Auto Sales data June 2023 – Domestic demand remains strong

Posted by : Sheen Hitaishi | Mon Jul 10 2023

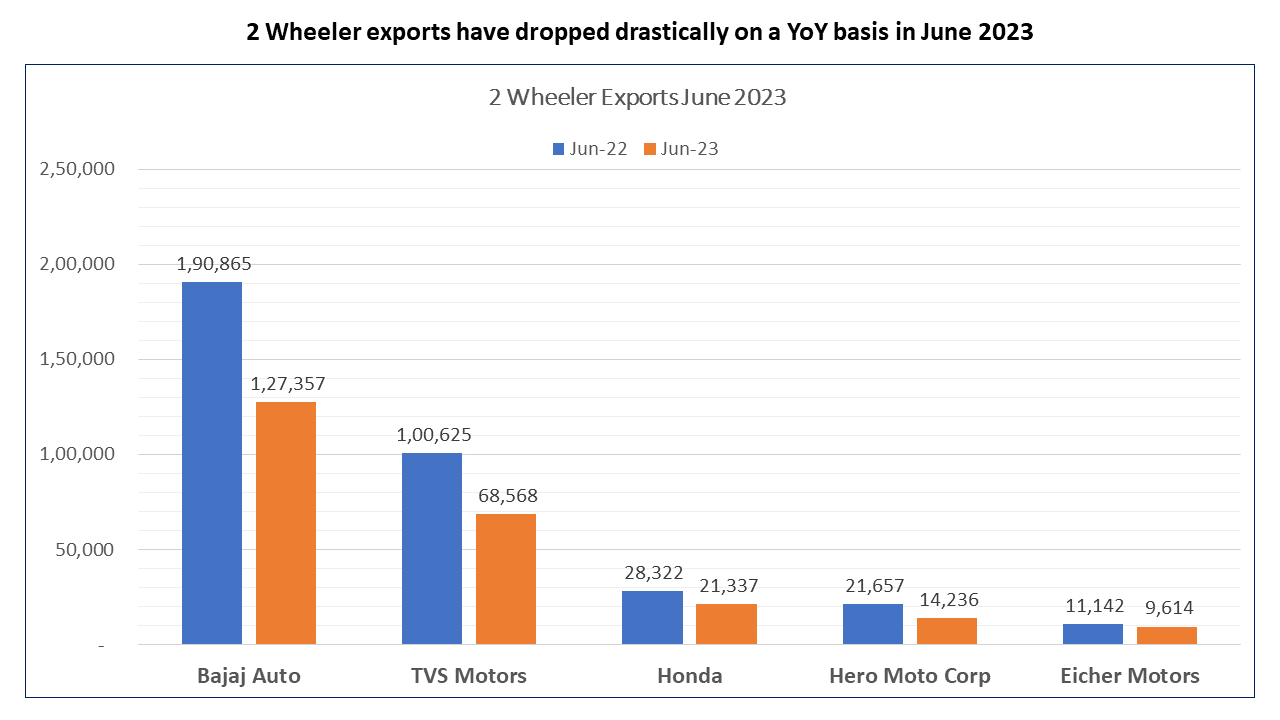

The data for June auto sales showed certain key trends. Sales of electric two wheelers have fallen sharply after the Government reduced the FAME subsidy. Maruti maintained its leadership in the passenger vehicle segment and also has received a favourable response to its new launches. Two wheeler (ICE) saw healthy domestic demand but exports fell across the board

