Bajaj Auto rides into top gear with Q3FY23 Results

Posted by : Sheen Hitaishi | Sat Jan 28 2023

Bajaj Auto, the flagship company of Bajaj Group, is a two-wheeler and three-wheeler manufacturing company that exports to 79 countries across several countries in Latin America, Southeast Asia, and many more. It has acquired 48% of the KTM Brand which manufactures sports and super sports two-wheelers, which was 14% in 2007 when the company first took a stake in KTM.

Bajaj Auto announced their Q3FY23 results on 25th January 23 and on the next trading day, the stock shot up 6% on a day when many stocks fell drastically due to Hindenburg’s report on Adani group. So, let’s now analyze their Q3FY23 numbers & check if there is any more upside potential.

Bajaj Auto beats Q3 profit estimates on higher prices, domestic demand

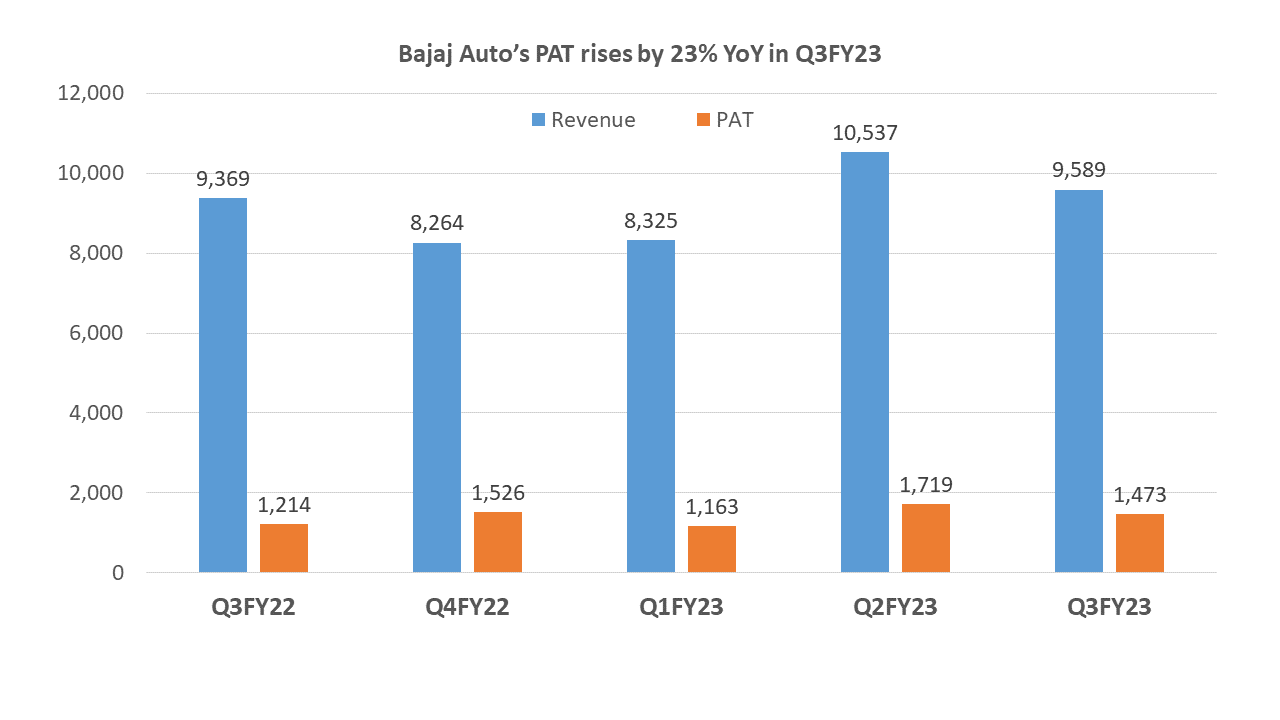

Bajaj Auto reported a nearly 23% YoY rise in net profit in Q3FY23 to Rs 1,473 crore, as compared to Rs 1,214 crore in Q3FY22. Revenue from operations came in at Rs 9,315.14 crore, up 3% YoY with robust double-digit revenue growth in the domestic business offsetting the drop in exports arising from the challenging market context. Overall spares revenue came in at an all-time high, the company said.

The Q3FY23 EPS (Earning per share) is 52, up 5.8% compared to Q3FY22. While Maruti Suzuki reported the All time high EPS, on a QoQ basis Bajaj Auto’s EPS has decreased from 60 to 52.

