Indian Hotels Company Set for Strong FY24 After Successful FY23

Posted by : Sheen Hitaishi | Tue May 09 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1683619950343{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]Indian Hotels Company is part of the Tata group and operates hotels in various segments like the Taj luxury hotels, Vivanta upscale hotels and budget hotels under the Ginger brand.

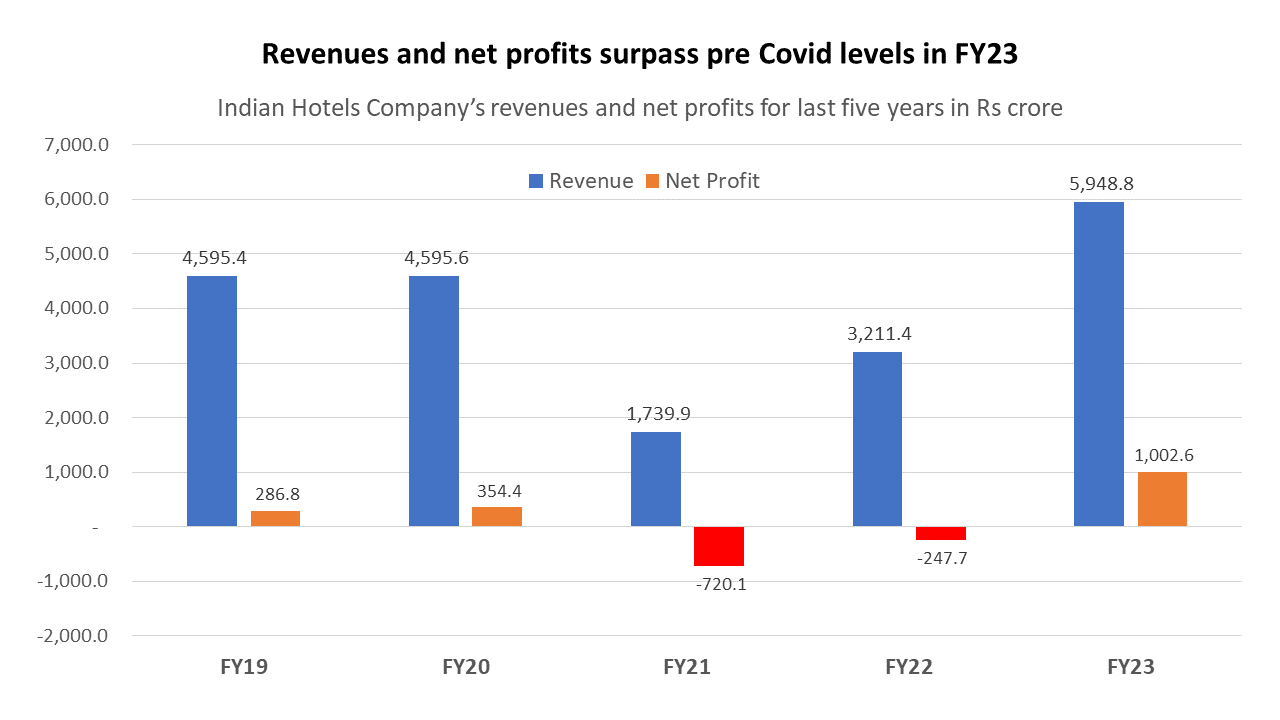

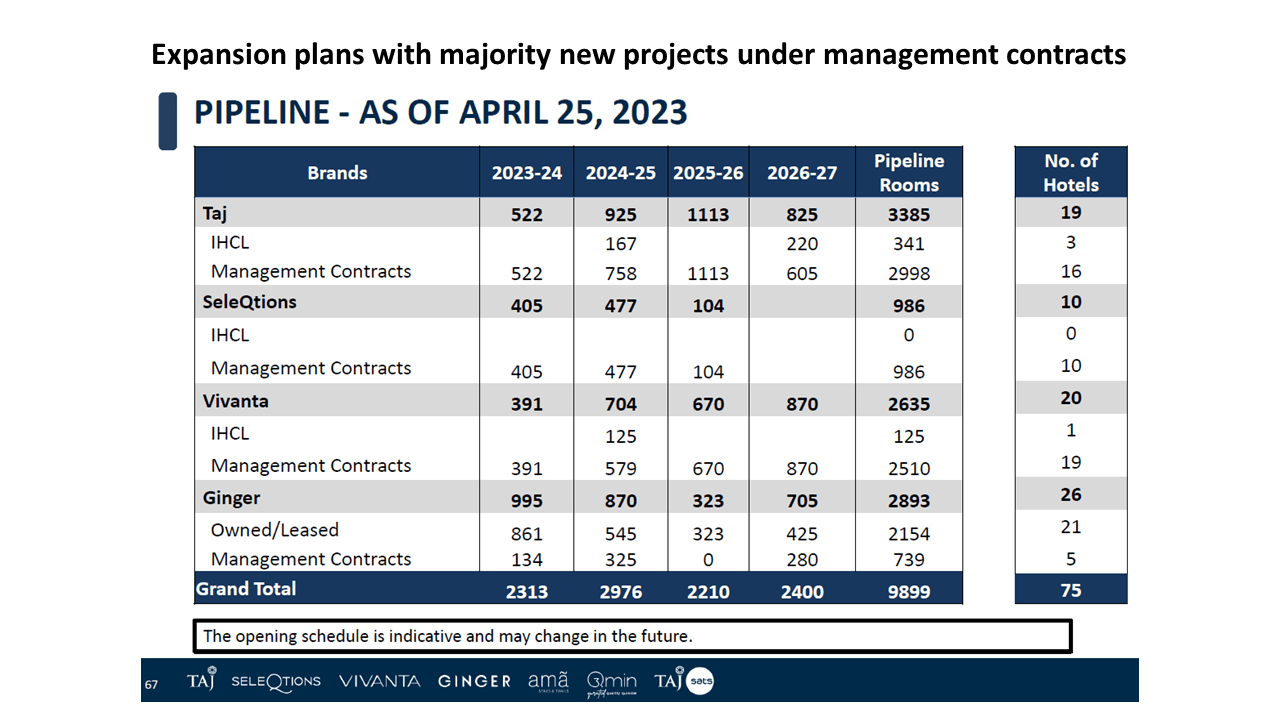

The hotel chain delivered a spectacular performance in FY23 closing the year with the highest-ever revenues and net profits. For an industry that suffered hugely in the previous two financial years on account of the pandemic, Indian Hotels has bounced back strongly and management policies of expansion via an asset-light model have paved the way for its next growth trajectory.

