A smooth ride awaits the 2W Industry over the next few quarter

Posted by : Sheen Hitaishi | Tue Nov 29 2022

It is no secret that the recent spike in the costs of commodities and raw materials had put pressure on auto and auto components companies’ bottom line during Q2FY23. But despite that NIFTY AUTO has seen an up move during Q2FY23, post which it has started its consolidating with 13,600 acting as major resistance. The main reason behind this was that margin pressure bottomed out in Q2 which has therefore lifted the investor sentiment about prospects.

The automobile industry includes both 2W and 4W, while 2W has a much bigger pie due to its affordability and as per the standard of living in India. Further, as companies tried to offset the cost by increasing the price of the end products, market conditions and competition were not favourable for the same. That’s why the auto index went sideways in the last two months.

While the good news is that raw material and commodity prices have now started softening and market watchers say that the auto industry should start seeing the benefits from Q3 onwards. So, let’s now analyse the Q2FY23 performance of a few listed 2W auto majors and compare them to derive insights into how well they performed and what investors should expect next.

Market Leader in 2W lagged in performance while other players remained robust in Q2FY23

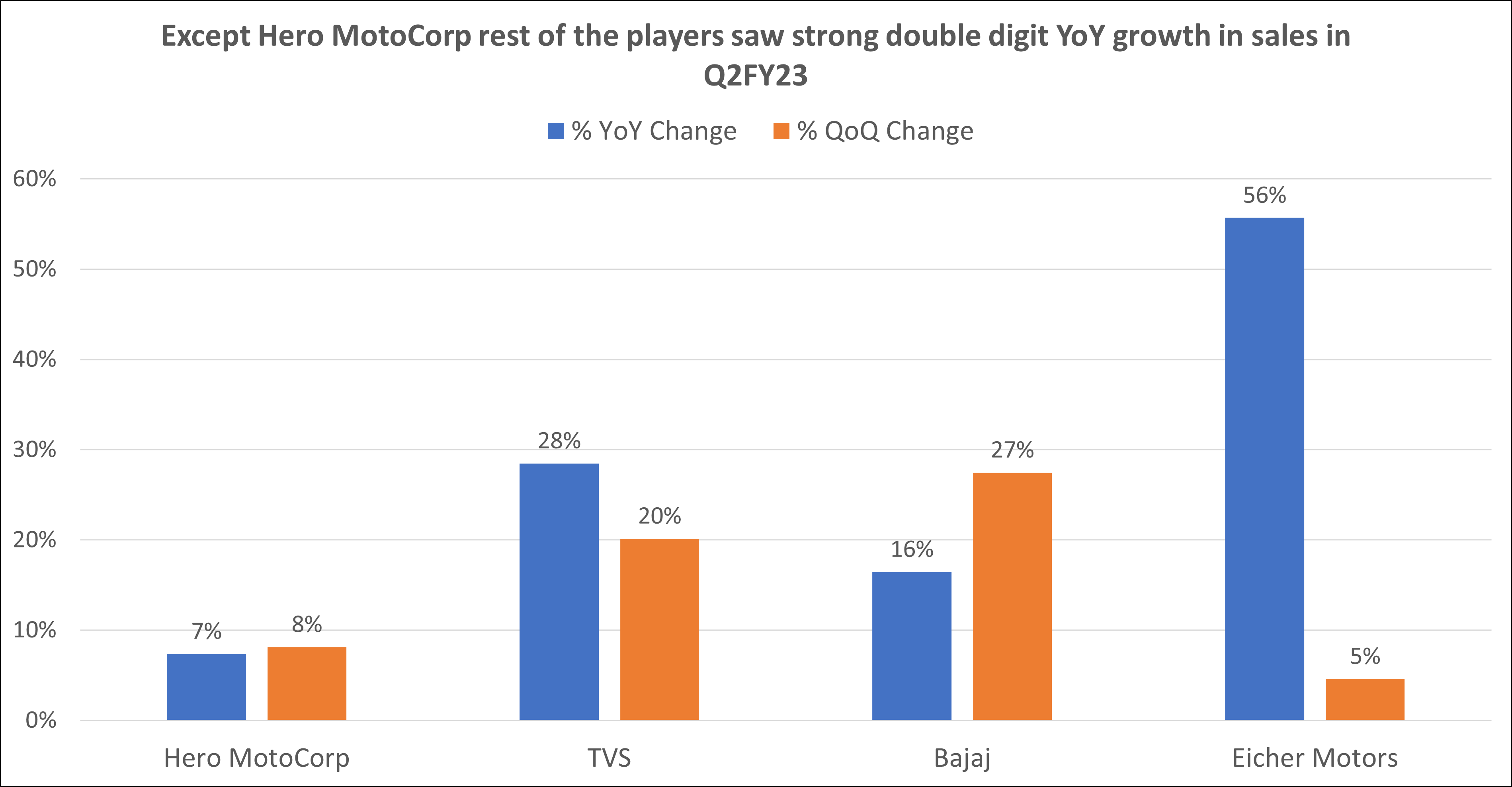

Semiconductor issues have been persistently disrupting the auto industry. However, it has started to normalise, and supply was almost fully reliable in Q2FY23. This has therefore enabled the 2W manufacturers to improve their sales and profitability. While another major reason for big YoY growth numbers for a few firms could be associated with a low base effect. The same is depicted in the graph below.

It can be seen in the graph that Eicher recorded the highest YoY growth in Q2FY23, aided by solid operating income. Whereas for others, they also managed to showcase double-digit revenue growth in Q2FY23 with the exception of Hero MotoCorp, which saw a meager 7% YoY & 8% QoQ growth. Further, it may be noted that Bajaj and TVS both saw 27% and 20% QoQ revenue rise in Q2FY23, which indeed is an exemplary performance