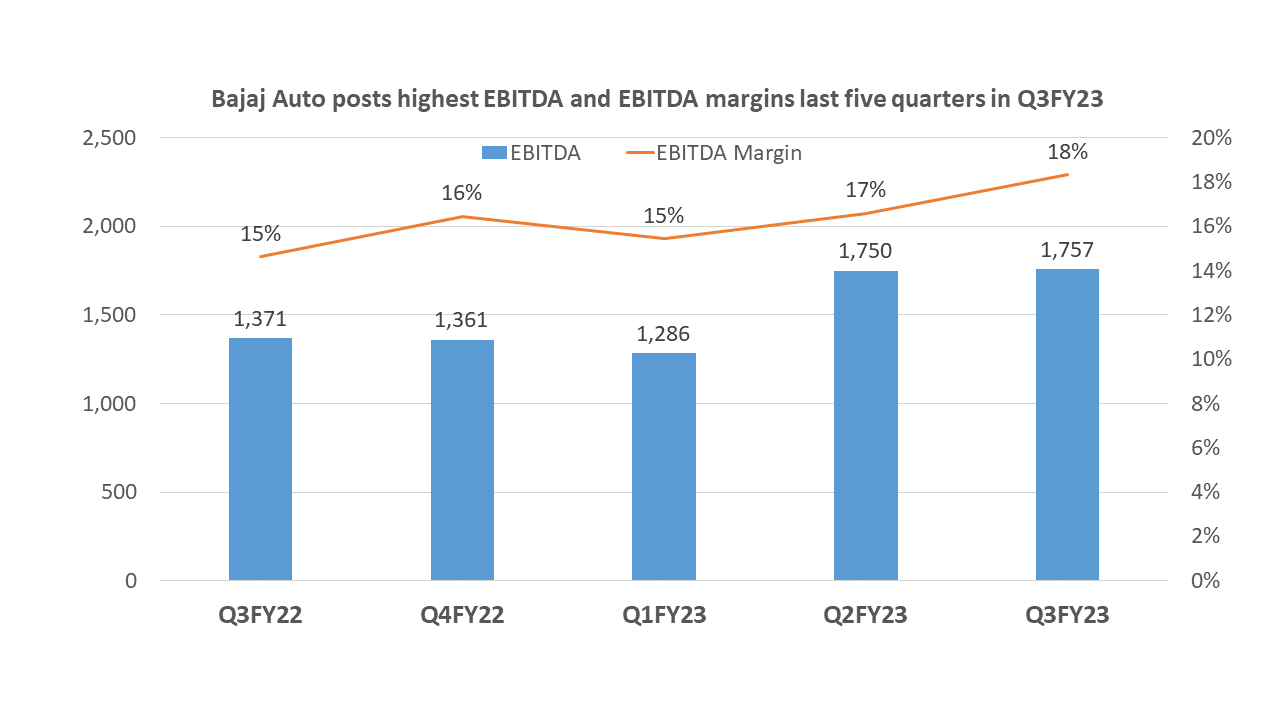

Bajaj Auto sees the highest Profit Margins in the last five quarters in Q3FY23

Meanwhile, EBITDA margins rose to 18.3% in Q3FY23 as against 14.6% in Q3FY22. This was led by judicious pricing, better dollar realization, and a richer product mix. Operating profit, calculated as earnings before interest, taxes, depreciation, and amortization (EBITDA), rose by a sharp 29.4% YoY to Rs 1,757 crore and margins expanded by a whopping 386 basis points to 18.3%. Bajaj Auto’s total expenses dropped 1% in the third quarter.

Meanwhile, EBITDA margins rose to 18.3% in Q3FY23 as against 14.6% in Q3FY22. This was led by judicious pricing, better dollar realization, and a richer product mix. Operating profit, calculated as earnings before interest, taxes, depreciation, and amortization (EBITDA), rose by a sharp 29.4% YoY to Rs 1,757 crore and margins expanded by a whopping 386 basis points to 18.3%. Bajaj Auto’s total expenses dropped 1% in the third quarter.

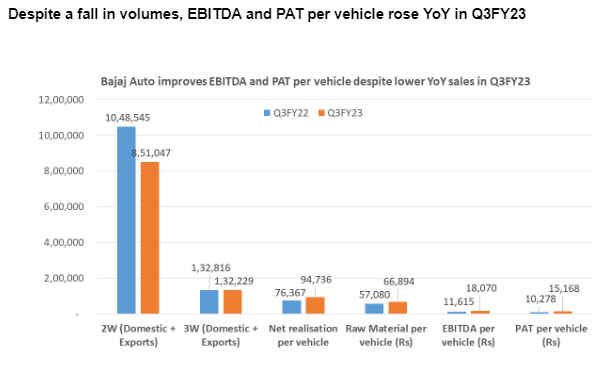

Exports, which accounted for 45% of the total sales volume, declined a sharp 33% YoY in the quarter to 439,088 units, and 4% sequentially. While the Company continues to navigate this situation through decisive actions, market share remains stable and the resilient performance in ASEAN is alleviating in part, the drop in volumes across other regions. The domestic sales volume grew 4% YoY to 544,188 units but fell a sharp 22% sequentially. As a result, the total sales volume declined 17% YoY and 15% sequentially to 983,276 units.

