IPO Review: Honasa Consumer

Posted by : Sheen Hitaishi | Fri Nov 03 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1698734122144{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]There has been a slew of IPOs this year, both in the Mainboard IPOs as well as SME IPOs, many of which have seen an overwhelming response during subscription followed by impressive listing gains.

One of the IPOs that is about to hit the market this week is Honasa Consumer. It is the parent company of the “Mamaearth” brand, which has been making inroads in the BPC (the Beauty and Personal Care) industry over the past few years. Another reason why the brand has a high recall value is that one of its founders, Ghazal Alagh, was a part of the judges’ panel of Shark Tank India Season 1.

Coming to the details of the issue, Honasa Consumer Limited IPO is a book-built issue of Rs 1,701.00 crores. The issue comprises a fresh issue of Rs 365.00 crore and an offer for sale of 4.12 crore shares, with the price band set at ₹308 to ₹324 per share. The issue opens for subscription from October 31, 2023, to November 2, 2023. It is expected to list on November 10, 2023.

According to the DRHP, Honasa Consumer describes itself as a company focused on the beauty and personal care business. They have a portfolio of six BPC brands viz., Mamaearth, The Derma Co., Aqualogica, Ayuga, BBlunt, and Dr. Sheth’s, each with differentiated value propositions. Their product portfolio includes products in the baby care, face care, body care, hair care, color cosmetics, and fragrances segments. This product portfolio is supplemented by our professional salons chain, BBlunt Salons.

The positives for the IPO

Honasa Consumer is a completely homegrown consumer company competing with MNCs like Hindustan Unilever, PGHH, Colgate-Palmolive, as well as Indian brands such as Dabur, Marico, and Godrej Consumer Products. Although much smaller than these companies, it has reached a point where it can be compared with these giants in just six years, while the others have been around for a few decades.

On the management side, apart from the promoters, Varun and Ghazal Alagh, the leadership team boasts experienced professionals like Vivek Gambhir, former CEO of Godrej Consumer, which, during his tenure as CEO, experienced maximum growth. Also on the team is Subramaniam Somasundaram, former CFO of Titan.”

I made corrections to the punctuation, capitalization, and word usage for clarity.

The Negatives for the IPO

There are several red flags that need consideration before making any investment decision. The company does not hold any patents for its product formulas, and according to their own admission, they may not be able to prevent competitors from developing, using, or commercializing products that are functionally equivalent to their own. In fact, the company outsources the entire manufacturing process and has virtually no control over it.

One of the IPO’s objectives is to raise funds for setting up Exclusive Brand Outlets (EBOs). However, the company has stated in its prospectus that it has not yet identified the exact locations or properties for these EBOs or salons where they plan to utilize the funds from Net Proceeds.

Currently, the company is far from being profitable. In FY21, the company incurred a loss of Rs 1,765.14 crore against revenue of Rs 472.1 for the financial year. This loss reduced to Rs 150.97 crore in FY23 against revenue of Rs 1515.27 crore. While it reported a profit of Rs 24.72 crore against revenue of Rs 477.1 in Q1FY24, sustaining profitability remains a challenge due to its high marketing and consumer acquisition costs. Nearly 75% of its revenues are offset by advertising and marketing expenses.”

I’ve made corrections to the punctuation, wording, and sentence structure to enhance clarity.