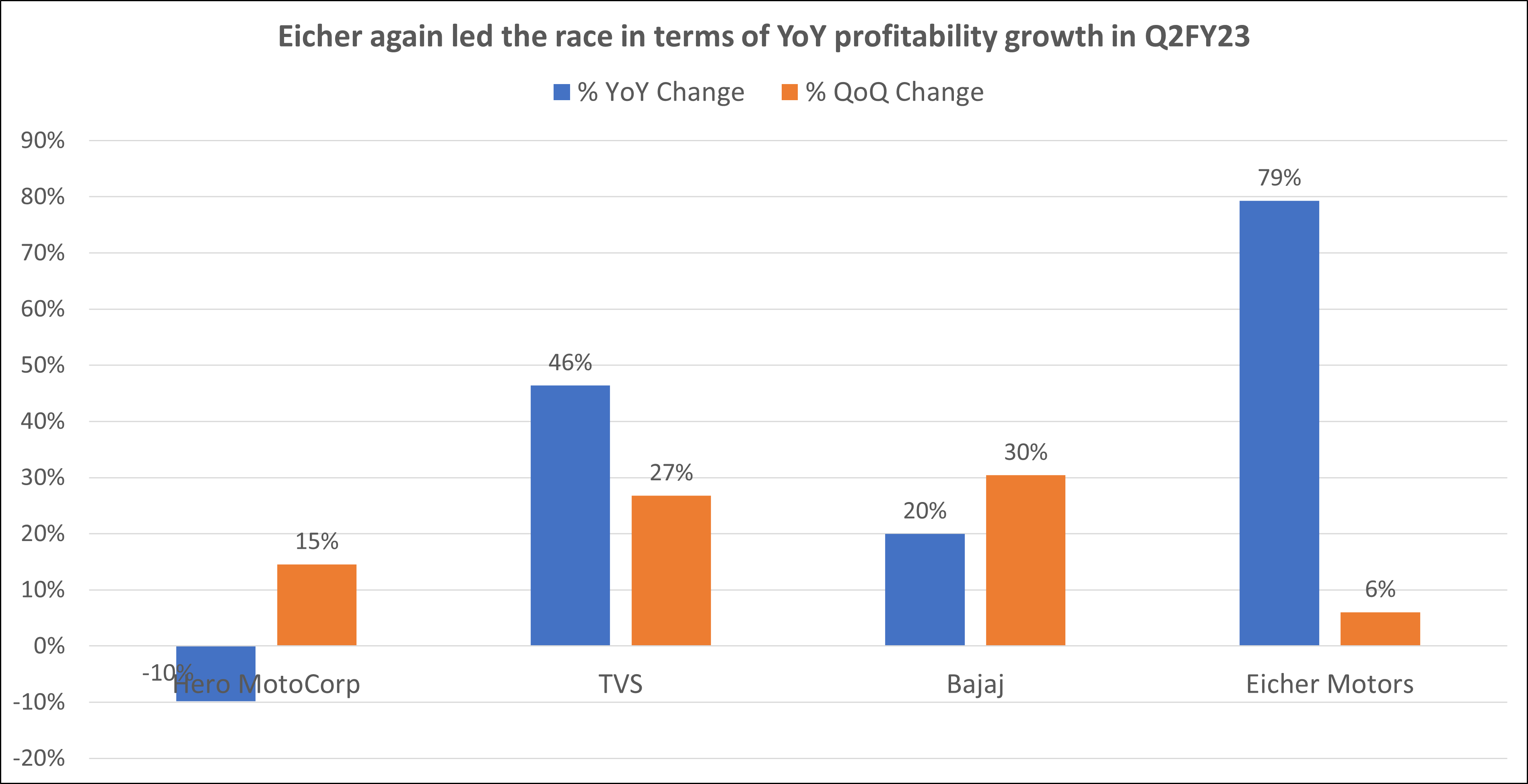

Now, that we have understood the revenue position, it wouldn’t be surprising to find that Eicher again secured the top spot in terms of profitability growth as it saw 79% YoY and multi-fold QoQ growth in PAT in Q2FY23. The only player which saw negative YoY growth was Hero MotoCorp which also saw a low double-digit QoQ growth compared to other players. The reason behind the de-growth was higher costs, weak operational performance, and moderate sales growth, as it weighed on the overall earnings of the company.

You may also like: Mutual Fund Buys in October 2022

Volume growth remained moderate for most of them in Q2 despite the festive season

Though enquires have not improved by a significant amount MoM, sales volumes grew moderately owing to some festivals. Inventory levels across segments have inched up ahead of the festive season and stood at 6 weeks of sales. Whereas exports remained robust with the gradual opening of economies.

While wholesale sales have picked up with the easing of supply chain constraints, retail sales remained sluggish for the 2W sector in Q2FY23. For TVS, while the export mix is weak due to geopolitical concerns, a pick-up in volumes and an improved domestic mix were expected to help improve its margin QoQ. For Eicher, 11% growth in volume QoQ and stable margin is likely to drive 14% earnings growth QoQ. However, Hero MotoCorp with slower volume ramp-up and Bajaj Auto’s sharply adverse mix QoQ has therefore pressured them to underperform their peers in Q2FY23.

Lastly, there has been growing interest in EVs amidst the increasing fuel prices and the launch of Ola. The increasing awareness about environmentally friendly transport has increased the demand for EVs. Here, Hero MotoCorp, India’s largest manufacturer of motorcycles has a market share of about 46% in the two-wheeler category. Further, it holds a 38% stake in Ather Energy. Ather Energy is one of the leading manufacturers of electric 2-wheelers in India. Thus, this makes Hero Stand out among others.

