Phoenix Mills – Rising like a phoenix in a post pandemic world

Posted by : Sheen Hitaishi | Tue Jun 27 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1687325568861{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]Phoenix Mills is a leading retail mall developer and operator in India. It specializes in retail-led, mixed-use properties and has developed over 17.5 million sq ft of retail, commercial, hospitality, and residential properties across major cities in India.

The journey of Phoenix Mills has been one of transformation, starting as a textile company and evolving into one of the country’s largest mall developers. It all began with the defunct Phoenix Mills in Mumbai, which was redeveloped into a mixed-use complex featuring a luxury mall and a hotel over a decade ago. Since then, the company has embarked on an expansion spree, developing numerous luxury and high-end malls across the country.

Company surpasses pre Covid revenues and profitability in Q4FY23

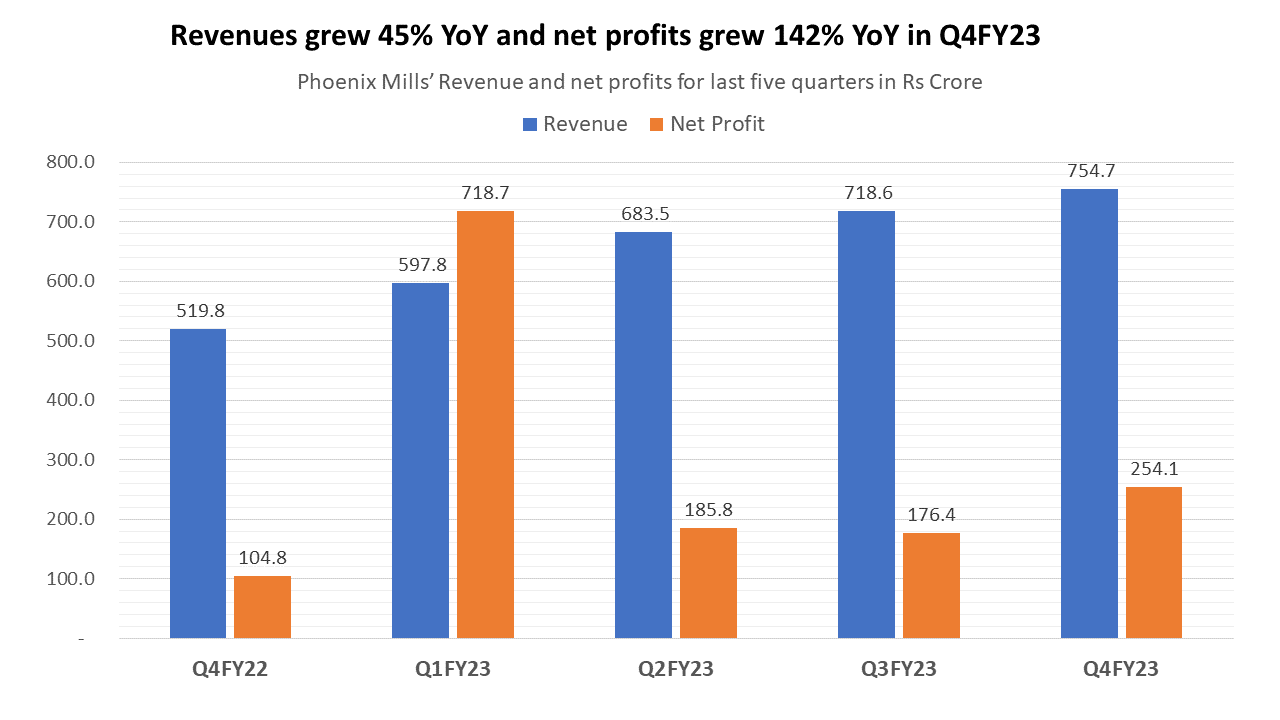

The latest Q4 results demonstrate that the company has successfully rebounded from the impact of the pandemic, achieving its highest-ever revenues and net profits in FY23.

In Q4FY23, revenues grew by 45% on a YoY basis, supported by the operational launch of two new properties in Ahmedabad and Indore. The company recorded a remarkable 142% YoY growth in consolidated net profit, surpassing Rs 254 crore for Q4FY23. Additionally, income from operations for the quarter rose by 47% to Rs 729 crore. In line with the luxury retail theme, over 35 prestigious brands such as TUMI, Michael Kors, Kate Spade, and Coach opened their stores in Ahmedabad for the first time.