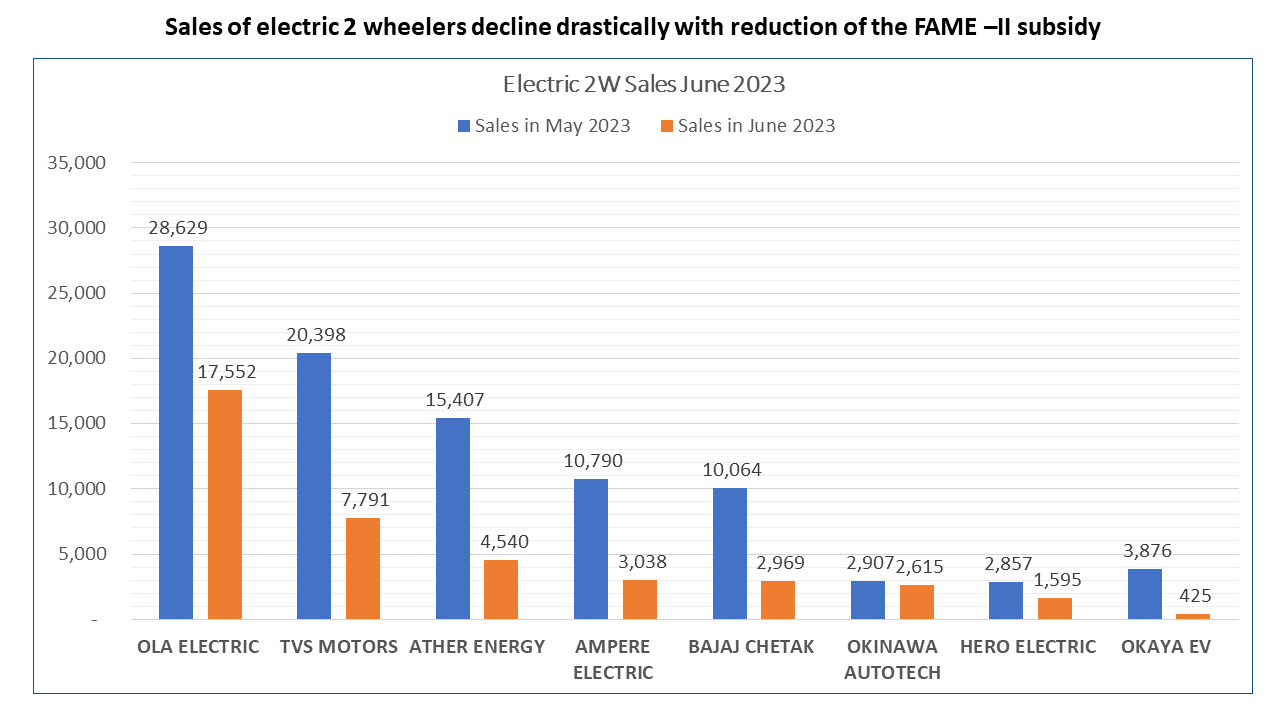

Electric two-wheeler sales, which had reached new highs in May, saw a sudden fall in June this year. Sales of electric two-wheelers dropped month-by-month by 61%. They were severely impacted after the government reduced the FAME II subsidy on electric vehicles.

The reduction in the FAME-II subsidy by the Ministry of Heavy Industries is significantly impacting the growth of India’s electric two-wheeler market. The sudden decline in registration and sales of two-wheelers is a direct result of capped incentives, leading to increased retail prices across the EV two-wheeler industry.

While the government claimed that it reduced the subsidy to promote the incentive scheme and ensure a larger number of people benefit from the allocated Rs 10,000 crore subsidy, manufacturers such as Ola, TVS, and Ather had to raise the prices of their electric scooters.

