IT firms saw their fundamentals rebounding in Q2FY23

Posted by : Sheen Hitaishi | Mon Oct 17 2022

Among the major IT companies, TCS was the first to release Q2FY23 results on October 10. Following this, several tech behemoths who had recently seen their shares fall in value, have posted their Q2FY23 results. Investors have therefore begun appraising companies based on their results and rearranging their portfolios in advance of the festive season and the end of Q2FY23.

TCS, the market leader in the IT space has beat all estimates by posting excellent results, whose analysis could be found on the Univest website. While it is important to analyse each company individually, it is also important to compare their performances with their IT peers, to check which companies are performing better than the industry’s average. So, today we shall analyse the Q2FY23 numbers of three other IT giants, which announced their results last week. This includes Wipro with a market cap of 206,973 crores, Infosys with a market cap of Rs 620,338 crores & HCL Tech with 272,058 crores.

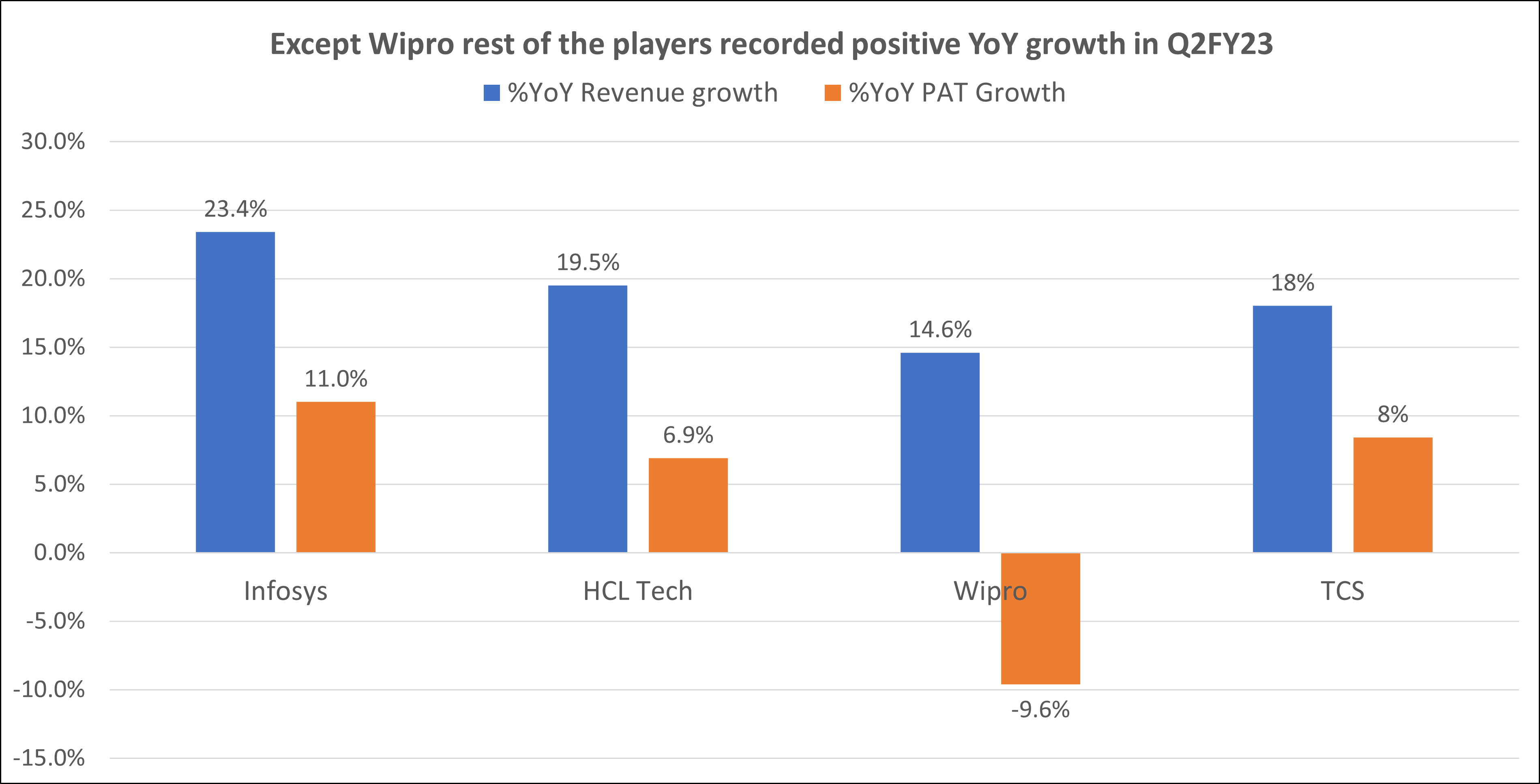

Two of the three companies saw their revenues as well as profits growing in Q2FY23, and did manage to report a decent quarter. This includes HCL Tech & Infosys which has shown positive growth while Wipro was the only player which was lagging behind. TCS, the market leader also saw robust YoY growth despite moonlighting & other issues such as high attrition acting as headwinds.

