Bikaji Food IPO subscribed 27 times on Day 3

Posted by : Sheen Hitaishi | Thu Nov 10 2022

Bikaji Foods International is one of India’s leading FMCG brands with an international presence, providing Indian snacks and sweets, and is one of the fastest-growing companies in the Indian organised snacks market. With an annual manufacturing capacity of 9,000 tonnes for handcrafted papad and 29,380 tonnes for Bikaneri bhujia, it is the second-largest manufacturer of both foods in FY22.

Bikaji is also the third-largest player in the organised sweets market, with annual capacities of 24,000 tonnes for packaged rasgulla, 23,040 tonnes for soan papdi, and 12,000 tonnes for gulab jamun. This market leader recently launched an initial public offering (IPO) with an 881.22 crore issue size. As of November 7, 2022, the entire issue, which has no new shares offered for sale, has been subscribed to 26.67 times.

The latest grey market premium for the IPO has been observed at Rs 40. The allotment for the IPO will take place on 11th November while the IPO shall be listed on 16th November. So, let’s now understand whether the company is fairly valued or not given the fact that this IPO is purely an offer for sale with no fresh issue of shares while Bikaji Foods has already mobilised Rs 262 crore from anchor investors ahead of its IPO.

Bikaji Product Portfolio

The company’s product line is divided into six main categories: cookies, bhujia, namkeen, packaged sweets, papad, western snacks, and other snacks, which mostly consist of gift packs (assortment), frozen food, cookies, and the mathri range.

Therefore, an extensive assortment of Indian snacks and sweets has been established by the company. As of June 30, 2022, their diverse product range featured more than 300 products across all of their product segments.

You may also like: zomato

IPO Details & Purpose:

Bikaji Foods IPO is to hit the market on November 3 and will close on November 7. Bikaji Foods IPO to raise around Rs 881 crores via IPO that comprises fresh issue of Rs 0 crores and offer for sale up to 29,373,984 equity shares of Rs 1 each. The retail quota is 35%, QIB is 50%, and HNI is 15%. The IPO has a price band of Rs 285 – 300 per share with a minimum retail lot size of 50 shares & multiples thereof.

The objects of the Offer are to

● Achieve the benefits of listing the Equity Shares on the Stock Exchanges

● Carrying out the offer for sale of up to 293,73,984 equity shares by the selling shareholders.

● Further, the company expects that the proposed listing of its equity shares will enhance its visibility and brand image as well as provide a public market for the equity shares in India

● The selling shareholders will be entitled to the entire proceeds of the offer after deducting the offer expenses and relevant taxes thereon.

SWOT Analysis – Bikaji Food Limited:

Strength:

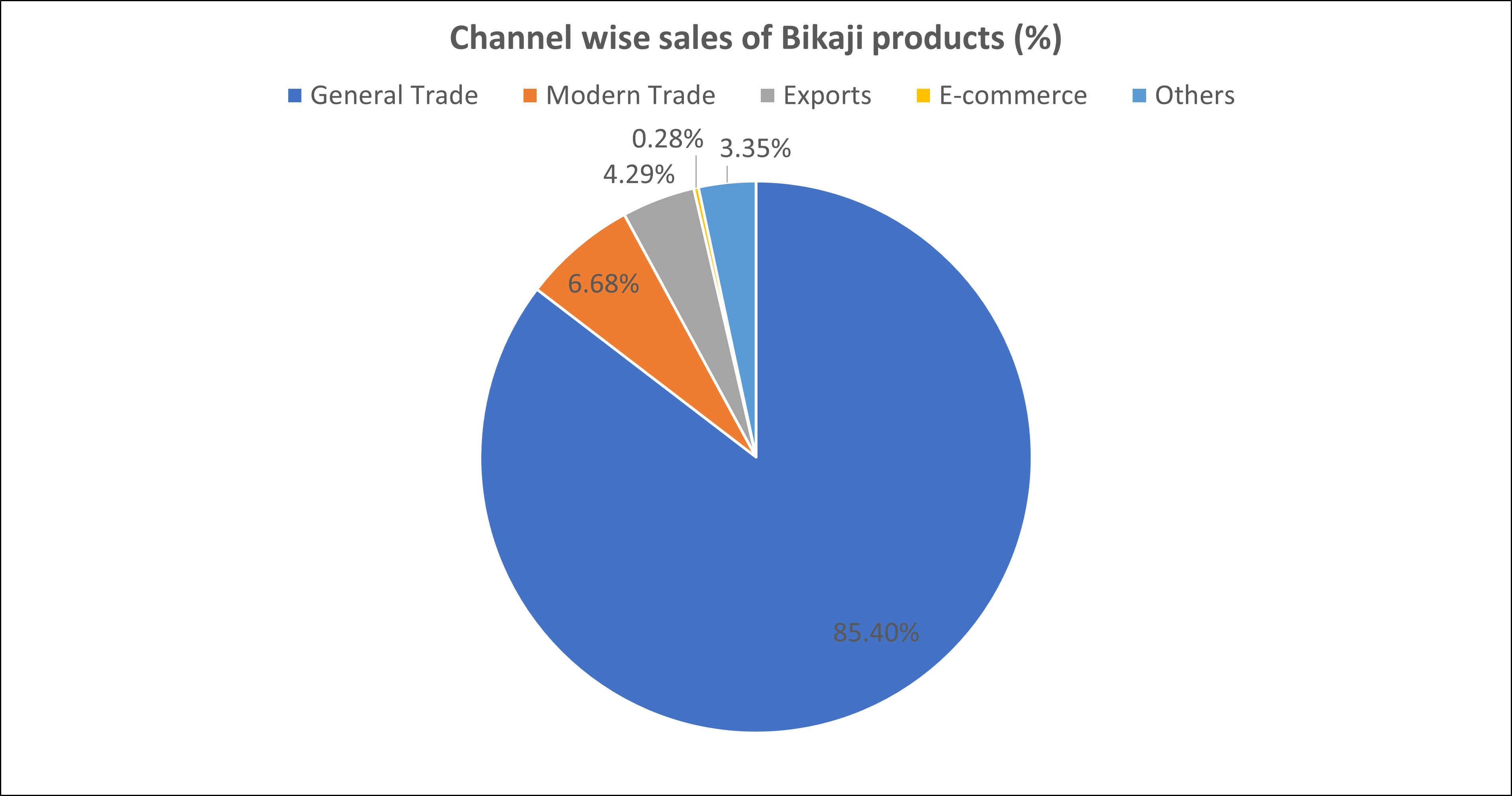

The business has a well-known brand that is popular throughout India. Bikaji has over the years established market leadership in the ethnic snacks market in the core states of Rajasthan, Assam, and Bihar. It is also strengthening its market share in other states. Since the business offers all of its goods under the well-known “Bikaji” brand. They had six depots, 38 super stockists, 416 direct distributors, and 1,956 indirect distributors spread over 23 states and four union territories in India as of June 30, 2022.

Weakness:

An overreliance on bhujia products is a problem because sales of bhujia products account for 35% of their total revenue.

Additionally, businesses won’t be able to fully pass on an increase in raw material prices to the customers, which would have an effect on their margins and profit after tax.

Being entirely an OFS, the company will not receive any proceeds from the issue. The selling shareholders will be entitled to the entire proceeds, giving them a partial or full exit from the company.

Opportunity:

It benefits from many export promotion programmes run by the Indian government. In accordance with the “Production Linked Incentive (PLI) Scheme for Category Segment Ready to Cook/Ready to Eat,” the GOI approved BFL’s request for sales-based incentives for the fiscal years FY22 through FY27. The corporation pledged to spend Rs 256.9 crores in FY21-23 as part of the incentives. For the years FY22 through FY26, Bikaji Foods additionally gained clearance for an incentive related to branding and marketing expenses abroad.

Under the PLI Scheme, the government is encouraging the production of four major food product categories in India, including ready-to-eat and ready-to-cook goods made from millet, processed fruits and vegetables, seafood, and mozzarella cheese. The most the corporation can be rewarded under the plan is Rs 261.4 crore.

Threat:

The snack sector is extremely competitive due to the presence of numerous MNCs and Indian companies in various subcategories. With new regional competitors entering the ethnic snacks sector, the competition may grow even more fierce.

Final Status:

On the final day of bidding on Monday 7th November, the Bikaji Foods IPO received roughly 27 times as many subscriptions. Against the 2,06,36,790 shares that were on offer, the initial share sale received bids for 54,94,47,200 shares, according to BSE data.

By 5 PM, on 7th November the qualified institutional buyer’s category had received 80.63 times as many subscriptions as the non-institutional investor’s quota. The fraction of retail individual investors was subscribed to 4.69 times, for a total of 26.62 times.