Highlights of Q4FY22 and FY23 results

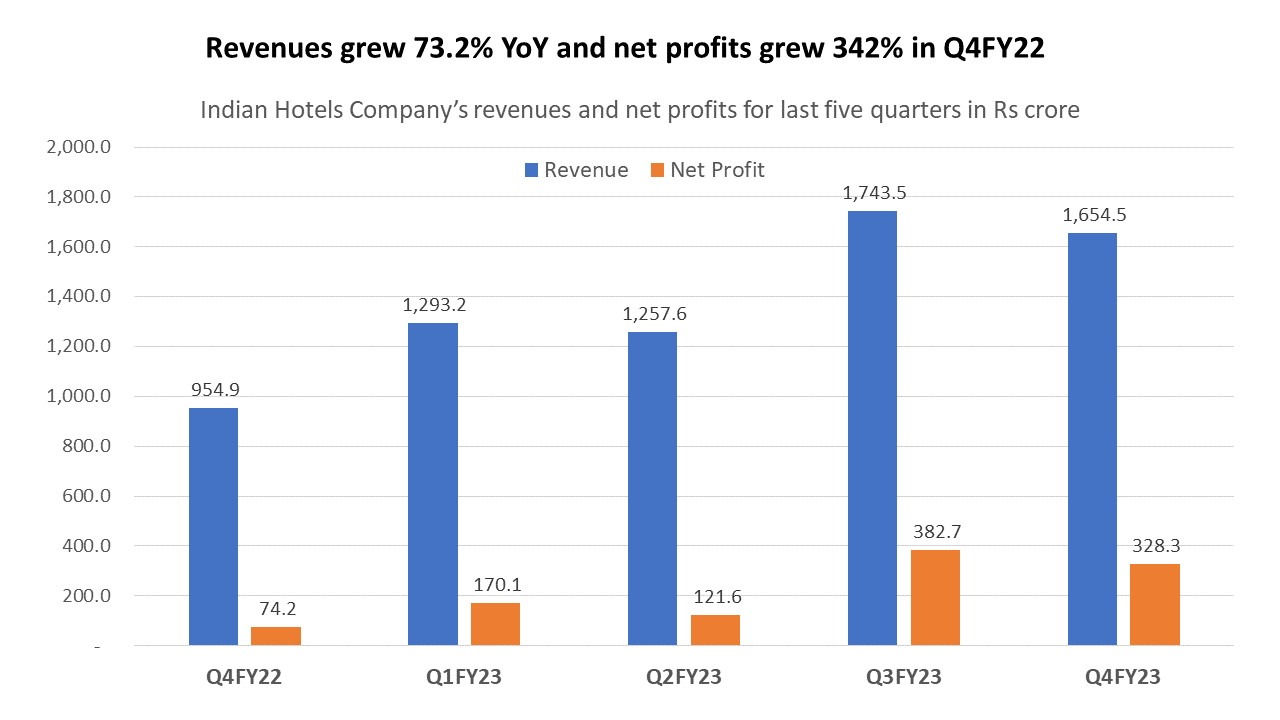

- Revenues grew 73.2% YoY to Rs 1,654 crore and net profits grew 342% YoY to Rs 328.3 crore in Q4FY23

- All four quarters in FY23 were profitable with net profit for FY23 at Rs 1,002 crore

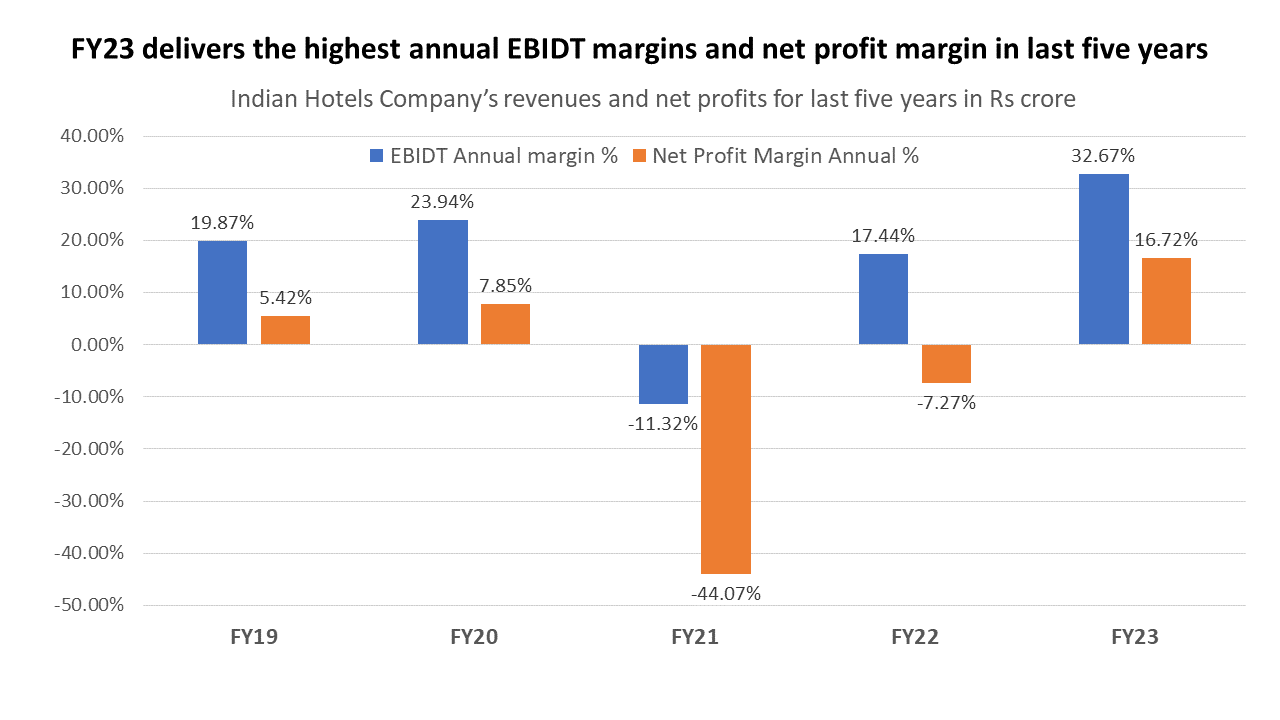

- Operating Profit margin went up to 33% in Q4FY23 as compared to 18.2% in FY22

- Net Profit margins for FY23 stood at 16.7% which are higher than the pre pandemic level of 7.8% in FY20

- Total of 16 new hotels were opened and new deals for 36 new hotels were signed in FY23

- International expansion in new geographies of Riyadh and Dhaka

Post pandemic travel resumption a major catalyst for growth

With travel picking up from the last quarter of FY22, this financial year saw a full-fledged recovery in travel, be it person or business related. All four quarters of FY23 saw a healthy revenue across properties.

The annual revenues and net profits in FY23 have surpassed the pre Covid levels of FY20. In fact, FY23 generated the highest ever revenues for the hotel chain. This saw contribution across it brands including the premium Taj Palaces and Resorts and even the budget hotel brand Ginger.

