Stock buying by MFs in January 2023

Posted by : Sheen Hitaishi | Thu Feb 16 2023

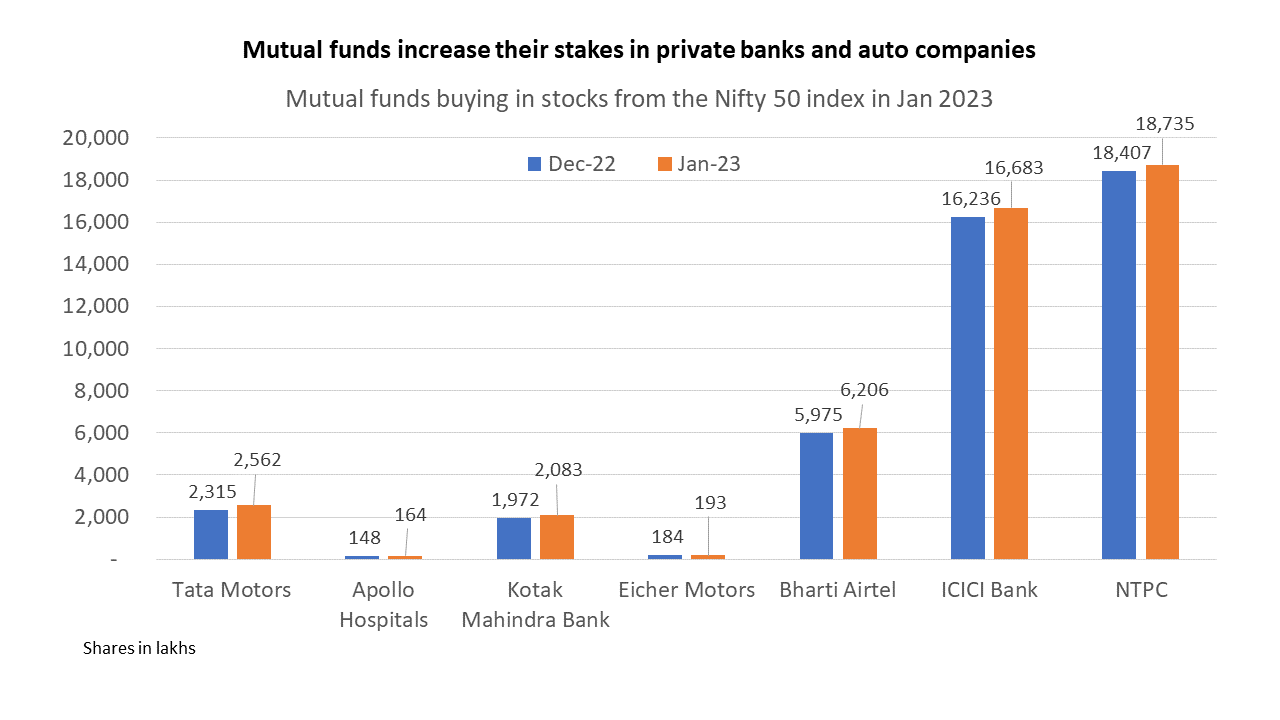

The month of January 2023 saw huge volatility in the market due to the Hindenburg Report and the benchmark Nifty index lost 2.5% in January. Amidst the volatility, mutual fund managers have been adding stocks to their respective schemes, which include a few private banks, auto companies, and auto component manufacturers.

Stocks from the Nifty 50 Index which saw increased buying include ICICI Bank, Bharti Airtel, and Tata Motors among others.

Tata Motors

Tata Motors is India’s leading commercial vehicle manufacturer and has the third highest market share of passenger vehicles in India. It has taken the lead in EV in the car segment with the Nexon EV. In Q3FY23, it posted net profits after several quarters of losses.

Funds that increased holdings in Tata Motors were Axis Long Term Equity Fund Growth, ICICI Prudential India Opportunities Fund Regular Growth, ICICI Prudential Equity & Debt Fund Growth, and UTI Value Opportunities Fund Regular Plan Growth.

Apollo Hospitals

Apollo Hospitals is a healthcare chain that operates hospitals, diagnostic chains, and pharmacies. As part of its aggressive pharmacy store expansion plan, it added 473 stores in H1FY23 as compared to 411 stores in FY22, taking the total number of stores to 5,002 at the end of H1FY23.

Funds that increased holdings in Apollo Hospitals were Kotak Flexicap Fund Growth, Kotak Equity Opportunities Fund Growth, Aditya Birla Sun Life Equity Advantage Fund Growth, and Kotak Equity Arbitrage Fund Growth.

Kotak Mahindra Bank

Kotak Mahindra Bank is one of the leading private banks in India. The bank posted a stellar set of Q3FY23 results where its revenues grew by 34.3% YoY and net profit grew 31% YoY to Rs 10,210 crore.

