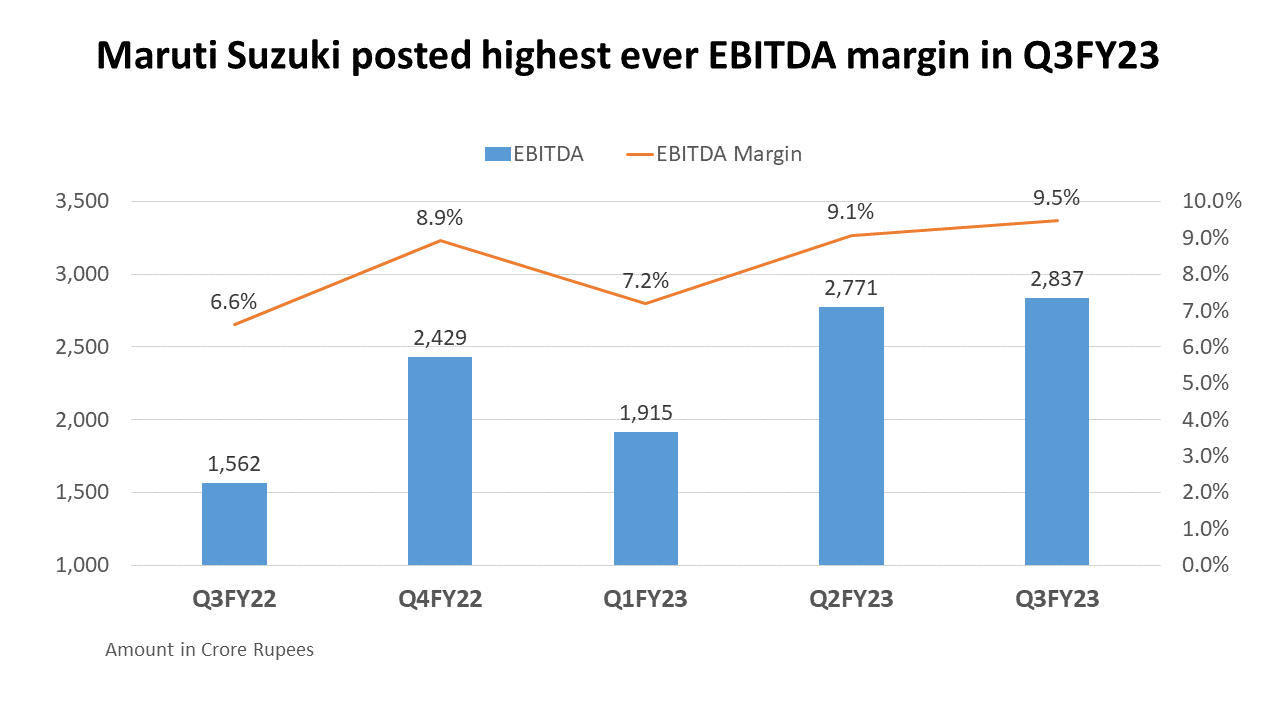

Profit growth was driven by higher sales and a fall in raw material costs. Maruti Suzuki’s EBITDA margin expanded 300 basis points from the same period last year and was in line with estimates of 9.7 percent. This is the second straight quarter and the third time in the last four quarters where Maruti’s margin has been in excess of 9 percent. The major negative factor affecting companies performance is increasing sales promotion cost.

