HDFC Bank reported robust Q2FY23 in line with expectations

Posted by : Sheen Hitaishi | Thu Oct 20 2022

HDFC Bank has demonstrated the ability to generate high double-digit returns historically and since its share price has drastically corrected since 2022, analysts now anticipate a recovery. HDFC Bank recently announced its Q2FY23 results, which again brought the company into focus. The results were in line with estimates, as per an analyst’s poll. HDFC Bank which has a market cap of Rs 804,218 crores, announced its Q2FY23 results on 15th October 22. On Friday, a day before the results, the HDFC Bank stock jumped nearly 4% to close at Rs 1446 per share. Even the brokerages have now upgraded their rating to Buy, after this Q2FY23 results. So, let’s now proceed towards analysing those numbers, which convinced investors of its future potential.

HDFC Bank Q2FY23 results: Highest NII reported in Q2FY23 backed by robust NIMs

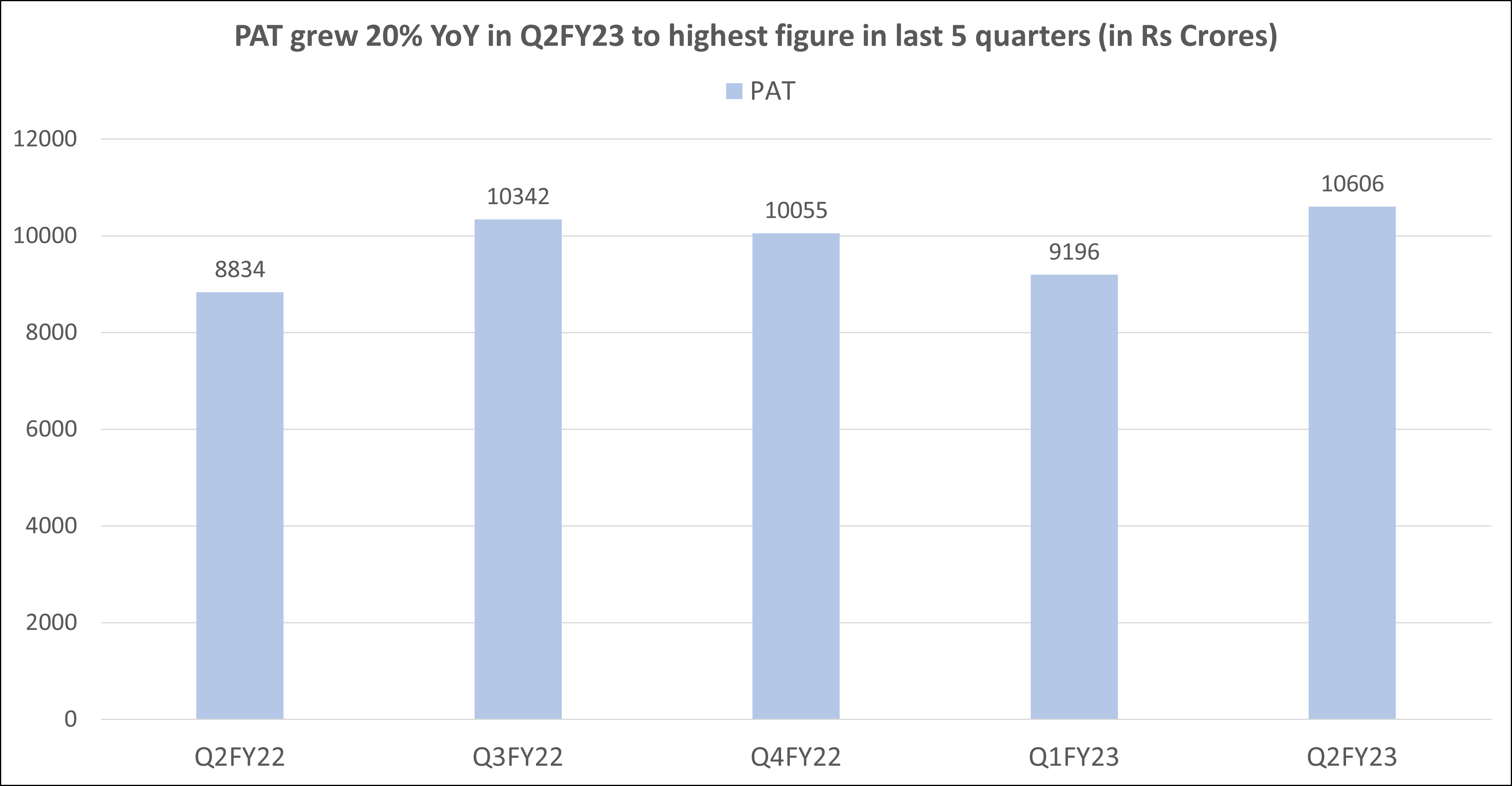

- HDFC Bank reported a PAT of Rs 10,606 crores in Q2FY23, a growth of 20% YoY from Rs 8,834 crores in Q2FY22 and 15% QoQ from Rs 9,196 crores in Q4FY22. This PAT growth was supported by healthy NII growth, i.e., Net interest income.

