IT Results Q2FY24: Top tier companies continue to underperform

Posted by : Sheen Hitaishi | Thu Oct 26 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1698311253441{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]As the Q2FY24 results season commenced, investors eagerly awaited the results of top-tier IT services companies. These companies are typically among the first to declare their results, and the trends set by them define the outlook for the overall technology sector.

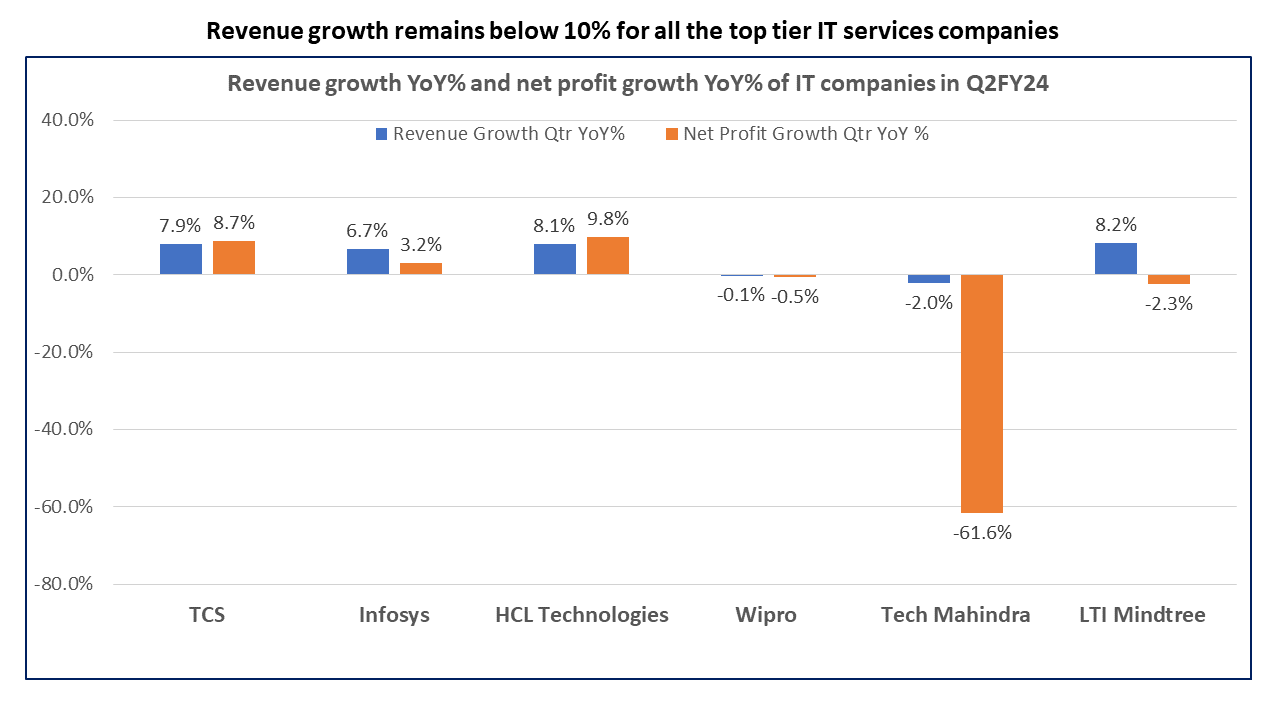

Unfortunately, the Q2 results for the top-tier IT companies once again fell below expectations. The slowdown in new contracts in the US and Europe has hindered their growth, with YoY growth not exceeding 10%. This is a cause for concern among investors.

TCS reported an 8.7% rise in consolidated net profit to Rs 11,342 crore for the September quarter, compared to ₹10,431 crore in the corresponding period last year. Infosys’ net profit rose 3.17% to ₹6,212 crore, compared to Rs 6,012 crore in the corresponding period last year. HCL Tech reported a 9.8% increase in its consolidated net profit, reaching Rs 3,832 crore, compared to ₹3,489 crore in the corresponding period last year.

Many analysts are not very optimistic about the near-term prospects of the Indian IT players due to the prevailing macroeconomic uncertainty in the US and Europe. The Israel-Hamas conflict has also raised fresh concerns. It is anticipated that if the conflict spreads to other countries, it will deal a serious blow to the fight against inflation and significantly impact the global economy.

On the brighter side, there are some signs that the companies may spring back into action over the next two quarters. TCS’s order book at the end of Q2FY24 stood at $11.2 billion. The order book is higher than the $10.2 billion Total Contract Value (TCV) it had in the previous quarter. This is the second-highest TCV ever recorded in a quarter.

Attrition, which was a major concern for IT companies over the last two years, also seems to be slowing down. The attrition rate for TCS came in at 14.9% in the last twelve months, significantly lower than the earlier rate of nearly 22-23%.

