Maruti Suzuki reported excellent Q2FY23 results

Posted by : Sheen Hitaishi | Thu Nov 03 2022

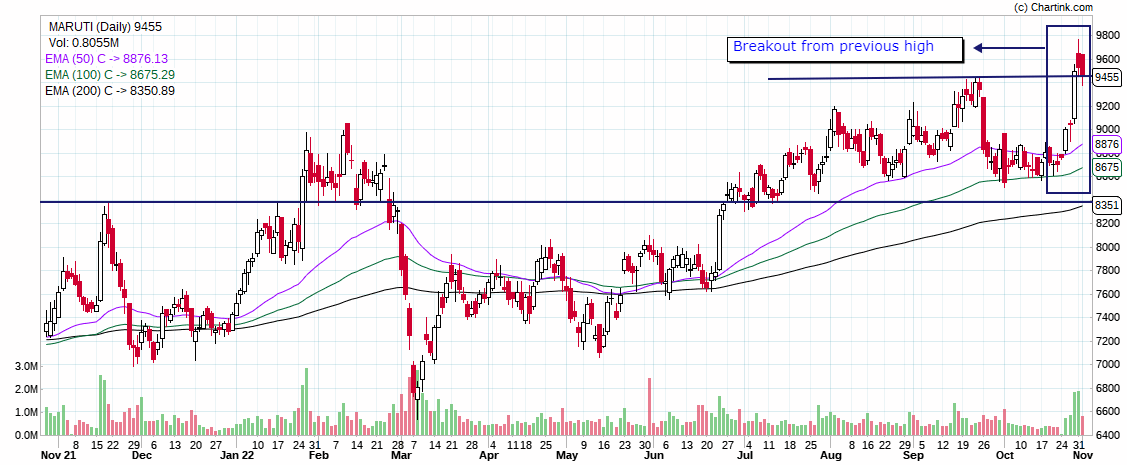

Maruti Suzuki is the market leader in the domestic passenger vehicle (PV) space with a market share pegged at 43.4% as of FY22 data. Maruti Suzuki on 28th October’22 announced their Q2FY23 results, where they reported an excellent performance across all metrics. The company recorded a whooping triple-digit YoY growth in its net profits supported by the highest-ever quarterly sales. Even on the technical charts, the Maruti Suzuki stock has made a breakthrough candle by surpassing previous highs as it gained almost 8% intra-day on the day of announcement of Q2FY23 results. So, let’s now analyse their Q2FY23 numbers & check if there is any more upside potential.

