Nifty at 20,000, what next??

Posted by : Sheen Hitaishi | Thu Sep 14 2023

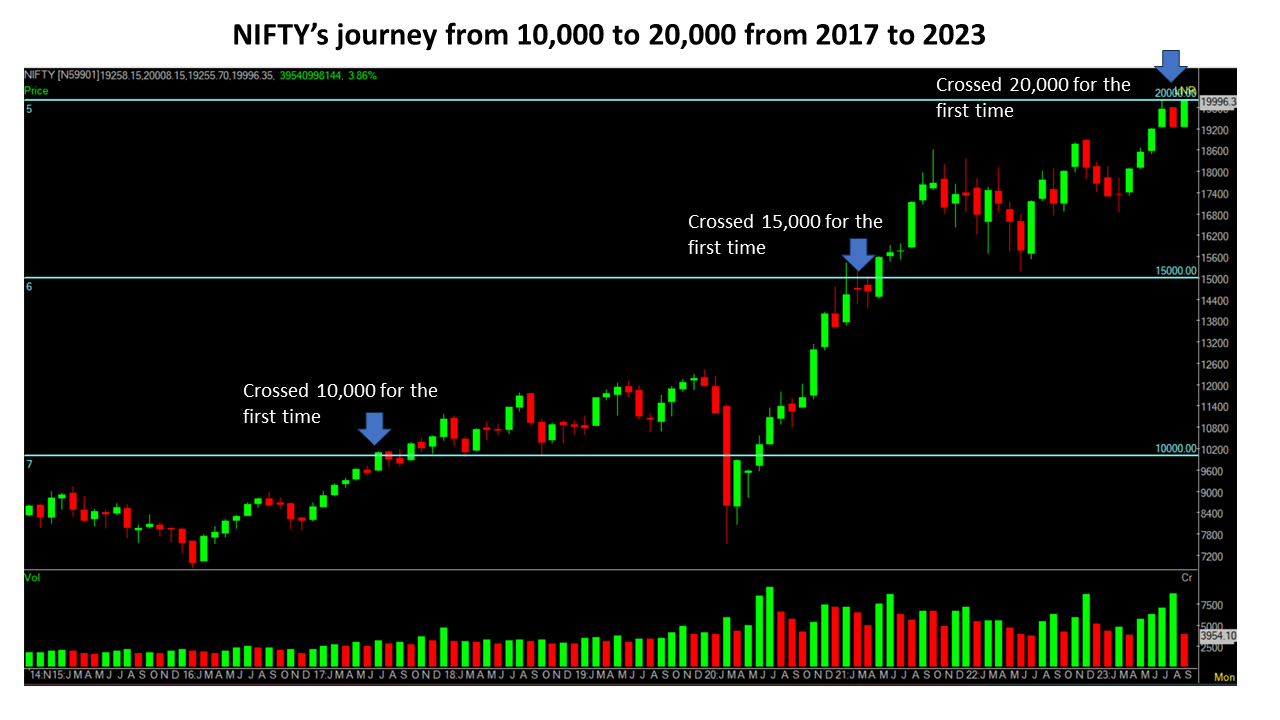

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1694509524796{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]On Monday, September 11, 2023, the Nifty crossed the magical 20,000 mark. This number assumes significance as it represents an all-time high for the Nifty. Coming on the heels of a successful G20 Summit hosted by India, it symbolizes India’s growing prowess, not only as a powerful nation but also as a strong economy.

A Brief History

While there has been euphoria regarding the Nifty reaching the 20,000 mark, this is just a landmark in the long journey that the Nifty will traverse in the coming years. The Nifty also represents the transformation that the financial services industry has undergone over the past three decades.

NSE commenced trading in derivatives on June 12, 2000, with the launch of Nifty 50 Index Futures. This was followed by the introduction of trading in Nifty 50 Index Options on June 4, 2001, Options on individual securities on July 2, 2001, and Futures on individual securities on November 9, 2001. By early 2000, the derivatives segment became completely digital, contributing to greater transparency and increased participation.”

These changes mainly involve adjusting phrasing and punctuation for clarity and flow.

Events That Shaped the Journey

The Nifty embarked on its journey with a base of 1000 points in 1997 and has since scaled numerous milestones, reaching 20,000 after more than two and a half decades. While an index reflects the Indian economy, the journey from 1000 to 20,000 witnessed the impact of liberalization in the late ’90s, followed by the dot-com bust in the early 2000s. It experienced a reversal of fortunes from 2003 to early 2008, marking the biggest rally in the Indian markets up to that point. Subsequently, it also endured the sharpest decline, losing nearly 50% of its value by the end of 2008. Even as recently as 2020, the index sharply declined in March 2020 due to the outbreak of Covid, but it rebounded to achieve new highs over the next one and a half years.

All these events were influenced by changes in the Indian government, whose policies have driven certain sectors in the market. For example, the cleanup of Indian PSU banks in recent years has resulted in higher returns for these stocks compared to private banks. Similarly, policy decisions in recent years have sparked rallies in defense and railway stocks.

What Should Investors Do?

Reflecting on the journey of the last two decades or so, investors must understand that equities remain an asset class that delivers higher returns than any other asset class. Over the years, there have been many tumultuous events, but the human spirit of innovation and entrepreneurship has seen the Nifty achieve new highs. Additionally, as we move higher, the numbers may appear larger, but in percentage terms, they represent smaller gains than the previous moves. For example, the move from 10,000 to 15,000 represented a gain of 50%, from 15,000 to 20,000 was a gain of 33.3%, and from 20,000 to 25,000 will be only 25%.

So, these numbers essentially serve as landmarks in a long and enduring investment journey. Investors must remain invested at all times to ultimately gain substantial returns from a high-return asset class.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Recent Ownership changes that led to turnarounds!![/vc_column_text][/vc_column][/vc_row]

Related Posts

Khazanchi Jewellers Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

Kesar Enterprises Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

J.G. Chemicals Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

IFGL Refractories Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here

EFC Gears Up for Q3 Reveal on 14th February. Check Key Expectations Here