Portfolio Analysis of Shark Investor Vijay Kedia as of Sept 2023

Posted by : Sheen Hitaishi | Fri Oct 27 2023

Vijay Kedia is an investor known for his maverick style of investing. His investment philosophy is SMILE, Small in size, Medium in experience, Large in aspiration and Extra-large in market potential.

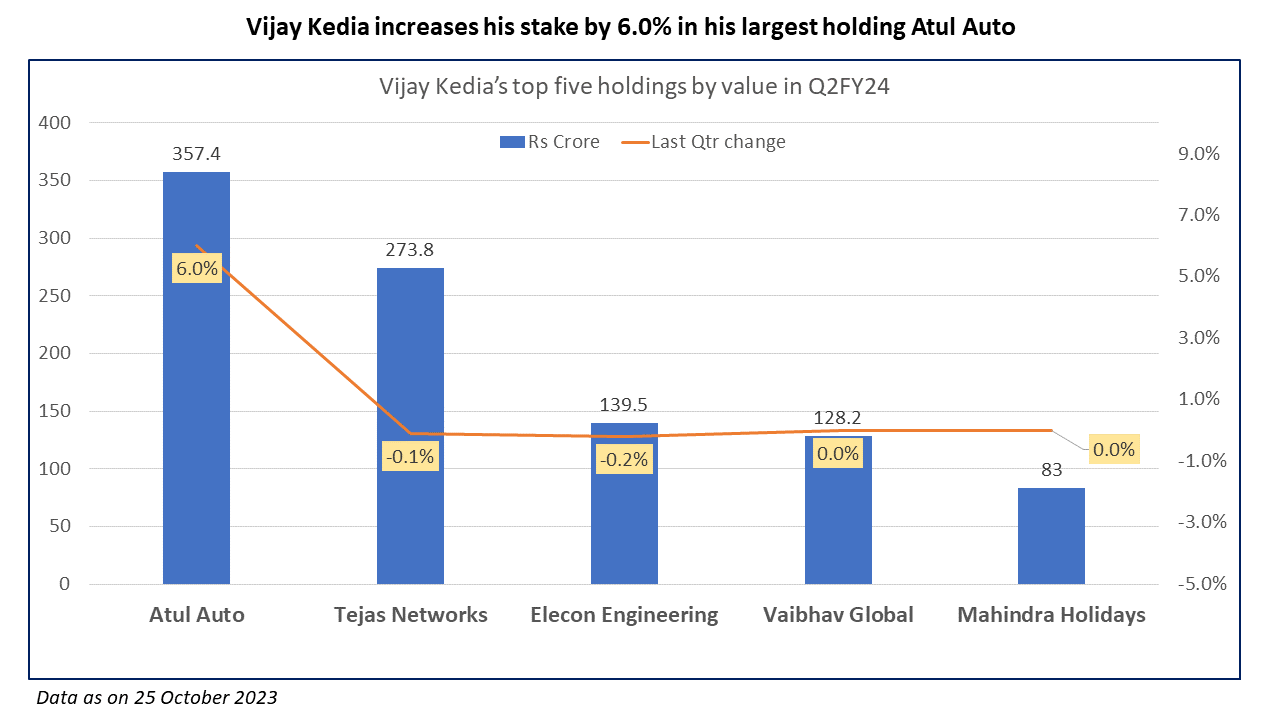

As per the latest corporate shareholdings filed, Vijay Kedia publicly holds 15 stocks with a net worth of over Rs. 1,431.64 crore. Based on this data, let us look at some of the top holdings in his portfolio.