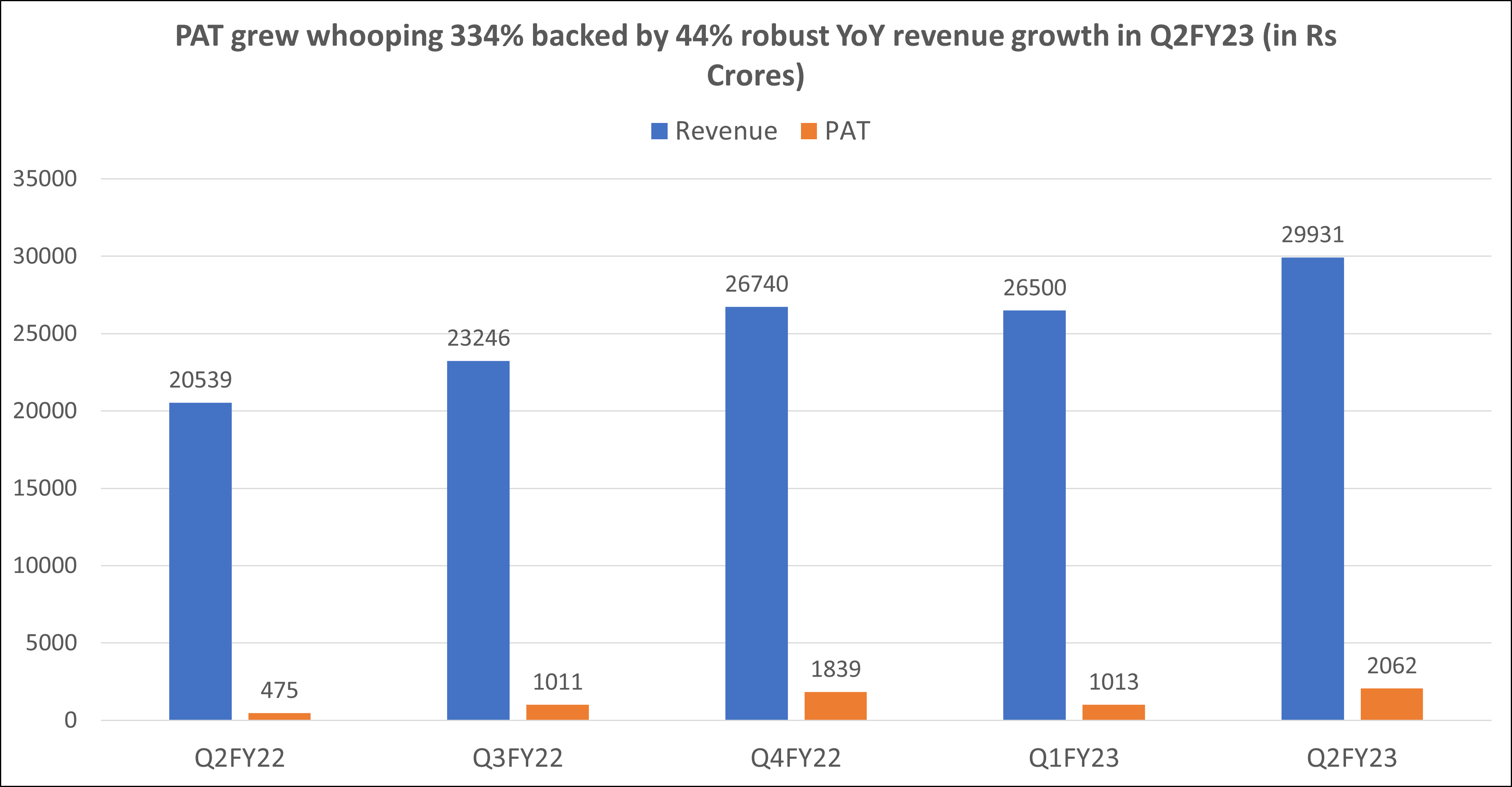

Maruti Suzuki results in Q2FY23: PAT grew 4X YoY owing to higher other income

Maruti Suzuki has reported a PAT growth of 334% YoY to Rs 2,062 crores in Q2FY23 from Rs 475 crores in Q2FY22. While Consequent PAT in Q2FY23 came in at Rs 2,062 crores, 2x QoQ. PAT performance was driven by higher operating margins & higher other income. Coming onto revenue, it grew growing 45% YoY to Rs 29,931 crores in Q2FY23 from Rs 20,539 crores reported in Q2FY22. On a QoQ basis, it grew 13% from Rs 26,500 crores in Q1FY23.

