Asian Paints reported robust volume growth despite margins under pressure

Posted by : Sheen Hitaishi | Wed Nov 16 2022

Asian Paints (APL) is India’s largest decorative paint company. The company derives 98% revenue from the paints business while 2% business comes from the home improvement business. It has a market cap of Rs 2,97,098 crores along with a strong distribution network of 70,000 dealers, almost 2x more than the No. 2 player.

The company on 20th October’22 announced their Q2FY23 results, where it saw continued pressure on margins which was further pushed due to increased CapEx. On the margins front, raw material inflation hit the company badly, due to which Asian Paints saw its margin % contracting. While the company still reported double-digit growth across PAT & revenue, they couldn’t win investors’ support, as the stock continuously produced red candles on the technical charts post the results. So, let’s now analyse their Q2FY23 numbers and check whether this correction offers an opportunity for investors.

Asian Paints results Q2FY23: Revenue grew 19% YoY along with robust double digit volume growth in different paint segments

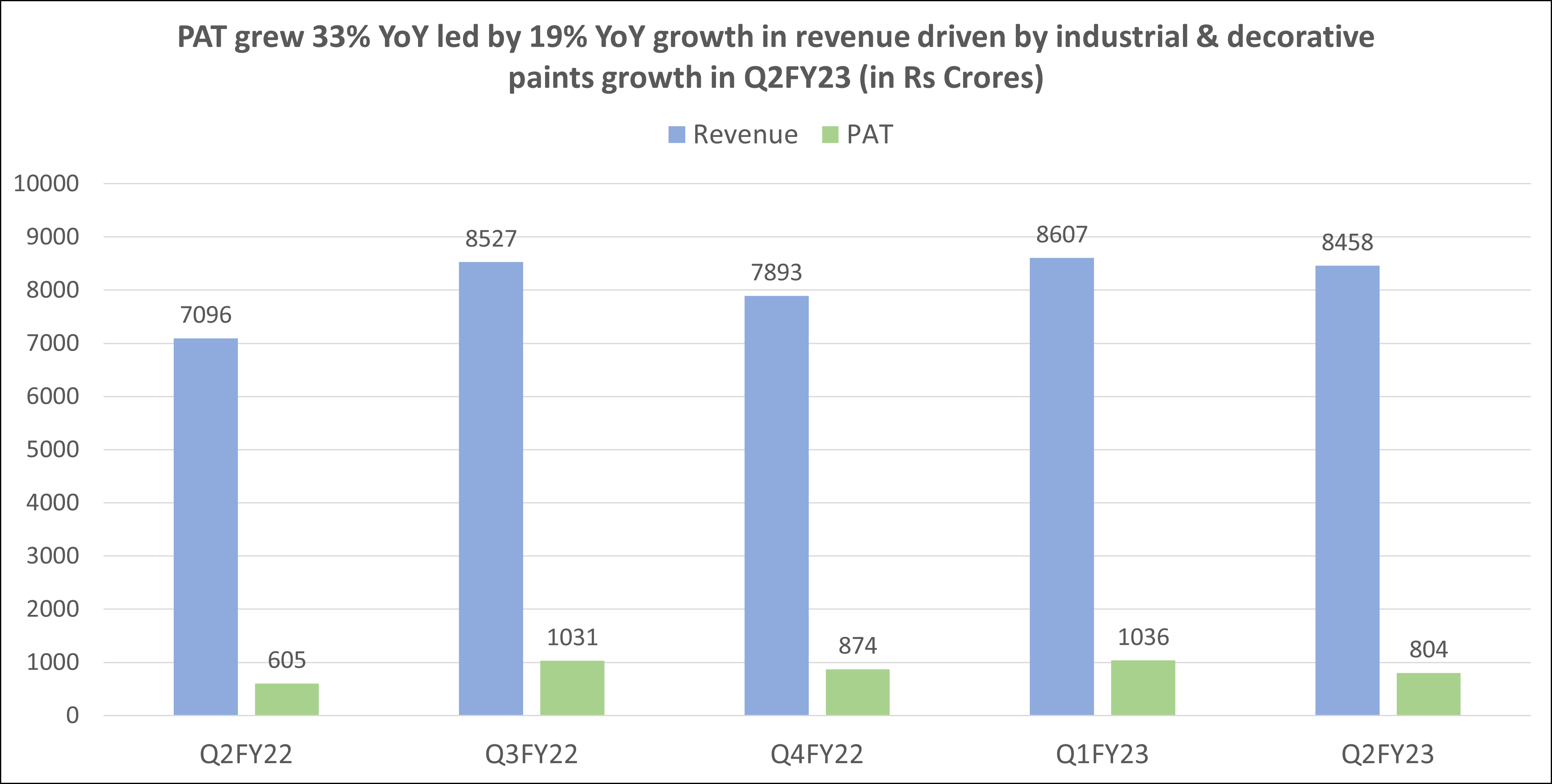

PAT increased by 33% YoY to Rs 803.8 crore from Rs 605 crore in Q2FY22, due to robust top-line growth. Additionally, increased growth in both the industrial and decorative paints sectors drove the consolidated revenue growth of 19% YoY to Rs 8,457.6 crores from Rs 7096 crores in Q2FY22. While sequentially, the revenue and PAT both decreased by 1.7% and 22.4% when compared to the Q1FY23 figure.