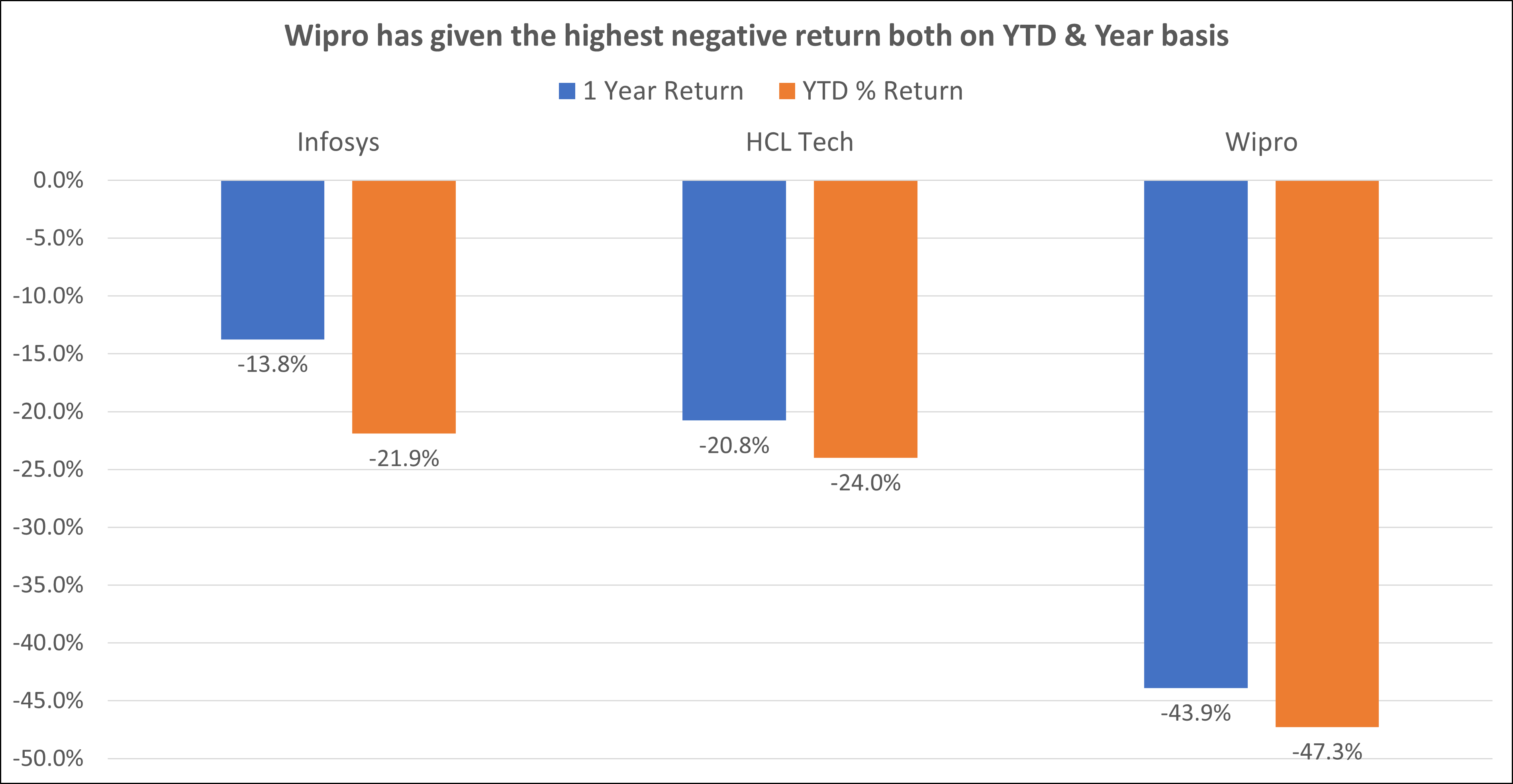

Even the shares of all these top 4 IT companies have lost more than 25% on an average since the beginning of this year. This means their current valuation is quite low, which may be an opportunity for investors in the long term. Therefore, to check whether this is applicable or not let’s analyse their quarterly results & understand what lies ahead for the IT firms.

