Rise of P2P lending in India

Posted by : Sheen Hitaishi | Tue Feb 28 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” advanced_gradient_angle=”0″ gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid” gradient_type=”default”][vc_column_text]The financial sector has witnessed disruptions due to the online financial industry also more commonly known as fintech. Peer-to-Peer (P2P) lending is one such fintech business model that has gathered momentum globally and is taking root in India.

Although fairly new in India and not significant in value yet, the potential benefits that P2P lending promises to various stakeholders (to the borrowers, lenders, agencies, etc.) and its associated risks to the financial system have caught the attention of the Reserve Bank of India which has developed a regulatory framework for P2P lending and regularly seeks public opinion and views of the various stakeholders on the future course of action with regard to the current legal and regulatory framework.

What exactly is P2P lending and how does it work?

P2P lending is the use of a digital platform to raise loans which are paid back with interest. It can be defined as the use of an online platform that matches lenders with borrowers to provide unsecured loans. The borrower can either be an individual or an entity requiring a loan. The interest rate may be set by the platform or by mutual agreement between the borrower and the lender. Fees are paid to the platform by both the lender as well as the borrower. The borrowers pay an origination fee (either a flat rate fee or as a percentage of the loan amount raised) according to their risk category.

The lenders, depending on the terms of the platform, have to pay an administration fee and an additional fee if they choose to use any additional service (e.g., legal advice, etc.), that the platform may provide. The platform provides the service of collecting loan repayments and doing a preliminary assessment of the borrower’s creditworthiness. The fees go towards the cost of these services as well as the general business costs. The platforms do the credit scoring and make a profit from arrangement fees and not from the spread between lending and deposit rates as is the case with normal financial intermediation.

What is the current P2P landscape in India like?

P2P lending platforms are tech companies registered under the Companies Act and acting as an aggregator for lenders and borrowers thereby, helping create a match between them. Once the borrowers and lenders register themselves on the website or app, due diligence is carried out by the platform and those found acceptable are allowed to participate in lending/borrowing activity.

Most P2P companies follow a reverse auction model in which the lenders bid for a borrower’s loan proposal and the borrower has the freedom to either accept or reject the offer. The platform moderates the interaction between the borrower and the lender as well facilitates the documentation for the lending and borrowing arrangement. The lender transfers money from his/her bank account to the borrower’s bank account.

In most cases, the lending is primarily from one individual to another. Since all payments are through bank accounts, the KYC exercise can be deemed to have been carried out by the banks concerned. Though these platforms claim to follow soft recovery practices, the possibility of the use of coercive methods cannot be ruled out.

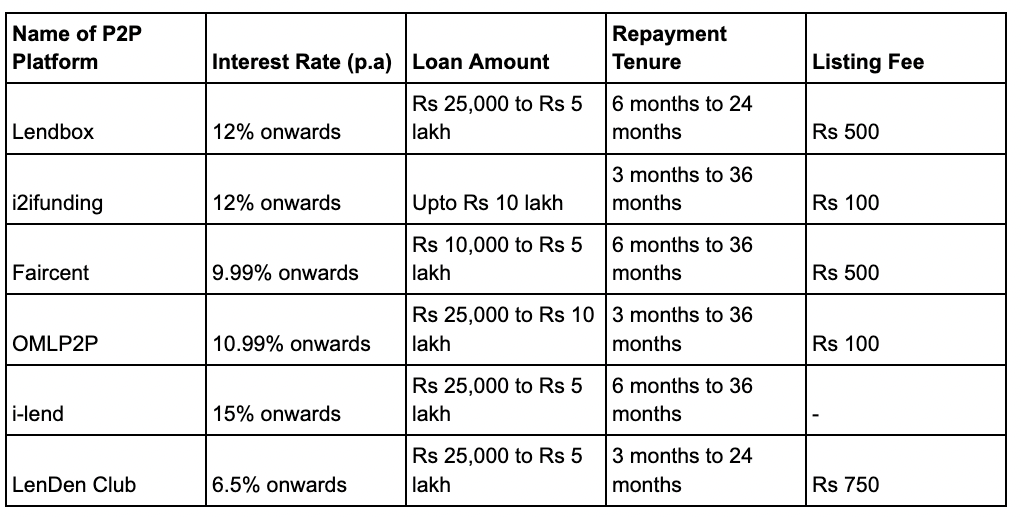

Over the last few years, there have been many P2P lending platforms that have begun operations in India. The table below lists some of them.

The above list is not exhaustive and there are many other players like Liquiloans and 12% Club who are also trying to capture market share in this space. What makes this space attractive is that the fintech company acts only as a facilitator and is not liable for credit risk default.

To put it simply, P2P lending is a financial arrangement made between a lender and a borrower without the involvement of any third parties, such as a bank. By thoroughly evaluating each party’s eligibility for these digital transactions, a fintech organisation arranging this peer-to-peer exchange will serve as the risk mitigator between these two parties.

What are the benefits for the parties involved?

The fact that lenders can generate significantly better returns than bank savings or investment choices, and borrowers may be able to borrow money at cheaper interest rates, stands out as an advantage for both parties. It works as a win-win situation for both the lender as well as the borrower.

The RBI has put regulations in place and Aadhar cards, PAN cards, and other common KYC documents would all be needed. In addition to the CIBIL score, P2P Platforms will utilise additional metrics to analyse loan applicants. These metrics include historical performance, stability, and intention of borrowers, which are assessed using documents like pay stubs, ITRs, bank statements, balance sheets, etc.

Though an attractive proposition, risk factors should be considered.

While the return to a lender looks attractive, a lender must know that P2P lending is meant to help those who are desperate to borrow money. These are borrowers who either do not meet the eligibility of banks or NBFCs or the borrower might be an SME who is looking at borrowing at a lower interest than a bank.

Another point to remember is that it should not be seen as an investment product that offers high returns that can be compared with mutual funds or FDs. P2P lending falls under the spectrum of unsecured lending where the lender is likely to lose money in case of default by the borrower.

If a bank happens to default, one can recover the funds to the tune of Rs 5 lakh by virtue of the insurance given by the DICGC (Deposit Insurance and Credit Guarantee Corporation). No such safety net is available for P2P lending. Hence once default takes place, it is not easy to recover the loan from the borrower.

Our view is that though there is an element of risk involved, a small portion can be invested for higher returns via P2P lending. The P2P platforms have their checks and balances to reduce the risk of default and with the way, fintech is revolutionising the financial industry, a relatively new segment like P2P is likely to grow much faster and in the process evolve in coming years.

As a disclaimer, Univest is associated with the platform, Faircent to offer P2P solutions to its clients via our app. Univest believes that investors should diversify their risks across asset classes and there is no harm in taking a small exposure to P2P lending, to begin with, and checking it the returns are delivered as promised. Based on first-time experience, investors can enhance their exposure in the future.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purposes only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly update

[/vc_column_text][/vc_column][/vc_row]