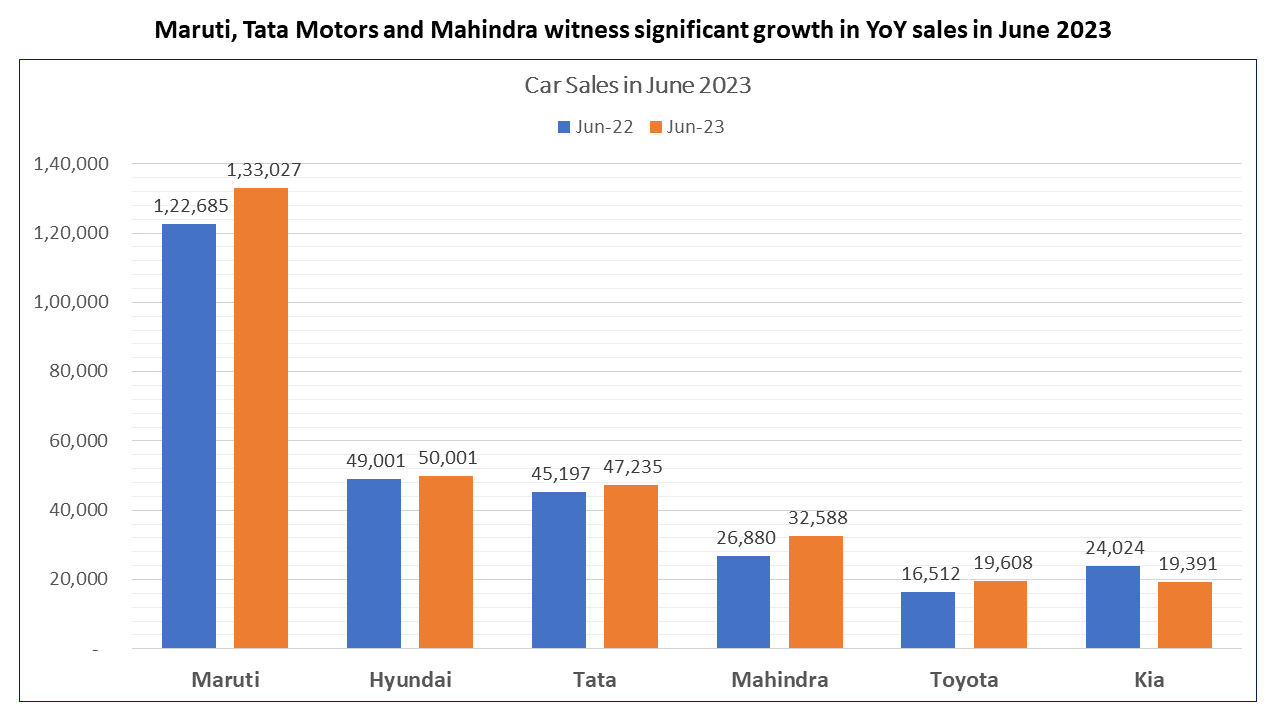

Nearly 3.27 lakh passenger cars were sold in the Indian market in June 2023. The easing of semiconductor supplies has led to a surge in dispatches by automakers and increased stock at dealer networks. Stock levels at dealerships have already reached pre-COVID levels, and the waiting period for all models has now reduced.