Regarding the data for Q1FY23 net profits displayed in the graphic above, it shows profits exceeding the revenues. However, this is due to an exceptional item, specifically the profit from the partial sale of investments in two subsidiaries: Offbeat Developers Private Limited and Vamona Developers Private Limited. The company sold a portion of its property in Kurla, Mumbai, and therefore, the profit figures reflect the proceeds from this sale.

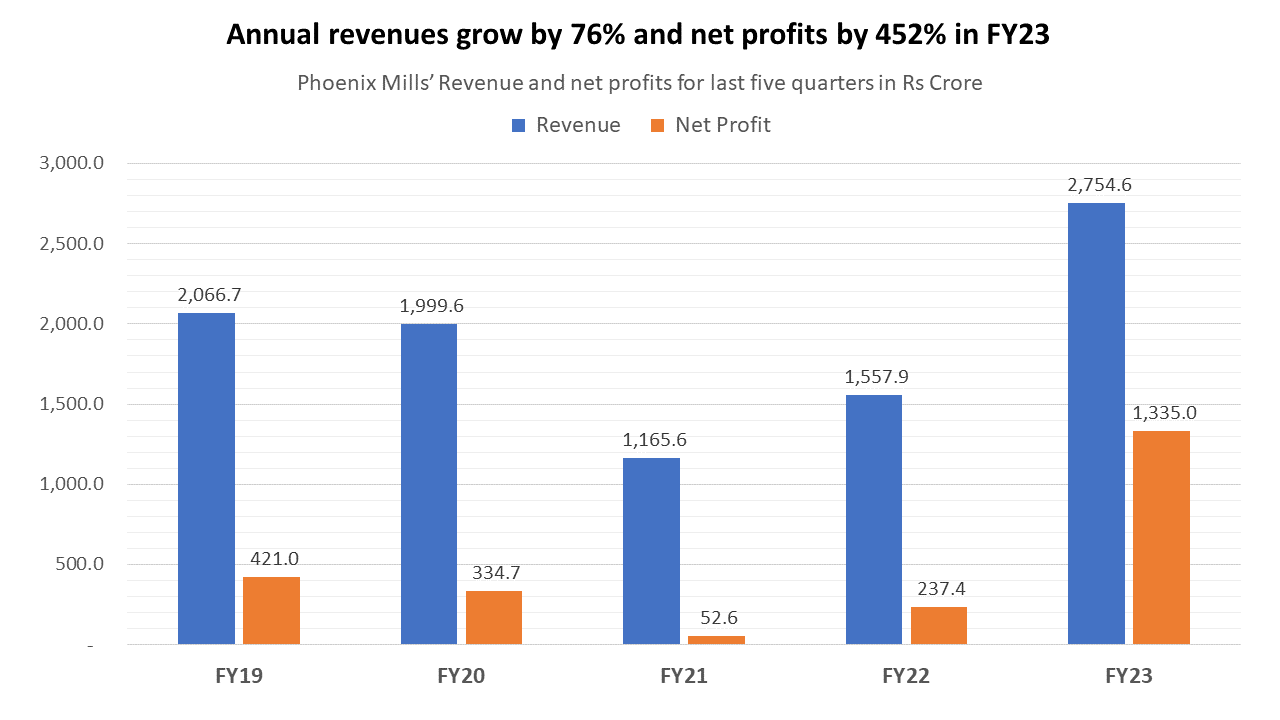

For the financial year FY23, the company’s consolidated net profit rose by over 452% to Rs 1,477 crore, supported by a 78% growth in income from operations at Rs 2,638 crore. The company has significantly surpassed pre-Covid revenues and net profits in FY23. While FY21 and FY22 were challenging years, FY23 delivered the highest ever revenues for the company.