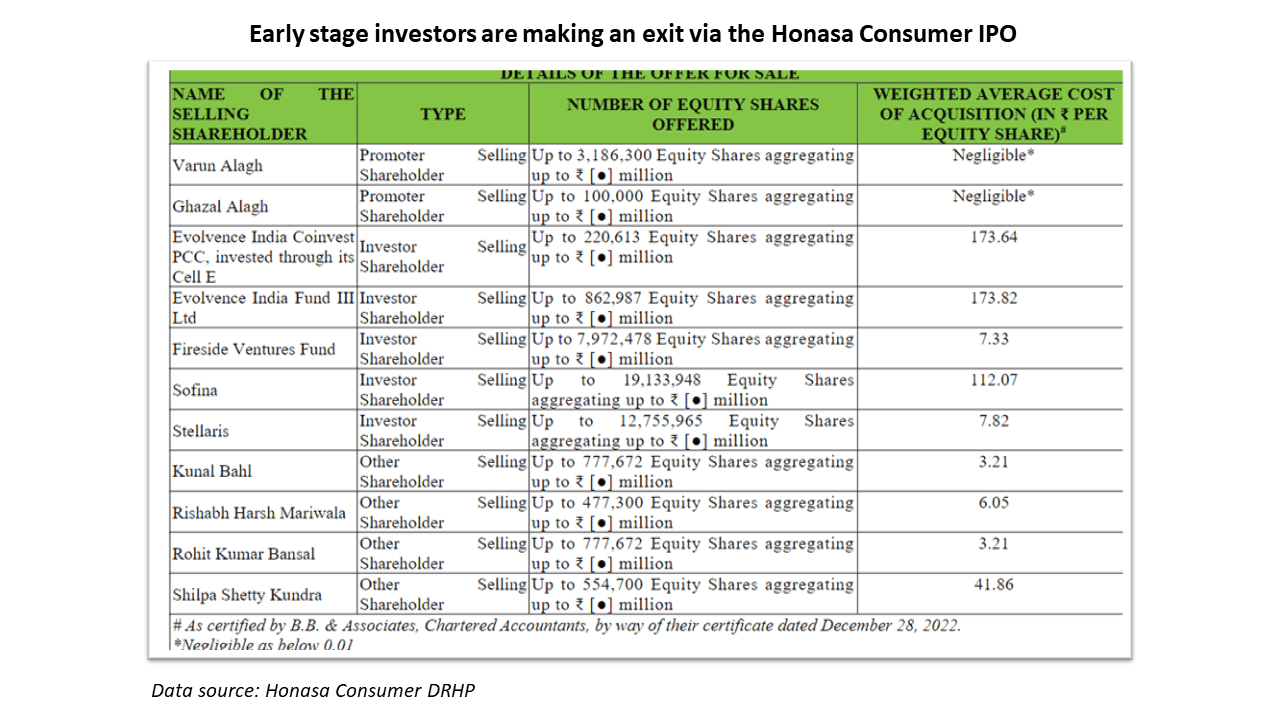

The issue is a combination of a fresh issue and an Offer for Sale (OFS) component. The OFS component consists of shares from early-stage investors such as Fireside Ventures, Kunal Bahl, Rishabh Harsh Mariwala, and Shilpa Shetty Kundra, who are set to make multibagger gains on their investments as they exit through the IPO.

The issue is also tilted in favor of the Qualified Institutional Buyers (QIB) segment, with a reservation of 75% of the shares on offer, leaving only 10% for retail investors and 15% for High Net Worth Individuals (HNIs).

Conclusion:

Honasa Consumer has demonstrated its ability to grow its brands and build an Architecture of Brands model in a short span of time. However, concerns regarding profitability remain. Additionally, there are certain risk factors related to intellectual property and outsourced manufacturing.

For retail investors, it is advisable not to expect significant listing gains if they receive allotments. It may take a few quarters for the company to display enough investment-worthy metrics. In essence, this IPO is designed for high-risk investors, primarily QIBs who can make calculated bets for the long term. Retail investors may consider avoiding this IPO for now.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Portfolio Analysis of Shark Investor Vijay Kedia as of Sept 2023[/vc_column_text][/vc_column][/vc_row]

Related Posts

Omnitech Engineering IPO Review 2026: GMP Rises 3.52%, Key Investor Insights

Yaap Digital IPO Review 2026: GMP Flat, Key Investor Insights

Yashhtej Industries IPO Listing Preview: What to Expect Now?

Kiaasa Retail IPO Day 1: Subscription at 0.06x, GMP Rises 20.74% | Live Updates

Mobilise App Lab IPO Day 1: Subscription at 1.32x, GMP Rises 20.00% | Live Updates