Difference between short and long term investing

Posted by : Sheen Hitaishi | Fri Mar 17 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1679058544913{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]The stock market attracts investors with the potential for high returns. A new investor may be drawn to the market for various reasons, such as hearing about a friend or relative’s success or exploring online tools to find high-performing stocks. An element of excitement surrounds stock market investing, especially when gains of 10% on a particular investment are seen in a week.

The pandemic was a turning point for investing in Indian markets, as lockdowns and work from home situations led to many new investors entering the market. Statistics show that nearly ten million demat accounts were opened in FY21 alone, a 25% increase in the country’s demat accounts.

However, new investors often overlook what kind of investment style is suitable for them, depending on their risk appetite and investment goals. Without a clear objective, the purpose of the gains may be unclear. This brings us to two different types of investing styles and their pros and cons.

When it comes to investing goals, short-term investing can supplement monthly income but cannot replace it. Long-term investment is done with the purpose of accumulating funds or a corpus that can serve as a source of income after a few years.

Short-term investments

Short-term investments are trades made with the aim of generating gains in a relatively brief period, ranging from a few days to a few months. The success rate of such trades is crucial, as not every investment may turn out to be profitable. For short-term investments, the tax implications on gains are typically 15% of the total amount earned.

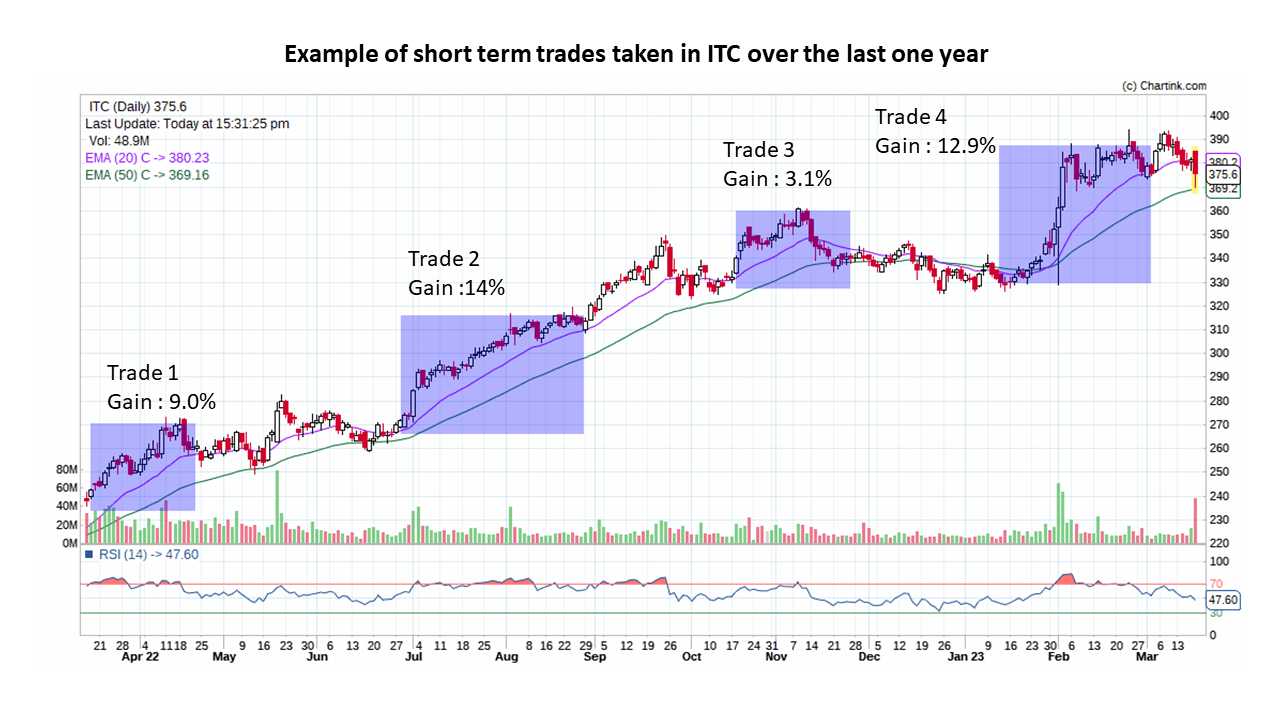

Consider the example of an investor who has made multiple short-term trades in the International Tobacco Company (ITC) over the last year.

