Cyient Analysis

Posted by : Sheen Hitaishi | Tue Jan 17 2023

High Conviction Long Term Idea

Upside Potential: 40% over the next year

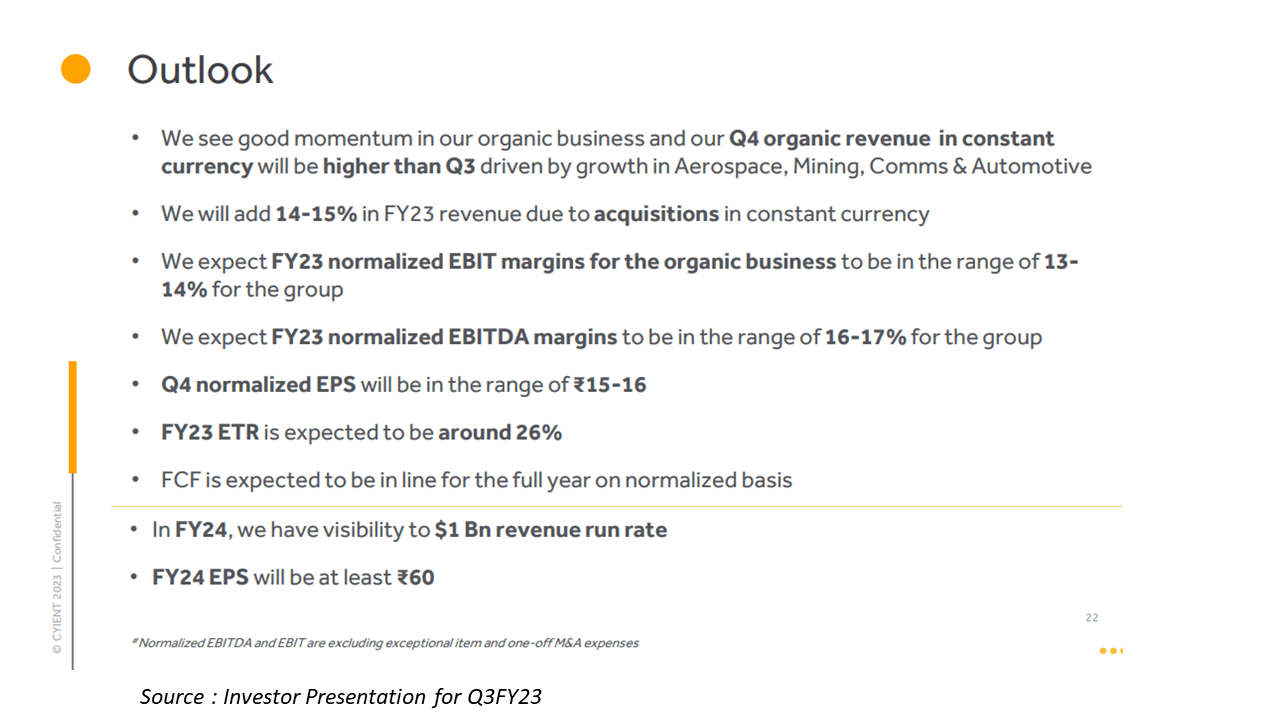

Positive Triggers: Management has guided higher revenue growth in Q4FY23. “We see good momentum in our organic business and our Q4 organic revenue in the constant currency will be higher than Q3 driven by growth in Aerospace, Mining, Comms & Automotive,” said the management in Q3FY23 Investor Presentation.

Guiding for FY24, the management said that “In FY24, we have visibility to $1 Bn revenue run rate and FY24 EPS will be at least Rs 60 per share”.

Red Flags: Possible slowdown in some of the European markets and prudent management of foreign currency as the majority of contracts are in USD.

About the Company

Cyient is an IT services company that offers engineering & development services to aerospace & defence as its key business verticals. Today, Cyient has 300 customers across 14 countries. Cyient’s current industry focus has expanded to include solutions for healthcare, telecommunications, rail transportation, semiconductor, geospatial, industrial, and energy.

What brings this company in focus?