Funds that increased holdings in Kotak Mahindra Bank were HDFC Balanced Advantage Fund Growth, HDFC Arbitrage Fund Wholesale Plan Growth, SBI Arbitrage Opportunities Fund Regular Growth, and ICICI Prudential Banking and Financial Services Fund Growth.

Eicher Motors

Eicher Motors is the leader in the mid-size motorcycle segment in India with its iconic brand “Royal Enfield”. It also manufactures commercial vehicles in association with Volvo. Q3FY23 saw the demand rising for their motorcycles on the back of new launches like the Super meteor 650. Net profit in Q3FY23 was the highest in the last 10 quarters at Rs 680.7 crore.

Funds that increased holdings in Eicher Motors were Kotak Equity Arbitrage Fund Growth, HDFC Balanced Advantage Fund Growth, Tata Arbitrage Fund Regular Growth, and Invesco India Arbitrage Fund Growth.

Bharti Airtel

Bharti Airtel is India’s second-largest telecom operator with ~33.2 crore wireless customers in India and around 13.9 crore subscribers across 14 African countries. It enjoys industry-leading ARPU in the wireless business in India.

Funds that increased holdings in Bharti Airtel were SBI Equity Hybrid Fund Regular Payout Inc Dist cum Cap Wdrl, Kotak Equity Arbitrage Fund Growth, Motilal Oswal Flexicap Fund Regular Plan Growth, and HDFC Top 100 Fund Growth.

ICICI Bank

ICICI Bank is among the leading private banks in India. In Q3FY23, the banks’ net profit rose 34.2% YoY to Rs 8311.9 crore. The bank has also been managing its NPAs well with a net NPA ratio below 1 for the last six quarters.

Funds that increased holdings in ICICI Bank were Kotak Equity Arbitrage Fund Growth, ICICI Prudential Value Discovery Fund-Growth, HDFC Flexi Cap Fund Growth, and SBI Balanced Advantage Fund Regular Growth.

NTPC

NTPC is India’s largest power generation company with a total installed capacity of 69134 MW at the group level. The company’s vision is to become a 130 GW+ company by 2032 of which 60 GW would be contributed by renewable energy

Funds that increased holdings in NTPC were ICICI Prudential Bluechip Fund Growth, ICICI Prudential Value Discovery Fund-Growth, ICICI Prudential Multi-Asset Fund Growth, and UTI Mastershare Unit Regular Plan Payout Inc Dist cum Cap Wdrl

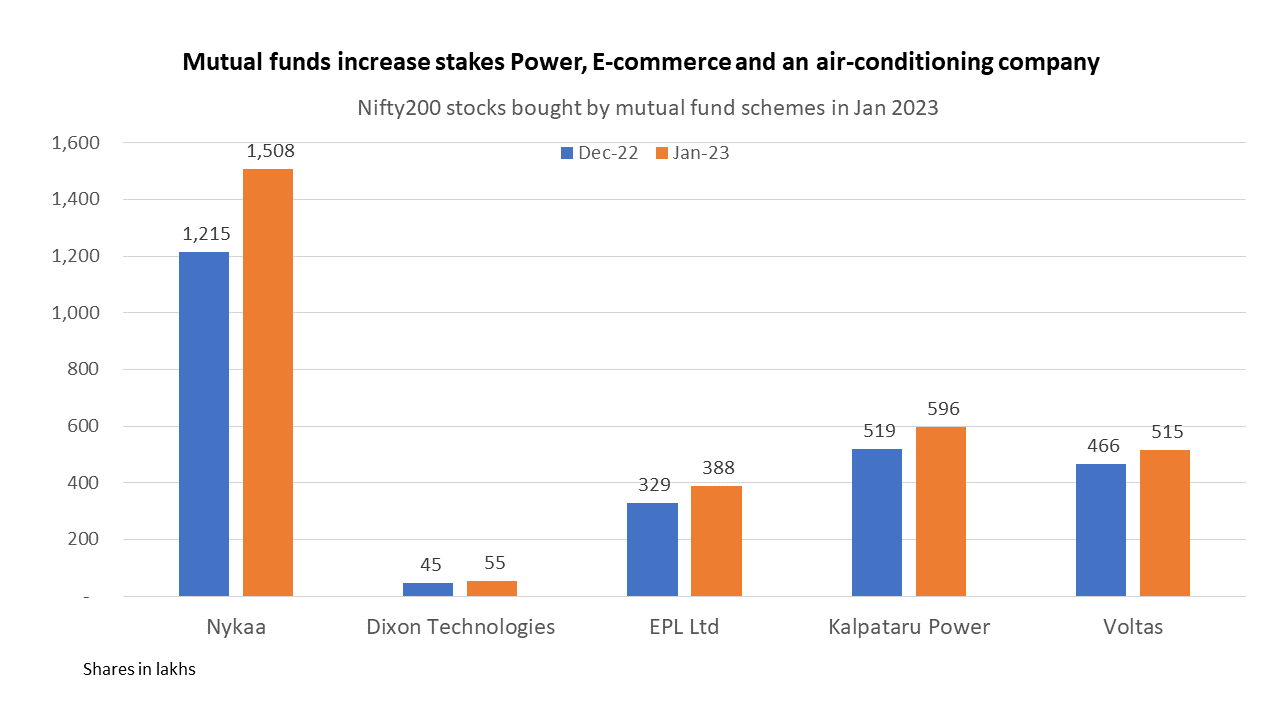

Apart from the large-cap names, mutual funds also bought into stocks from the Nifty 200 constituents. These include companies across diverse industries such as power, e-commerce, and hotels.