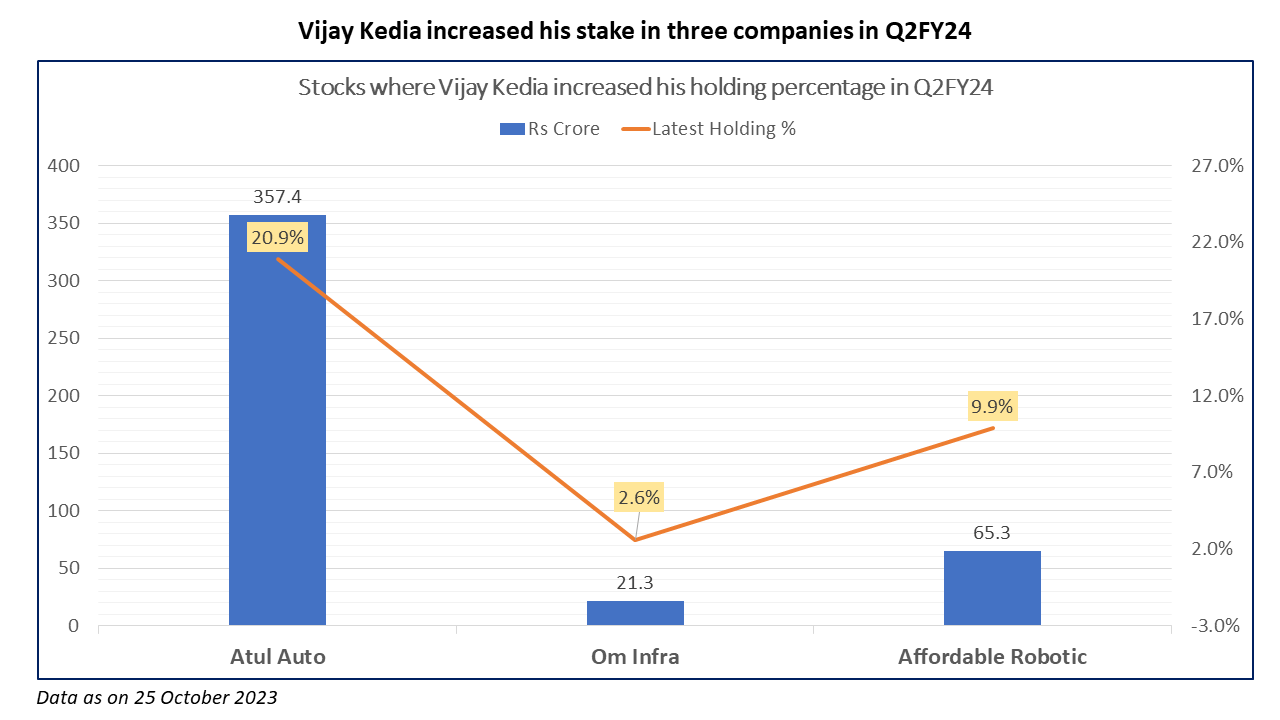

The top holding is Atul Auto, a manufacturer of three-wheelers based in Gujarat. Vijay Kedia has been steadily increasing his stake in this company for the past eight years through his personal investments and via his investment company, Kedia Securities Private Limited. In 2015, he had a 1.16% stake in Atul Auto, which has now grown to 20.9%.