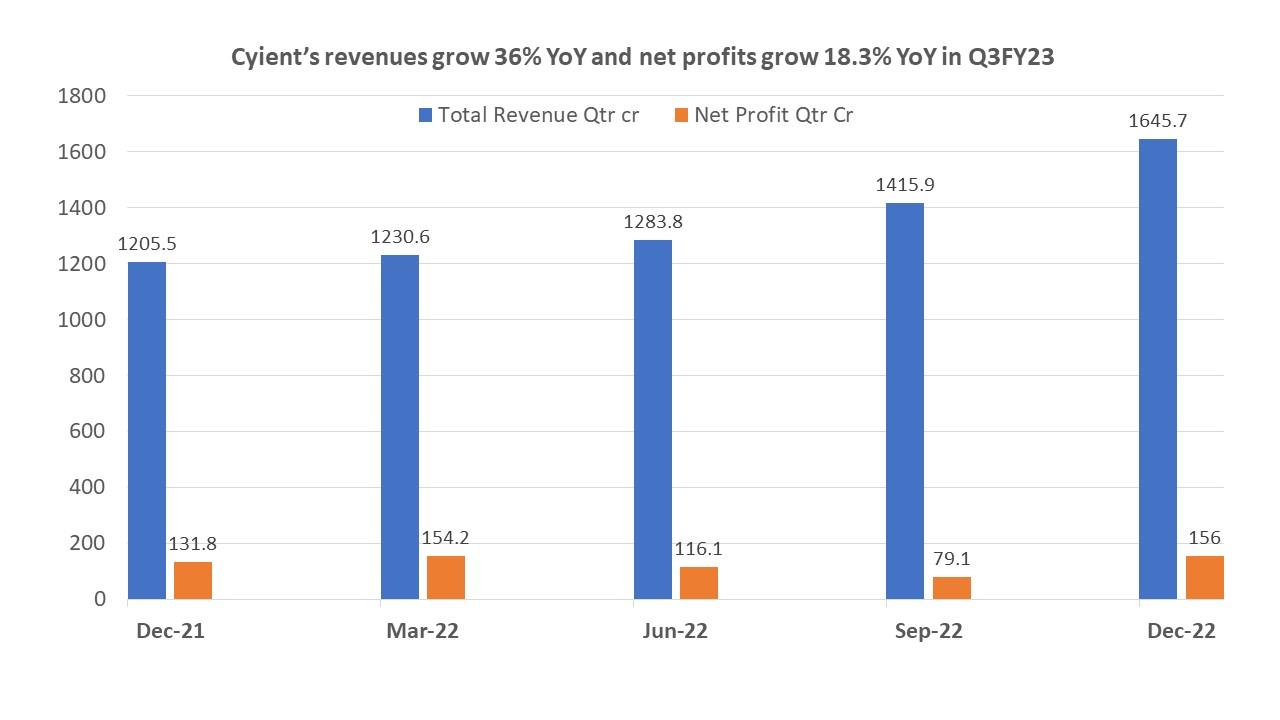

Cyient declared its Q3FY23 numbers on 12th January 2023 and its revenues grew 36.7% YoY and 15.9% QoQ in INR terms. This translates to 28.6% YoY growth and 13.4% QoQ growth in CC terms. Its net profits grew 18.36% on a YoY basis and 97.2% on a QoQ basis. In an environment where analysts expected IT companies to underperform, Cyient has reported its highest-ever quarterly revenue.

Management Speak

Cyient Ltd’s subsidiary, Cyient DLM Limited has filed a draft red herring prospectus (DRHP) dated January 9th, 2023 with the Securities and Exchange Board of India, BSE, and NSE in connection with its proposed IPO.

“The markets continue to be dynamic considering the current geopolitical situation, high inflation, rising interest rates, higher energy prices, supply chain constraints, etc. However, the globalization of R&D activities, the rising demand for integrating the latest technologies in the product and service offerings, and the growing need to shorten the product lifecycles and cost optimizations are expected to fuel the growth of the market. Major customers are showing signs of growth, but the challenges persist.” Quoting the management in Q3FY23 Investor Presentation.

