Budget 2023 Analysis – Many high points and a few low ones

Posted by : Sheen Hitaishi | Wed Feb 01 2023

This Union Budget was presented today and this will be the last budget before the general elections scheduled for next year. This year’s budget was presented by the Hon Finance Minister as a clear-cut vision document for the “Amrit Kaal”. The key focus areas identified were opportunities for citizens with an emphasis on the youth, growth, and job creation as well as a strong and stable macro-economic environment.

The seven priorities as outlined by the Government in this budget are:

- Inclusive Development

- Reaching the last mile

- Youth power

- Financial Sector

- Green Growth

- Unleashing the Potential

- Infrastructure and Investment

All of these would be the contributing factors for “Amrit Kaal”.

To give credit where it’s due, the Budget is aligned with a vision for development and did not resort to populist measures in a pre-election year. This is a far cry from when budgets were allocated based on which states were headed for election and catering to the whims of powerful ministers with higher allocations to their respective ministries.

Key highlights of the Budget

- The fiscal deficit for 2022-23 stands at 6.4% of GDP. Finance Minister says that it will fall to 5.9% in 2023-24.

- The Centre’s capital outlay towards infrastructure development rises 33% to Rs 10 lakh crore.

- In this Budget, Rs 2.4 lakh crore will be allotted towards railways.

- Increased allocation to defence Budget to Rs 5.94 lakh crore for 2023-24 from last year’s allocation of Rs 5.25 lakh crore.

PM Vishwa Karma Kaushal Samman-package of assistance for traditional artisans and craftspeople has been conceptualised, and will enable them to improve the quality, scale & reach of their products, integrating with the MSME value chain. The Centre is focused on increasing jobs for the youth and enhancing the agriculture sector by bringing modern technologies.

The government has a Capex of Rs 35,000 crore for energy transition investment. Finance Minister Nirmala Sitharaman says that battery storage will get viability gap funding.

The government also remodels the credit guarantee scheme for MSMEs with an investment of Rs 9,000 crore, reducing the cost of credit by 1 percentage point. This will come into effect from April 1, 2023.

Finance Minister, in her budget, has extended the date of incorporation for startups to avail tax benefits to March 31, 2024, from March 31, 2023. The FM also proposes the benefit of carrying forward losses on change of shareholding for startups to 10 years of incorporation from the current seven years.

Focus on youth skill development.

The Budget is focusing on the development of the youth and has envisaged programmes that will help add to the talent pool in the country.

Skill Digital India Platform – It enables demand-based formal skilling, linking with employers and facilitating access to entrepreneurship schemes

Centres of excellence for artificial intelligence – Three centres for AI to be set up realising the vision of ‘Make AI in India and Make AI Work in India’.

National Apprenticeship Promotion Scheme – To provide stipend support to 47 lakh youngsters in three years through Direct Benefit Transfer.

Pradhan Mantri Kaushal Vikas Yojana 4.0 – On-job training, industry partnership, and alignment of courses with the needs of the industry

In addition at the school level, a National digital library for children and adolescents will be set up for facilitating the availability of quality books across geographies, languages, genres, and levels, and device-agnostic accessibility.

States will be encouraged to set up libraries for them (children) at panchayat and ward levels and provide infrastructure for accessing the national digital library’s sources.

Healthcare gets a boost in the Budget

Finance minister Nirmala Sitharaman in her Budget 2023-24 increased the allocation for Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) to Rs 7200 crore, while Rs 646 crore has been allocated for the Ayushman Bharat Health Infrastructure Mission (PM-ABHIM).

Sitharaman also announced that the union government will launch a mission to eliminate sickle cell anaemia in India by 2047. “It will entail awareness creation, universal screening of 7 crore people in the age group of 0-40 years in affected tribal areas, and counselling through collaborative efforts of central ministries and state governments,” Sitharaman told parliament.