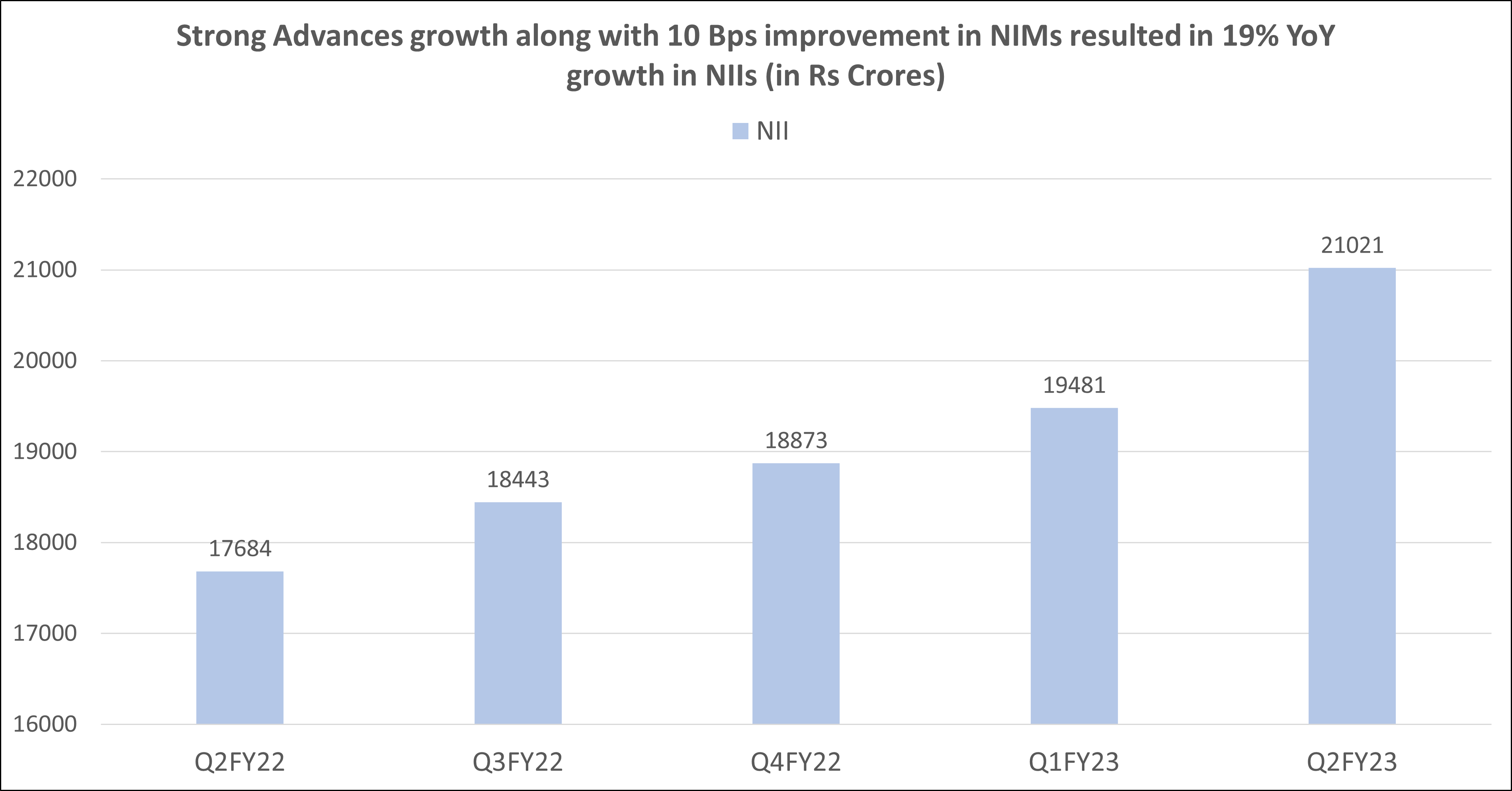

NII for Q2FY23 was Rs 21,021 crores, an increase of 8% QoQ and nearly 19% YoY. NII growth of 19% YoY, which was roughly in line with forecasts, was underpinned by strong advances in growth and a 10 Bps improvement in NIMs on a sequential basis.

The 11% QoQ increase in interest on advances and the 12% QoQ increase in interest expenses show the impact of repricing quite clearly. The bank is therefore concentrating on speeding up its retail deposits to enable strong growth in advances. Thus, NIMs increased 10bps QoQ to 4.1%.

Other Income

Meanwhile, fees from the retail segment, which account for 93% of the fee income, continued to grow strongly and were up 17% YoY. However, a treasury loss of Rs 2,500 crores held back the entire non-interest income. Retail growth kept pace with wholesale banking, which saw growth of 27% YoY and 9% QoQ, as well as commercial and rural banking, which saw growth of 31% YoY and 9% QoQ.

You may also like: Which one is the best pick in the banking sector?