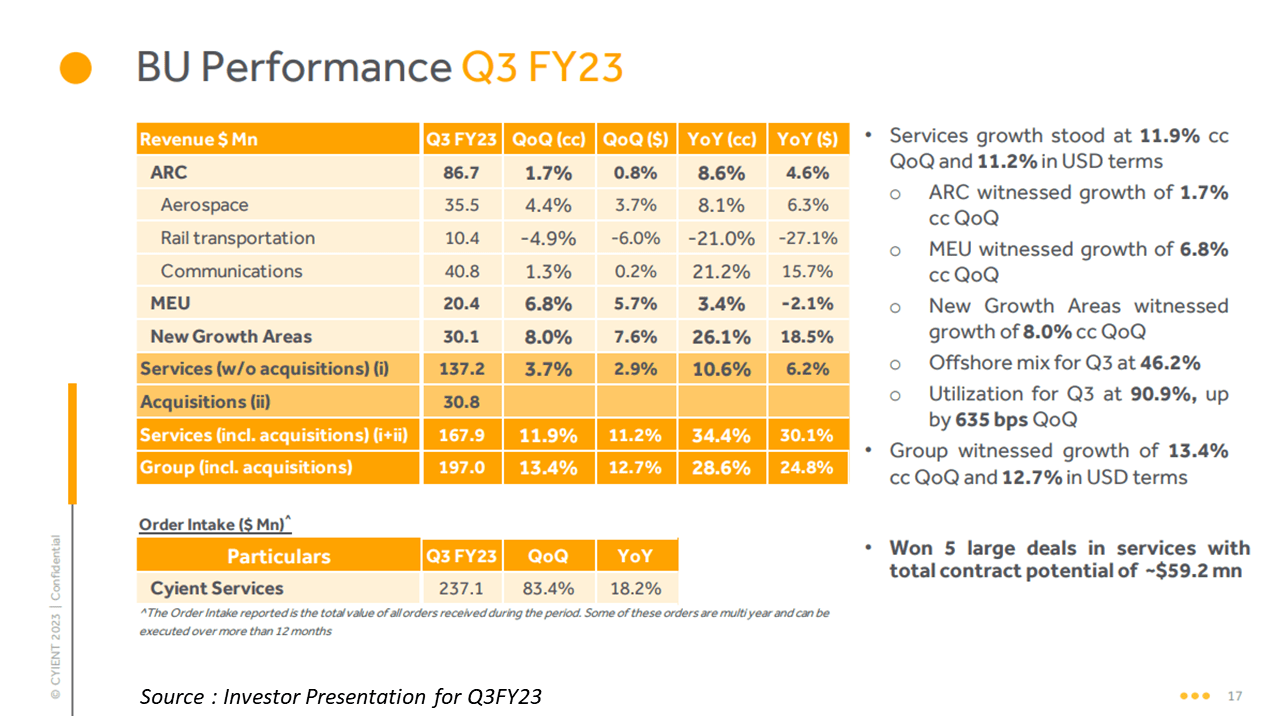

Commenting on the results, Mr. Krishna Bodanapu, Managing Director and Chief Executive Officer, said “Cyient witnessed positive Q3 FY23 results, with revenue at $197.0Mn, a growth of 13.4% QoQ, and 28.6% YoY in constant currency. The services revenue was $167.9Mn an increase of 11.9% QoQ and 34.4% YoY in constant currency, driven by the Semiconductor, Automotive, Energy, and Mining business. The normalized group EBIT margins, at 12.9%, is higher by 98 bps QoQ and lower by 100 bps YoY.

Commenting on the results, Mr. Ajay Aggarwal, Executive Director & CFO, said, “I am pleased to share that we have witnessed strong revenue growth on an organic basis coupled with the full impact of all the four acquisitions. Group revenue stood at $197.0 Mn, this is a growth of 28.6% YoY and 13.4% QoQ in CC terms. With a strong foundation on sustainable initiatives, we remain confident of this momentum continuing in Q4 FY23. We remain strongly focused on growth, margin, and cash generation and exiting FY23 on a very strong note.

