Decoding high dividend yield stocks of FY23

Posted by : Sheen Hitaishi | Fri Feb 24 2023

Dividends on stocks have always been a point of debate between investors. There are different viewpoints and these are seen from the perspective of the investing mindset of the investors. One school of thought is that while dividends are important, capital appreciation of the share price is more important. Another viewpoint is that long-term investors need not bother about capital appreciation but focus on dividends as a source of income being credited directly to their bank accounts.

Firstly, let us understand what the concept of dividends is. A dividend can be described as a reward that companies pay to their shareholders, and its source is the company’s net profit. Such rewards can either be in the form of cash, cash equivalent, shares, etc., and are mostly paid from the remaining share of profit once essential expenses are met. A company’s board of directors decides the rate of dividends, wherein, the approval of majority shareholders is also factored in. Essentially only companies that make profits give dividends.

The dividend payout is solely at the discretion of the company management. There are some companies, though profitable does not pay any dividends as the management would rather utilise the entire profits for further growth and expansion. Dmart (Avenue Supermarkets) for example has not paid any dividends to its investors since listing in 2016.

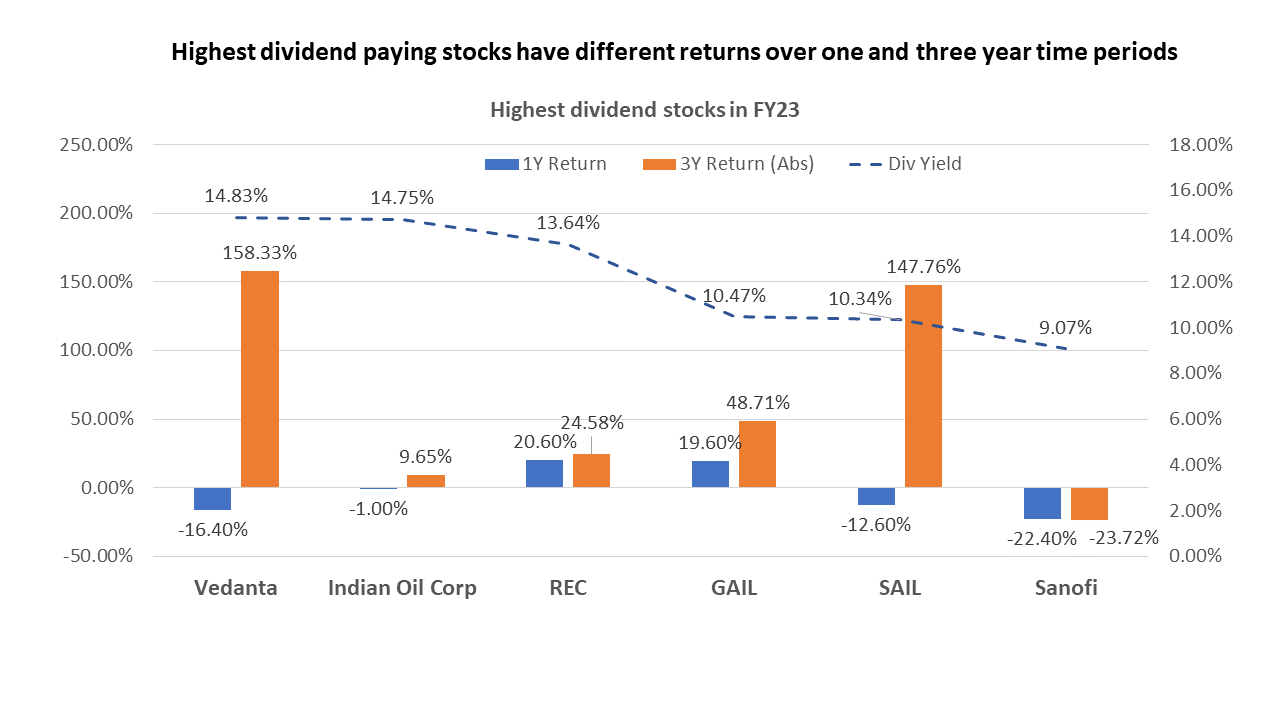

Recently we came across data that listed a few stocks that have given a very high dividend payout to their investors. Some of these stocks have given an annual dividend yield as high as 14.83%, prompting investors to compare the same with returns on some fixed-income instruments. However, it is important to remember that one should compare apples to apples, and comparing stocks with a fixed-income asset would not be a fair comparison.

In the above graphic, we have plotted the dividend yield as well the returns on these stocks over a one and three-year period. The stock returns are varied with the metal stocks. Though Vedanta and SAIL delivered negative returns last year but have delivered more than 100% returns over the past three years. On the other hand Sanofi, a multinational pharmaceutical company has delivered negative returns for both one and three-year time periods. There is no specific data that proves that high dividend yield stocks are likely to give higher returns. It all depends on the sector they are in and the movement of that sector over shorter as well as longer time periods.

Some of these high dividend-paying companies like Indian Oil Corp, GAIL, REC, and SAIL are companies where the government has a major stake. It is not difficult to decipher why these companies are paying high dividends. These companies are in the Oil and Gas sector (Indian Oil Corp and GAIL), electrification (REC), and steel (SAIL). All these businesses have large revenues and profits and the prices of their products and services are regulated by the government. Since the core business objective of these companies is limited to their own sector, it becomes difficult for a public sector undertaking to diversify into another sector. That is why they prefer to distribute profits via higher dividends.

Take the case of Reliance Industries, a private player in the Oil and Gas sector, which has diversified into Retail as well as telecom with the profits it generated from the Oil sector, over the last decade. The same cannot be done by a public sector oil company, whose profits go back to investors as dividends.

In a conclusion, investors can look for high dividend yields as one metric but this cannot be the sole factor for selecting a stock. As pointed out above, companies in government control with a limited scope of diversification or no expansion plans on the horizon are always likely to pay out higher dividends.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Mid and small cap IT companies lead revival of the IT sector in 2023