HDFC Bank Q2FY23 results

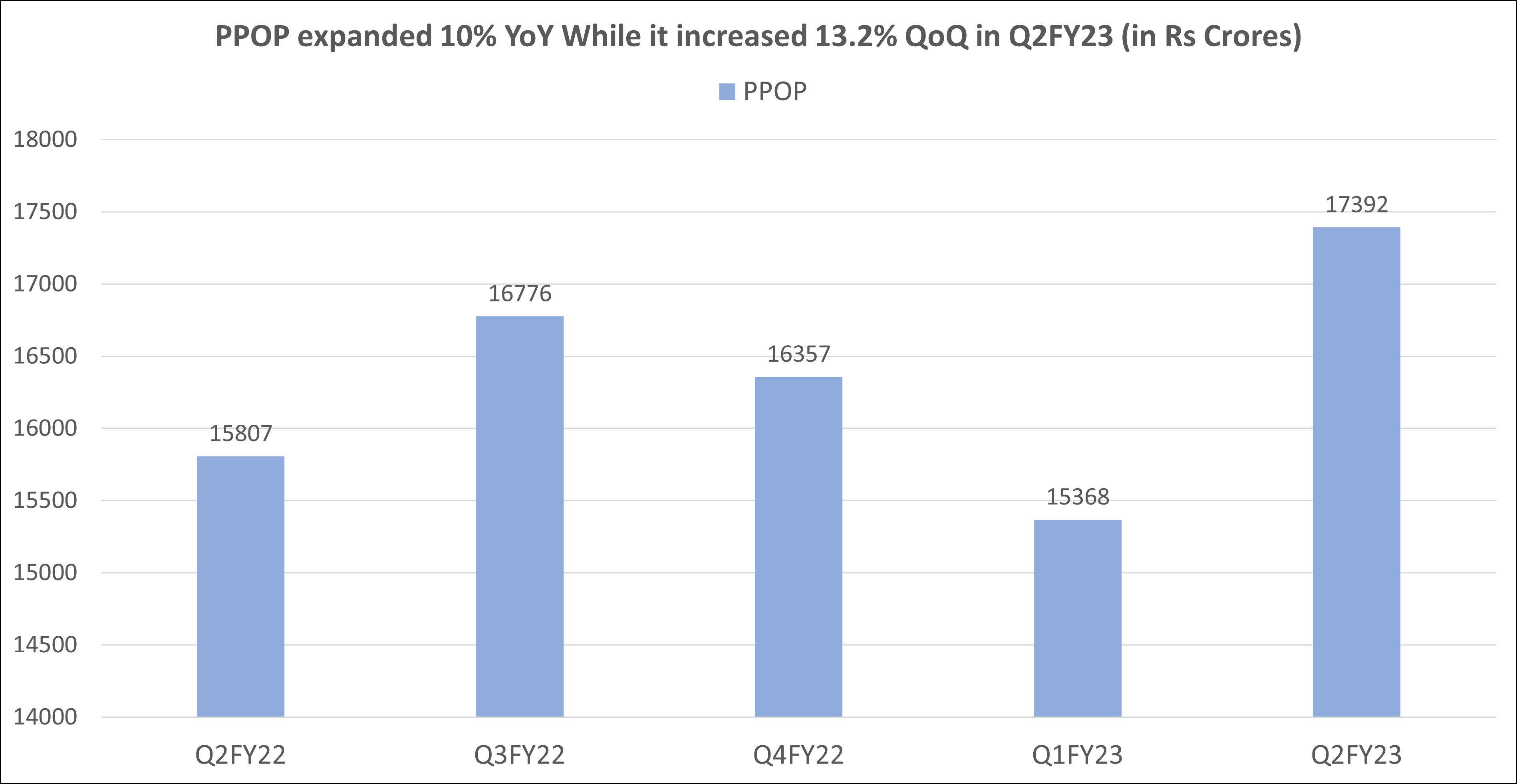

Operating profits robust in Q2FY23 HDFC Banks PPOP for Q2FY23 came in at Rs 17,392 crores, which is almost a 10% YoY rise from Rs 15,807 crores in Q2FY22. Whereas on a sequential basis, Pre-Provisioning Operating Profit (PPOP) grew 13.2% from Rs 15,386 crores in Q1FY23. In Q2FY23, provision coverage, which includes floating, contingent, and standard provisions, was Rs 110 crores. Additionally, bad loan provisions and contingencies decreased to Rs 3,240.1 crore from Rs 3,924.7 crore in Q2FY22. In contrast to Q2FY22’s 1.30%, the overall credit cost ratio for this quarter was 0.87%.

HDFC Bank Q2FY23 results: Operating profits robust in Q2FY23

HDFC Banks PPOP for Q2FY23 came in at Rs 17,392 crores, which is almost a 10% YoY rise from Rs 15,807 crores in Q2FY22. Whereas on a sequential basis, Pre-Provisioning Operating Profit (PPOP) grew 13.2% from Rs 15,386 crores in Q1FY23. In Q2FY23, provision coverage, which includes floating, contingent, and standard provisions, was Rs 110 crores. Additionally, bad loan provisions and contingencies decreased to Rs 3,240.1 crore from Rs 3,924.7 crore in Q2FY22. In contrast to Q2FY22’s 1.30%, the overall credit cost ratio for this quarter was 0.87%.

