Speciality chemical sector saw mixed performance in Q2FY23

Posted by : Sheen Hitaishi | Wed Nov 30 2022

Market analysts expected a healthier demand environment across end-user industries to lead a strong revenue growth for firms in the speciality sector, amid better volumes and realisations growth. Speciality Chemicals is a sector that came into the limelight in 2022, on account of the sourcing policy of China+1 and Europe+1 amid the standoff between Russia and Ukraine… One of the major headwinds that emerged in recent times for the companies in this sector is the inflationary hurdles, which were seen in Q1FY23. But for Q2FY23, it was expected to be absorbed by other factors such as better realisation and growing exports due to the strengthening dollar.

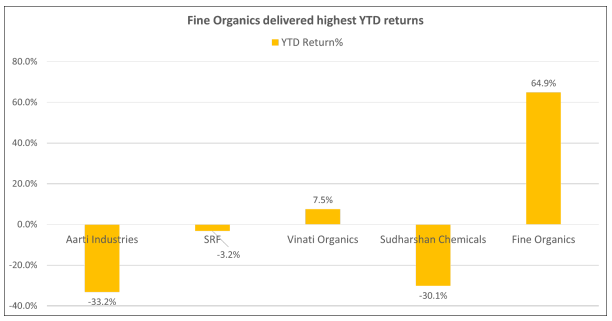

A few well-known firms in this sector include Aarti Industries, SRF, Fine Organics, Vinati organics, and Sudarshan chemicals. Fine Organics was one of the most preferred picks among investors due to its immense potential and high return delivered till now. While another name that’s in news right now is Aarti Industries, whose discounted valuations offer a lucrative opportunity for investor gains.

As seen in the graph above Fine Organics delivered the maximum investor returns since the beginning of the year. Whereas Aarti Industries and Sudarshan chemicals saw similar negative share price movements. Lastly, Vinati Organics and SRF both saw decent gains. Therefore, let’s now analyse the Q2FY23 performance of these speciality chemical shares and understand which ones have reached their potential and which ones carry further potential ahead for investor returns.