Ginger reported revenue of Rs 300 crore and an EBITDA of Rs 120 crore, and margin of 39%, going up from 26% to 39%. According to the management, the best is yet to come and IHCL is eagerly awaiting the opening of Ginger in Santa Cruz in Mumbai as of October 1, 2023.

The company believes that Ginger brand has the potential to deliver a minimum of 50% margin. They are pleased about their flight kitchen business which is a joint venture with STS from Singapore. For the first time in history, margin was 20% of revenue which exceeded Rs 600 crore with an EBIT of Rs 127 crore. Since the launch of Qmin it has done a GMV of Rs 150 crore till date.

Major improvement across financial metrics in FY23

A crucial financial metric for any company is the EBIDT and EBIDT margins. While pre Covid margins were healthy, they dropped drastically during FY21 to a negative return. We saw these bounce back in FY22 with an EBIDT of Rs 559.9 crore and a healthy margin of 17.4%. In FY23, which nearly doubled in FY23 to 32.67%.

The margins improved by 1,339 bps vs Q4FY20, which was contributed by existing hotels (670 bps), New Hotels (120 bps), and new businesses (Ginger, Qmin, Ama, Chambers, 250 bps). Reported PAT stood at Rs 339 Crore, up 245% vs the Pre-Covid levels of Q4FY20, led by an increase in turnover and strong operating leverage.

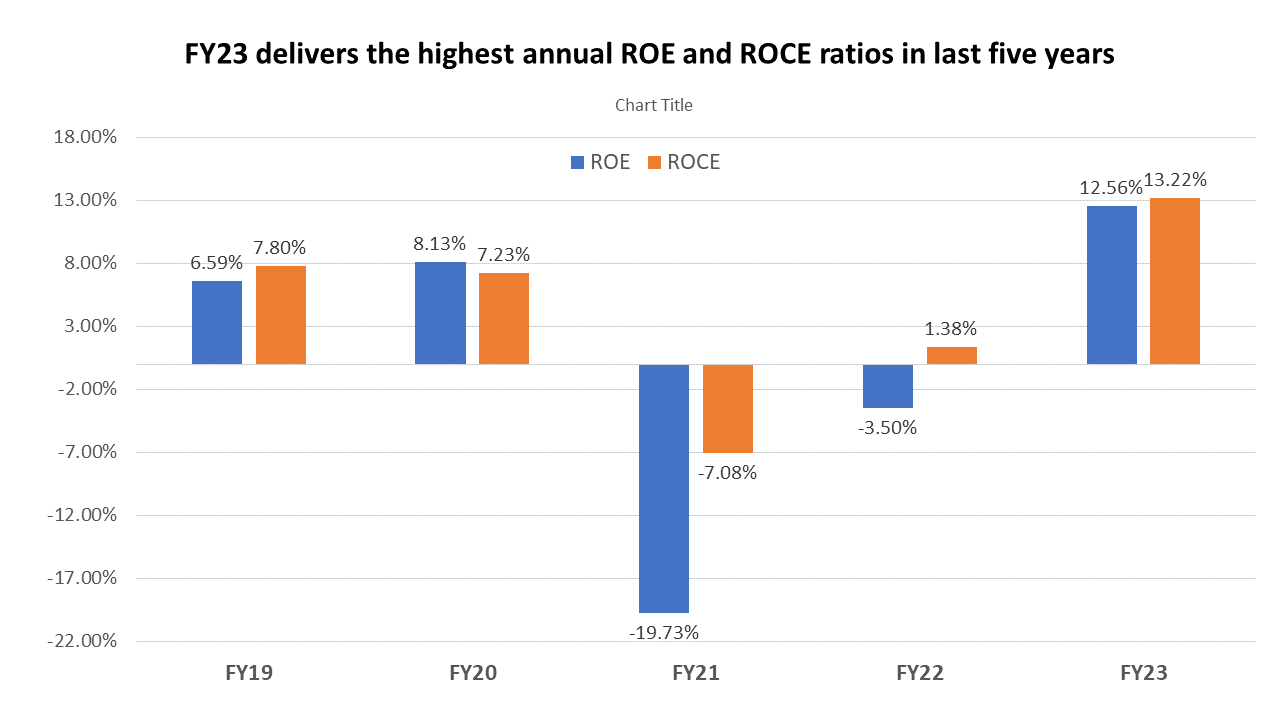

The company’s key financial ratios, the ROE and ROCE has also improved drastically in FY23. These are now at the highest levels in last five years. This also indicates that the company has been on a cost optimisation programme which has resulted in better cash flows leading to higher ROCE.