Margin pressure affected Hero to the maximum extent

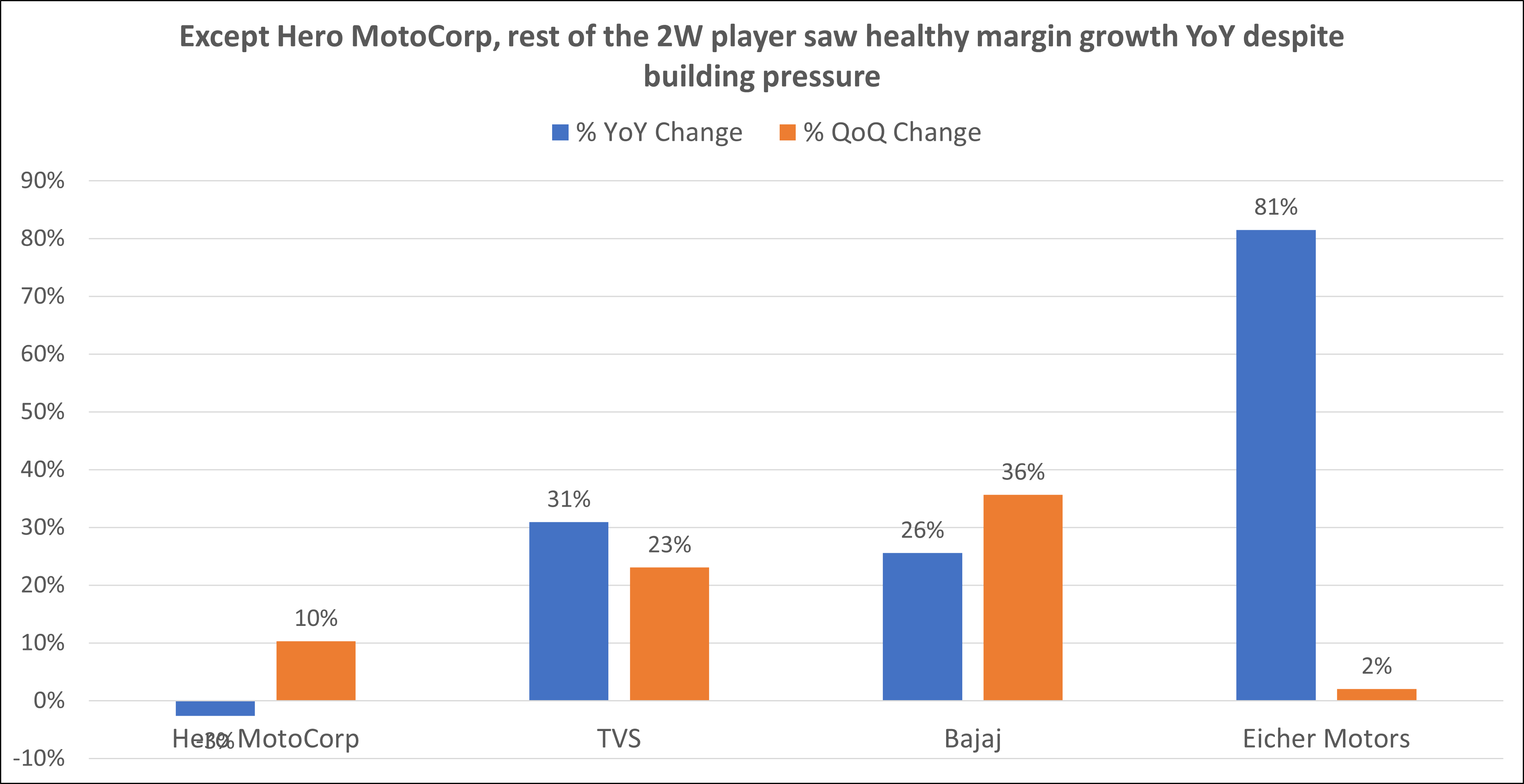

Due to rising commodity prices, the operating profit margin of auto companies had been affected. However, as commodities prices of steel are experiencing a correction, the operating profit margins for the year 2023 will grow. Further, one of the most crucial factors to evaluate a business is pricing power. It is the ability to pass on the increased cost to the customer without reducing demand. Companies such as Eicher Motors and TVS tried passing the cost to the customers, but this didn’t help much to the company much.

As per the graph above, Eicher Motors again saw an extremely good performance in margin terms as it grew 81% YoY in Q2FY23. Bajaj and TVS both also saw decent growth compared to the negative growth in Hero’s margin. Even sequentially Hero posted the lowest growth while the rest of the players saw robust numbers.

Univest View:

Finally, it can be said that both in terms of top and bottom-line growth Eicher performed exceptionally well. While Eicher Motors also gave an appreciable performance on a YoY basis followed by TVS and then Bajaj, Hero MotoCorp, or the market leader was the only player that lagged behind.

The Indian automobile sector is one of the fastest-growing sectors in India. Looking its performance and Q2FY23 data indicate that these stocks are most likely to perform great in the coming years. Therefore, investing with a long-term horizon can generate considerable wealth for investors. Lastly, a positive factor for the 2W manufacturers is the falling inflation and the upcoming festive season in Q3FY23. Both investors, as well as market analysts, carry high hopes for the sector.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Bharat Forge offers an opportunity for long term investors

Related Posts

Omnitech Engineering IPO Review 2026: GMP Rises 3.52%, Key Investor Insights

Yaap Digital IPO Review 2026: GMP Flat, Key Investor Insights

Yashhtej Industries IPO Listing Preview: What to Expect Now?

Kiaasa Retail IPO Day 1: Subscription at 0.06x, GMP Rises 20.74% | Live Updates

Mobilise App Lab IPO Day 1: Subscription at 1.32x, GMP Rises 20.00% | Live Updates