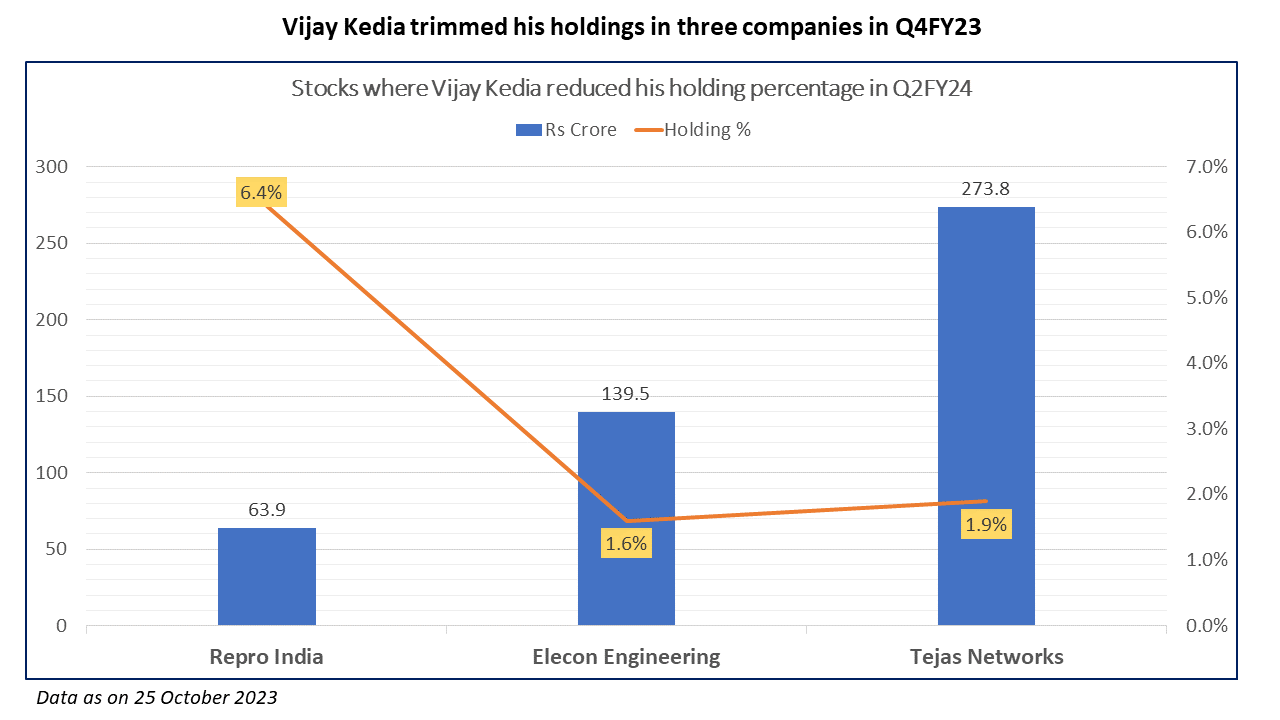

His second-largest holding, Tejas Networks, has been a part of his portfolio for the past three years. Starting with a holding percentage of 1.52% in June 2020, the highest percentage was reached in June 2021 at 5.35%. Afterward, he has been reducing his stake every subsequent quarter, and it currently stands at 1.9% as of September 2023. The stock price of Tejas Networks has risen from Rs 50 per share in June 2020 to Rs 885 in October 2023. Over these three years, he has achieved significant returns from this stock.