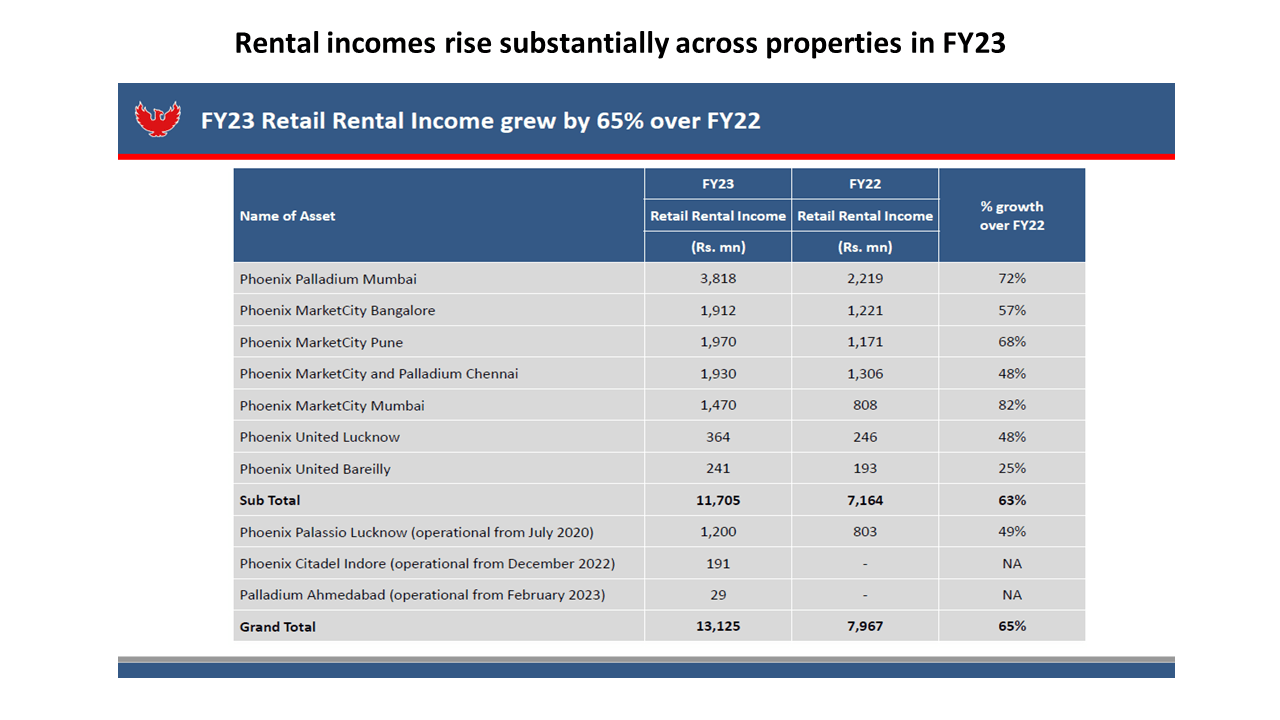

The key contributors to revenue growth have been the higher rental incomes from the malls. In Palladium Mumbai, rental income grew by 32% YoY to Rs 968 crore in Q4FY23. In Phoenix Market City Bangalore, rentals grew by 27% YoY to Rs 473 crore in Q4FY23. Similar growth was observed in malls in Pune, Chennai, and Lucknow.

The income from leased office spaces also improved across most locations in FY23, with aggregate income amounting to Rs 1,698 crore compared to Rs 1,580 crore in FY22.

The company’s exceptional performance can be attributed to its business model, which sets it apart from other developers. They develop land parcels into rental assets that command a premium in their respective segments. Assets such as malls, hotels, and office spaces generate high-value rentals, and even the residential component is able to command a premium as part of the overall development.

Furthermore, the company has expanded into warehousing as an extension of its real estate portfolio. It has acquired a 33-acre land parcel at a cost of Rs 54 crore, and consultants for architectural and structural design have been appointed.