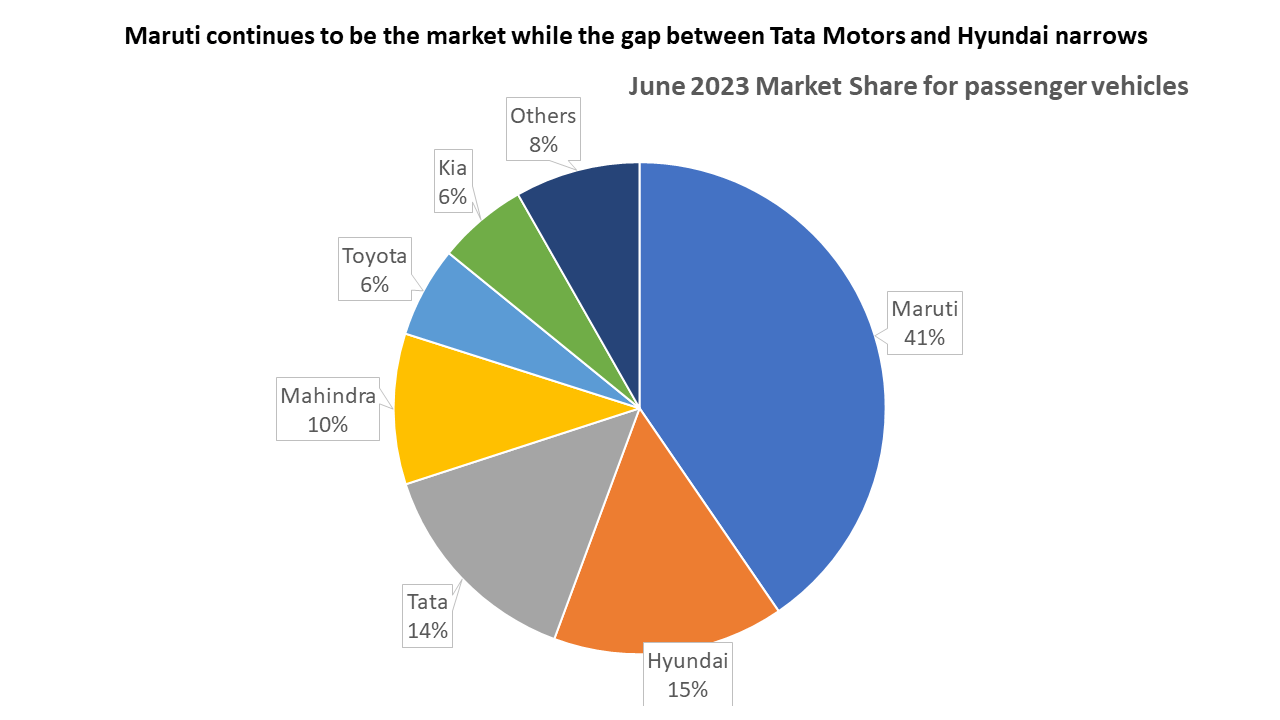

Maruti retained its leadership in the passenger vehicle segment with a 41% market share in June. The new launches have received a favorable response, with 8.3% of Maruti Suzuki’s sales this month coming from new launches. Specifically, 11,062 units of Jimny and Fronx were dispatched in June ’23.”

Tata Motors dispatched a total of 47,235 units in June, marking a 4.5% year-on-year (YoY) increase and a 3% month-on-month (MoM) increment. Additionally, Tata Motors reported its highest-ever quarterly sales of 19,346 units in Q1 FY24, reflecting a remarkable growth of 105% compared to Q1 FY23. In terms of market share, Tata Motors has only a 1% difference with Hyundai Motors. With new launches like the Altroz CNG, it may replace Hyundai as the runner-up in the passenger vehicle segment.

Hyundai reported wholesales of 50,001 units in June, representing a 2% YoY increase over June 2022, when it sold 49,001 units. This marks the third month in 2023 that Hyundai has surpassed the 50,000 mark. Hyundai is planning to launch the Exter in July 2023, aiming to widen the gap with Tata Motors.

Mahindra & Mahindra’s passenger vehicle dispatches to dealerships saw a significant 21% jump to 32,588 units in June, driven by robust demand for SUVs. There is also excitement in the market about the soon-to-be-launched five-door Thar.

