Iron and Steel Products – A standout sector this quarter.

Posted by : Sheen Hitaishi | Sun Mar 26 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1679817253207{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]Since the beginning of this calendar year, the benchmark Nifty50, as well as most sectors, have seen a decline in their value. Many sectors and industries have experienced a selloff, and their sector indices have fallen by more than 10% since January 2023. However, one industry that stands out in contrast is the “Iron and Steel Products” industry, which has been among the best-performing industries over the last quarter.

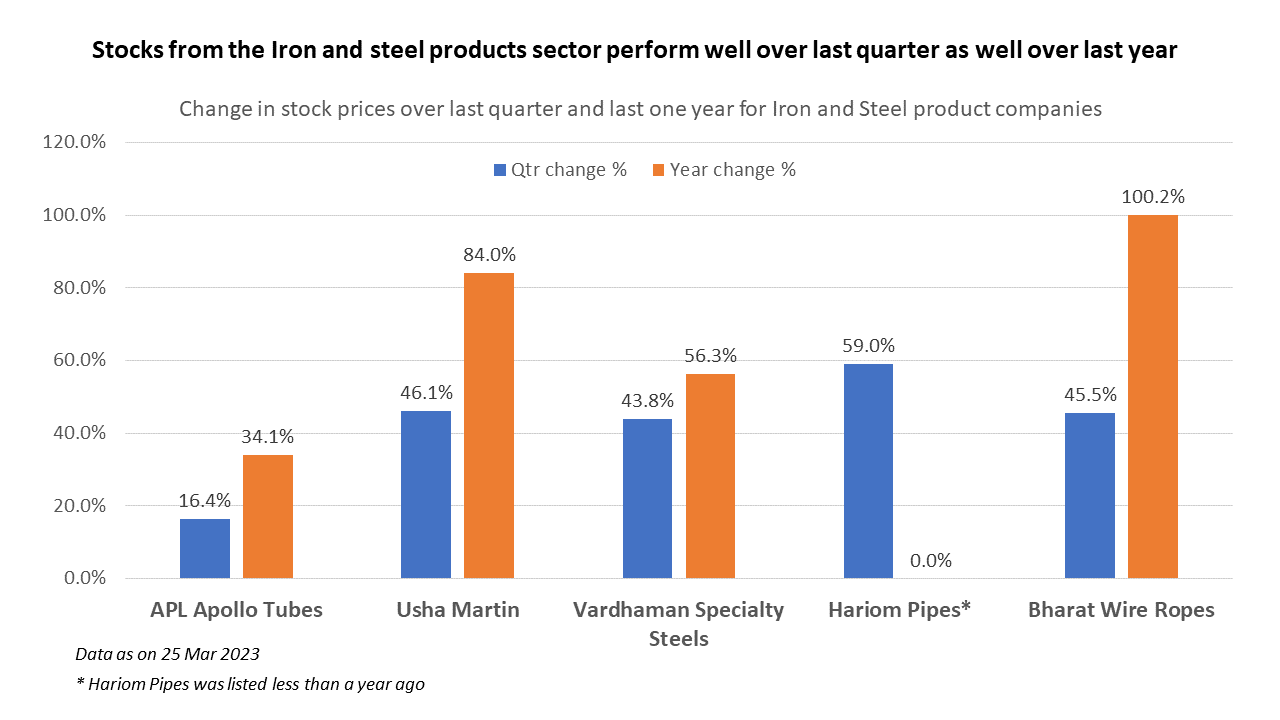

What sets this industry apart is that most of their products are specialized or customized, and they are not just producers of raw material. By virtue of being specialized, these products automatically become value-added products, and hence they have better margins. Over the last quarter, the Nifty 50 index has delivered a negative return of 6.9%. At the same time, companies from the Iron and Steel Products sector have given positive returns ranging from 16% to 59%, clearly standing out against the trend. On a yearly basis, the Nifty 50 delivered a negative 2.9% return, while companies from this sector have given returns as high as 100% in some cases.

Let’s delve into the reasons for the rise of this sector in the last few quarters. The pandemic had affected this sector in FY21 and FY22. However, in this financial year, the demand for these products is back on track. This demand is further accelerated due to many factors. The priority given by the Indian Government for infrastructure projects has increased the consumption of products from this sector, be it applications for building construction, bridges, construction equipment, etc. Many of these companies have a high percentage of export orders, which have picked up in the last few quarters after issues regarding logistics have subsided, and freight prices have fallen from their peak a year ago.

The companies considered in this analysis are those that have a market capitalization of above Rs 800 crore and quarterly revenues above Rs 100 crore. APL Apollo Tubes leads by a wide margin with revenues of Rs 4,336.4 crore in Q3FY23. APL Apollo Tubes has a wide portfolio of products ranging from handrails, gates, structural members for metros, airports, stadiums, and even steel door frames. It recently forayed into the pre-engineered building segment, which is gaining prominence in the construction industry on account of the speed of construction.

While the sales of APL Apollo Tubes are completely focused on domestic consumption, the other companies in this sector have a major component of revenues from exports. For Usha Martin, domestic sales contribute only 49%, while Europe contributes 21%, Asia Pacific 19%, Middle East, and Africa 7%, and America contributes 4%. Their key product is specialty steel rope, which finds application in infrastructure and construction, cranes, oil rigs, elevators, etc.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Shark investor ‘Ashish Kacholia’ bets big on infrastructure companies in Q3FY23[/vc_column_text][/vc_column][/vc_row]