HCL Technologies saw wins with strong deals this quarter. ‘Our new bookings of US$4bn this quarter are at an all-time high, driven by a standout mega deal. This achievement underscores our ability to seize exceptional opportunities in the market and gives us optimism for our medium-term growth prospects,”’ said C Vijaykumar, CMD.

Tech Mahindra saw the worst decline in net profits among its peers as it reported a 61.6% fall in net profit to Rs 494 crore for Q2FY24, signaling a washout in the second quarter driven by slowing demand in the telecom and communications segment and delays in deal cycles.

Most IT companies have cut their guidance for FY24. HCL Technologies has trimmed its FY24 revenue guidance to 4-5% from 6-7% in the preceding quarter and also reduced its services revenue guidance to 4.5%-5.5% in constant currency terms. EBIT margin is expected to be between 18-19%, according to the management.

Infosys cut down its revenue growth guidance to 1%-2.5% from 1%-3.5%. The change in revenue guidance for FY24 was somewhat surprising. In constant currency terms, it now projects revenue growth in FY24 of 1% to 2.5%. It did, however, stick to the 20%-22% operating margin guidance for the year.

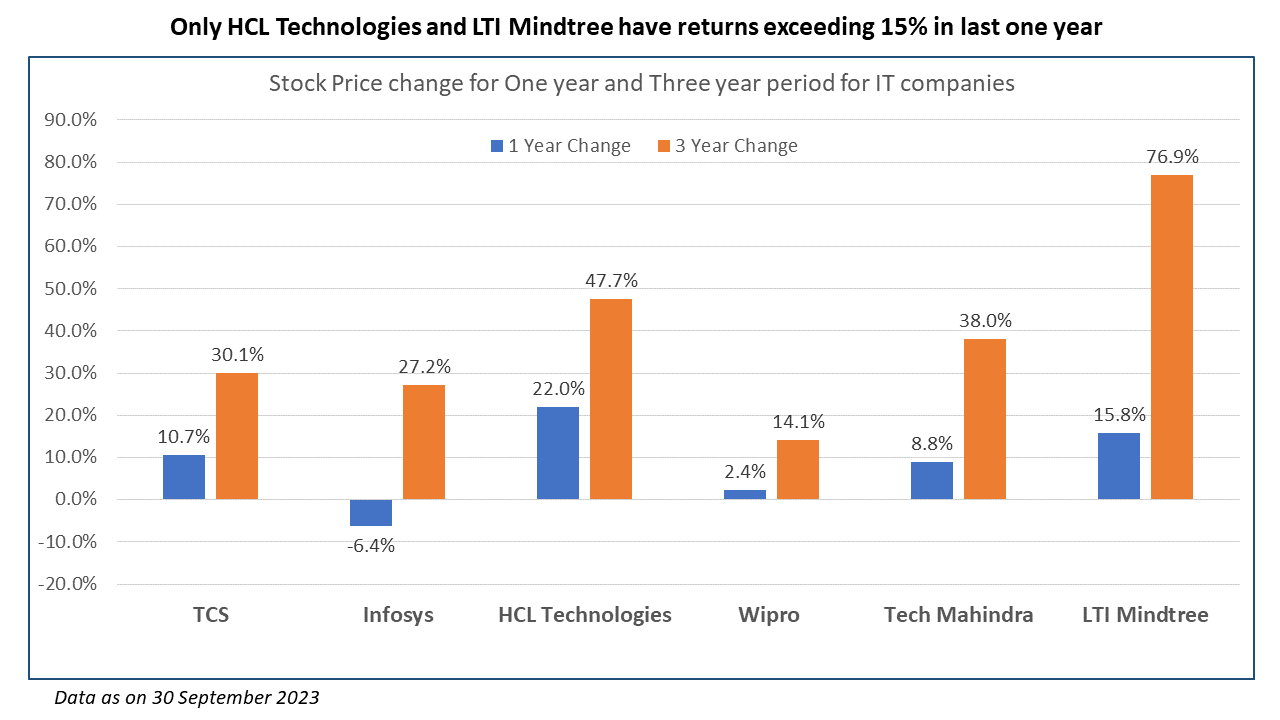

The stock returns from the top tier IT companies have been dismal for the last year. Only HCL Technologies and LTI Mindtree delivered more than 15% returns. Over a three-year period, the returns are below average compared to the returns given by these companies during the last decade.

While this quarter clearly indicates that the worst may not be over for these IT companies, for now, there is optimism that the next quarter may bring some improvement. In case the next quarter also disappoints, it would be safe to conclude that the IT sector, which was among the strongest, has clearly lost its shine.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stocks bought by Mutual Funds in September 2023[/vc_column_text][/vc_column][/vc_row]

Related Posts

Why is the Mega Corporation Share Price Falling?

Penny Stocks Below 5 rupees | Multibagger Stocks in 2026

Gaudium IVF & Women Health IPO Listing Preview: What to Expect Now?

Manilam Industries India IPO Listing Preview: What to Expect Now?

Yashhtej Industries IPO Listing at 25% discount at ₹88 Per Share