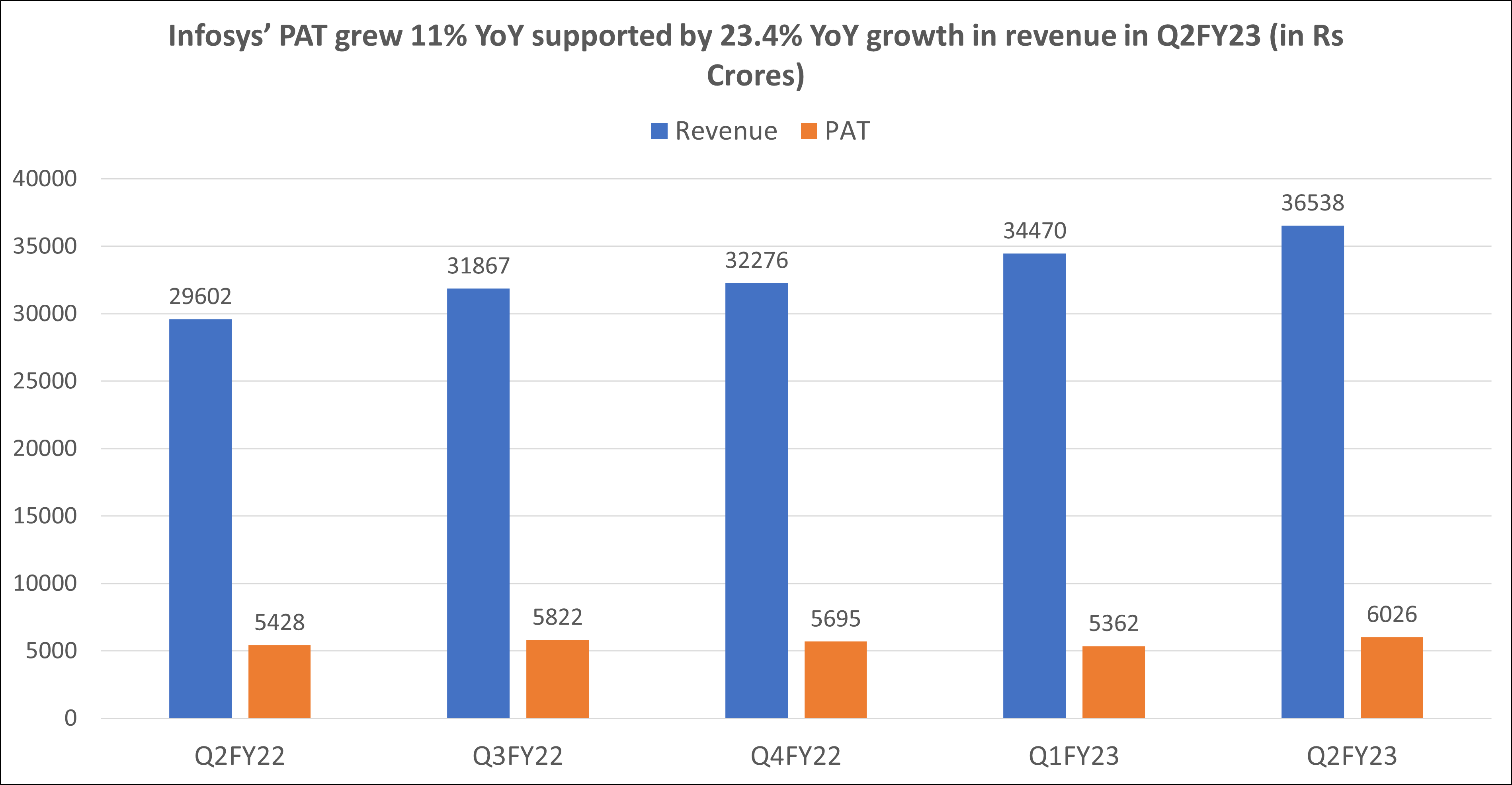

Infosys in Q2FY23 reported highest revenue followed by highest PAT & EBITDA in last 5 quarters