Business Highlights

In this quarter, Bajaj Auto launched the all-new Pulsar P150, N160, and P125 carbon fibre, continuing to display solid traction across markets. Commercial vehicles maintained their path of recovery to pre-covid levels (now at -75%), as the quarter saw strong growth with stepped-up volumes and market share hit an all-time high across segments. The Chetak EV business continues to steadily expand – volumes are up 5x over the previous year.

Univest view with Technical analysis

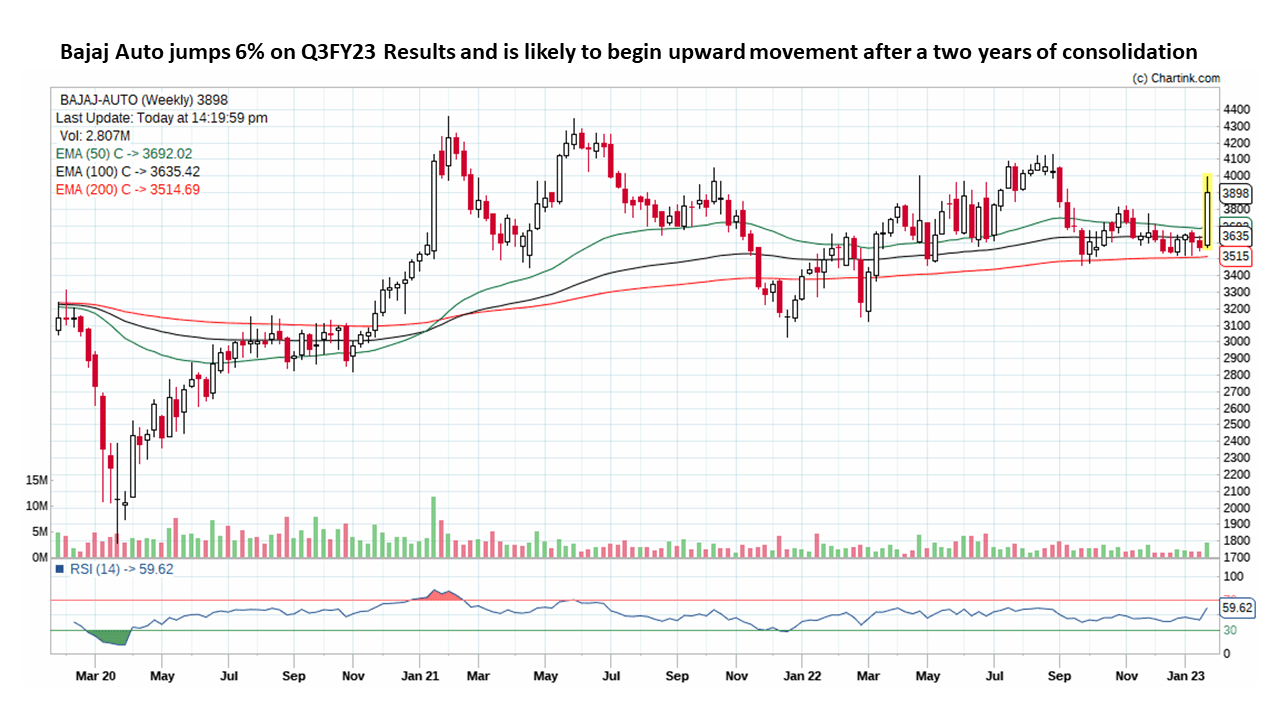

On Friday, Bajaj Auto scrip was up 6% to touch Rs 3,995.00 apiece on NSE. The stock climbed 14% last year, compared with the Nifty auto index’s 15% gain.

On the Univest App, the company has a buy rating, having strong fundamentals but a bullish stance for short-term and for long-term trend. This can be a bottoming-out scenario, with good stock price growth along with volumes, and the stock is likely to begin a new uptrend. There is strong resistance at 4131, whether it sustains or not is something time will tell.

The stock price is trading above the moving averages as shown in the graph, which is a good sign of positioning toward a bullish move. The Relative Strength Index in the Daily timeframe has crossed 70, both weekly and monthly rejected from 50, which supports the above statement. From this, we can expect overall good performance in the Automobile sector.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purposes only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Reliance Industries Q3FY23 Results: Strong growth in Retail and Jio

Related Posts

Karbonsteel Engineering IPO GMP & Review: Should You Apply or Avoid?

Taurian MPS IPO GMP & Review: Should You Apply or Avoid?

Shringar House of Mangalsutra IPO GMP & Review: Apply or Avoid?

Dev Accelerator IPO GMP & Review: Apply or Avoid?

Vigor Plast India IPO Listing Preview: What to Expect Now?