Highlights of the conference call with analysts

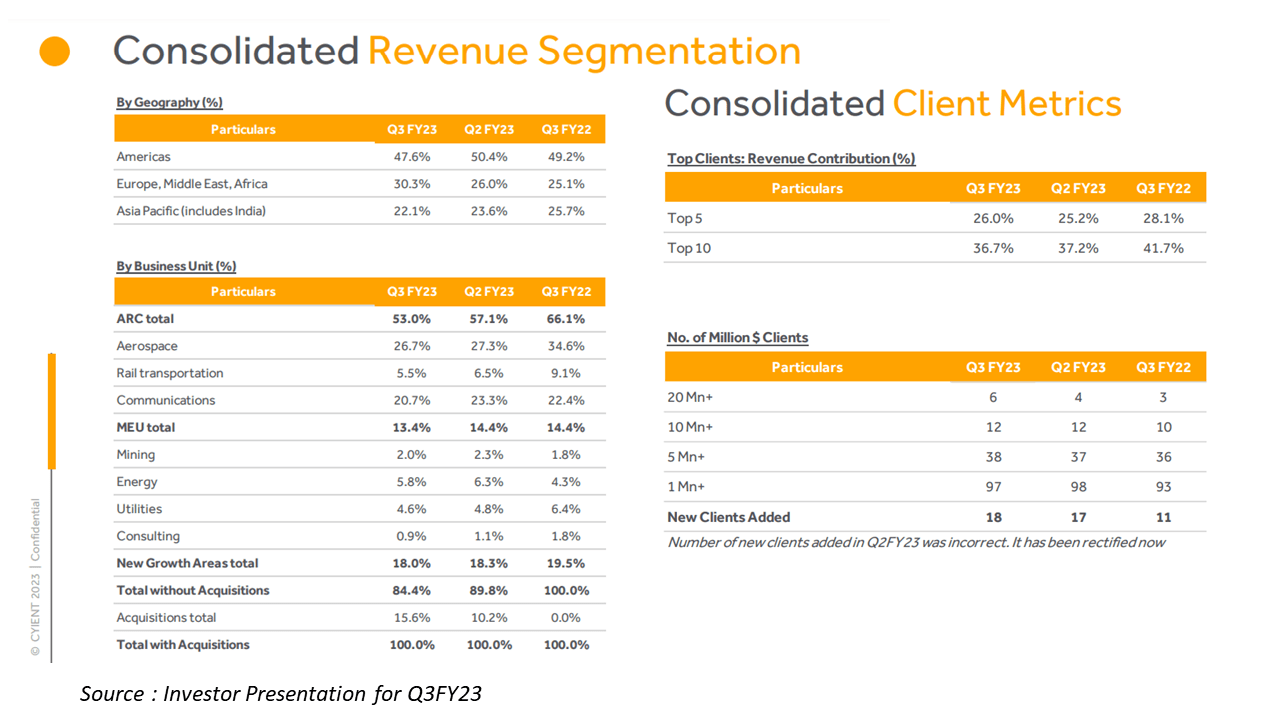

- Geography-wise EMEA continued to lead the growth with 30.2% QoQ, which would be on account of increased contributions from acquired companies while America (48% of the mix) reported growth of 5.4% QoQ. Asia Pacific revenue declined 0.9% QoQ.

- The company mentioned that it has completed the integration of all four acquired companies and is seeing the benefits of integration. Cyient indicated that all companies are accretive at the EBITDA margin level and will be accretive at the EBIT level in the medium term. The company also indicated that it is seeing opportunities with Citec wherein it is synergising its go-to-market & winning deals. Cyient further indicated that Celfinet will help to grow its communications business.

- The company indicated that it is witnessing a rebound in the aerospace vertical. It mentioned that one of its large OEM in the aerospace vertical is scaling up the business as travel has been picking up with the lifting of Covid restrictions globally including China, which is expected to have 2mn people traveling in the near term.

- In MEU vertical, the company indicated that the mining vertical is driven by decarbonising & energy transition. In the energy & utilities vertical, the company indicated that it is bullish on this vertical in the medium to long term as the carbon capture solution transition is picking up not only across Europe but also across the regions of America, Asia Pacific & India

- The company indicated that in the New Growth Areas, the growth will be driven by the auto & mobility sub-segment with increased traction in Software Defined Vehicle (SDV) and autonomous systems

- For FY23, the company has maintained its guidance of 14-15% CC of revenue contribution by acquired companies and normalised EBITDA margins in the band of 16-17%. The company has also maintained its normalized EBIT margin of the group at the organic level of 13-14%

What do the Technical Charts say?