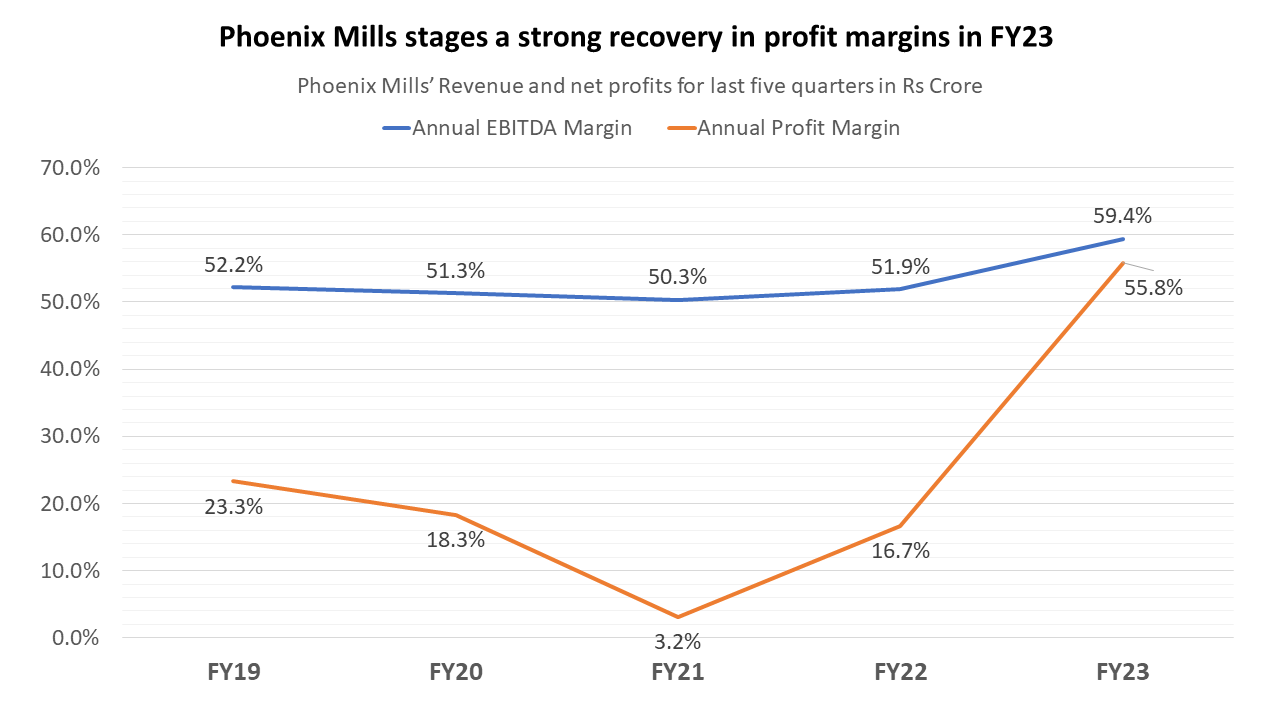

Another key feature of the FY23 results is the strong recovery in annual profit margins. FY21 and FY22 were severely impacted by the pandemic, particularly in the malls and hotels industry. Prior to the pandemic, annual profit margins were declining and reached rock-bottom levels of 3.2% in FY21. However, the company exhibited a robust recovery, achieving profit margins of 55.8% in FY23.

In the upcoming year, the company plans to inaugurate two new destination malls in Pune and Bengaluru, encompassing a combined leasable area of 2.4 million sq ft in FY24. This expansion is expected to position the company as the largest mall developer and operator in the country, with nearly 11 million sq ft of operational retail assets.