In order to offset rising raw material costs, the company raised prices by 1% in Q2FY23 (in addition to a 22% price increase in FY22 and a 2% price increase in Q1FY23).

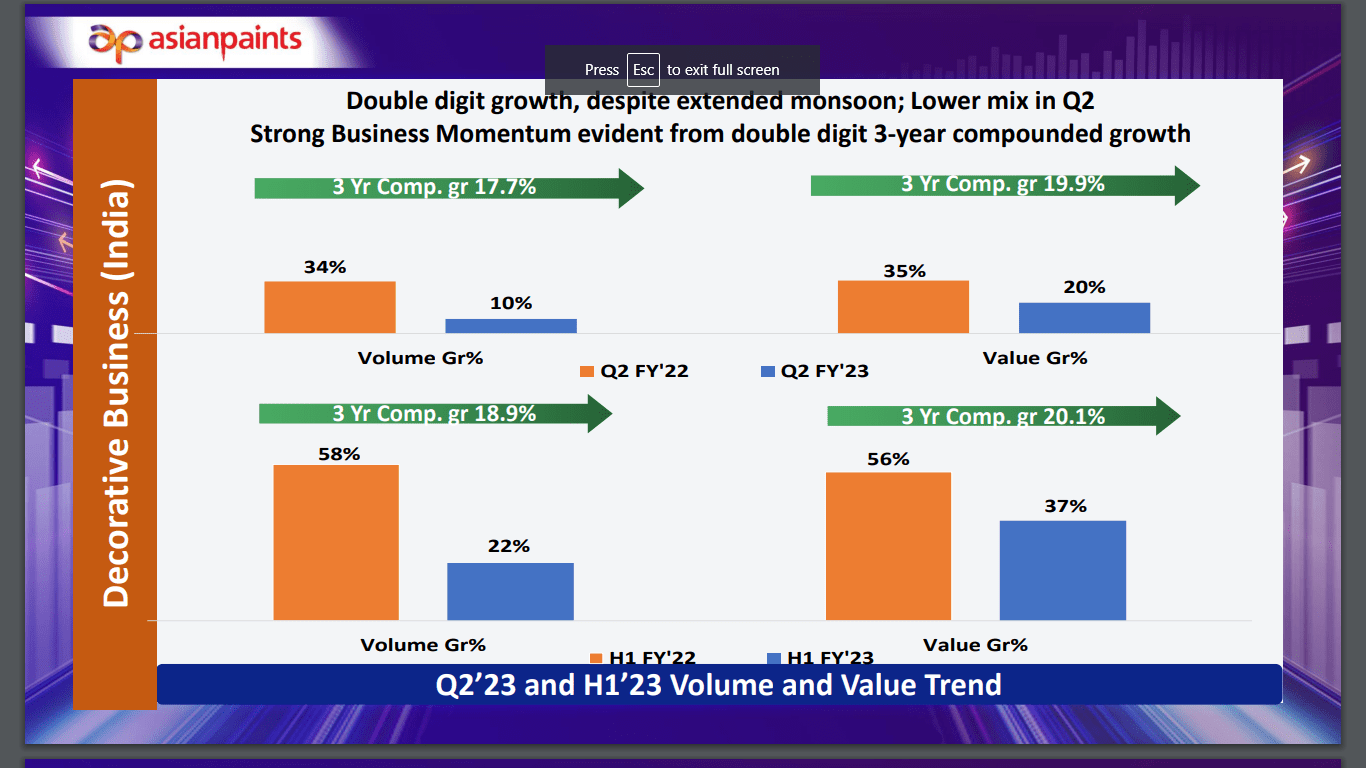

With a 10% increase in volumes, Asian Paints also maintained its double-digit volume growth trend. Cities in Tiers 3 and 4 experienced greater growth than T1 and T2 centres.

The management confirmed the robust demand outlook for H2FY23 for both decorative and industrial paint, driven by the holiday and wedding seasons as well as the recovery in the automobile industry. Future increases in the market for decorative paints in rural areas would be aided by good monsoon conditions.

As a result, the management has kept its double-digit volume growth forecast for the years FY23 to FY24E, which will be driven by strong demand from tier III and tier IV cities as well as new product releases.