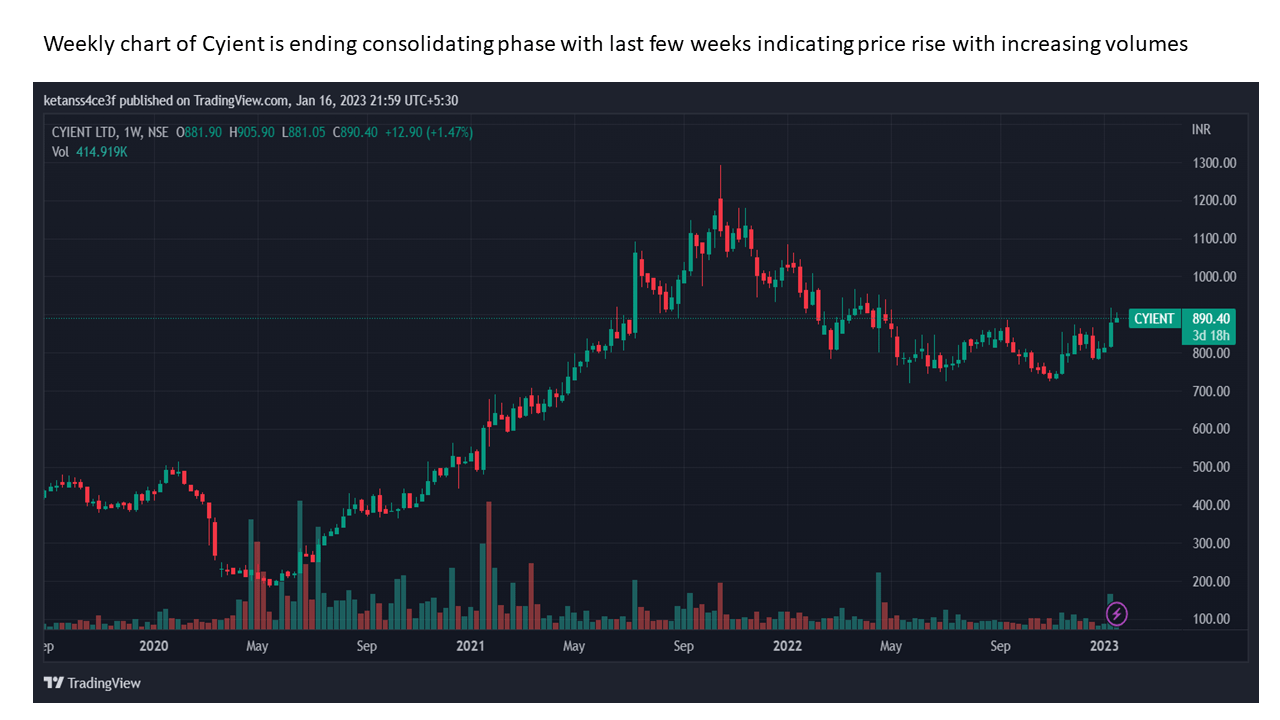

Like most IT companies Cyient saw a huge rally starting in May 2020 at a trading price of Rs 200 per share to deliver 6X returns till October where the stock price touched Rs 1200 per share.

After such a large rally, the stock went into a downtrend for the next year and traded in a price range of 900 on the higher side and 750 on the lower side since April 2022 consolidating within that range. The last few weeks saw the price crossing 900 levels with higher volumes of shares traded last week. It looks like Cyient is preparing to breakout out of this consolidation zone and begin a fresh uptrend. In case it does that, we could see the stock test it’s previous high of 1200 within a year’s time.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly update

Related Posts

Shree Ram Twistex IPO Allotment Status:9.10x Subscribed, GMP Rises 15.87% — Check Online

Clean Max Enviro Energy Solutions IPO Allotment Status:0.54x Subscribed, GMP Rises 0.28% — Check Online

Accord Transformer & Switchgear IPO Allotment Status:0.60x Subscribed, GMP Rises 20.47% — Check Online

Mobilise App Lab IPO Allotment Status:18.88x Subscribed, GMP Rises 10.00% — Check Online

Kiaasa Retail IPO Allotment Status:0.60x Subscribed, GMP Rises 20.47% — Check Online