In recent years, the Taj Hotel group has been focusing on expanding its presence in key international markets such as the US, UK, Middle East and Africa. The group has also been investing in new properties and renovating existing ones to enhance the guest experience.

In addition, the Taj Hotel group has been making efforts to leverage technology to improve its operations and enhance guest experiences. For example, the group has launched a mobile app that allows guests to book rooms, order room service and access other hotel services.

Many upcoming corporate travels and international tourists are expected to add further growth to demand. Major events such as G20 and Cricket World Cup in India would aid in the further growth of the industry.

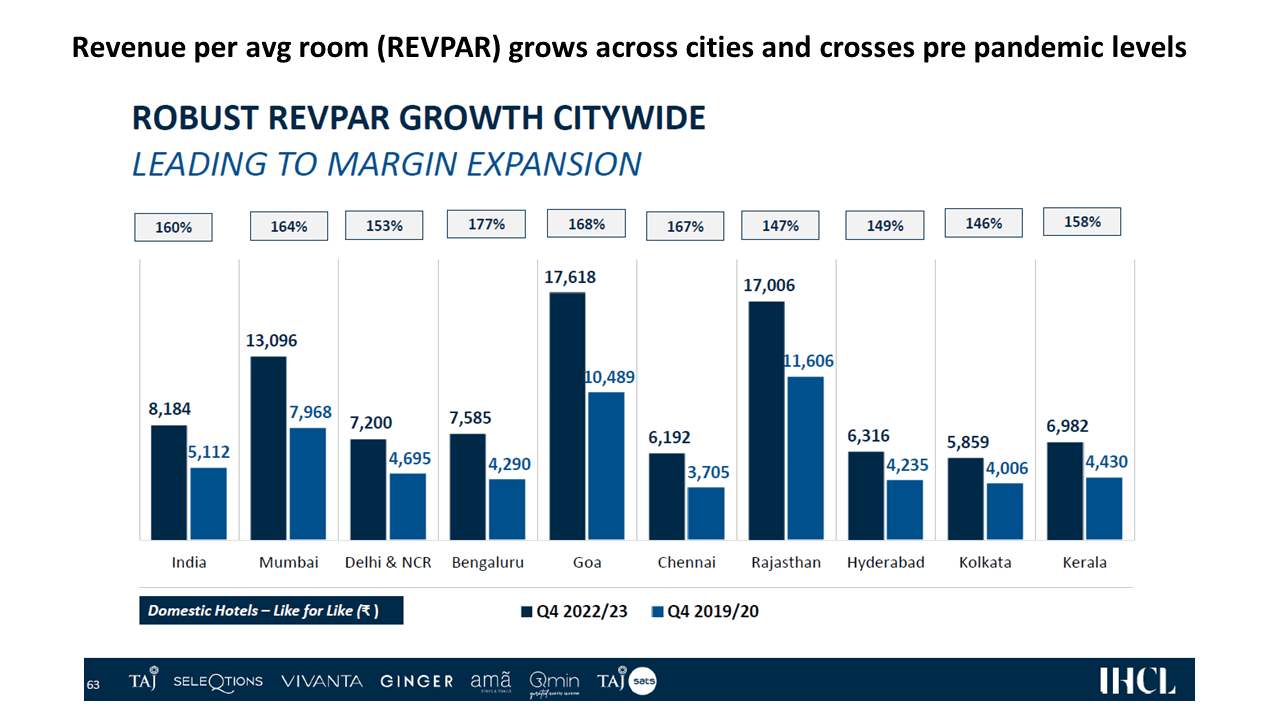

In terms of international segment, average occupancy recovered to 88% of pre-Covid levels to 57% while room rates were up 17% leading to RevPAR growth of 3% from pre-Covid levels. In terms of regions, Maldives and Dubai reported RevPAR growth of 27% and 44%, respectively, vs pre-Covid while RevPAR of UK grew 4% vs pre-Covid levels. The US, which had crossed pre-Covid level in Q3FY23, reported de-growth of 3%.

Conclusion

Given its strong performance in FY23, growth plans with majority being management contracts and the tourist inflow for events like G20 and the Cricket World cup, Indian Hotels company should be able to continue it performance in FY24 also. Investors investing at these levels are likely to see gains of more than 30% in a year with the share price crossing 510 levels in a year’s time.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Auto Sales Data April 2023[/vc_column_text][/vc_column][/vc_row]