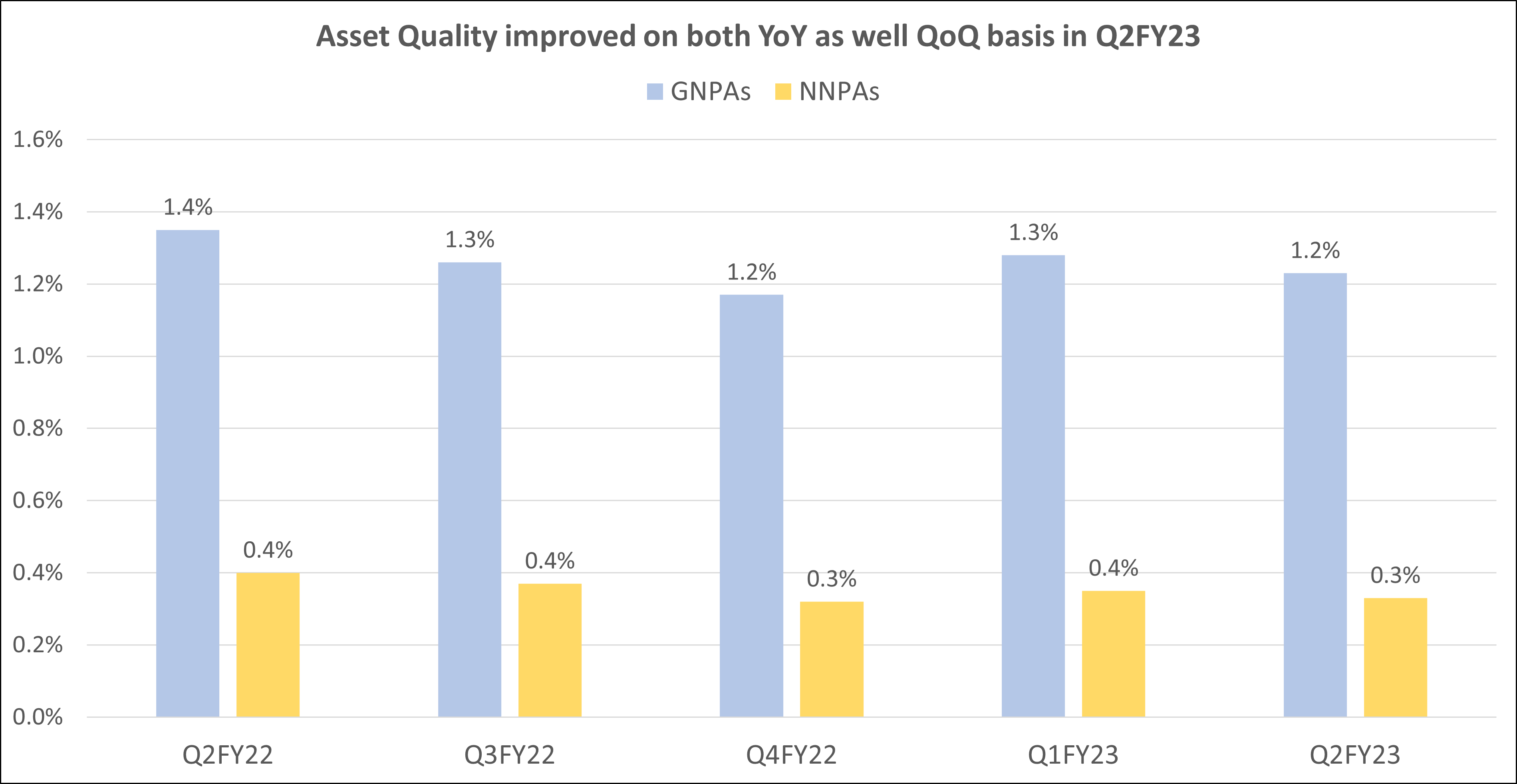

HDFC Bank Q2FY23 results: Asset quality finally started improving in Q2FY23 The bank’s asset quality increased as the gross NPA ratio decreased from 1.35% of total advances in Q2FY22 to 1.23% in Q2FY23. Sequentially, the gross NPA decreased by 5 basis points. For the quarter that ended on September 30, net NPA was at 0.33% of net advances, a sequential reduction of 2 basis points.

Thus, Asset Quality remained stable with GNPA at 1.23% vs. 1.28% QoQ. The restructured book continues to decline, falling 27% QoQ to Rs 7850 crores (53 Bps of advances).

Nevertheless, the slippages were kept to 1.9%. Earnings at HDB Financial also showed an increase in asset quality and a pick-up in growth traction.