The allocation for Ayushman Bharat, the world’s largest government-funded health assurance scheme, is a 12% increase from the amount of Rs 6,412 crore allotted in FY23.

A sum of Rs 88,956 crore was allocated to the health and family welfare ministry, compared to Rs 86,606 crore in FY23

Other announcements for the healthcare sector include:

Setting up of facilities in select ICMR Labs will be made available for research by public and private medical college faculty and private sector R&D teams for encouraging collaborative research and innovation.

A new programme for the promotion of research and innovation in pharmaceuticals will be taken up through centres of excellence.

Dedicated multidisciplinary courses for medical devices will be

supported in existing institutions to ensure the availability of skilled manpower for futuristic medical technologies, high-end manufacturing, and research.

One hundred and fifty-seven new nursing colleges will be established in co-location with the existing 157 medical colleges established since 2014.

Big relief to the middle class

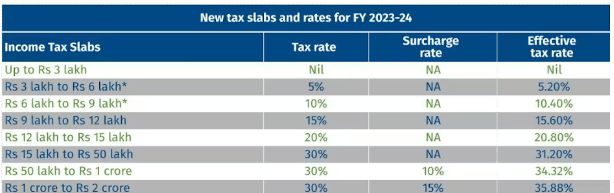

In a much-anticipated move, the Finance Minister revised the income tax slab rates. This is seen as a big relief for the middle class as an individual need not pay any income tax for annual income below Rs 7 lakhs per annum. This will be applicable if the individual is filing income tax returns as per the new tax regime.

What gets cheaper and what gets costlier?

As in every budget some items are likely to get cheaper and some more expensive. These would have a direct impact on some of the stocks.

Cheaper

- Mobile phones

- TV

- Lab-grown diamonds

- Shrimp feed

- Machinery for lithium-ion batteries

- Raw materials for the EV industry

Listed companies likely to benefit from this include Shrimp feed companies like Avanti Feeds and Godrej Agrovet. Similarly, consumer durable players like Whirlpool and Dixon Technologies will benefit from lower custom duties on TV components. Many players supplying raw and finished goods to the EV industry including battery manufacturers like Exide and Amara Raja as well as component manufacturers like Uno Minda are likely to gain.

Costlier

- Cigarettes

- Silver

- Compounded rubber

- Imitation Jewellery

- Articles made from gold bars

- Imported bicycles and toys

- Imported kitchen electric chimney

- Imported luxury cars and EVs

Listed companies that will be impacted by higher costs include cigarette manufacturers namely ITC, Godfrey Philips, and VST industries. Jewellery industry players like Titan, Rajesh exports, and Kalyan Jewellers get impacted by higher price of silver and gold bars.

Life Insurance companies take a big hit post the budget

The shares of insurance companies were beaten down today following Finance Minister Nirmala Sitharaman’s renewed thrust for the new tax regime, where deductions are not allowed, in Budget 2023-24. The government also announced it will disallow deductions in certain cases.

At the end of trading on Budget day, HDFC Life fell by 10.9%, ICICI Prudential Life fell by 11.2%, SBI Life by 9% and the largest state-owned LIC fell by 8.4%.

The budget proposed that where the aggregate premium for life insurance policies (other than ULIP) issued on or after April 1, 2023 is above Rs 5 lakh, income from only those policies with an aggregate premium of up to Rs 5 lakh shall be exempt.

“This will not affect the tax exemption provided to the amount received on the death of a person insured. It will also not affect insurance policies issued till March 31, 2023,” said the document.

However, this has not gone down well as the deductions under section 80C for life insurance under the old income tax regime were highly suitable for the life insurance industry as many salaried individuals have been purchasing life insurance every year to fulfill the exemption under life insurance policies. Asking individuals to switch to the new tax regime does not bode well for life insurance companies.

Revisiting the changes in life insurance is something that the Government should consider and make amends before the Budget is cleared by the House.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Reliance Industries Q3FY23 Results: Strong growth in Retail and Jio