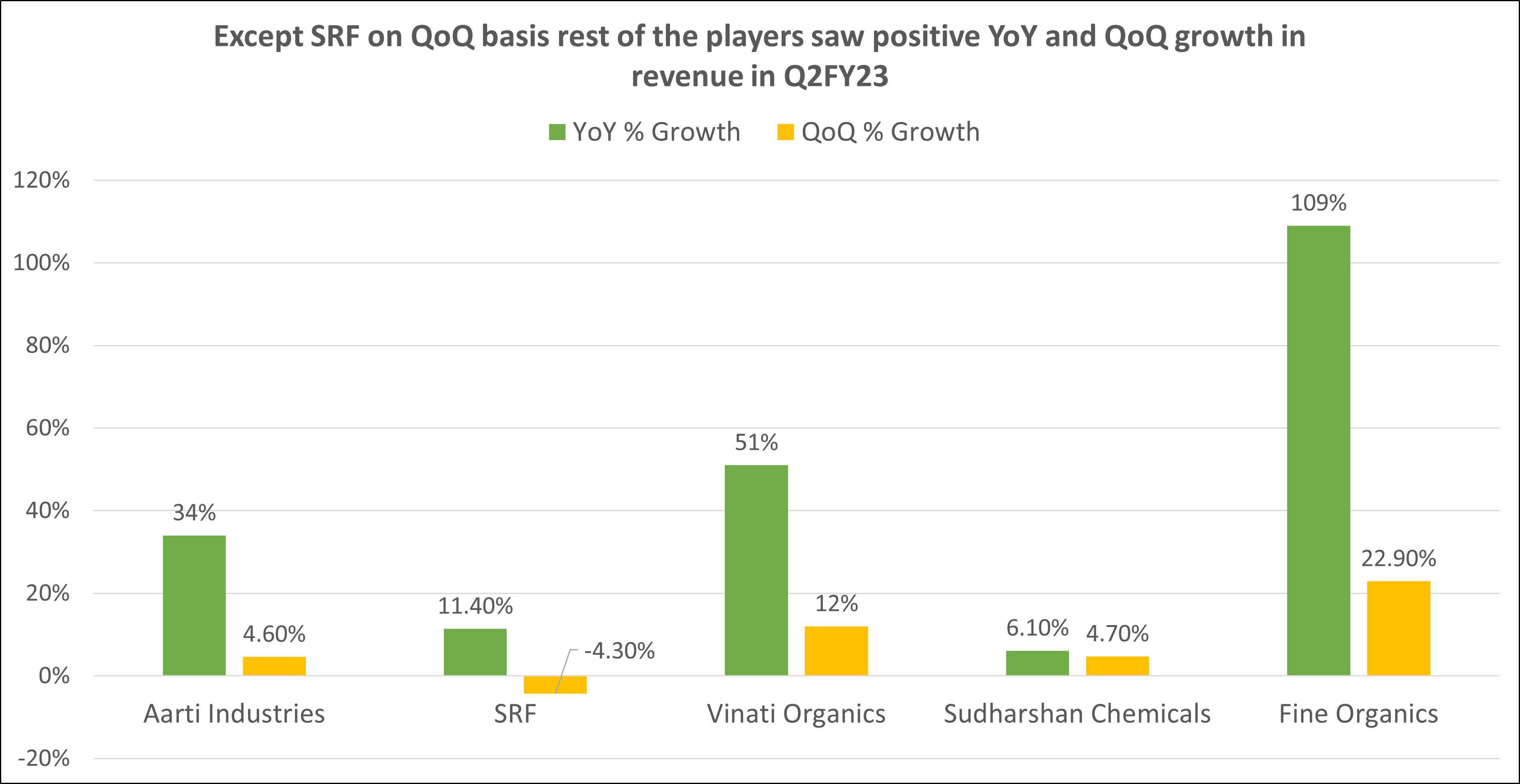

Revenue: Except Sudarshan rest of the players saw robust revenue growth YoY in Q2FY23

Recovery in the demand for sectors such as Textile, Paper, Metals, Automobiles, Pharma, etc, has supported the higher volume growth for most of the companies in this sector ranging from pigments, dyes, and soda ash industries. Further, better realisations can aid overall performance. Specialty chemicals having a large order backlog in place, should likely sustain similar momentum as witnessed in the last quarter. Another growth lever was the impact of growth CAPEX undertaken by most of the players in the last few quarters.

In the graph above, it is quite visible that Fine Organics as previously saw the highest YoY and QoQ growth in revenue, followed by Vinati Organics and Aarti Industries at 51% and 34% YoY respectively. It can be seen that Sudarshan Chemical remained a laggard as it posted only single-digit YoY growth in revenue, similar to the low double-digit growth posted by SRF. While sequentially SRF was the only player that saw de growth in revenue whereas Vinati still saw a healthy rise compared to the low single-digit increase reported by Aarti and Sudarshan Chemicals.