(Source: Investor Presentation of Asian Paints for Q2FY23)

Asian Paints results Q2FY23: Raw Material inflation delayed margin recovery

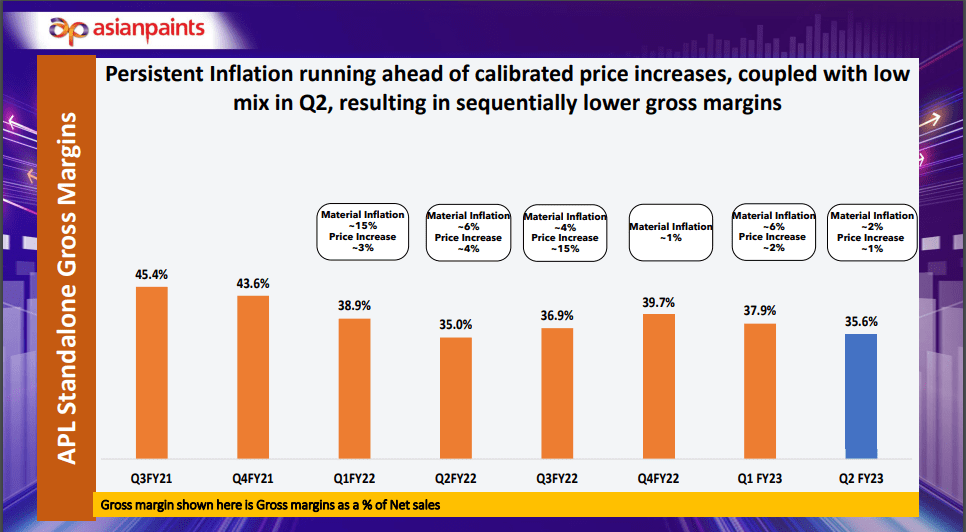

Due to a delayed price increase and a poor product mix, the gross margin decreased by 197 bps QoQ (up 98 bps YoY) in Q2FY23. Asian Paints increased prices by 1% in Q2FY23 despite a 2% increase in material prices. As a result, the gross margin decreased to 35% in Q2FY23 from the previous quarters’ range of 36-38%.

(Source Investor Presentation of Asian Paints for Q2FY23)