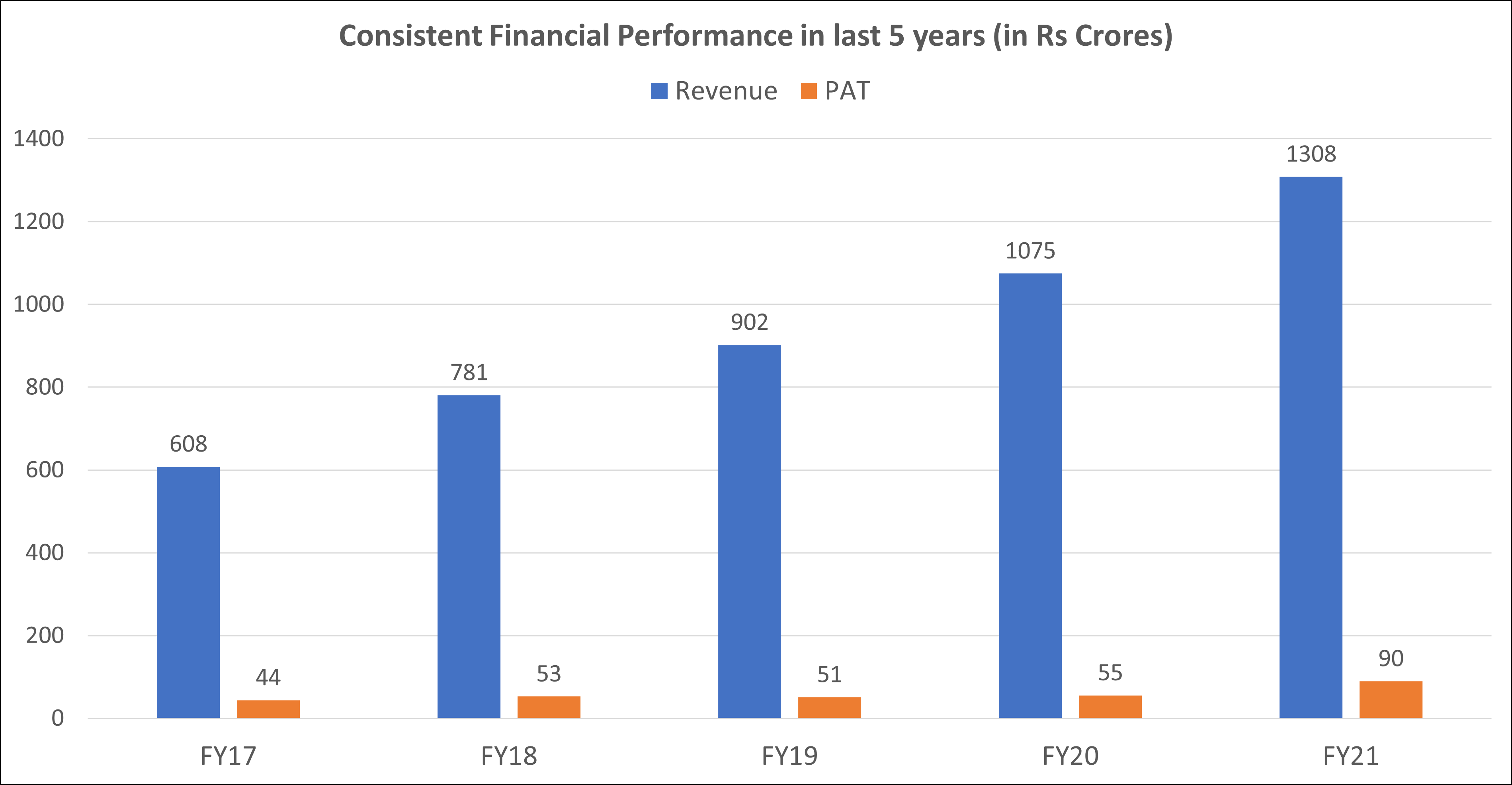

Consistent financial performance

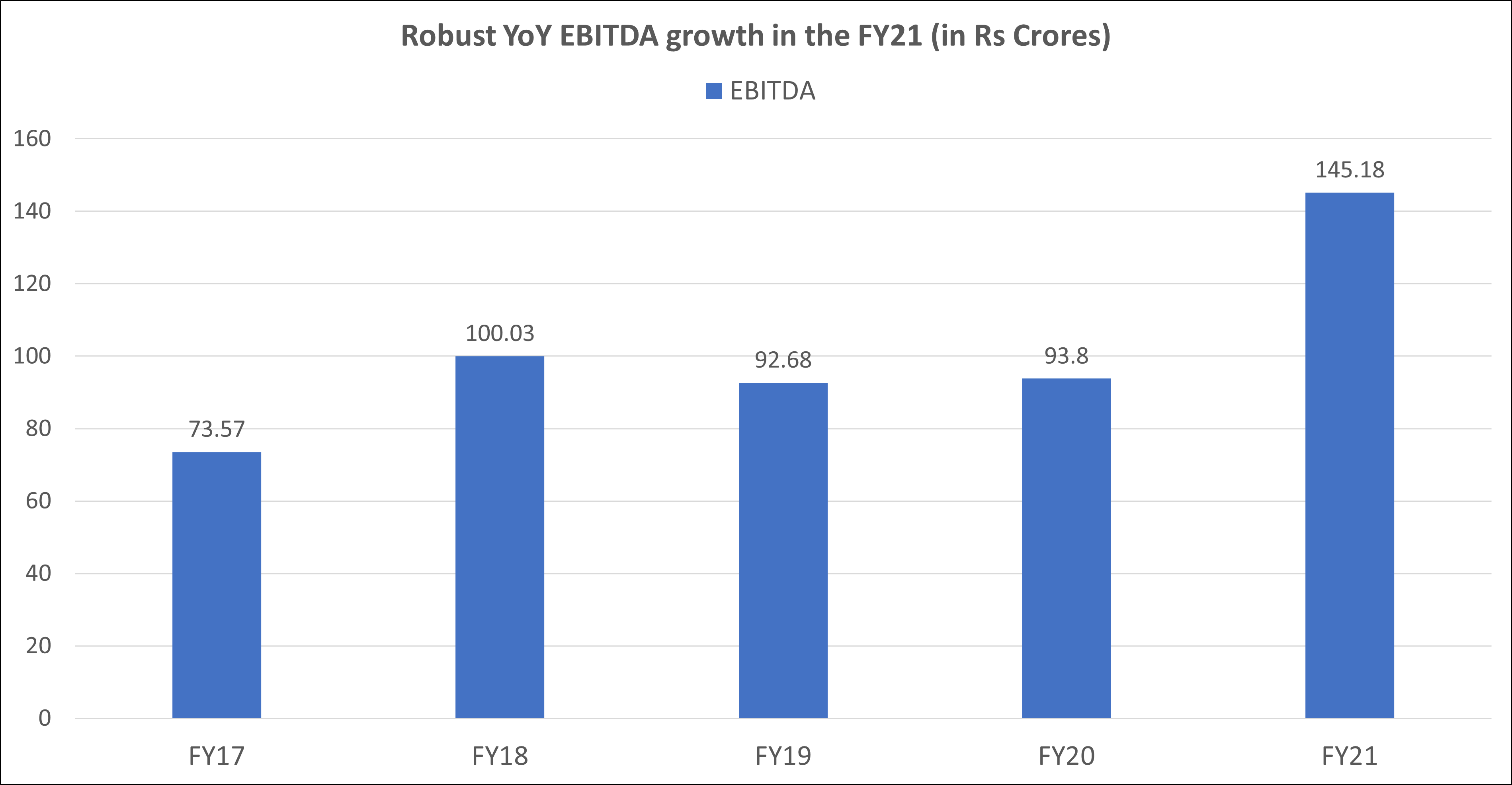

Bikaji’s continued focus on efficiency, productivity, and cost rationalization has enabled it to deliver consistent financial performance, despite the recent increase in the cost of certain of its raw ingredients, and packaging material.

For instance, it has managed to maintain consistent EBITDA margins by passing on the increase in raw ingredient costs to its customers, despite the price of palm oil increasing significantly in Fiscal 2022 and the increase in inflation leading to an increase in raw material prices in the three months ended June 30, 2022. It would be able to take advantage of huge development prospects in the Indian snacks business in India because of its strong operational and financial performance.

Univest View:

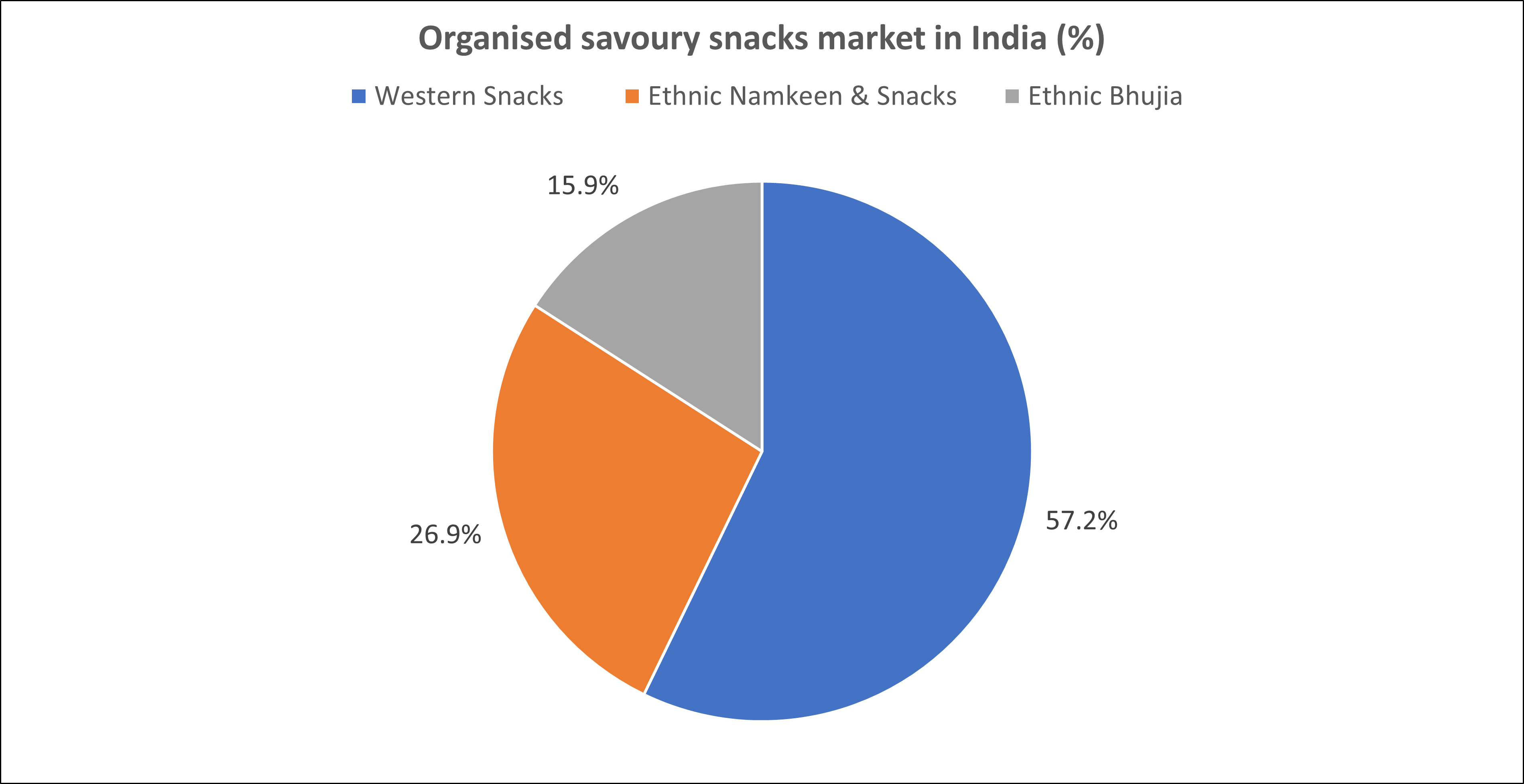

The packaged food industry in India is currently worth Rs. 4,240 billion. It has expanded dramatically over the past five years as a result of urbanisation, increased earnings, and changing lifestyles. Retail sales of packaged foods were Rs. 2,434 billion in Fiscal 2015, with a CAGR of almost 8.3% from Fiscal 2015 to Fiscal 2022. It is projected to increase by 8% CAGR over the following five years to reach Rs. 5,798 billion.

Choice Broking said Bikaji is demanding an EV/Sales multiple of 4.5 times, which is premium to the peer average. “The food market in which the company is operating is normally dominated by unorganised players. This might be the reason for the lower operating margin for Bikaji, despite so much value addition. In the current inflationary environment, we are cautiously optimistic about the sustainability of the profitability margins. We assign a ‘Subscribe with Caution’ rating for the issue,” it said.

Since the GMP is around Rs 30–40, it can be inferred that the company’s existing values are reasonable and that there is little potential for listing profits for this IPO. Long-term investors may find the investment opportunity favourable, however those seeking listing gains should pass on this IPO. A cautious approach is advisable based on how the share price changes in the weeks following its listing.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Bharti Airtel shares hit all-time high on Q2FY23 results

Related Posts

Best Multibagger Midcap Stocks in India 2026

Why is the IRFC Share Price Falling?

Striders Impex IPO Review 2026: GMP Rises 0.00%, Key Investor Insights

Fractal Industries IPO Listing at 6.02% Premium at ₹229 Per Share

PNGS Reva Diamond Jewellery IPO Day 1: Subscription at 0.04x, GMP Rises 2.33% | Live Updates