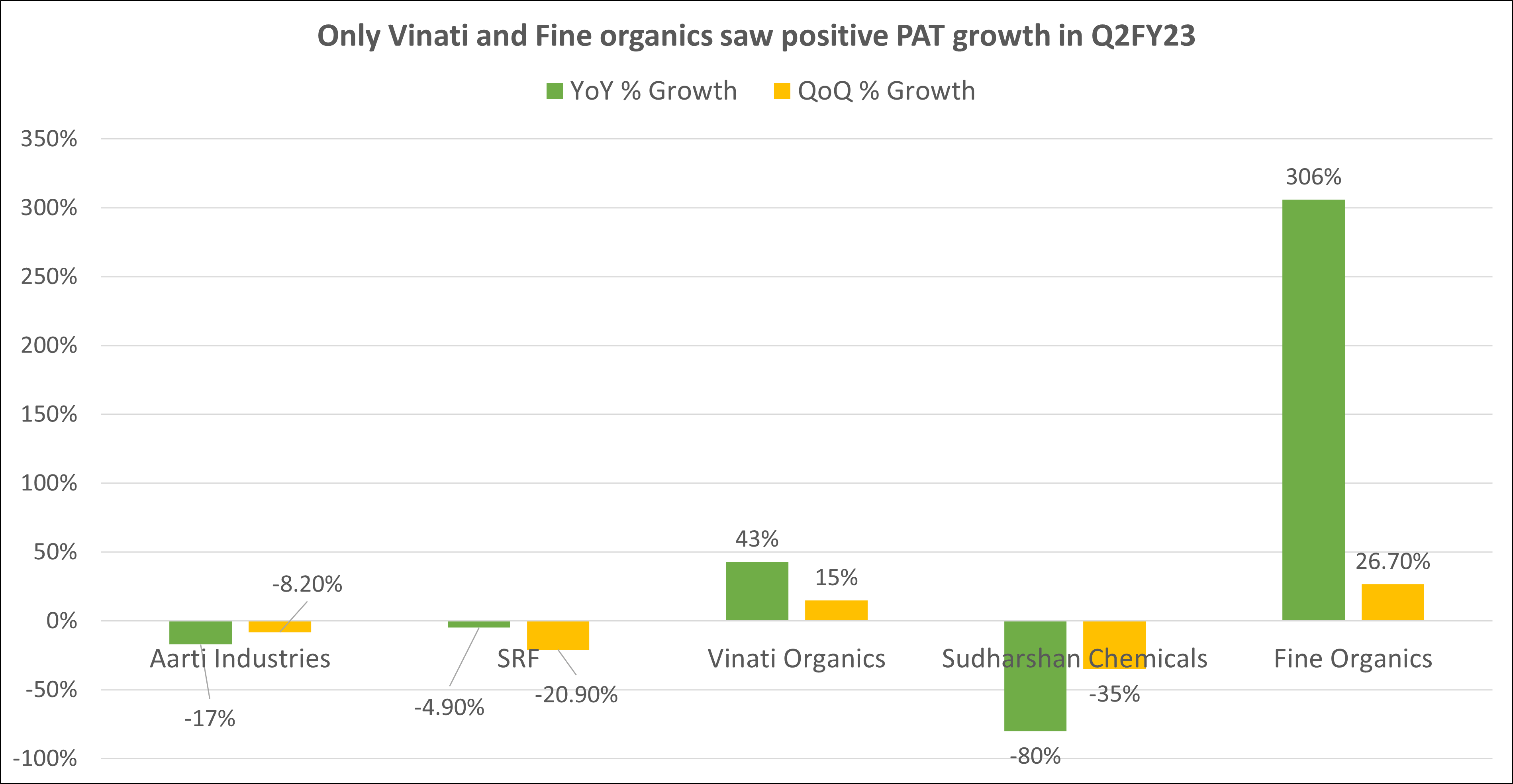

PAT: Majority of players saw de-growth due to higher than expected costs in Q2FY23

On the bottom-line front brokers expected a much higher YoY growth to be driven largely by healthy EBITDA performance besides lower tax outgo and higher other income. But only Fine organics and Vinati Organics managed to report positive YoY growth in PAT, while the rest of the players like Aarti Industries, SRF, and Sudarshan Chemicals saw negative growth in their PAT.

As reported in the graph above, only Fine organics at 306% YoY and Vinati at 43% YoY saw robust growth, while Sudarshan chemicals saw a massive YoY fall in their PAT in Q2FY23. Even sequentially, only those two players were able to report positive growth while the rest of the players saw growth in red colours.

The main reason behind such a fall in Sudarshan Chemical’s revenue was higher-than-expected raw material costs, other expenses, finance costs, and tax outgo, all at the same time. Whereas, SRF also saw declining PAT owing to higher finance costs due to mark-to-market impact and an increase in depreciation for new capacities added in the past.

You may also like: Tech Mahindra and Sun Pharmaceuticals results declared

EBITDA: SRF also reported healthy EBITDA growth YoY similar to Fine & Vinati Organics in Q2FY23

EBITDA growth across companies was mainly affected due to the global inflationary situation and falling rupee but still, the companies in focus managed to perform decently due to higher realisations and increased volume.

As per the graph above, it’s no surprise that Fine organics and Vinati Organics both saw high growth in their EBITDA margins in Q2FY23 owing to revenue and volume growth. The interesting thing to note here is that Aarti Industries also saw 31% YoY EBITDA growth in Q2FY23, while it still went onto report negative YoY PAT growth. The main reason behind this was increased cost due to inflation. Whereas EBITDA growth can be attributed to robust revenue growth. While SRF and Sudarshan both reported negative YoY growth, sequentially, only SRF reported negative growth in EBITDA.

Univest View

Finally, it can be concluded that Fine Organics was a leader in terms of all, investor returns, profit growth as well as revenue and EBITDA margins. While another significant player was Vinati Organics which also saw high double-digit growth in Q2FY23. The rest of the players saw a decent performance as Aarti performed well on EBITDA front while SRF performed well on on the profitability front. While the one which remained a laggard was Sudarshan Chemical as it didn’t outshine on any parameter.

According to Arpit Agrawal, co-founder of Electrum, the portfolio management services (PMS) division of Arihant Capital, the speciality chemicals business has seen substantial change over the last three to four years, and new opportunities are developing as a result of China+1 and Europe+1. Therefore, this sector carries a lot of potential in the future.

Investors can maintain a bullish view on stocks like Fine Organics & Vinati Organics due to their strong fundamental position whereas Aarti industries as well, as it offers an excellent long term investment opportunity currently due to its availability at discounts. The stock has experienced correction till now but recently, brokerages have changed their view on the stock, therefore it will be worthwhile to wait and invest once the share turns bullish on technical indicators as well. While this quarter may have been a mixed bag, this sector is still expected to be one of the outperforming sectors over the next few years.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stocks to watchout for next week

Related Posts

Shri Raj Oil Gears Up for Q3 Reveal on 13th January; Check Key Expectations Here

Tokyo Finance Q3 Results 2026 Highlights: Net Profit Falls by 48.89% & Revenue Up 1.92% YoY

Why is Mangalore Refinery & Petrochemicals (MRPL) Share Price Falling?

Hawa Engineers Q3 Results 2026 Highlights: Net Profit Surged by 277.17% & Revenue Up 21.00% YoY

Gretex Corporate Services Q3 Results 2026 Highlights: Net Profit Falls by 75.00% & Revenue Up 700.00% YoY