You may also like: Adani’s group’s market cap surpasses Tata group’s

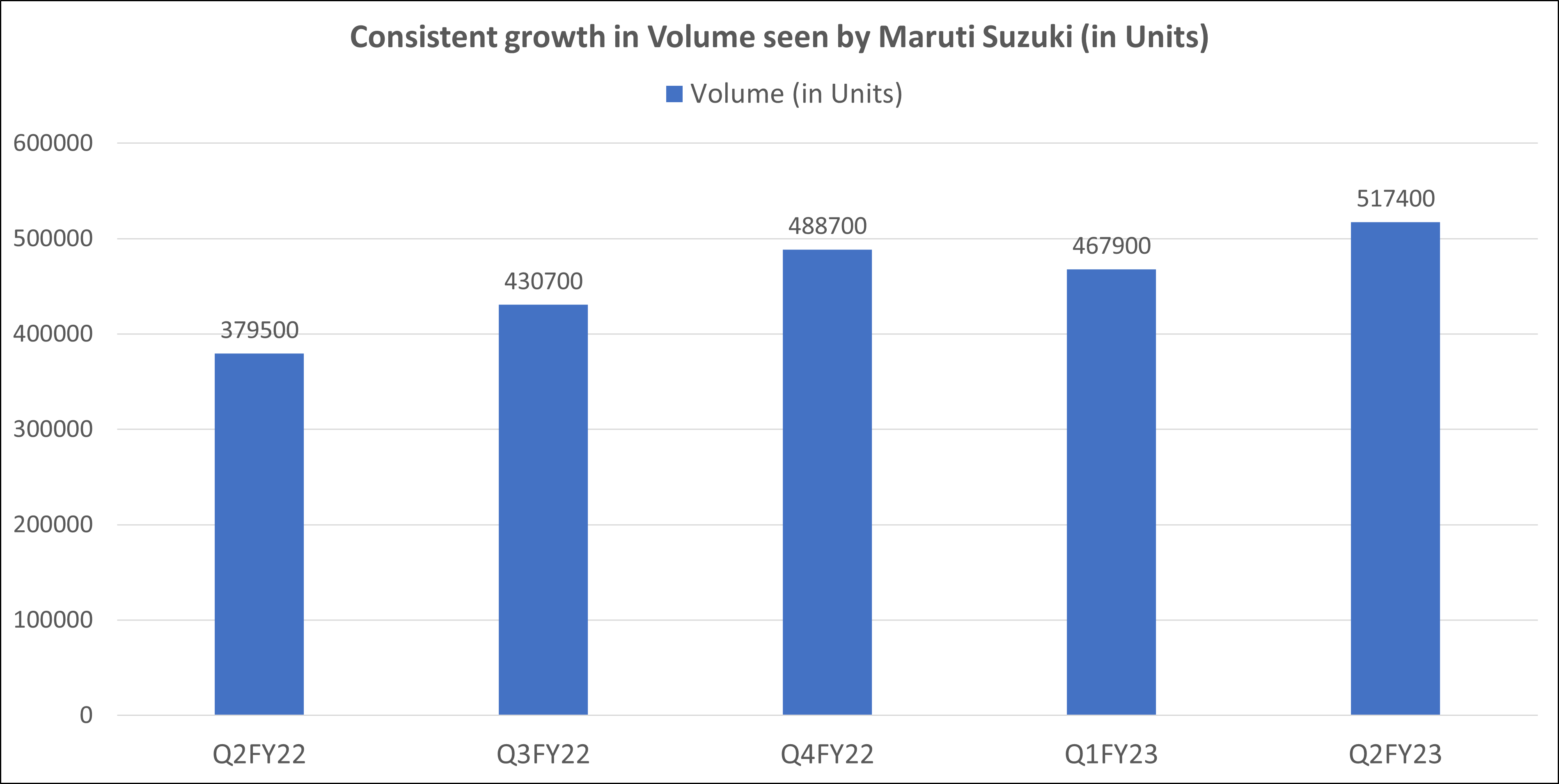

Maruti Suzuki results Q2FY23: Highest ever quarterly sale of cars during Q2FY23

The company sold highest ever cars quarterly during Q2FY23, at 5,17,395 units. Of this, domestic volumes grew 14% QoQ to 4,54,200 units while export volumes were down 9% QoQ at 63,195 units. The average selling price (ASP) came in at Rs 5.52 lakh/unit, up 2.1% QoQ.

Further, the management said 35,000 units of production were lost due to chip shortage in Q2FY23 vs. 51,000 lost in Q1FY23. Maruti Suzuki is trying to source chips from alternate suppliers to offset production loss.

During the quarter company celebrated 40 years of celebration in India and laid the foundation stone for an EV facility in Gujarat and an upcoming facility in Haryana. Lastly, the company continues to witness a strong order book of 4.1 lakh units as of Q2FY23. With respect to the launch of recent products, they received 1.3 lakh bookings.

