Can the entry of new players shake the dynamics of the paint industry?

Posted by : Sheen Hitaishi | Wed Jun 14 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1686744528022{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]The paint sector in India has seen consistent growth in recent years. The industry has numerous applications, including paints for automobiles, industrial applications, and applications in buildings for external and internal purposes. Whether it’s a commercial building, a residential building, or even an individual bungalow, paints are in demand. The growth of infrastructure projects after the pandemic, coupled with a surge in housing sales, has given an impetus to the paints industry.

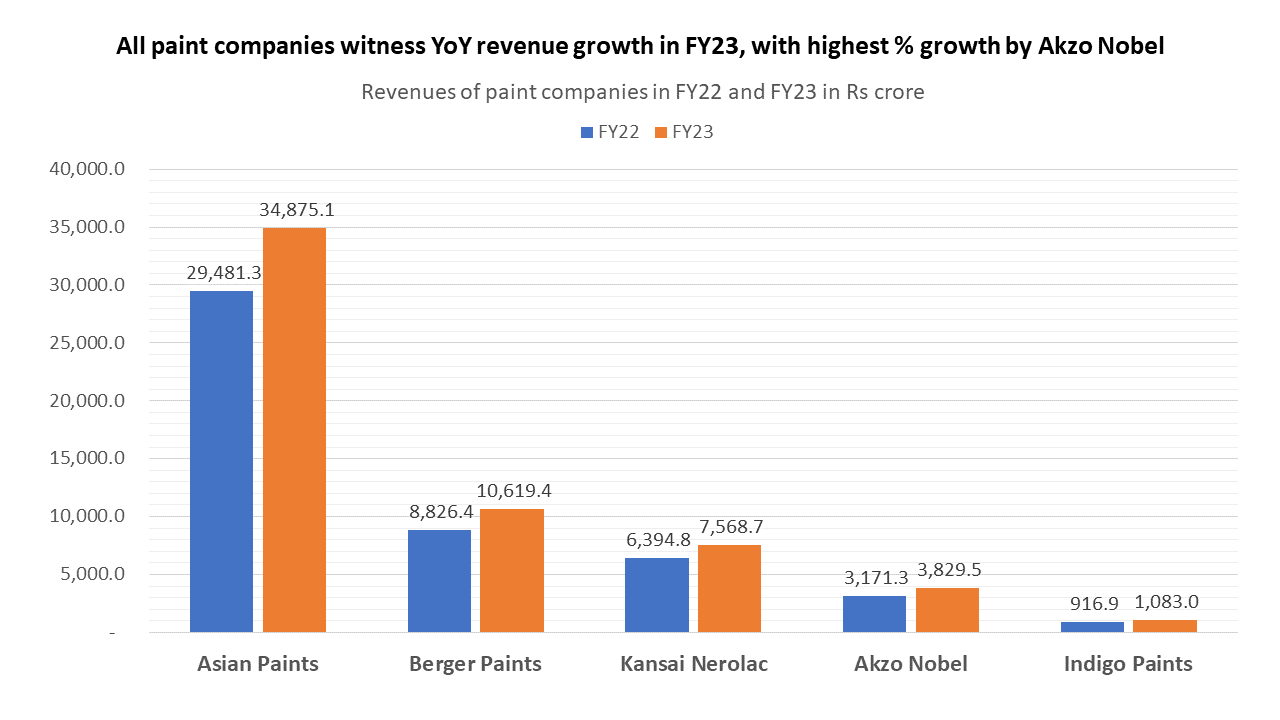

The market share in this industry is dominated by Asian Paints, leading with a massive 59% market share, followed by Berger at 18%, Kansai Nerolac at 15%, and Akzo Nobel, the makers of Dulux Paints, at 7%. The recent results for Q4FY23 and the financial year FY23 have shown that growth remains intact in this sector, with all companies increasing their revenues on a year-on-year basis.

