HDFC Bank – Raring to go post completion of merger

Posted by : Sheen Hitaishi | Thu Jul 27 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1690442936318{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]HDFC Bank is India’s largest private sector bank in terms of market capitalization. It has also been one of the companies that have consistently delivered above-average returns to investors over the last decade.

Over the last few years, the bank had impactful events that raised doubts in investors’ minds about its ability to continue its performance in the future. One being the change in leadership, with Mr. Aditya Puri, who was the CEO since the inception of the bank, retiring and Mr. Sashidhar Jagdishan taking the top slot at the bank. However, a few quarters under the new leadership have witnessed continuity of the bank’s growth trajectory, albeit aided by favorable macros.

The other event was the merger of its parent company, HDFC Ltd, into HDFC Bank, which was announced last year and got completed last quarter. There were apprehensions due to complex issues related to the ownership of subsidiaries and other legal compliances, coupled with the merging of the manpower of the two entities. The merger has been successfully completed, and this should help the bank for its next growth trajectory.

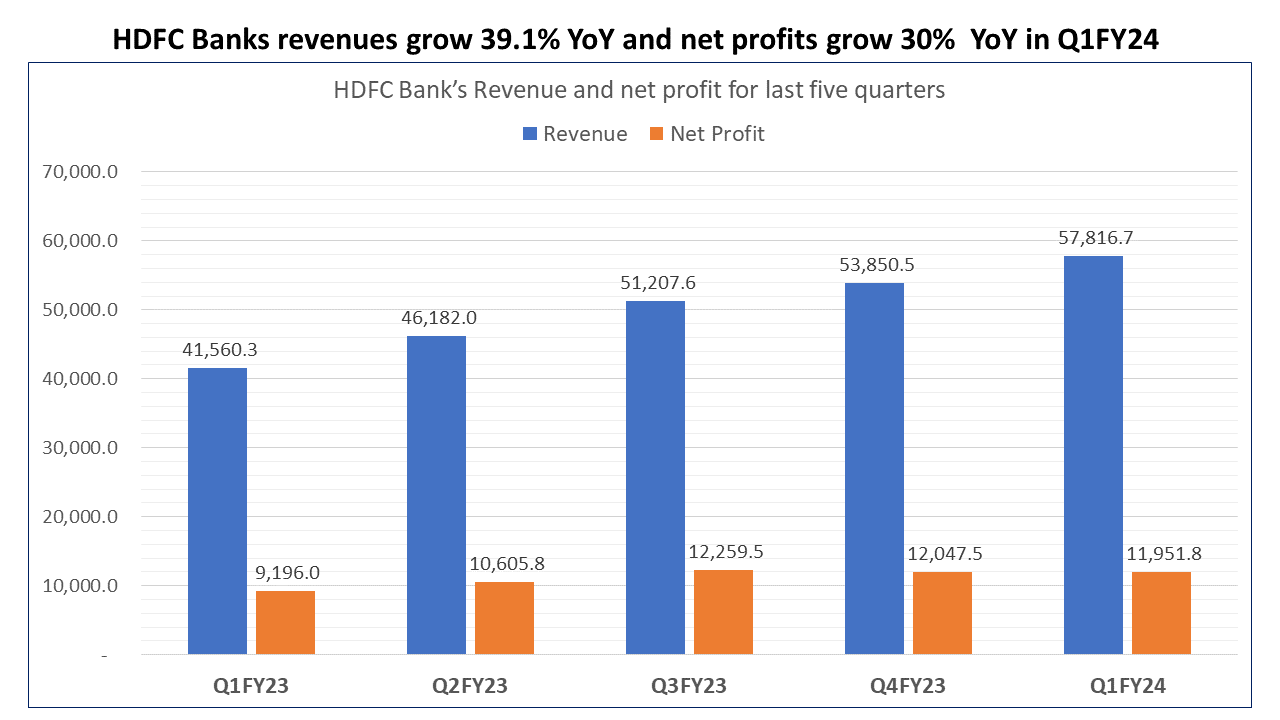

The Bank recently declared its Q1FY24 results, and the bank has once again delivered a decent set of numbers with YoY revenue growth of 39.1%.