The investor made four trades in ITC and held the stock for varying time periods. Assuming the same amount of capital was deployed in each trade, they made cumulative gains of 39% on the ITC stock.

In short-term investing, investors must also consider additional costs like brokerage and other associated expenses paid on each trade. Short-term trades are usually based on analyzing price charts, indicators, and other factors. Investors should calculate their risk-reward ratio and set a stop-loss, meaning the trade must be closed at a loss if the price drops below a certain percentage from the buying price.

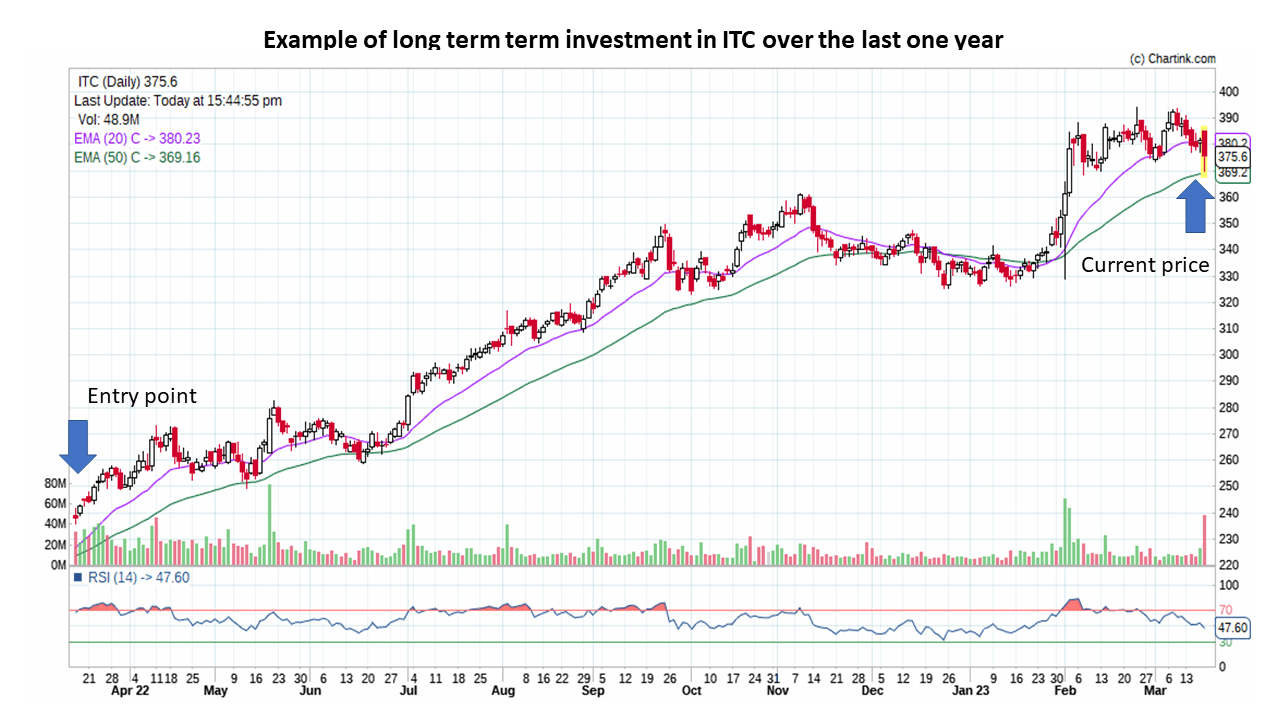

Long-term investments involve staying invested for more than one year with a specific purpose. For some seasoned investors, this period can extend up to five or ten years as well. Consider the same stock, ITC, and an investor who held onto the stock for a period of one year.

From his point of entry till now, the investor has gained 55.7% returns on the stock. If he decides to sell it now as he has completed a year, the tax implication will be 10% on gains beyond a gain of Rs one lakh. The investor has also paid the brokerage once at the time of buying and has not paid any extra costs for the period of holding.

Unlike short-term investments, long-term investments are done based on deep research of the fundamentals of the company. A study of the future prospects of the company helps in informed decision-making as the monies are likely to be invested for a few years.