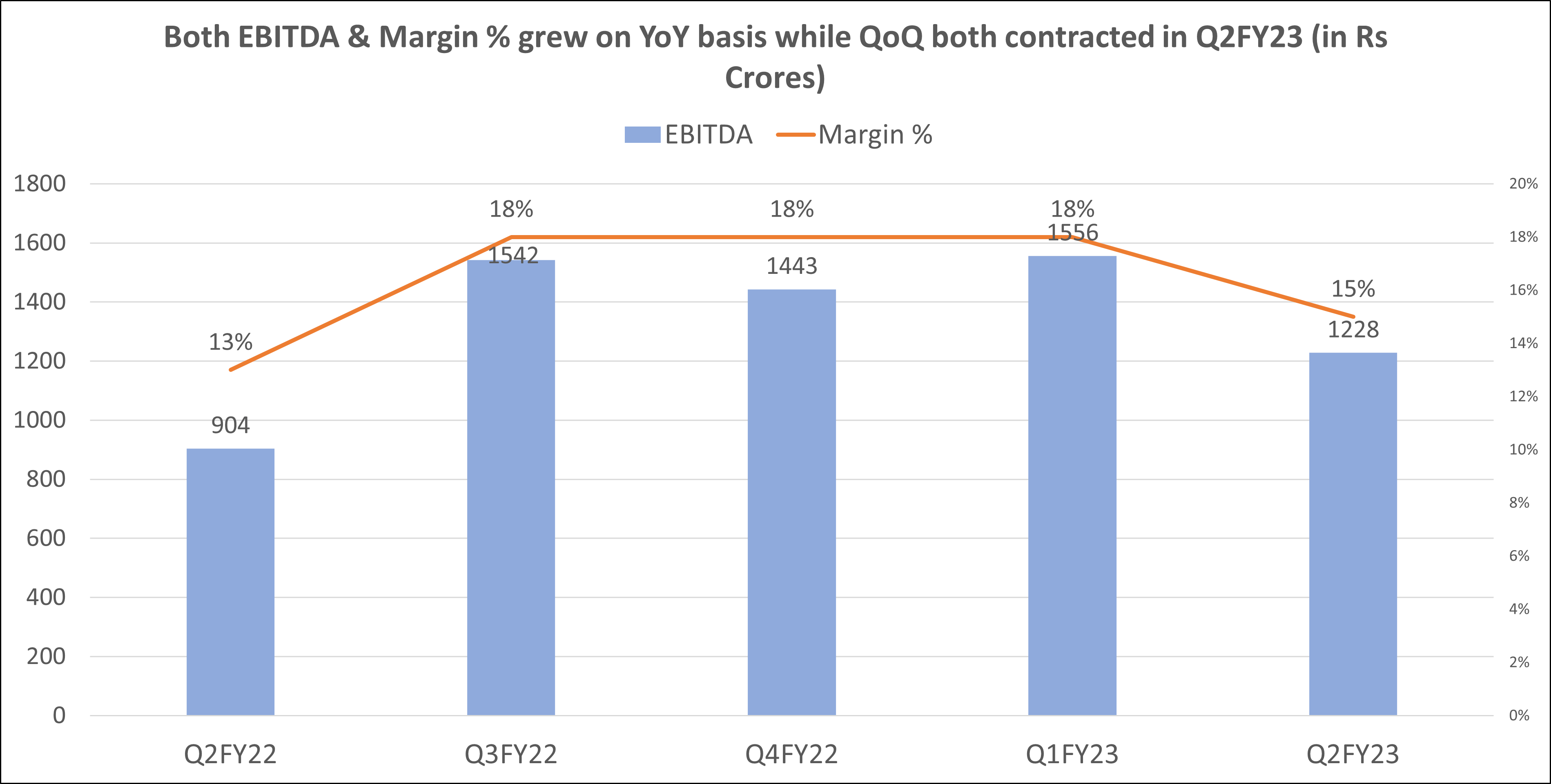

Whereas in absolute terms, EBITDA increased 35.8% YoY to Rs 1,228 crores from Rs 904 crores in Q2FY22. While EBITDA fell 21% QoQ from Rs 1,556 crores reported in Q1FY23. Due to this fall, EBITDA Margin% also fell from 18% in Q1FY23 to 15% in Q2FY23, a 300 Bps fall.

You may also like: Bajaj Auto Q2FY23

Asian Paints results Q2FY23: Capex Plans moving ahead

Over the following three years, the company plans to invest a total of Rs 6,750 crore. Out of this, Rs 3400 crore would be utilised to increase capacity, Rs 2,550 crore for backward integration, and Rs 800 crore will be used for inorganic expansion prospects, including recent acquisitions of White Teak and Weather seal.

Further, Asian Paints will be increasing its in-house paint manufacturing capacity by more than 30% to 2.3 million tonnes per annum.

New Opportunity to gain Competitive Edge

In order to manufacture Vinyl Acetate Monomer (VAM) and Vinyl Acetate Ethylene Emulsion (VAE) in India, the company would engage in backward integration. The primary emulsion used to create eco-friendly paints is VAE, and the primary raw material needed to create VAE is VAM. India currently relies solely on imports for VAM & VAE. The company will thus get a competitive edge by producing VAM & VAE in India.

The installation of 1.5 lakh tonnes of installed capacity for VAE and 1 lakh tonnes of installed capacity for VAM will cost Rs 2100 crore over the next three to four years.

Latest Joint Venture to leverage benefit in White Cement Manufacturing

Additionally, Asian Paints revealed a 60:40 joint venture with Riddhi Siddhi Group to build a 2.65 lakh MT annual white cement facility in Fujairah, United Arab Emirates. For the same, an investment of Rs. 550 crores are needed. Quality limestones, a crucial component of white cement, are made available by the Riddhi Siddhi group. Putty, which serves as an undercoat for painting, contains White Cement as a primary component. In the putty market, Asian Paints has the second highest market share, and with this new facility, may eye a leadership position.

Univest View along with Technical Analysis:

Strong brand, market leadership position, and robust balance sheet condition do justify Asian Paint’s premium valuation. Currently, the stock price has retracted back to the same levels as a year ago. The 50 EMA is still above its 100 & 200 EMA, while the stock price has lost almost 5% post-announcement of Q2FY23 results.

The company is currently experiencing margin pressure due to raw material inflation, while the CapEx plans of the company are also in full force. Therefore, in the long term, the market situation as well as the fundamentals of the company are robust, and investors can take advantage of this opportunity by accumulating stock with a long-term view. This is also because going forward margins are expected to ease with demand expanding due to the festive and holiday season.

ICICI Direct said, “We maintain our BUY rating on the stock & revise our target price to Rs 3685/share.”While HDFC Securities said, “While beneficial in the long run, it will certainly be a drain on FCFF and returns profile in the short to medium term. We maintain our SELL rating.” Whereas IDBI Capital said, “We maintain our EPS estimates for FY23-24E. We value Asian Paints at 65x FY24E EPS. At the current price, we maintain a HOLD rating with a target price of Rs 3,499.”

On the Univest app, Asian paints have a hold rating for the long run with a bearish stance for short-term trends. For the long term, Asian paints has a neutral rating along with a neutral

rating on fundamentals. Therefore, existing investors should remain invested while fresh investors should wait till the technical indicators become bullish in the short term.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: HUL results