Best Footwear Stocks in India

Posted by : Ketan Sonalkar | Tue Jan 16 2024

Best Footwear Stocks in India

India’s footwear market is not merely a bustling bazaar; it’s a meticulously choreographed ballet, each step pulsating with the rhythm of a billion-dollar industry. Poised to pirouette from a graceful $15.22 billion waltz to a breathtaking $35.43 billion crescendo by 2029, this market, fueled by the aspirational arabesques of a rising middle class, evolving lifestyles, and swelling disposable incomes, has captivated the attention of investors yearning to join the grandpas. However, before donning their investment tutus and leaping into this lucrative arena, navigating the intricate footwork, potential stumbles, and strategic pliés is crucial for a successful performance.

India, the second-largest producer and buyer of shoes in the world, now has this unique opportunity to leverage innovation, technology and customer demand to take the industry to new heights. Moreover, digitalisation, large-scale tech adoption, endeavours like Make-in-India and Startup India have unlocked new opportunities, leading to new trends in this industry contributing to growth.

Demystifying the Terrain:

India’s footwear landscape is a vibrant tableau woven with established ballets by Bata India and Liberty Shoes, nimble start-up pirouettes, and international powerhouses vying for centre stage. While this fierce competition fuels innovation and keeps prices competitive, it also presents its own grand jetés. Economic dips can dampen consumer pirouettes, seasonality dictates revenue streams, and reliance on imported raw materials adds a touch of unpredictability. Government policies, like import duties and regulations, can also play the role of conductor, influencing profitability and dictating the tempo of the market

The Champions Take the Spotlight:

Despite the inherent challenges, the market boasts a league of resilient performers, their market capitalizations a testament to their agility and unwavering presence:

- Relaxo Footwear: The undisputed prima ballerina, waltzing gracefully with a market cap of ₹7,974 Cr. The management stated that volume growth in H2 is likely to be normalised to 15%, led by closed footwear. In Q4FY23, it highlighted that it will target 15-20% volume growth in FY24. Triggeres for growth include that demand is likely to recover in FY24, especially in rural India. The company is doubling its capacity of Sparx from the current 50,000 pairs/day to 100,000 pairs/day at Bhiwadi in Rajasthan.

- Bata India: A seasoned veteran, still holding centre stage with a market cap of ₹2,921 Cr. Over the last couple of years, following the change in management, a renewed focus on growth has been evident, catalysed by a brand refresh, introduction of new product lines (such as the newly launched sneaker segment), and enhancements to the backend supply chain infrastructure. The management expects double-digit revenue growth in the medium term, on the back of high single-digit SSSG. It expects premiumization to further boost this revenue.

- Campus Activewear: Injecting youthful energy and capturing the athleisure trend, its market cap steps in at ₹2,230 Cr. According to the management, upcoming elections, strong monsoon, and the impending festive season could revive revenue growth and margin improvement in H2FY24. Price sensitivity in the Campus products is strong. Company has not taken any significant price hike and intends to sell a majority of the products at full price. Online sales grew 10% YoY while D2C offline jumped 82% YoY due to store additions in Q2FY24.

- Khadim India: Catering to regional nuances and building a loyal fan base, its market cap stands at ₹1,518 Cr. The Company is the second largest footwear retailer in India in terms of number of exclusive retail stores operating under the Khadim’s brand, with the largest presence in East India and one of the top three players in South India. The Company also has the largest footwear retail franchise network in India.

- Metro Brands: The market leader in this segment in terms of market capitalization which stands at Rs Rs 35,331 Cr. Metro Brands is one of the largest Indian footwear speciality retailers, and are among the aspirational Indian brands in the footwear category. The Company retails footwear under its own brands of Metro, Mochi, Walkway, Da Vinchi and J. Fontini. The company opened its first store under the Metro brand in Mumbai in 1955, and as per latest count, the company operates 624 Stores across 142 cities spread across 30 States and Union Territories in India.

Why Join the Investment Tango?

While competition and uncertainties may tango hand-in-hand, the Indian footwear market offers investors an alluring fandango of opportunities:

- High-Growth Potential: The projected CAGR of 12.83% over the next five years is akin to a captivating rhythm, promising investors the melody of long-term returns.