Another aspect of long-term investments is that a few of the stocks can become “multibaggers” over a few years. This means that the value of the investment grows multiple times.

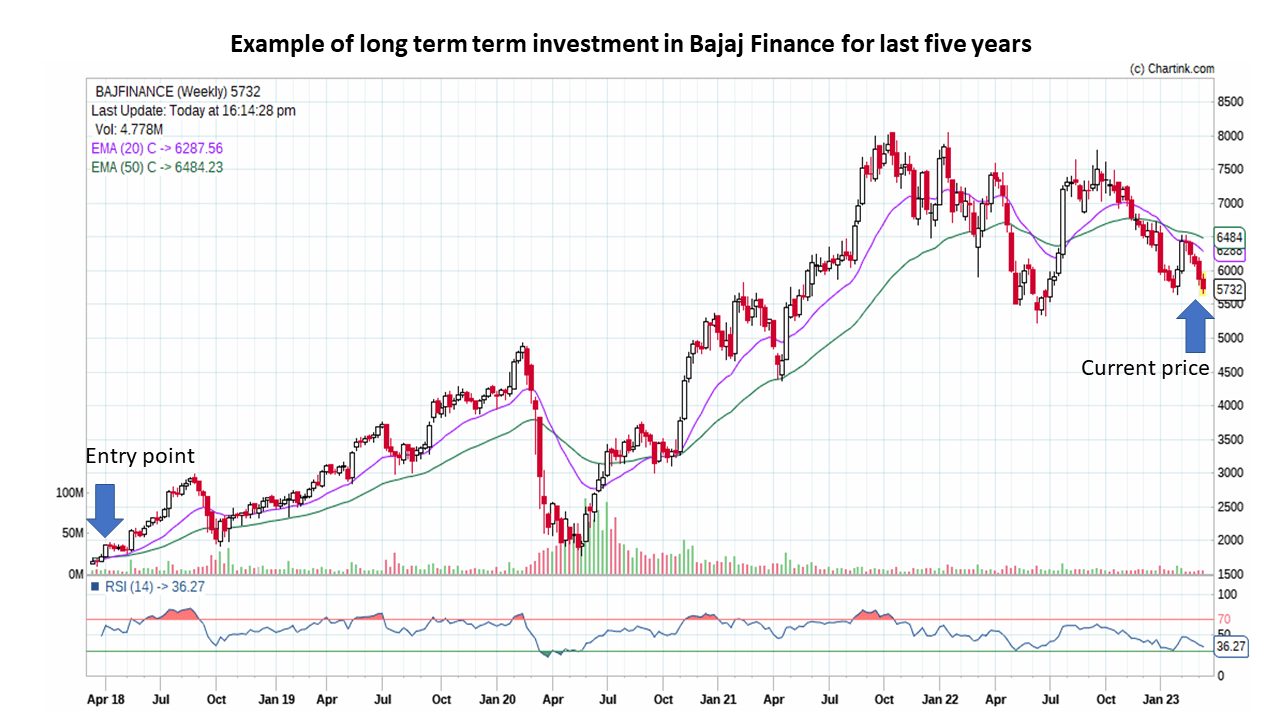

Consider the chart below where an investment was made in the stock of Bajaj Finance five years ago.

The entry price five years ago was at Rs 1850 per share. The current price is Rs 5732 per share, multiplying the original investment value three times. It was the conviction of holding the stock even through the ups and downs that superlative returns are achieved over the years. A note of caution here is that one cant simply invest and forget, but must monitor results every quarter to check if one can continue holding onto the stock.

Ideally a smaller percentage should be allotted to short term investing, while larger percentage for long term investments. Each investor must define his purpose for each type of investment. Short term investments can augment your monthly income while long term investments can deliver multibagger returns in some cases and help build a substantial wealth corpus over many years.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: The Role of Coffee in Investment Portfolios[/vc_column_text][/vc_column][/vc_row]

Related Posts

Best High Promoter Holding Penny Stock List for 2026

Best Steel Penny Stocks in India | Steel Penny Stocks List

Accord Transformer & Switchgear IPO Listing at 8.70% premium at ₹50.00 Per Share

Clean Max Envior Energy Solutions IPO Listing at 10.00% discount at ₹960.00 Per Share

Why is Larsen & Toubro’s Share Price Falling?