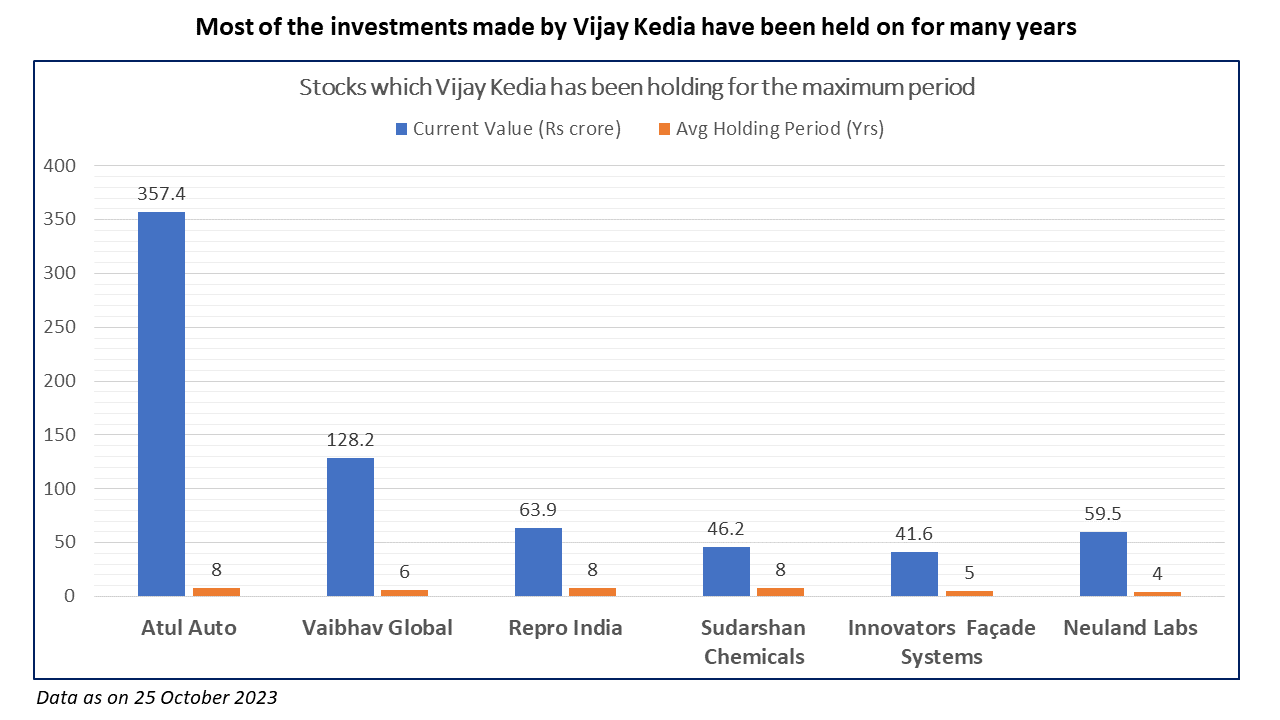

Based on data for the latest quarter and a study of the holding patterns for different stocks, it can be said that Vijay Kedia follows an investment style characterized by concentrated bets, holding them for an extended period, and reducing his stake as the returns multiply. His current portfolio is limited to 15 stocks, with varying allocations. While the top holding is currently valued at Rs 357.4 crore, the fifth-largest holding is only around Rs 83 crore.

Unlike many other sharp investors, Vijay Kedia does not seem to churn his portfolio too much every quarter. In Q2FY24, only three stocks saw additions to the portfolio. Of these, Atul Auto saw him increase his holding percentage, while Om Infra, Affordable Robotics and Automation are new entrants to the portfolio.

Om Infra Ltd is a conglomerate with diverse interests in infrastructure, including hydro-mechanical equipment, turnkey steel fabrication solutions, hydropower development, real estate, entertainment centers, and hotels. It is the flagship company of the Om Kothari Group. The stock has risen by 140% in just six months and has been a multibagger over the past three years, delivering a 400% return.

Reductions in stake were limited to only three stocks, where he decreased his holdings by 0.1 to 0.2% in Repro India, Elecon Engineering, and Tejas Networks. Two other stocks have also seen their stakes reduced to below 1%. These are Heritage Foods and Panasonic Energy. In the previous quarter, the holdings for both of these were at 1.2%. It is not clear whether he has completely exited these stocks, as it is mandatory to declare only those stocks where the holding percentage is more than 1%.

Shark investors are known for their ability to identify multibaggers early on and hold onto their positions for an extended period of time. In the case of Vijay Kedia’s portfolio, some of the stocks, such as Cera Sanitaryware and Innovators Façade Systems, have provided returns exceeding 10X over the last few years.

Vijay Kedia’s investment philosophy revolves around small-cap and mid-cap companies. He has also emphasized the importance of seeking out companies with good management. Companies with strong and honest management, combined with products poised for growth, should be considered. It is equally important to understand where the company stands in the broader economy. He believes that investing in companies with such potential for a period of 10 to 15 years can yield significant profits.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly Update

Related Posts

Weekly Update- 20 Feburary 2026

IIFL Finance NCD: Tranche Detail

PNGS Reva Diamond Jewellery IPO Review 2026: GMP Rises 5.70%, Key Investor Insights

IEX Share Price Falls 25.96% YoY: What Went Wrong & What’s the Target

Yashhtej Industries IPO Allotment Status: 1.05x Subscribed, GMP Rises 1.82% — Check Online