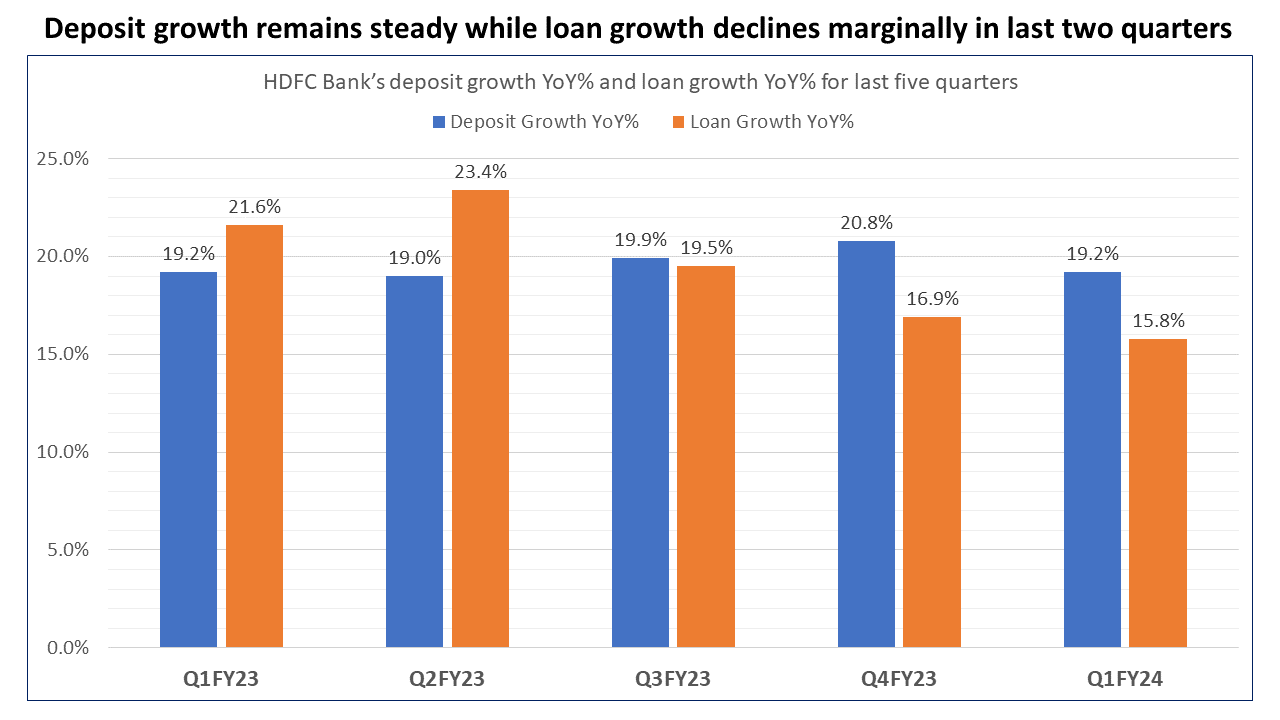

It registered a loan book growth of 15.8% YoY and 0.9% QoQ in Q1 FY24 at Rs 1,615,672 crore. The retail segment reported robust growth of 20.0% YoY, driven by strong home and personal loan performance. The Commercial Rural Banking segment witnessed a continued robust growth of 29.1% YoY, driven by the MSME/ PSL book during the quarter. The wholesale lending book grew by 11.2% YoY but experienced a 1.2% sequential decline. One highlight of this quarter was that the Xpress car loans constitute about 30% of total car loan volumes.