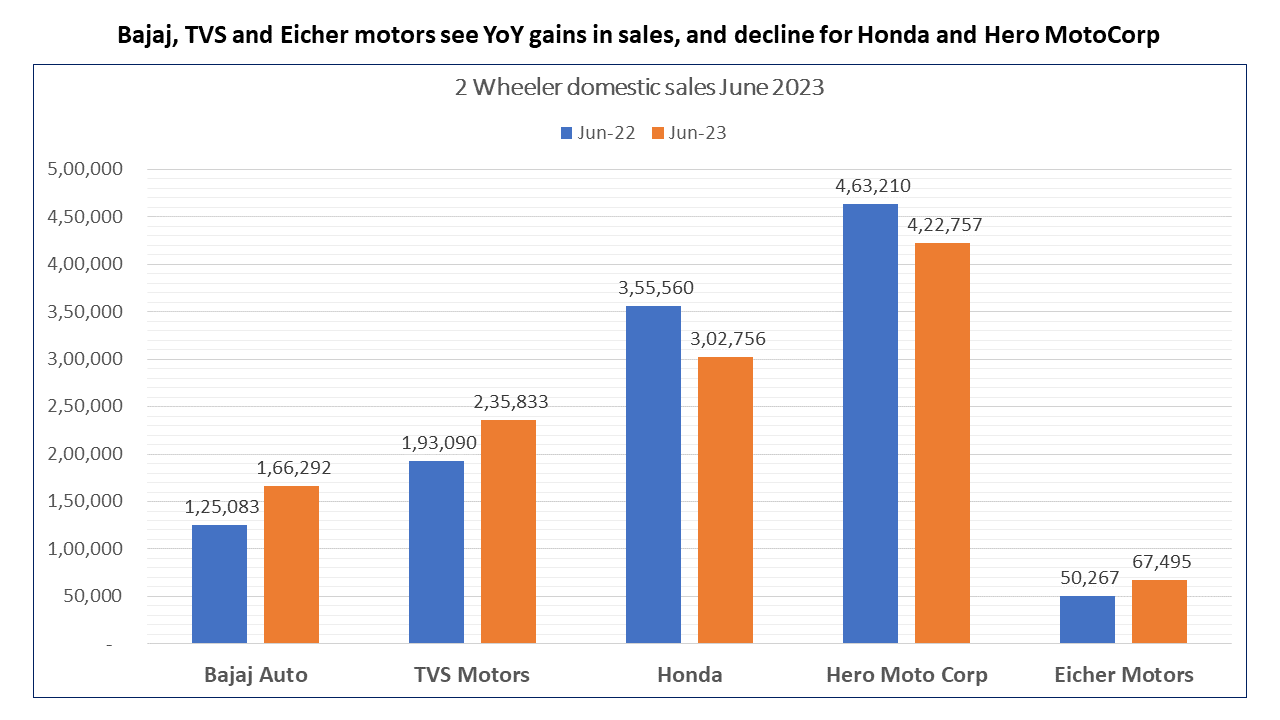

In the ICE (Internal Combustion Engine) two-wheeler segment, Bajaj, TVS Motors, and Eicher Motors saw domestic sales rise on a year-on-year (YoY) basis. In the coming months, we are likely to witness a fierce battle for market share in the motorcycle above 300 cc category. Eicher Motors, with its iconic “Royal Enfield” brand, is the leader in this category. Hero MotoCorp and Bajaj are entering this segment through foreign partnerships.

Hero will be distributing the Harley-Davidson X440, which it has developed in collaboration with the American parent company Harley Davidson. Triumph is set to launch the all-new Speed 400 and Scrambler 400 X, both built in India by Bajaj.

Exports have been a key component for Indian two-wheeler manufacturers. While exports were performing well until some time ago, the last few months have seen a decline. In June this year, export numbers fell across the board for all Indian manufacturers.

The reason for this decline is the economic conditions of the importing countries. The majority of their overseas market footprint is in emerging and developing economies. India’s top markets for two-wheeler exports are Colombia, Nigeria, the Philippines, Mexico, and Nepal. Meanwhile, Nigeria, Somalia, the UAE, Iraq, and Mexico are among the top destinations for three-wheeler exports. All of these countries are currently facing economic challenges such as high inflation and currency depreciation.

Many two-wheeler companies are now looking to rework their export strategies and enter newer markets such as New Zealand, Australia, Colombia, and the Philippines.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Astral – A building materials behemoth in the making

Related Posts

Khazanchi Jewellers Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

Kesar Enterprises Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

J.G. Chemicals Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

IFGL Refractories Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

EFC Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here