Q4FY23 – a strong quarter for most paint companies

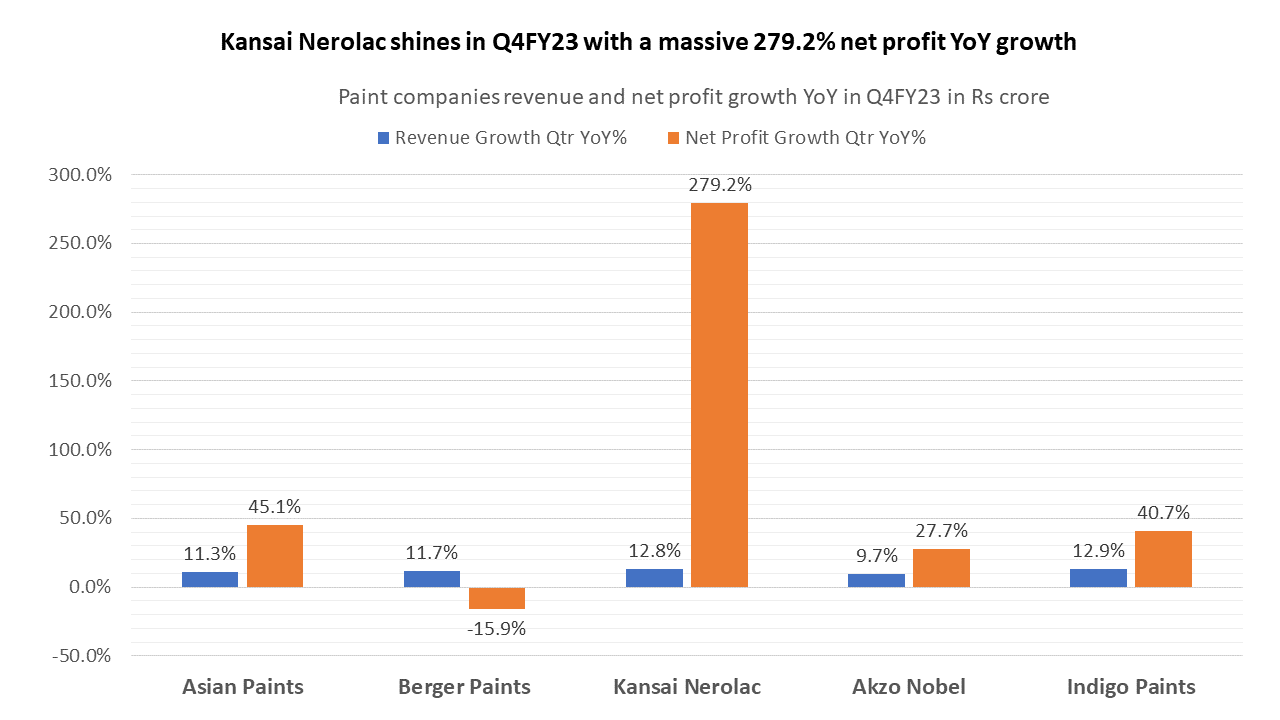

The Q4FY23 performance of Kansai Nerolac Paints is noteworthy as it achieved remarkable growth in its consolidated net profit, which grew by 279.2% YoY. Asian Paints demonstrated a significant rise in its consolidated net profit, reaching Rs 1,258 crore in Q4, indicating a growth of 43.97% YoY. Furthermore, its revenues jumped by 10.91% YoY to Rs 8,750.85 crore.

Indigo Paints showcased a healthy 40% YoY rise in its consolidated net profit, reaching Rs 49 crore. The revenue from operations during the same quarter witnessed a growth of 13% YoY, amounting to Rs 325 crore. Akzo Nobel reported a strong performance in Q4, with its net profit growing by 27.7% YoY to ₹95.4 crore.

However, Berger Paints faced a setback in Q4, experiencing a decline of 15.9% YoY in its consolidated net profit, reaching Rs 186 crore. This decline was primarily attributed to a loss resulting from a fire incident at its Goa plant.