- Rising Brand Swagger:Indian footwear brands are shedding their outdated tutus, strutting onto the scene with avant-garde designs, superior craftsmanship, and competitive pricing, captivating a larger share of the consumer’s imagination.

- Governmental Applause: Initiatives like “Make in India” and policies supporting domestic manufacturing act as a supportive chorus, attracting investments and fostering sustainable growth.

- Portfolio Diversification: Investing in footwear adds a new rhythm to your portfolio, mitigating risks associated with other sectors and creating a more resilient financial pirouette.

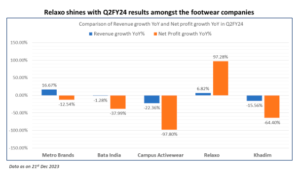

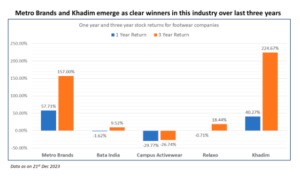

In 2023, most other footwear brands in the mid-price and value segment lost the price war to the unorganised sector, Metro Brands, which focused on the premium segment, retained its market position. Its target was the modern consumer with enough disposable income to spend on premium brands. Metro Brands is better placed than others because about 86% of its portfolio is premium, i.e above Rs 1,500. The contribution of premium footwear is far less for Bata India, Relaxo Footwear or Campus Activewear.

In 2023, most other footwear brands in the mid-price and value segment lost the price war to the unorganised sector, Metro Brands, which focused on the premium segment, retained its market position. Its target was the modern consumer with enough disposable income to spend on premium brands. Metro Brands is better placed than others because about 86% of its portfolio is premium, i.e above Rs 1,500. The contribution of premium footwear is far less for Bata India, Relaxo Footwear or Campus Activewear.

Stepping into others shoes:

One classic example of how brand recall plays out in this sector is the case study of Woodland shoes. The owners of the “Woodland” brand were suppliers to multinational brand “Timberland”. While Woodland began selling its shoes in 1993, Timberland was not present in the Indian market.

When they entered the Indian market in the mid 2000’s, they were unable to make significant sales. The reason was that customer perception saw it as a much more expensive copy of “Woodland”, whereas in reality it was Woodland which was inspired by Timberland. After a lot of legal wrangles, Timberland finally quit the Indian market in 2015 as the perception built around it was more negative and Woodland flourished in the same period. This also speaks of the fact that an Indian customer is a cost conscious customer and is willing to pay a premium for quality but not an exorbitant premium.

The Final Step:

The Indian footwear market, with its energetic growth and alluring potential, beckons investors to join its captivating ballet. However, like any complex choreography, informed steps and meticulous planning are crucial. Analyze the competitive landscape with the precision of a seasoned grand maître, assess the impact of economic cycles with the foresight of a choreographer, and stay abreast of evolving government policies with the agility of a prima ballerina. Remember, diversification is your key partner, and risk management, your guiding light. With these elements in your arsenal, step confidently onto the dance floor and allow the Indian footwear market to serenade you with its rhythmic returns.

Encore: Addressing Investor Doubts (FAQs)

Navigating an investment landscape inevitably stirs doubts. To address some of the most pressing concerns:

Can Indian brands compete with international giants?

While international brands still hold a prominent role, Indian brands are rapidly closing the gap. Their focus on innovative designs, quality improvement, and competitive pricing is already propelling them into the global arena, as evidenced by successful export ventures.

Is the sector experiencing sluggish growth?

While the market may encounter occasional dips, the long-term trajectory is undeniably upward. The projected CAGR paints a clear picture of sustained growth, offering investors a promising outlook.

Is there dumping from China?

Concerns about dumping impacting domestic players are valid. However, the government has implemented safeguard duties to protect the local industry and ensure a fair competitive environment.

Should I invest in this sector?

Ultimately, the decision rests on your individual risk appetite and investment goals. However, the Indian footwear market, with its robust growth potential, strong fundamentals, and diversification benefits, warrants serious consideration from long-term investors seeking

Related Posts

Striders Impex IPO Listing Preview: What to Expect Now?

Acetech E-Commerce IPO Allotment Status: 0.85x Subscribed, GMP Flat — Check Online

Acetech E-commerce IPO Day 3: Subscription at 0.85x, GMP Flat | Live Updates

Why is Asian Paints’ Share Price Falling?

Highest Dividend Paying Stocks in India