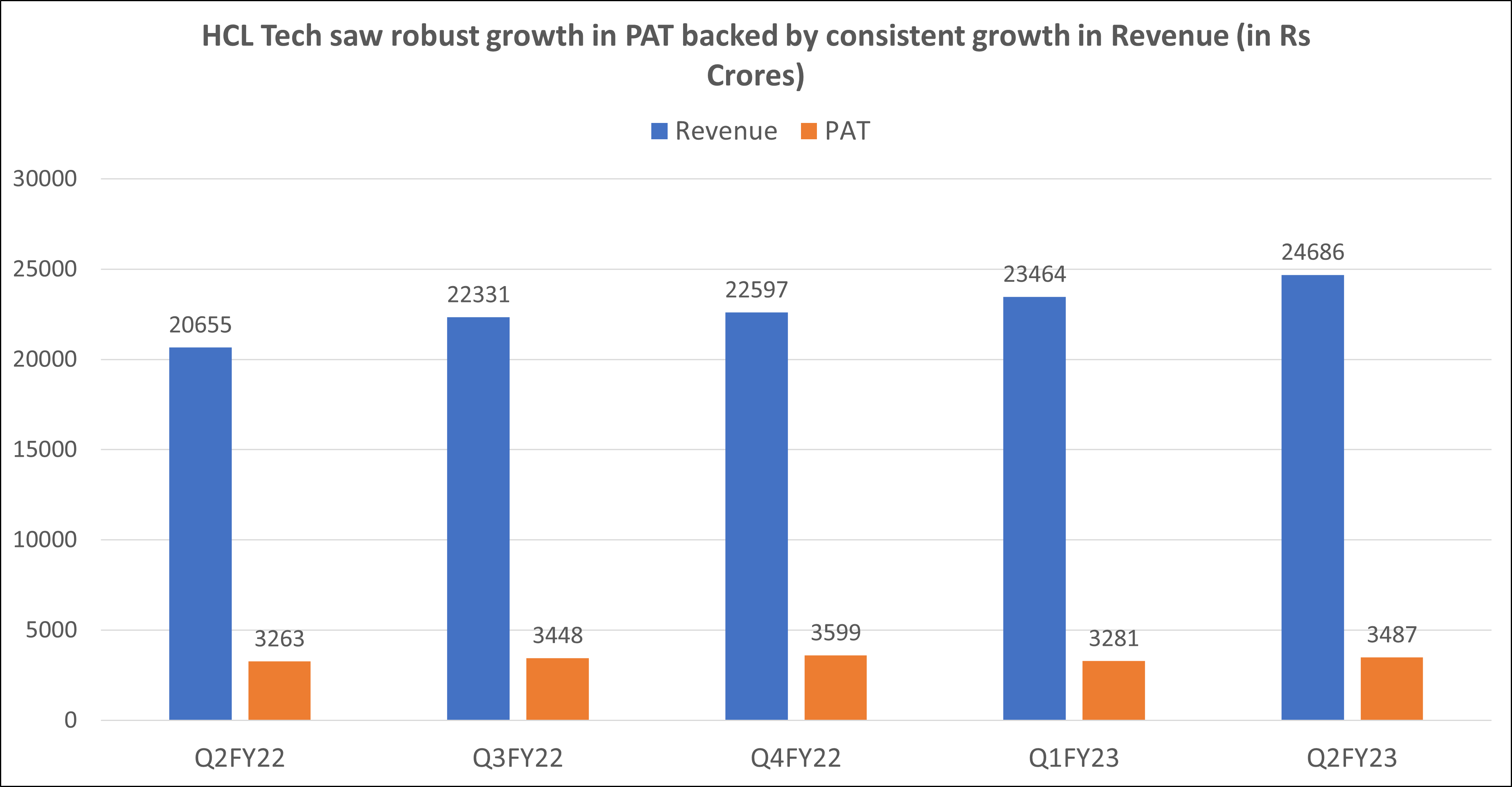

IT giant Infosys reported a consolidated net profit of Rs 6,026 crore for Q2FY23 on October 13th, an increase of 11.1% from Rs 5,428 crore in Q2FY22. Revenue for the company increased 23.4% YoY to Rs 36,538 crore from Rs 29,602 crore in Q2FY22. As a result of a 6% QoQ growth in revenue in Q2FY23, Infosys’ net profit increased sequentially by 12.3%.

When expressed in dollars, Infosys’ revenue increased 13.9% to $4,555 million in the September 2022 quarter from $3,998 million in the previous period.

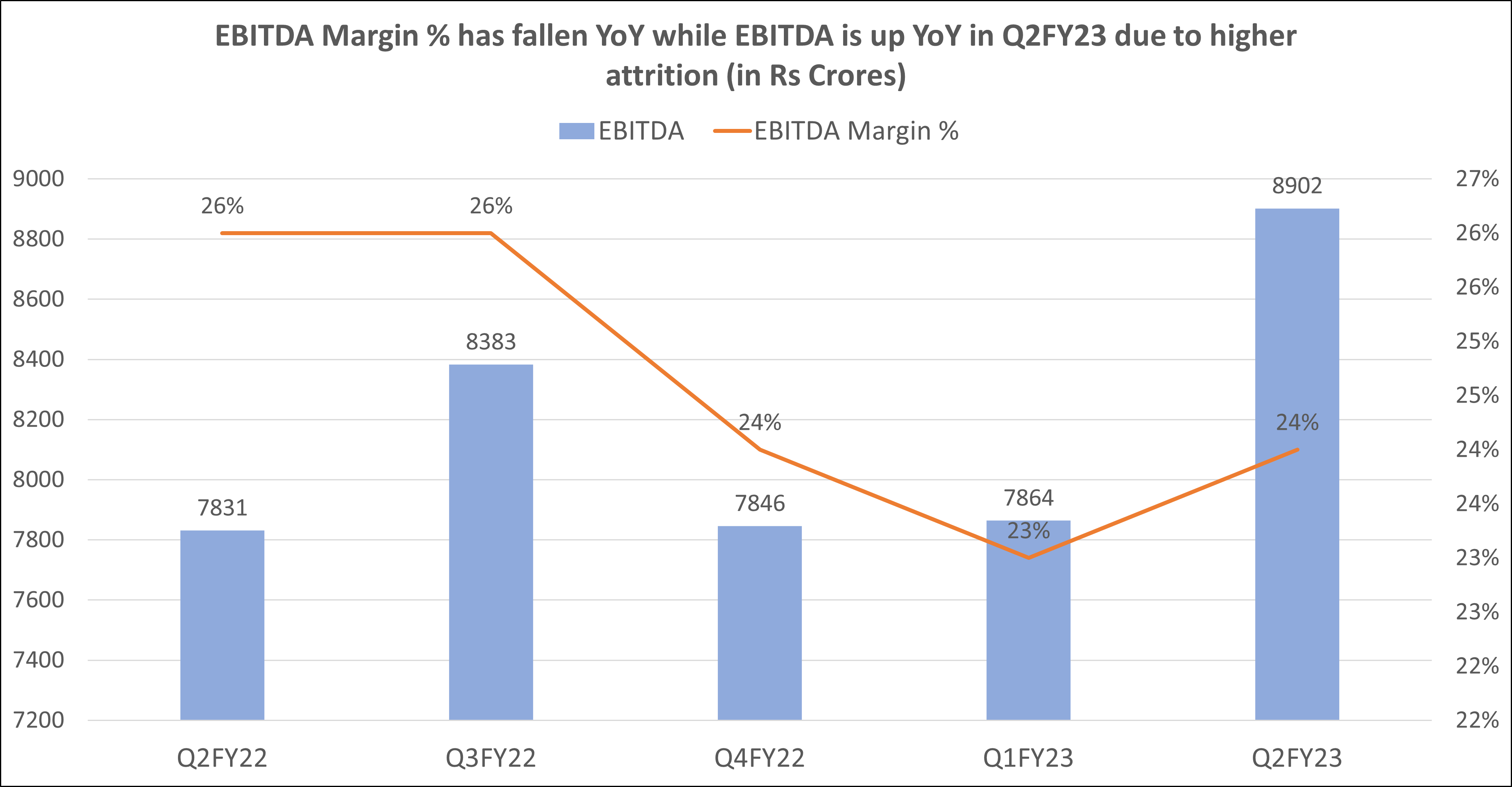

Infosys’ operating margin % for Q2FY23 improved to 24% from 23% in Q1FY23. While on YoY margin % fell 200 Bps due to an increased level of attrition. Despite that, EBITDA grew both YoY and QoQ in Q2FY23.