Paint companies record double digit growth in FY23

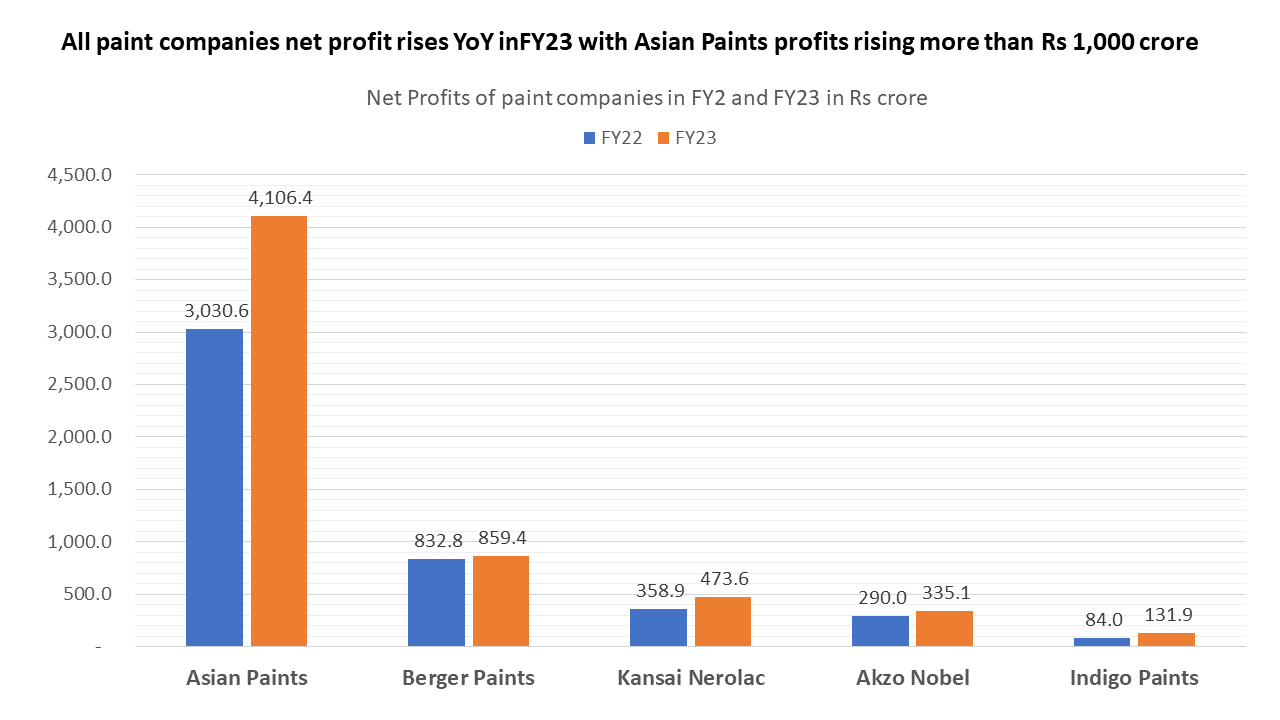

FY23 witnessed all paint companies experiencing YoY revenue growth. Two critical raw materials used in the paint industry are crude derivatives monomers and titanium dioxide. While crude prices have recently eased, the costs of these raw materials have remained at elevated levels, impacting the margins of paint companies. Nevertheless, all paint companies managed to achieve higher YoY net profits in FY23.

As the paint sector witnesses growth, some of the largest investors are changing their preferences within this sector. The foreign institutional investor (FII) stake in Asian Paints decreased to 17.02% in Q3FY23 from 18.11% in the previous quarter. Similarly, Berger Paints saw a reduction in FII stake to 10.64% in Q4FY23 compared to 11.11% in Q2FY23. This marks the third consecutive quarter in which FIIs have reduced their stake in both Asian Paints and Berger.

Even in Indigo Paints, the FII stake declined to 8.8% in Q4FY23 from 10.19% in the previous quarter. Meanwhile, Akzo Nobel India and Kansai Nerolac Paints experienced a marginal increase in FII holdings during this period.

New entrants set to join the party!!

The paint industry was limited to a few players until now, but today many more have made their foray into this industry. Some of them have deep pockets and are establishing new production facilities, while others have entered through acquisitions. Notably, Grasim, JSW Paints, Astral, Pidilite, and JK Cement are among the companies that have entered the paint sector in FY23.

Grasim Industries, the flagship company of the Aditya Birla Group, has earmarked an investment of Rs 10,000 crore in its paint venture by FY25. This amount is twice the initial earmarked investment when the company first announced its entry into the sector in January 2022. The plan involves establishing plants with a production capacity of 1,332 million litres per annum (MLPA) and commencing operations by the fourth quarter of FY24.

JK Cement has acquired a 60% stake in Acro Paints and rebranded it as JKMaxx Paints. It has already introduced the products in North and Central India. It has a production capacity of 60,000 KL in decorative paints and 6,700 KL in construction chemicals.

Pidilite has entered the decorative paints segment under the brand name ‘Haisha.’ The company has indicated that it introduced decorative paints to complete the product portfolio based on requests from the dealers.

Astral has invested in SAP in Gem Paints and plans to rebrand its paints in FY24, leveraging its existing paint depots and three manufacturing units.

Most of the new entrants operate in the building materials space. Paints are an adjacency that allows them to drive synergies and leverage a common distribution network. On the other hand, market leader Asian Paints has also made acquisitions in the building materials space, acquiring a UPVC window and a lighting company in the last financial year.

It is widely anticipated that the entry of the new players will dent the market share of existing players. However, the existing players are gearing up to take on the competition. Asian Paints is increasing its capacity from 1,751 million litres to 2,636 million litres, Berger Paints is increasing its production capacity from 620 million litres to 1,100 million litres, while Kansai Nerolac Paints Ltd. is expanding its current total of 600 million litres by 1.54 lakh kilolitres annually.