Nykaa

Nykaa is engaged in the business of manufacturing, selling & distributing of beauty, wellness, fitness, personal care, health care, skincare, and hair care products on online platforms or websites such as e-commerce, m-commerce, internet, intranet as well as through physical stores.

Funds that increased holdings in Nykaa were SBI Large & Midcap Fund Regular Payout Inc Dist cum Cap Wdrl, Mirae Asset Focused Fund Regular Growth, Mirae Asset Large Cap Fund Regular Growth, and Nippon India Small Cap Fund – Growth.

Dixon Technologies

Dixon Technologies transformed from being a manufacturer of electronic goods to a leading multi-product corporation with widespread activities. The Company is primarily engaged in the manufacturing of electronics as its core business activity. It is also a beneficiary of the Government PLI scheme for electronics manufacturing.

Funds that increased holdings in Dixon Technologies were Kotak Emerging Equity Scheme Growth, Nippon India Multi Cap Fund – Growth, Nippon India Growth Fund – Growth, and ICICI Prudential Long Term Equity Fund (Tax Saving) Growth.

EPL Ltd

EPL (formerly known as Essel Propack Ltd) is engaged in the manufacture of plastic packaging material in the form of multilayer collapsible tubes and laminates used primarily for packaging of consumer products in the Beauty & Cosmetics, Health & Pharmaceuticals, Food, Home, and Oral Care categories.

Funds that increased holdings in EPL were ICICI Prudential Smallcap Fund Growth, ICICI Prudential Large & Mid Cap Fund-Growth, ICICI Prudential MNC Fund Regular Growth, and ICICI Prudential Multi-Asset Fund Growth.

Samvardhana Motherson

Samvardhana Motherson (formerly known as Motherson Sumi Systems Limited) is one of the world’s leading, specialized automotive component manufacturing companies for Original Equipment Manufacturers (OEMs). Products include wiring harnesses, rear view mirrors, molded plastic parts including car interior and exterior parts, bumpers, dashboards and door trims, complete modules, rubber components for automotive and industrial applications, high precision machined metal parts, injection molding tools, and HVAC systems.

Funds that increased holdings in Samvardhan Motherson were ICICI Prudential Bluechip Fund Growth, Canara Robeco Flexi Cap Fund Growth, IDFC Flexi Cap Fund Growth, and Nippon India Tax Saver (ELSS) Fund – Growth.

Ashok Leyland

Ashok Leyland is engaged in the manufacture and sale of a wide range of commercial vehicles. The company is present in M&HCV trucks and buses as well as LCV goods segments. It also has a formidable presence in the e-mobility (electric buses) domain through Switch Mobility.

Funds that increased holdings in Ashok Leyland were PGIM India Midcap Opportunities Fund Regular Growth, Nippon India Arbitrage Fund Growth, HDFC Arbitrage Fund Wholesale Plan Growth, and PGIM India Small Cap Fund Regular Growth.

Apollo Tyres

Apollo Tyres is a leading tyre manufacturer, with operations in India & Europe and an installed capacity of about 7.9 lakh MT per annum. In India, it has a substantial presence of 31% market share in the new tyre segment and 21% market share in the preplacement space.

Funds that increased holdings in Apollo Tyres were Kotak Flexicap Fund Growth, Kotak Equity Opportunities Fund Growth, Aditya Birla Sun Life Equity Advantage Fund Growth, and Kotak Equity Arbitrage Fund Growth.

Indian Hotels

Indian Hotels is part of the Tata Group. It owns and operates hotels under its various brands like Taj Hotels, Vivanta, Ginger, and Seleqtions. It has seen a rebound in the last two quarters after a dry spell during the pandemic. Its consolidated revenues grew 57.3% YoY to touch Rs 1743.5 in Q3FY23.

Funds that increased holdings in Indian Hotels were Kotak Equity Arbitrage Fund Growth, Motilal Oswal Midcap 30 Regular Growth, Motilal Oswal Flexicap Fund Regular Plan Growth, and Nippon India Arbitrage Fund Growth.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Retail Inflation rises to 6.52% in January, what lies ahead??

Related Posts

Why is JP Power Share Price Falling?

Why is the MRF Share Price Falling?

Best SIP Plans for 3 Years in 2026: Build Wealth with Stability

Acetech E-commerce IPO Review 2026: GMP Flat, Key Investor Insights

PNGS Reva Diamond Jewellery IPO Day 3: Subscription at 0.99x, GMP Rises 0.26% | Live Updates