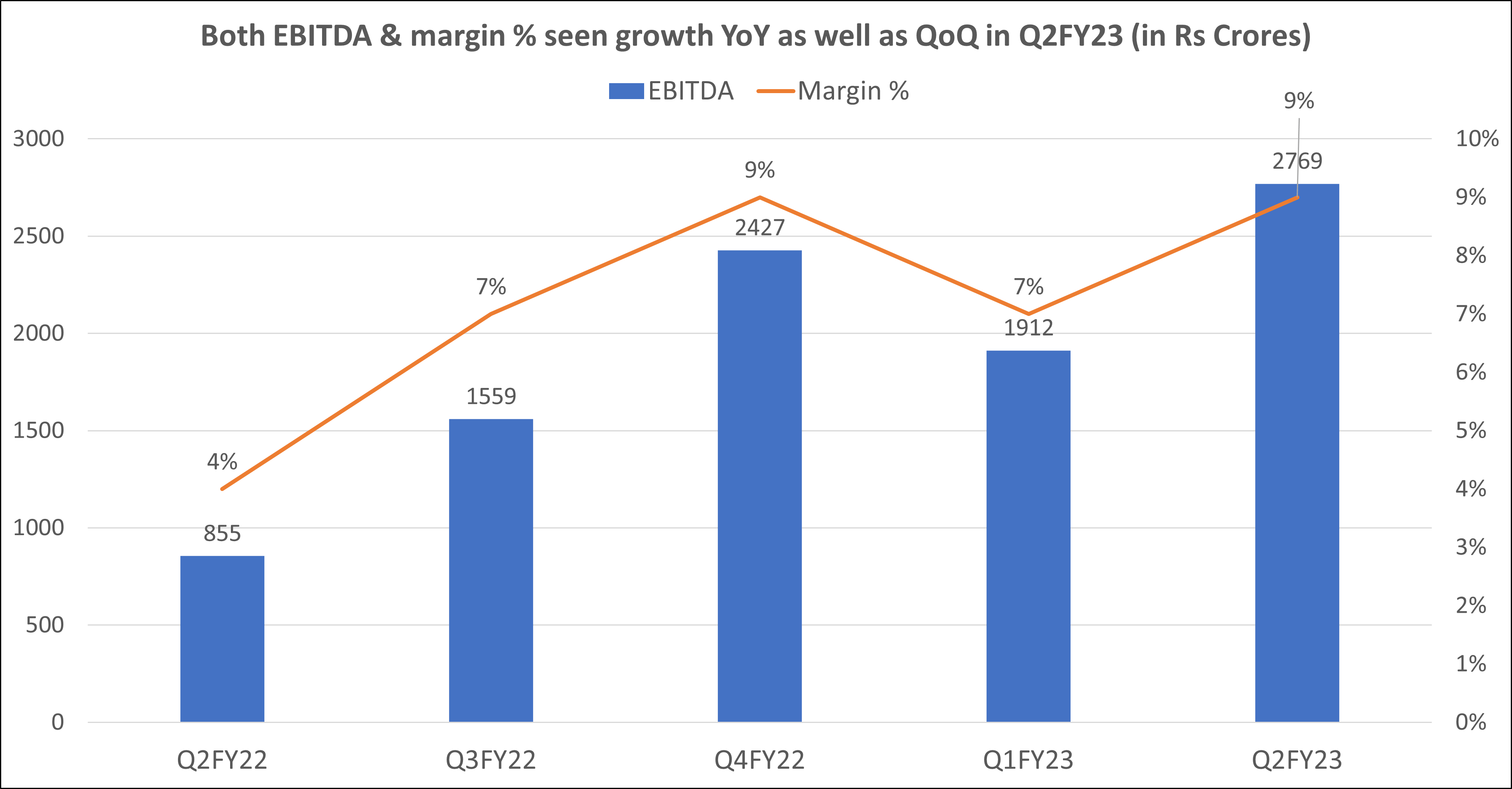

Maruti Suzuki results Q2FY23: Margin% went up 204 Bps QoQ in Q2FY23

Margins surprised positively this time, up 204 bps QoQ to 9.3%. Gross margins expanded by 150 bps QoQ while employee costs were down by 59 bps. Other expenses witnessed a marginal rise tracking higher A&P spending.

While EBITDA for Q2FY23 came in at Rs 2,769 crores, up 224% from Rs 855 crores in Q2FY22.While sequentially EBITDA grew 45% from Rs 1,912 crores reported in Q1FY23.

Univest View along with Technical Analysis:

Maruti Suzuki reported an inline operating performance in Q2FY23, led by strong volume growth and a favourable commodity and currency. With launches gaining traction and semiconductor shortages easing, the company is on a strong footing for a recovery in market share and margin.

On the technical charts, Maruti Suzuki shares made a new high after the announcement of Q2FY23 results. Though it saw slight profit booking after it, the stock is still bullish with 50 EMA above 100 & 200 EMA.

ICICI Direct, “We retain our BUY rating tracking industry tailwinds of underpenetrated PV segment domestically, benign RM price outlook, and robust order book. Upgrading our estimates, we now value Maruti Suzuki at Rs 11,200.

While Motilal Oswal said, “Strong demand and a favourable product lifecycle for MSIL augur well for market share and margin. We expect a recovery in both market share and margin in 2HFY23, led by an improvement in supplies, a favourable product lifecycle and mix, RM and currency-related benefits, and operating leverage. We maintain our Buy rating with a TP of Rs 11,250.”

On the Univest App, the company has a BUY rating, having strong fundamentals and a bullish stance for short as well as long term trend. Therefore, existing investors can remain invested while fresh investors can consider buying the stock now with a long-term view and TP of 11,200.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Reliance saw O2C margins under pressure in Q2FY23

Related Posts

Best Multibagger Midcap Stocks in India 2026

Why is the IRFC Share Price Falling?

Striders Impex IPO Review 2026: GMP Rises 0.00%, Key Investor Insights

Fractal Industries IPO Listing at 6.02% Premium at ₹229 Per Share

PNGS Reva Diamond Jewellery IPO Day 1: Subscription at 0.04x, GMP Rises 2.33% | Live Updates