Stock market returns present a different picture

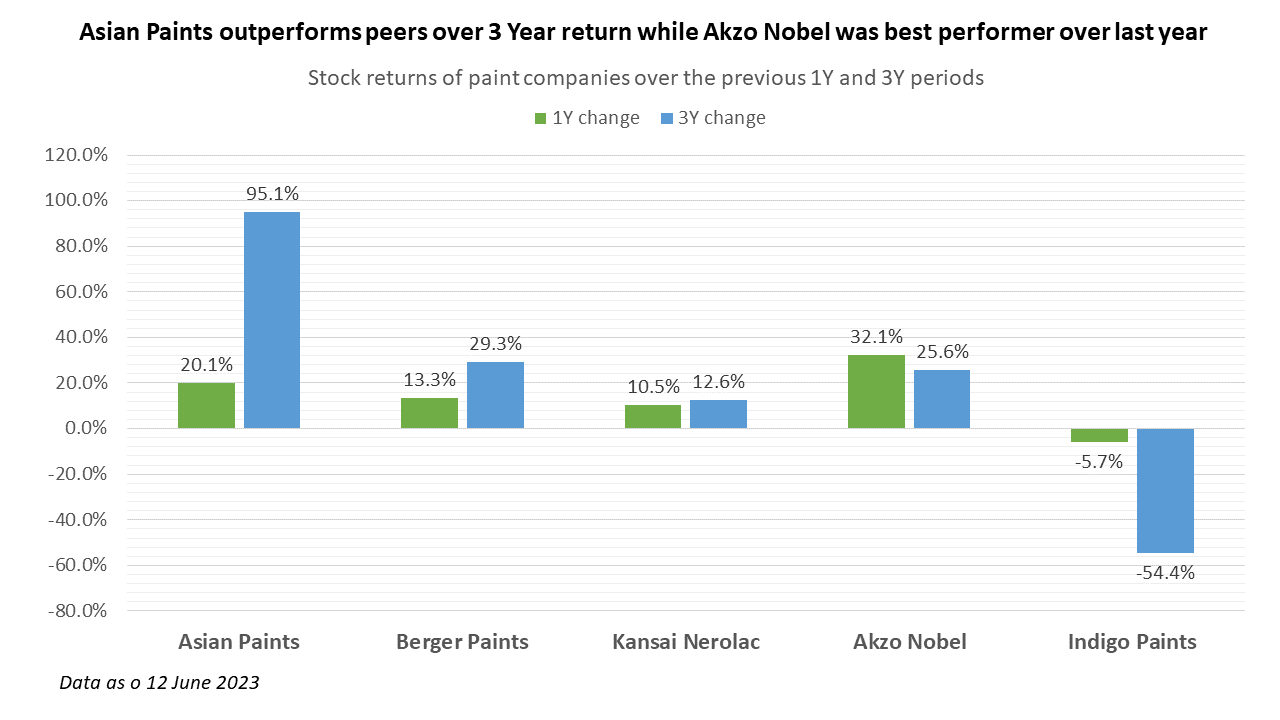

Investors eyeing this sector will be keen to study the returns on investments made in paint in the past few years. The market leader, Asian Paints, stands head and shoulders above its peers, delivering 20% returns over the past year and nearly doubling the shareholding value in the past three years.

Akzo Nobel has provided the best return in the last one-year period, although its three-year returns are less than satisfactory. Indigo Paints has reduced investor wealth by half over the previous three years. With rising competition, there may be pricing pressure, which is likely to impact the margins of these companies and eventually affect the stock price. While giants like Asian Paints and Berger Paints may be able to withstand predatory pricing, it will have a greater impact on others.

The paint business requires a strong dealership network and is built on the trust the brand creates. In this regard, Asian Paints has the strongest and largest dealer network, with many of them being second or third-generation dealers of the company. Challenging the dominance of Asian Paints is a herculean task for new players. However, the industry is transitioning from unorganized to organized players, leading to overall market growth in the coming years. In this expanded market scenario, Asian Paints may continue to be the dominant player.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly updates [/vc_column_text][/vc_column][/vc_row]

Related Posts

Why is JP Power Share Price Falling?

Why is the MRF Share Price Falling?

Best SIP Plans for 3 Years in 2026: Build Wealth with Stability

Acetech E-commerce IPO Review 2026: GMP Flat, Key Investor Insights

PNGS Reva Diamond Jewellery IPO Day 3: Subscription at 0.99x, GMP Rises 0.26% | Live Updates