The business also disclosed Rs 9,300 crore share buyback on Thursday. “The board approved a proposal for the company to repurchase its own fully paid-up equity shares of the Company at a price, payable in cash, aggregating up to Rs 9,300 crore from equity shareholders of the Company (other than the promoters, the promoter’s group, and people in control of the Company), representing 14.84% and 13.31% of its total paid-up capital and free reserves as of 30th September 2022,” Infosys said.

You may also like: Which one is the best pick in the banking sector?

HCL Tech saw consistent growth in revenue along with highest EBITDA in Q2FY23

HCL Tech reported a combined net profit of Rs 3,487 crores in Q2FY23, up 6% YoY. Revenue increased by 19.5% YoY to Rs 24,686 crores. HCL Tech’s revenue growth was 15.8% YoY and 3.8% QoQ in constant currency. In dollar terms, HCL Tech’s revenue increased 10.4% YoY and 1.9% QoQ reaching $3,082 million.

C Vijayakumar, the CEO and managing director of HCL Tech, said, “HCL Tech has delivered yet another solid performance this quarter with revenue growing at 3.8% QoQ and 15.8% YoY in constant currency and EBIT at 18% up 93 bps QoQ. Our services business grew 5.3% QoQ and 18.9% YoY in constant currency, led by strong demand for cloud, engineering, and digital services.”

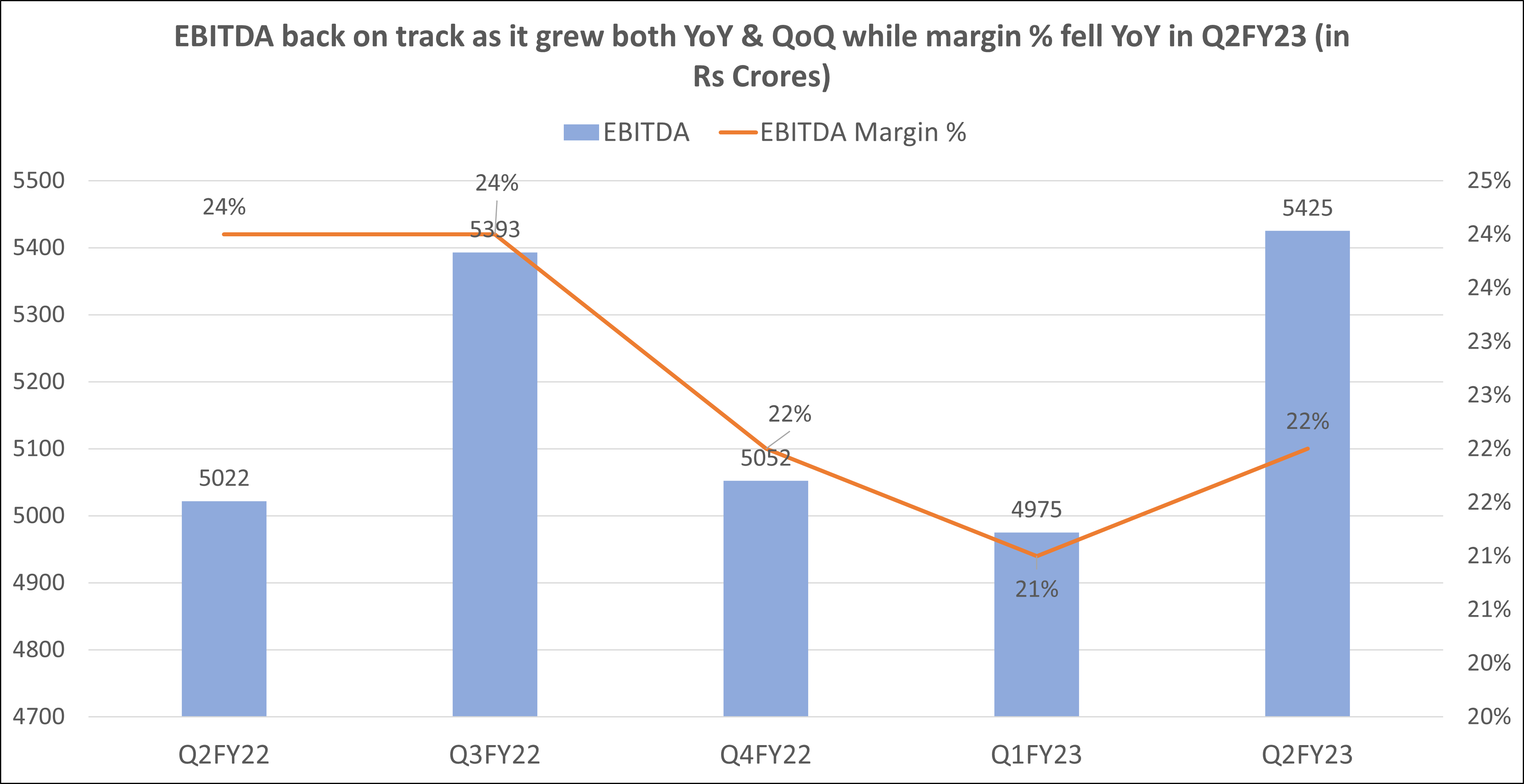

Lastly, HCL Tech’s EBITDA grew 8% YoY to Rs 5425 crores in Q2FY23 from Rs 5022 crores in Q2FY22. While the EBITDA bottomed out in Q1FY23, grew 9% QoQ from Rs 4975 crores in Q1FY23. Further, this was the highest EBITDA in the last 5 quarters reported by Wipro despite the high attrition levels.