Data Source: Company Investor Presentation

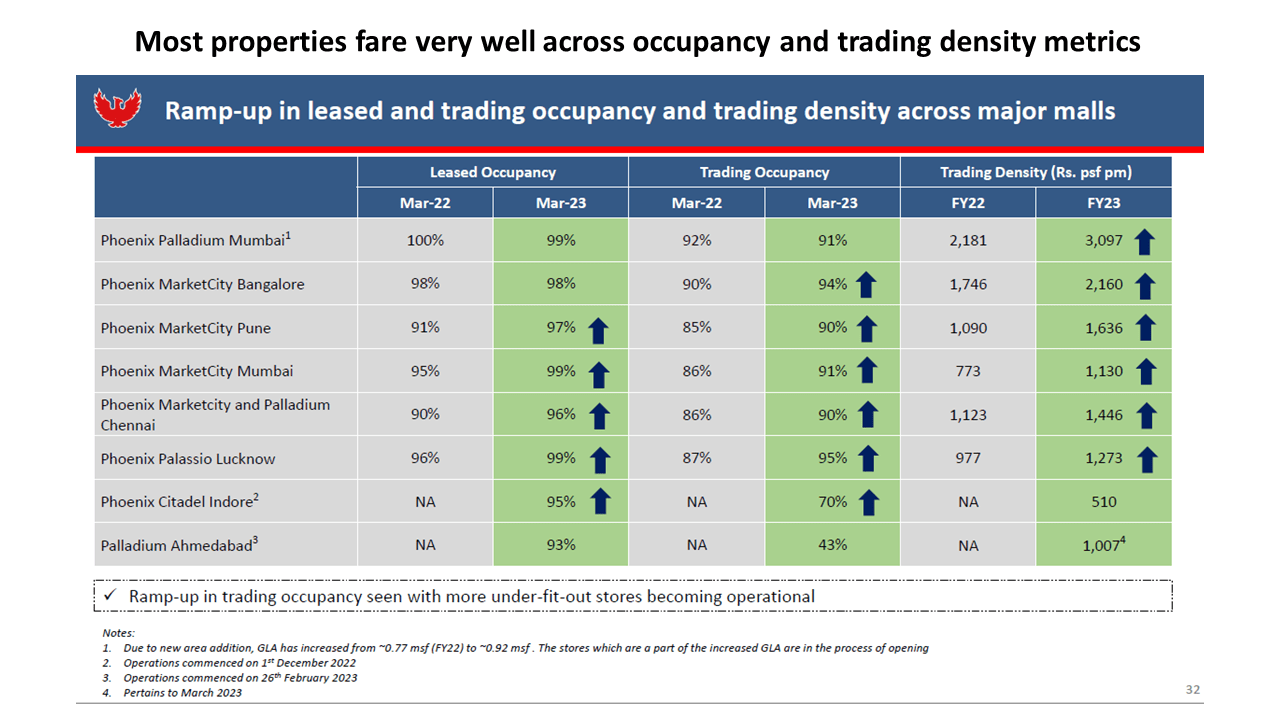

When delving into the details of the rental assets, it is evident that most of the malls experienced a YoY rise in occupancy levels during FY23. Moreover, all the malls boast an impressive occupancy rate of over 95%. Even the recently opened mall in Ahmedabad commenced operations in the last quarter with a 43% occupancy rate and is projected to reach 93% occupancy in the next quarter.

Data Source: Company Investor Presentation

FY23 witnessed growth in the hotels portfolio as well. The revenues for the St. Regis hotel in Mumbai reached Rs 4,042 crore, marking a 31% increase compared to pre-Covid levels in FY20. The improvement in occupancy was driven by the revival of corporate travel and social events. In April 2023, the occupancy rate stood at 82%, while the Average Room Rentals (ARR) amounted to Rs. 18,249.

Massive expansion plans over next two years

Massive expansion plans over the next two years are lined up for Phoenix Mills. Some projects are commencing construction, while others are nearing completion. In addition to the current plans, the company is targeting Navi Mumbai, Thane, Hyderabad, the National Capital Region, Chandigarh, and Jaipur for expanding its retail property portfolio. Locations such as Nagpur, Goa, and Vizag are also under evaluation for future expansion.

The Phoenix Mall of Asia at Hebbal, Bangalore is expected to be operational by Q2FY24. By the end of Q3FY23, over 90% of the retail Gross Leasable Area (GLA) was pre-leased, with rentals averaging Rs. 150-160/sq ft.

Phoenix Millennium at Wakad, Pune is anticipated to begin operations during FY24. More than 90% of the area has already been preleased, with average rentals at Rs. 120-130/sq ft.

The company has successfully won the bid for a premium land parcel of 5.5 acres in Alipore, Kolkata, for Rs. 414 crore. The plot has a gross developmental potential of Rs. 2,000 crore. The residential project has obtained height and ULC clearance, and the design and liaison architect has been appointed. The fencing work is complete, and the project launch is expected in eight to nine months.

The premium Project Rise at Lower Parel, Mumbai, commenced construction in June 2022. Preliminary construction work, such as shore piling, has been completed, and activities like rock anchoring and excavation are in progress. The company aims to add 1 million sq ft of office GLA and 0.2 million sq ft of retail GLA. The project is expected to be completed in FY25.

The company, in partnership with CPPIB, is constructing a 1 million sq ft retail leasable area mall in Kolkata. Demolition work for on-site structures has been completed, and the piling and diaphragm work is currently in progress.

The Surat Mall project is in the final stage of approval and is awaiting environmental clearance to commence construction. In December 2022, the company acquired a land parcel of 7 acres in partnership with GIC and Bsafal group for Rs. 501 crore. The development will span 1 million sq ft with an estimated construction period of around 3 years.

The Investment Rationale

Phoenix Mills has demonstrated its ability to successfully convert large land parcels into mixed-use developments, with luxury malls being a highlight. With increasing aspiration levels in India, the growth of luxury retail is inevitable, and Phoenix Mills has become the preferred real estate partner for many premium brands.

The financial performance in FY23 has been exceptional, particularly in regaining margins after a two-year lull. Revenues have significantly grown across all assets, including malls, hotels, and offices.

The company has operationalized two properties in the last quarter, and a host of projects are at various stages of construction. Over the next few years, these projects will contribute to the top line as well as the bottom line of the company.

Considering the above, an investment in the stock of Phoenix Mills has the potential to deliver more than 80% returns over the next one to three years.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stock bought by Mutual Funds in May 2023[/vc_column_text][/vc_column][/vc_row]

Related Posts

Marushika Technology IPO Review 2026: GMP Rises Flat, Key Investor Insights

Highway Infrastructure Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Euro Pratik Sales Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Vikas Lifecare Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Rajnish Wellness Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here