6 Best Sectors to Invest in Long-Term

Posted by : Ketan Sonalkar | Thu Jun 05 2025

Best Sectors to Invest in Long-term

Investment is something all of us look forward to. At the same time, most of us believe more in the risk involved and usually refrain from investing in the stock market. With the pace at which the Indian economy is growing, you can surely be a part of the growth revolution by making some long-term investments if you want your money to grow with the nation.

Numerous speculations suggest that India will soon be the fifth-largest stock marketplace in the world. The market grows with various stepping elements supporting this expansion, such as government initiatives, foreign relations, market dynamics, etc. Considering everything happening around in the financial sphere, here are the 6 best sectors for long-term investment.

1. Healthcare & Insurance

The healthcare industry in India has been on a boom ever since. With the pandemic hitting and the ever-increasing chronic illnesses, the need for healthcare infrastructure in India is growing at a considerable rate and this needs further and regular investment too.

Keeping the healthcare infrastructure on one end, the need for health insurance plans has also seen a boom in India. Not only more people are opting for it, but more and more insurance providers are also joining the league increasing competition and encouraging more breakthrough products in the future. The healthcare industry seems to be one of the most promising areas of investment for sure.

Here are some stocks that you can look out for:

| S.no | Stocks Name | Market Capitalization(in Cr) | P/E Ratio | 5 Years Returns (%) |

| 1. | Sun Pharmaceutical Industries | 3,56,625.2 | 40.04 | 227.55 |

| 2. | Divi’s Laboratories | 1,01,315 | 73.26 | 123.17 |

| 3. | Dr Reddy’s Laboratories | 99,276.9 | 18.99 | 115.01 |

| 4. | Cipla | 1,12,938.4 | 30.46 | 147.59 |

| 5. | Apollo Hospitals Enterprise | 90,042.3 | 114.08 | 415.18 |

2. Renewable Energy Sector

Energy is another sector that might interest investors who are looking best sectors to invest in India for the long term. More and more initiatives being taken towards encouraging the use of solar energy in India have led tons of investors to have an interest in the renewable energy sector.

Not only solar, the Indian government is also working towards setting up offshore wind energy projects which will, in turn, give financial boom to the wind energy sector also.

Considering the renewable energy industry already has the government’s support and motivation, this can be a really good sector to invest in.

If you are looking to get some good returns in the future. Here are some stocks that you might need to check out.

Following are some of the companies worth considering in this sector in India:

| S.no | Stocks Name | Market Capitalization(in Cr) | P/E Ratio | 5 Years Returns (%) |

| 1. | Reliance Industries | 19,62,577.6 | 28.19 | 111.63 |

| 2. | Oil & Natural Gas Corporation | 3,51,430.1 | 8.38 | 67.43 |

| 3. | NTPC | 3,40,886.3 | 18.94 | 167.86 |

| 4. | Adani Green Energy | 2,86,424.8 | 196.45 | 4115.47 |

Read more: Electric Vehicle Stocks to Invest in India

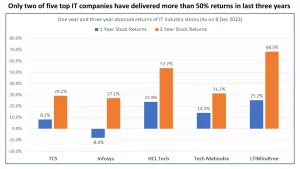

3. IT Sector

Another sector that has huge potential in India is the IT sector. The ever-rising demand for software development and maintenance service providers international clients have started showing interest in India, therefore, the Indian IT sector is moving towards a significant growth figure and we can definitely expect the sales to touch $300Bn by 2025.

Adding to this the government is taking several steps to digitize India and spread the use and benefits of digital technology to all the Indians which in turn will also lead to the IT sector’s growth. Without saying, the IT industry of India has great potential and can be a very good investment for your capital. Here are some stocks from the IT sector that hold good potential.

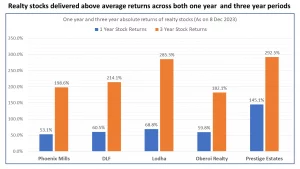

4. Real Estate Sector

Indian Real Estate sector is yet another potential success story that can prove to be a very good investment for your capital. However, there have been many challenges in this sector in terms of decreased demand due to affordability or maybe delayed possessions or no possessions at all.

Here are some of the real estate stocks you might want to add to your portfolio:

| S.no | Stocks Name | Market Capitalization(in Cr) | P/E Ratio | 5 Years Returns (%) |

| 1. | Indiabulls Real Estate Ltd. | 7,377.6 | NA | 15.82 |

| 2. | Oberoi Reality | 54,577 | 33.71 | 191.60 |

5. Fast-Moving Consumer-Goods Sector (FMCG)

Another industry that will surely be required to serve the changing lifestyle of the Indian audience is the FMCG industry. The industry offers goods, including packaged food and drinks, toiletries, and cleaning supplies. Indian consumers are getting more and more enlightened about how they can maintain a healthy lifestyle, and the demand for organic and chemical-free goods is also increasing.

This means there will be an increased demand for more R&D in the industry, hence more and more companies are pitching in money. Another major factor that is empowering the growth of this industry is the e-commerce revolution of the FMCG industry. If you invest in the FMCG sector, be ready for some possible good things ahead!

Here are some stocks you might want to look out for:

| S.no | Stocks Name | Market Capitalization(in Cr) | P/E Ratio | 5 Years Returns (%) |

| 1. | Hindustan Unilever Ltd. | 5,21,962 | 50.79 | 26.65 |

| 2. | ITC Ltd | 5,49,265.32 | 26.78 | 45.41 |

| 3. | Nestle India Ltd | 2,39,477 | 74.93 | 130.41 |

| 4. | Britannia Industries | 1,15,557.8 | 53.49 | 65.74 |

| 5. | Godrej Consumer Products | 1,22,958.35 | 68.89 | 86.87 |

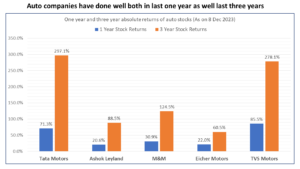

6. Automobile Sector

Another sector that holds 7% of the Indian GDP is the automotive sector. This also can be a very promising sector for your potential investment. Although the sales of two and four-wheelers saw a slowdown after the pandemic, the Indian government has taken many steps to bring back the sales numbers.

Schemes like Faster Adoption and Manufacture of Electric Vehicles (FAME), Production Linked Incentive (PLI), and more encourage both the buyers and the manufacturers to invest more in the business area in terms of both production, buying, and R&D. Everything, collectively will fuel India’s automotive sales in the future. Here are some stocks that you might be interested in:

Following are some of the companies worth considering in this sector:

Related Posts

Striders Impex IPO Listing Preview: What to Expect Now?

Acetech E-Commerce IPO Allotment Status: 0.85x Subscribed, GMP Flat — Check Online

Acetech E-commerce IPO Day 3: Subscription at 0.85x, GMP Flat | Live Updates

Why is Asian Paints’ Share Price Falling?

Highest Dividend Paying Stocks in India