Wipro: Only player to see PAT falling YoY in Q2FY23 despite revenue growing YoY

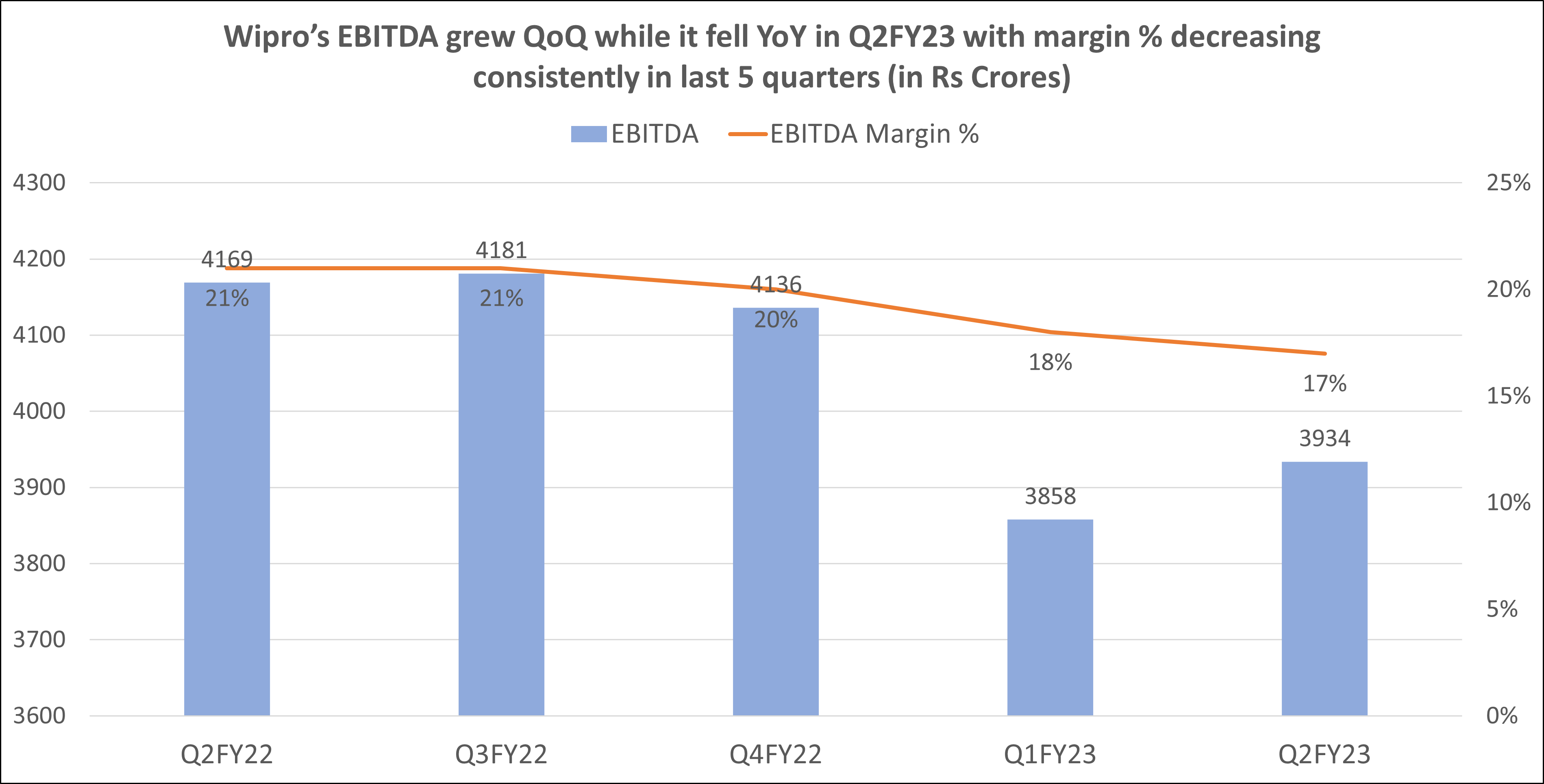

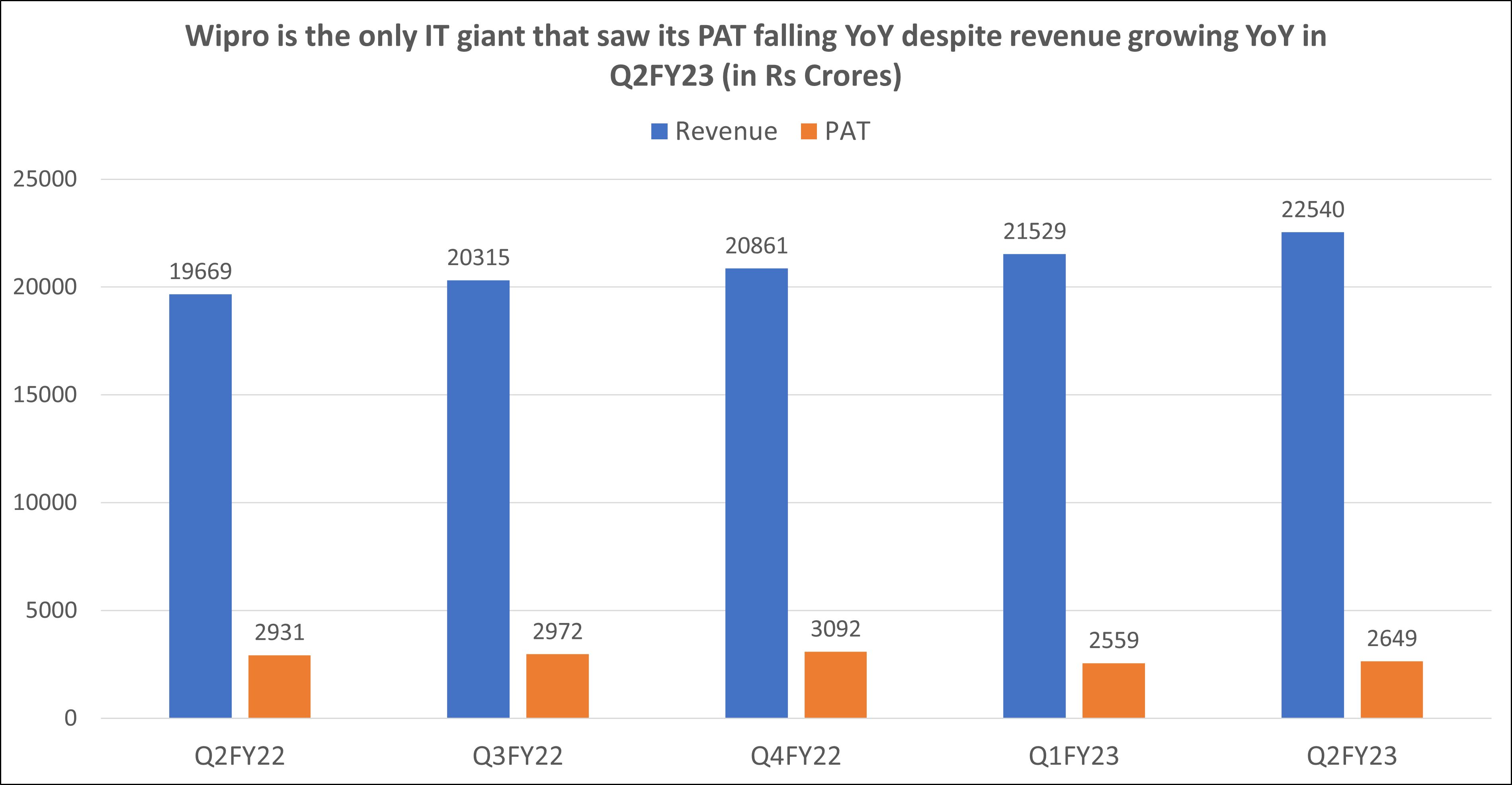

On October 12, 2022, IT industry leader Wipro Ltd. reported a 9.27% fall in its consolidated net profit for the Q2FY23, which came in at Rs. 2,659 crores, from Rs 2,930.7 crores in Q2FY22. In comparison to Q2FY23, its revenue for the quarter increased by 14.6% to Rs 22,540 crore, or Rs 19,667 crore. Wipro’s net profit increased 3.72% sequentially from Rs 2,563.6 crore in Q1FY23.

Last but not least, Wipro’s IT services business reported $2,797.7 million in sales, an 8.4% YoY growth.

said its IT services operating margin for the September 2022 quarter stood at 15.1 %, an increase of 16 basis points (bps) quarter. While the overall margin % fell both QoQ & YoY in Q2FY23. This is even though EBITDA has started rising QoQ to Rs 3934 crores in Q2FY23 from Rs 3858 crores in Q1FY23. It means that EBITDA has bottomed out & is expected to recover further going forward.

