Adani and Hindenburg Report

Posted by : Avneet Dhamija | Sun Jan 29 2023

Adani and the Hindenburg Report – Time will play out facts, but the damage is done!!

As we begin the new year with expectations of the market performing better than the previous year, in the first month itself we have a report on the Adani group by US based research firm Hindenburg accusing the Adani Group and its Chairman Gautam Adani of rigging the stock prices and corporate misgovernance. This had a domino effect with stocks of Adani group falling sharply and also caused a fall in shares of banks and other related businesses.

One report is all it took to shake the Group.

Hindenburg’s report indicated that Gautam Adani, Founder, and Chairman of the Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion in the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% in that period.

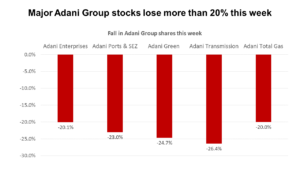

In the week starting 23rd Jan 2023, major Adani stocks lost more than 20%. These include the power, airports and energy businesses.

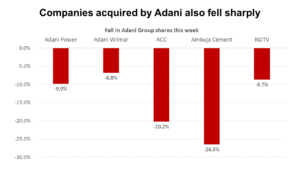

Other Adani Group companies, that were acquired over the last year including ACC, Ambuja Cements and NDTV had to bear the brunt of this fall. The findings of Hindenburg’s research report on Adani involved interactions with dozens of individuals, including former senior executives of Adani, reviewing thousands of documents and conducting diligence site visits in almost half a dozen countries.

Friday witnessed a sharp fall in shares of Adani group companies and the lenders that have exposure to it, some of India’s leading public sector banks said their exposure to the Adani Group was within the limits prescribed by the Reserve Bank of India. RBI allows for no more than 25% of a bank’s available eligible capital base to be exposed to any one group of connected companies.

Major PSU bank clarifies its position

“There is nothing alarming about our Adani exposure and we don’t have any concerns as of now,” SBI chairman Dinesh Kumar Khara told Reuters. He said the Adani Group hadn’t raised any funding from SBI in the recent past and that the bank would take a “prudent call” on any funding request from them in the near future, reported Reuters.

SBI has reached out to the company for clarification and the board will take any decision on the bank’s exposure to the group only after that, reported Reuters quoting an unnamed official.

An official at the state-run Bank of India said the loans to the Adani group were within permissible limits. “Our exposure to the Adani Group is below the large exposure framework of the Reserve Bank of India,” Reuters quoted an unnamed executive at the Bank of India as saying.

The timing of the report raises suspicion

The Hindenburg Report was released just days before Adani Group was scheduled to raise fund via a Rs 20,000 crore FPO. Under the Rs 20,000 crore worth FPO, on Friday, only 4,70,160 equity shares were bid against the offered size of 4,55,06,791 equity shares. The price band for the FPO is set from ₹3,112 to ₹3,276 per FPO equity share for all categories of investors.

If Adani’s FPO is fully subscribed, then this will become the second largest follow-on public offer in India after Coal India’s ₹22,558 crore issue in 2015. Earlier in 2020, Yes Bank had launched a ₹15,000 crore FPO.

Meanwhile, LIC remains undeterred by the fraud allegations and is plowing more money into Adani’s flagship unit. The state-controlled life insurer is spending about $37 million as an anchor investor in a $2.5 billion new share sale by Adani Enterprises Ltd., according to a filing. The investment would add to its current holding of 4.23%.

Adani Group yet to put out a strong defence

According to Anil Singhvi of Zee Business, the allegations and counter-allegations between Hindenburg and Adani Group will continue. Adani Group has informed exchanges about taking legal action against the financial research company.

“They have the option of legal action and will have to decide whether the group will file a case in India or in America as Hindenburg is a US-based company,” said Singhvi. Hindenburg has already challenged Adani Group that they should come to America and file a case against them.

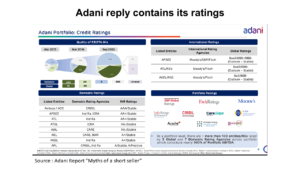

On its part Adani put out a document where they stated their position on some of the issues raised by Hindenburg, but not very detailed and a lot many questions still remain unanswered.

A check on the other side of the story

The Adani Group is no stranger to allegations. They have been in the limelight over the past few years for their rapid expansion into different areas and this has certainly not gone down too well with a section of the business community. They became the second largest cement manufacturer in the country with the acquisition of ACC and Ambuja Cements. They also acquired NDTV with a controlling stake. Last but not the least, they are now one of Mumbai’s largest real estate players with the contract for redevelopment of Dharavi. While all of this points to a high probability of crony capitalism, it also raises doubts whether vested interests may try to sabotage the group for the speed at which they are expanding.

Many countries who would not like to see India progress use “reports” as a strategy to defame the country as well as businesses in the country. In this respect, Hindenburg may just be a tool used by certain powerful nations to slow down the India growth story.

At this stage, it is clearly on the Adani Group to come out and clear their positions on many of the allegations made by the report. Whether it takes the legal route to file a case in the US or chooses any other option remains to be seen. However, the damage is done and Hindenburg seems to have won this round as they were short sellers an this group and obviously have made massive gains this week.