Other Key Updates: Merger expected to be completed earlier by one Quarter

The merger with HDFC Ltd. looks to be proceeding as planned, with HDFC Bank receiving an NCLT order to call a shareholders’ meeting for approval of the proposed merger on November 25, 2022, after which the bank will request final NCLT approval.

The management estimates that after the approval of the shareholders, the merger might take up to 6 or 8 months. As a result, the merger, which was planned to be finished by Q3FY24, could perhaps be finished by Q2FY24.

HDFC Bank anticipates that the rise in advances would be supported by the ongoing recovery in domestic demand, which has been encouraged by the start of the holiday season and higher government Capex. Even activity figures from the July to September quarter show that despite the risk of geopolitical conflict around the world and the strong dollar, economic activity is still holding up. On the other side, high frequency has increased so far this year and looks to offer more chance and hope.

Univest View along with Technical Analysis: A favorable shift in the portfolio mix toward retail loans and a speedier transmission of interest rate increases will assist HDFC Bank to boost its NIMs. The advances growth has been positive and is anticipated to continue. A solid CASA mix and strong retail-led granular deposit franchise should enable the bank to support the margin trend. Investors can also anticipate that asset quality would remain constant, and HDFC Bank will benefit from lending to high-quality clients by lowering its credit costs, which will boost earnings.

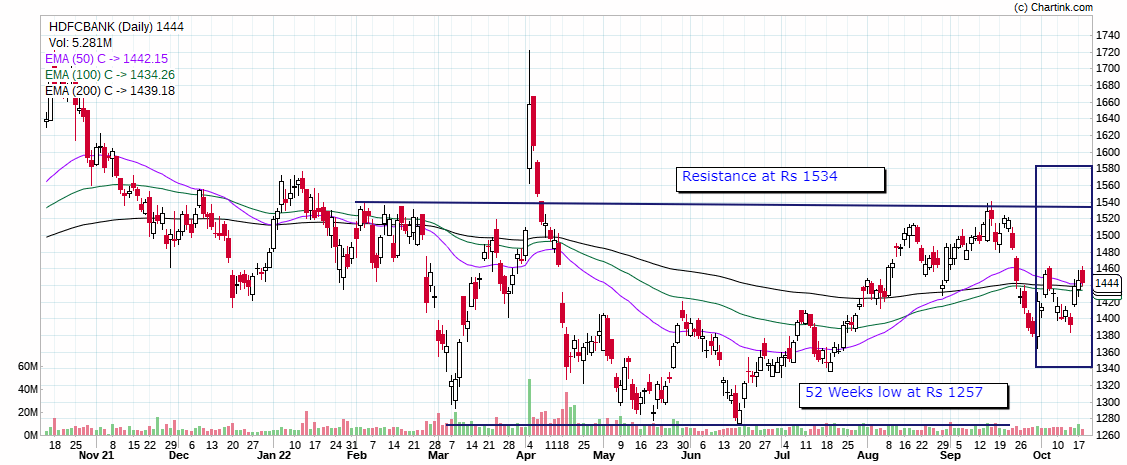

HDFC Bank is currently trading close to Rs 1450, which is more than 10% above 52 weeks low of Rs 1257. It is facing resistance at Rs 1534 and if moves up & sustains above this level, can potentially enter a bull run. Axis Direct said, “We maintain our BUY recommendation on the stock with a revised target price of Rs 1,800/share derived using the SOTP method (core bank at 3.1x FY24E ABV + Subsidiaries value Rs 69), implying an upside of 25% from the CMP.” ICICI Securities said, “Maintain BUY with an unchanged target price of Rs1,874. Key risks: regulatory costs attached with HDFC merger, and elevated opex.” On the Univest App, the company carries a neutral stance for fundamentals as well as short- & long-term trends. As the 50 EMA line is close to the 100 & 200 EMA line, therefore, a better approach would be to wait for confirmation on technical charts for future trends.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255)

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Bajaj Auto Q2FY23

Related Posts

Khazanchi Jewellers Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

Kesar Enterprises Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

J.G. Chemicals Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

IFGL Refractories Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

EFC Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here