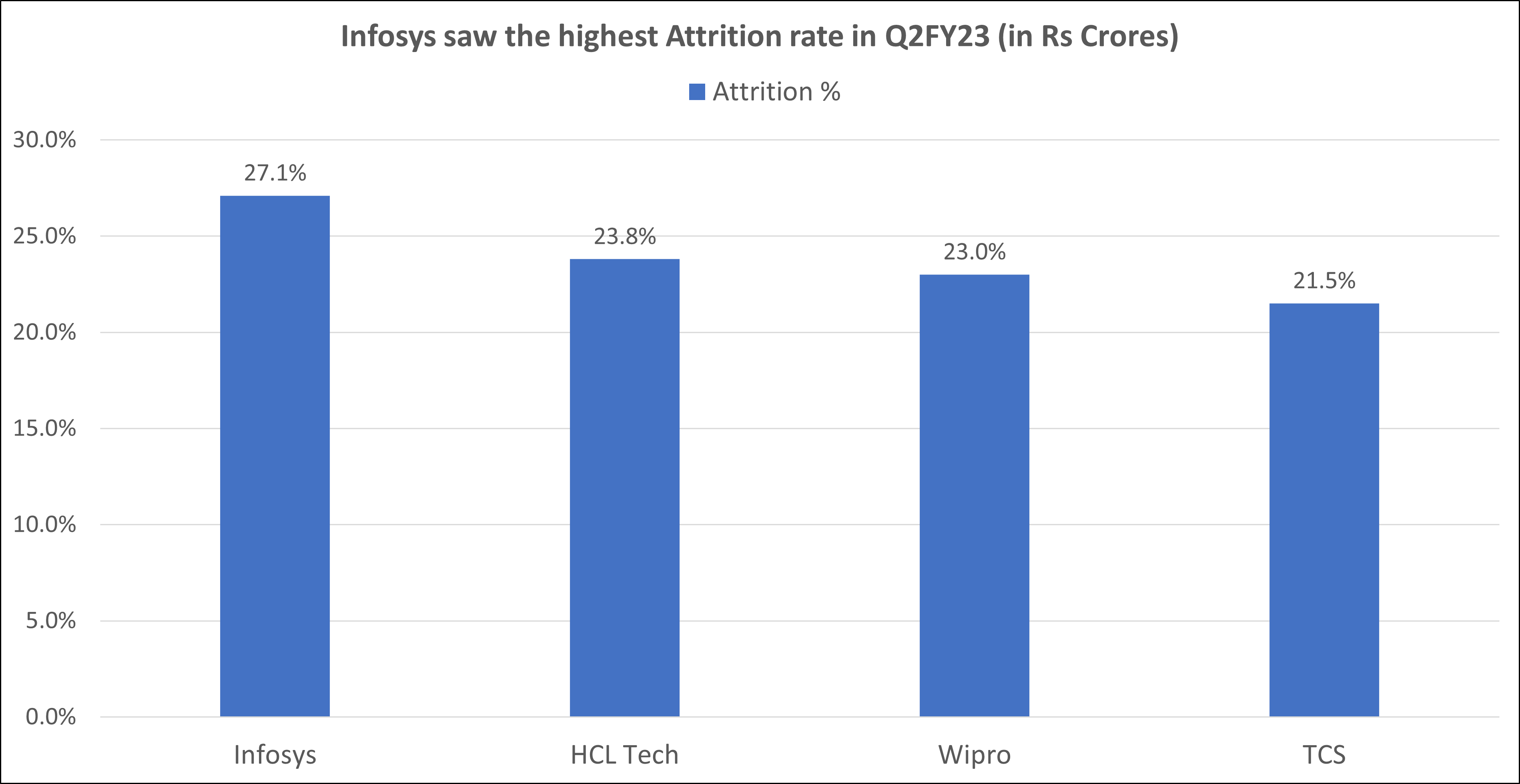

Attrition Rate: TCS had lowest attrition rate while Infosys had highest

According to Team Lease Edtech’s president and co-founder Neeti Sharma, “High attrition has been an issue in the IT sector for a while now. As a result of the discussions around the “Great Resignation” and “Great Movement,” the issue has, nonetheless, received more attention in recent quarters.

For Q2FY23, Infosys reported a voluntary attrition rate of 27.1%. Although it was lower than the 28.84% recorded in the previous quarter, it was higher on a yearly basis than the 20.1% reported in Q2FY22.

In Q2FY23, HCL Tech’s attrition rate stayed at 23.8%, while TCS’s IT services attrition rate was 21.5%. According to the company, Wipro’s voluntary attrition for the quarter was calculated over the preceding 12 months and was at 23%, down 30 basis points from the prior quarter.

Univest View with Technical Analysis

NIFTY IT Index has experienced a YTD decline of more than 27.77%, which is the greatest among other sectors. IT behemoths like Infosys and HCL Tech have also produced negative YTD returns, albeit less than the benchmark index. While Wipro provided a 2022 return of approximately -50%. As a result, Wipro’s current valuation is the lowest, increasing its potential for the biggest returns in the event that the share price increases. However, Wipro’s net earnings continued to decline YoY in Q2FY23, which caused another correction in the share price.

However, the brokerages still seem upbeat about the company’s fundamentals and anticipate things to become better. Therefore, investors with a long-term perspective may want to think about “accumulating” Wipro stock, comparable to the “Hold” and “accumulate” ratings given by brokers.

Coming to HCL Tech, the stock is still bearish as per EMA but recently has been seen testing one of its immediate resistances. Brokerages have recently given a ‘Buy’ rating with a TP of Rs 1050 to 1130. That’s why the stock has come into the limelight, lately. Therefore, investors wanting to make short-term gains can invest in HCL, if it closes above Rs 1010 with a TP of 1100. While for a long term, a better approach would be to wait till the share turns bullish on technical charts.

Finally, Infosys, which has produced a -21.9% YTD return and a -13.8% return in the last year, has been observed in a sideways trend. Brokers have set the average target price (TP) for Infosys at Rs. 1650 and have assigned the stock a “Buy” recommendation. Investors can, then, either buy now and wait for the target to be reached or they can acquire a position once the stock closes over the target price for the shares to turn bullish over the long term.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: IT Sector might be seen in pressure in Q2FY23 while it may improve going forward

Related Posts

Khazanchi Jewellers Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

Kesar Enterprises Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

J.G. Chemicals Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

IFGL Refractories Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

EFC Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here