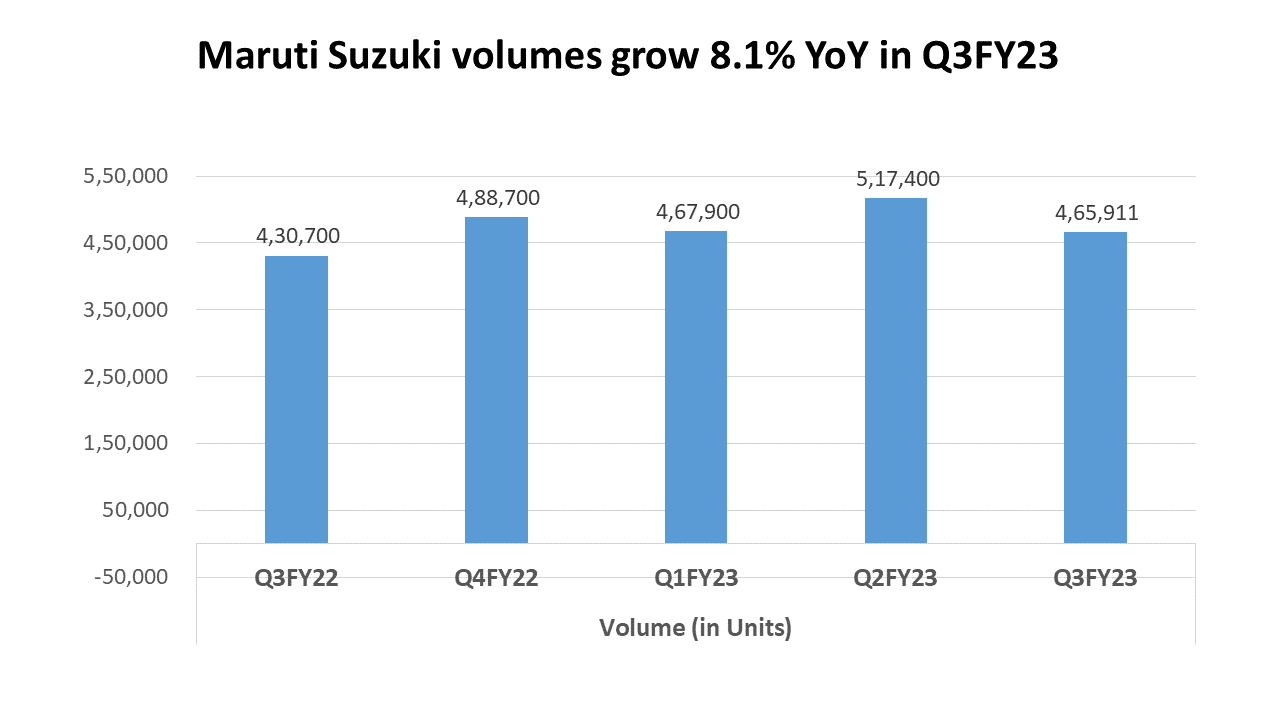

Volumes for the quarter grew 8 percent from the year-ago period to 4.65 lakh units. At the end of the quarter, pending customer orders stood at 3.63 lakh vehicles out of which 1.19 lakh orders were for newly launched models. The country’s largest automaker saw the highest-ever sales of 19,40,067 units in 2022, and record exports of 2,63,068 units. Its cumulative production crossed 25 million units. Ashwin Patil of LKP Securities called Maruti’s earnings impressive and said that they are 3-4 percent higher than their estimate.

In the recent Auto Expo, Maruti Suzuki launched two new models, its compact SUV Fronx as well as the SUV Jimny. These models are expected to help Maruti Suzuki maintain its leadership in the PV segment. However, one red flag is that Maruti has not yet introduced any EVs in the Indian market. Tata Motors has already established leadership in this segment with its Nexon EV and M&M is launching its EV on the 26th of January. With the growing adoption of EVs, Maruti Suzuki needs some catching up to do as the Government is also pushing for a higher adaptation of EVs.

Univest view with Technical Analysis

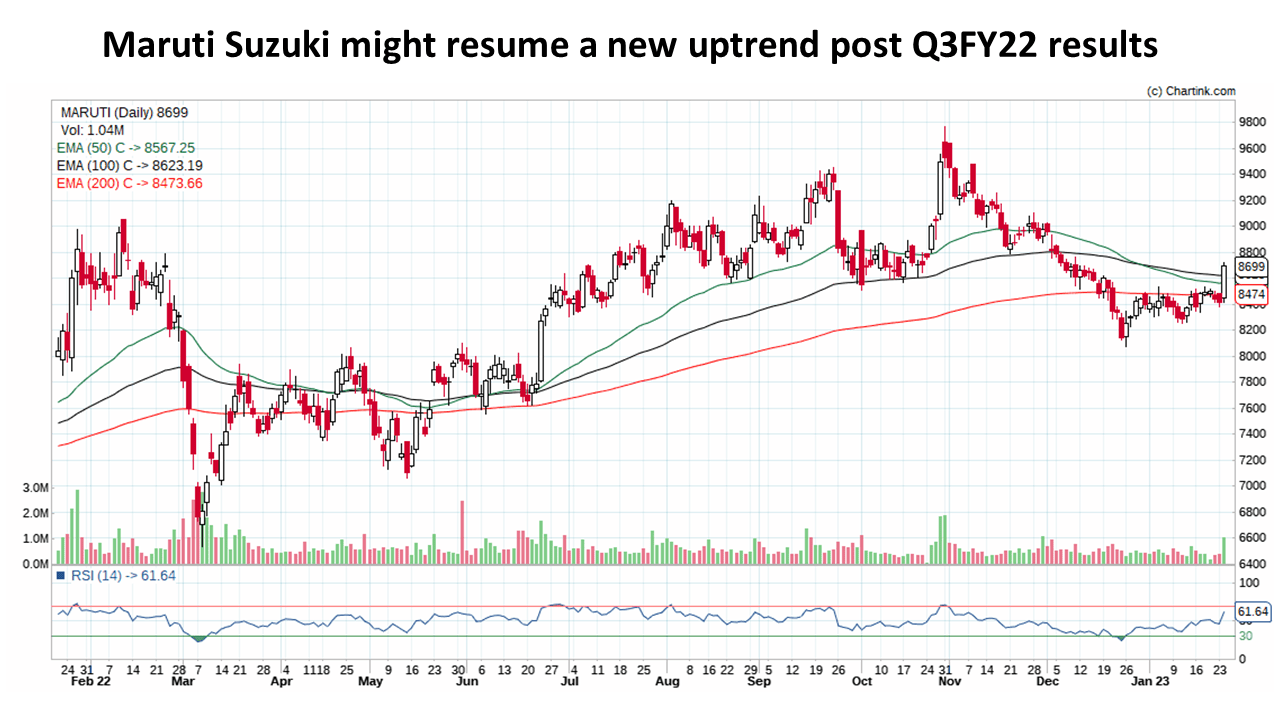

On the Univest App, the company has a BUY rating, having strong fundamentals and a bullish stance for short as well as the long-term trend. Therefore, existing investors can remain invested while fresh investors can consider buying the stock now with a long-term view and TP of 11,200.

The stock price has been rejected from the moving averages as shown in the graph, which is a good sign of positioning toward a bullish move. The Relative Strength Index in the Daily timeframe has crossed 60, both weekly and monthly rejected from 50, which supports the above statement. From this, we can expect overall good performance in the Automobile sector.

You may also like: Asian Paints Q3FY23 Results : Muted sales growth lead to below expectation results

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

Related Posts

Apollo Techno Industries IPO Listing at 11% Premium at ₹145 Per Share

Nanta Tech IPO Listing at 6.36% Premium at ₹220 Per Share

Dhara Rail Projects IPO Listing at 19% Premium at ₹150 Per Share

What are Mutual Funds? Everything You Need to Know About

Admach Systems IPO Listing at 20% Discount at ₹191.20 Per Share