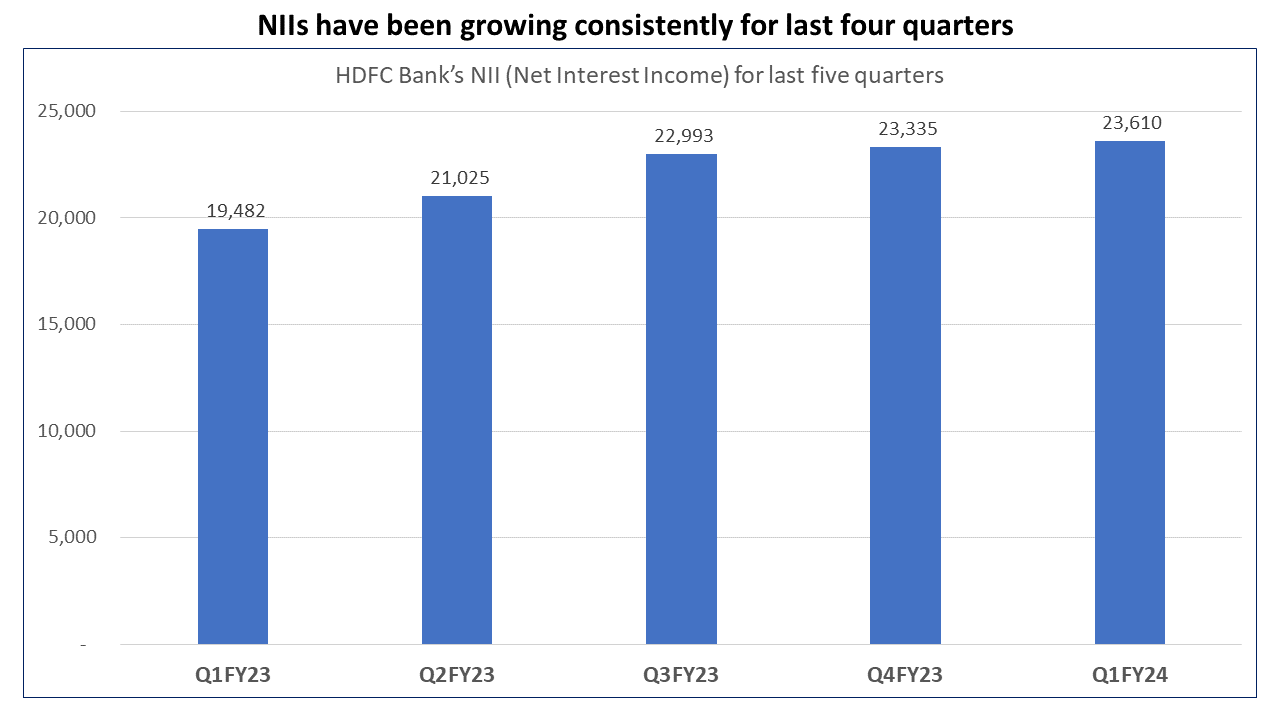

The bank’s NIIs (Net Interest Income) have been growing consistently every quarter, and this growth trend continued in Q1FY24 as well. The management is bullish over the medium term and expects to double its business every four years, compared to the earlier projection of five years. Retail asset penetration among the bank’s customer base is still low, with credit cards at 21%, personal and consumer durable loans at 14%, auto loans at 5%, mortgages at 2%, and insurance at 4%.

The bank is looking to build simplified journeys across its retail offerings to drive capabilities for end-to-end digital customer onboarding and sourcing of loans. The bank has significantly increased investments in semi-urban and rural India, which has helped sustain strong loan growth over the past three years. Even as retail slowed, the commercial and rural banking (CRB) segment has been the highest growth driver for the bank in FY2023, and it expects the strong momentum in the segment to continue going ahead.

The merger with HDFC changes the dynamics. HDFC Bank and HDFC Limited have successfully completed one of India’s largest financial services mergers. The merged entity is looking to seize the opportunities immediately and is confident in maintaining long-term profitability metrics. The bank has already started its expansion journey with increased investments in branches, distribution network, technology, etc. This would continue in the near term and would help gain sustained loan and deposit market share over the medium term.

The bank is likely to have a sustainable growth franchise despite its large base post-merger. With a large and expanding distribution, a strong customer base, adequate capitalization, and strong asset quality, the merged entity is well-positioned to capture growth. Based on the current stock trading levels, one can expect a 30% upside in the stock in the medium term.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly update [/vc_column_text][/vc_column][/vc_row]

Related Posts

AYM Syntax Gears Up for Q3 Reveal on 13th February. Check Key Expectations Here

Asian Paints Gears Up for Q3 Reveal on 13th February. Check Key Expectations Here

Alkem Laboratories Gears Up for Q3 Reveal on 13th February. Check Key Expectations Here

Alicon Castalloy Gears Up for Q3 Reveal on 13th February. Check Key Expectations Here

Akums Drugs and Pharmaceuticals Gears Up for Q3 Reveal on 13th February. Check Key Expectations Here